Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI sent a payment to a vendor via online bill pay from my bank, but the vendor never received the check. I called the bank and stopped the payment. In quickbooks I voided the original check and recorded another check (again paid through my bank's online bill pay).

Today the original check was deposited back into my bank account. How should I record this deposit?

Hello there, @firechaser.

I'd like to offer my assistance and make sure you properly record your vendor payments.

Since you've called your bank to stop the payment and voided the original vendor payment check transactions, you're on the right track. You don't need to do anything on your end especially if the payment in the bank was not really process at all. The voided check amount will show as 0 in QuickBooks will be mark as cleared.

However, as what you've mentioned the funds for the original check was deposited back into your account, it is possible that the first payment transaction was indeed processed. What you need to do is to recreate the check . Make sure to choose Account Payable instead of Expense (account use on the second check).

You will then see two negative transaction listed for the same vendor. You will also a negative balance for the said vendor when accessing the Open Balance report.

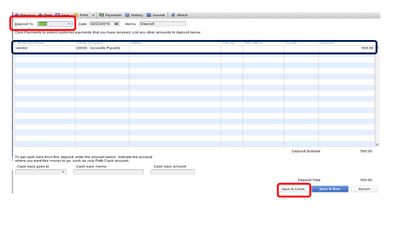

To zero out the balance, here's how to record the check from your bank:

That should do it! For additional insights, you may check out these articles:

If you need further assistance with the steps above, I'd recommend reaching out to our Customer Care Team. A specialist will be able to further help you via secured remote access session.

Here’s how you can reach them:

Feel free to click the Reply button if you have other questions about recording check transactions in QuickBooks Desktop. I'm here to help.

Thank you very much. I'm almost there I think.

I now have a check and a deposit in Quickbooks, for equal but opposite amounts. However, the bill still shows up on my Accounts Payable Aging Report, as if I haven't paid it. In the real world, I have paid this bill and and no longer owe the vendor any money. Can you help me zero this out?

Let's get it zeroed out, Firechaser.

The amount in the A/P aging report is the deposit you've created. To zero it out, you can create a bill credit for the refunded amount, then link it to the deposit.

First, let's create a bill credit. Here's how:

Then, link the deposit to the credit. Here's how:

Once done, check the A/P aging report again, it will show zero amount.

Please check the screenshots for your reference.

We're just here if you need more help. Have a good one!

I have the same issue as firechaser except I am on QBO Advanced. Summary below:

Please help me as I think I am just one or two steps away from getting this right.

I appreciate the detailed information, Aaronweiss66. I can think of one way to fix this.

We'll have to link the check and the deposit. It will zero out the vendor's balance. I'll guide you with the steps:

Once done, you can pull up a report like Transaction List by Vendor to view the transactions.

If you any questions arise, please feel free to leave a comment below. We're just around to help you.

I think that may have done it. Thank you for the fast response!!

I have this exact situation, where our vendor did not receive a check and I stopped the check, but have both a bank debit and credit to reconcile. I re-created the payment with check as instructed, and created a deposit as instructed, and the vendor balance looks good. Problem is that I cannot reconcille the bank statement because now that recreated check is showing in my reconciliation as an additional payment but it is obviously not in my checking bank statement. How do I clear this reconciliation line?

I have this exact situation, where we stopped a vendor payment check that the bank had already processed, so we now have a credit and a debit on the bank statement that I need to reconcile. I created the check and the deposit as suggested above and that all worked to clear the vendor balance. However, there is now an extra payment showing up in qbo reconcilliation report that I cannot match to the bank statement. How do I handle this?

Hello, khorwath. I appreciate you for bringing up your concern about the extra payment shown on the reconciliation report.

I'm joining the thread to share additional details about this issue.

You'll want to verify if the extra payment is for the Bill. Once verified, you need to create the payment again to match your bank statement.

Once everything is set, you can start reconciling the account to ensure they are accounted for properly.

Please reach back out to me here with any additional information on the issue so I can get you taken care of. Thanks for coming to the Community.

Hello,

I have a situation that is similar to the aforementioned however it was a stop payment using the QBO Billpay.

