Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello there, @antonsdispatch.

It would be my pleasure to help you access old vendor 1099s in QuickBooks Online. While these annual forms aren't stored within QBO, you have the option to recreate them from the regular Vendor module. Follow the instructions below to get started:

Create 1099's for previous years

We also offer an extensive guide on preparing and filing 1099's, as well as this thorough video tutorial for your convenience:

Doing this will allow you to prepare a 1099-MISC form for any year you still have Expense information stored in QBO. Please don't hesitate to reach out to me here for any additional assistance. Thanks for coming to the Community, wishing you and your business continued success in all that you do.

Following the instructions to retrieve a previous years 1099's.

Why would I be charged for something already filed?

I do not want to resubmit to IRS.

Thank you

Beth V.

Hi @BethCic,

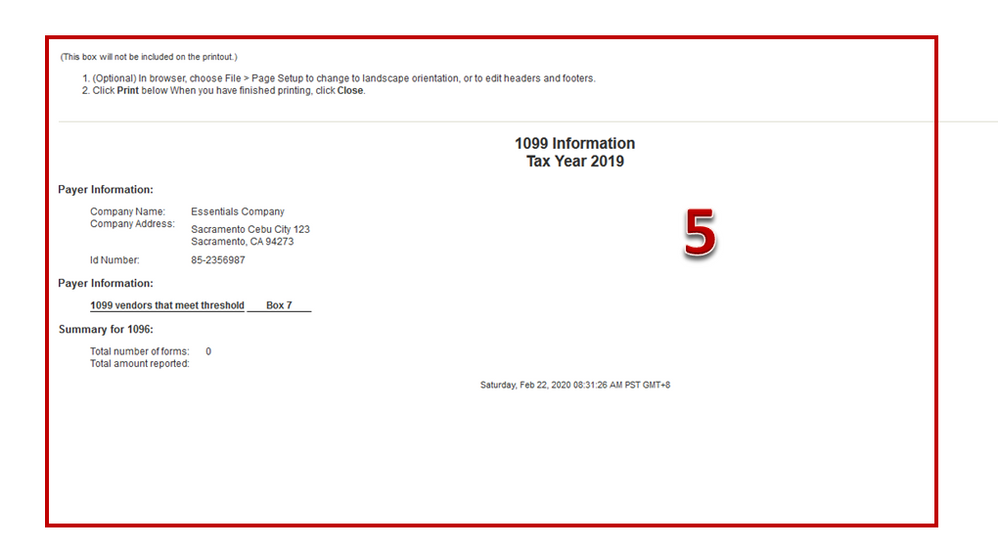

Following the steps provided above, you can proceed to step 5 File.

Go through these steps so you can either print or download a PDF copy of your previous 1099s:

Additional notes on this process can be found in this article: Print and mail 1099s in QuickBooks Online.

Let me know if you have other queries by posting a comment below. I'll be sure to get back to you.

I'm using Quickbooks Online. When I run a 1099 report for my contractors for a prior year nothing comes up. If I try to run the 1099s and select "below the threshold" the contractors appear, although I can't select them when it comes time to run the 1099. I've checked to make sure they all have the "Track Payments for 1099" selected. Any suggestions?