1. A vendor bill was paid using QBO Bill pay in June.

2. QBO Bill Pay deducted the funds and issued the check however the vendor never received the check.

3. In August the vendor notified us they never received the check and QBO Support was called and notified to stop the check.

4. QBO Support stopped the check and the original payment made in June was pushed back into the bank feed, out of the bank register and the original vendor bill reopened and marked as unpaid.

5. As the funds were originally deducted in June and the account already reconciled my reconciliation is now showing as off the amount of the payment.

How do i record the original funds that deducted the account in June so as to reflect the bank reconcilation and keep the vendor bill open so that a new payment can be made without it appearing like the vendor was paid twice?

Any help you can provide would be appreciated.

I am grateful for the detailed information, @Sozzle. I'll help you record the returned payment in QuickBooks Online.

Now that the bill has been reopened, you can generate a vendor credit and a bank deposit that will impact the Accounts Payable. Afterward, you can associate both transactions using the Pay bill function.

Here's how:

Then, deposit the money that has been returned. Follow the steps below:

Once done, utilize the Pay Bills feature to link the bank deposit with the vendor credit to maintain accurate records of your vendor expenses.

Here's how:

Finally, you have the option to reconcile the transaction manually. See the steps below:

You can also check out the topics from this article for additional resources about banking and reconciliation: Find help with bank feeds and reconciling accounts.

Feel free to click the Reply button below if you need help recording a returned payment in QuickBooks Online. I'm always here to help. Have a great day.

Thanks for sharing this..

Hi There,

Thank you for the prompt reply. I believe I followed all of your steps exactly and the Vendor's account is back up to date. Thanks!

However now my reconciliation is showing as off double the amount and the transaction that was pushed back into the bank feed is still unable to be matched to either the deposit or the vendor credit. How can I correct this?

Please note the following:

1. I did go back and void the receive payment from the original Pay Bills step outlined in step 3. I did this to try and allow the bank feed transaction to be matched to the the deposit. However, when I did match the bank feed transaction to the deposit it no longer appeared on the pay bills screen that you mentioned in your third step. Therefore,

2. I undid the match and followed step 3 again to complete the process you outlined. I did the following:

3. I then followed step 4 and manually reconciled the transaction on the register.

Could this have somehow caused a duplication? I have performed the following troubleshooting steps:

1. I double checked the bank register for duplicate transactions - there is only one - the deposit to AP

2. Performed a search on the transaction amount - it only appears as a Deposit and a Vendor Credit.

I cannot identify any reason why the reconcilation would show any amount off, much less double the original amount. Can you help?

Hello Sozzle!

I am happy you were able to get the Vendor Account back up! With this following situation, could you check if a vendor credit is going into your bank register and then a deposit for the same amount? Knowing this will aid us as we investigate this matter.

Looking forward to your response! See you in a few.

Hi Sasha,

On reviewing the transactions I realise I may have provided unclear information and seem to have resolved the issue on my end.

As of today we have not received the returned funds from QB Intuit for the stopped Bill Pay check. There was only ONE transaction in the register. The original expense from June.

What was showing in my bank transaction feed is the original EXPENSE transaction. It appears that when QB Support stopped the payment for me last week they voided the original transaction, thus creating the discrepancy on the bank reconciliation for June.

To rectify this, I have done the following:

1. Created a bill backdated to June under the vendor and titled it - Stopped Payment

2. Matched the above bill with the expense transaction that is on the bank transaction screen that was the original withdrawal in June. This is in effect a bill payment.

This re-instated the transaction that actually happened in June and trued up my reconciliation for June.

Meanwhile the original bill is open and available to be paid. It looks like it was re-opened when QBO Support voided the payment last week.

From what I understand the funds debited in June, will be returned from QB Intuit in 7-10 days, I believe the steps Ethel outlined to enter a vendor credit and deposit should be able to be matched to the returned deposit transaction, create a wash in the AP account and everything should be a wash. Is that correct?

Thanks for chiming back in. It is awesome that you got through with the other issue. I'm unfamiliar with the term wash, but you should be set if you follow the last agent's steps once the credit comes into your bank account. However, if you experience a problem, just let us know! We will be around to assist.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here