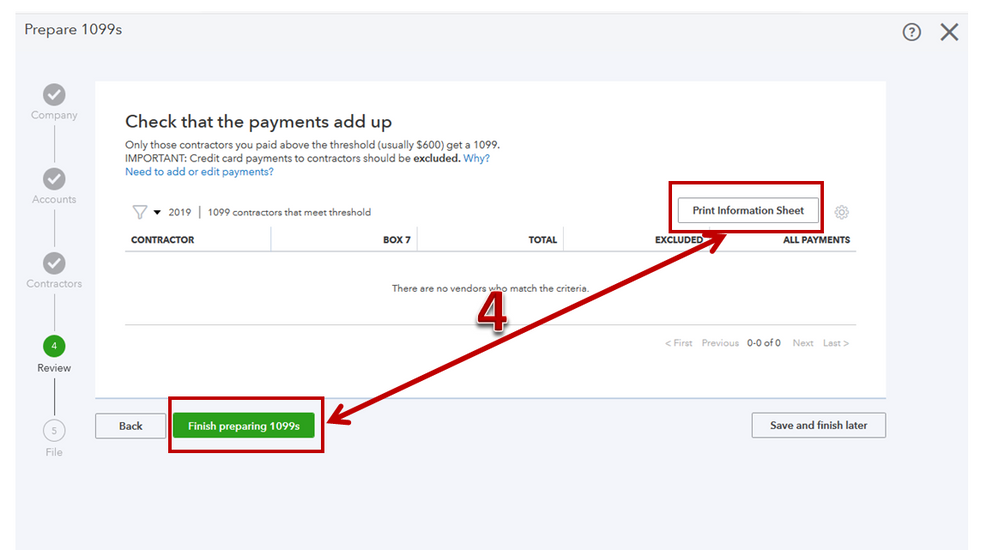

This is normal behavior, tamaraanderson.

QuickBooks will let you see your list of 1099 contractors that were paid below the threshold ($600). However, only those who meet the threshold will have a 1099 form. It's also explained in the upper section of the page that you're currently at.

You can also check out this article for your additional reference: Common questions about 1099s.

Let us know if you have additional questions with your 1099 forms. We are open 24/7, so you can just reach out to us anytime you need help.

My problem is that even though I should have several 1099s they don't show up at all for prior years, and won't let me reproduce them. I can look at the contractors individually and see there payments but he system will not produce W2s or bring them up in a 1099 report.

You didn't answer my question or help resolve my problem!

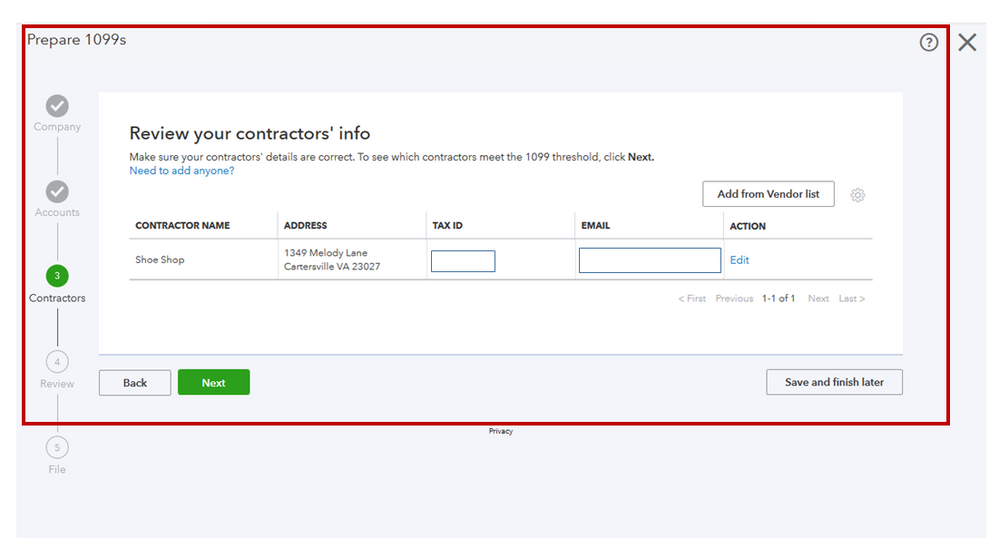

Let's check why these contractors are not showing in the 1099 form, Tamaraanderson.

First, let's ensure that the payments are tracked in an account associated with a box from the form. Next, contractors who are only paid through cash or check are reported.

I'll add the article to help you with the missing contractors.

Get in touch if you need more of our help. We're just around.

I tried this and it doesn't allow you to print actual "old" 1099's just a sample with factitious numbers

This method does not work and only allows you to print a sample. Is there a way to see the actual 1099 or a place to check to make sure certain venders were submitted? All I got was a confirmation my 1099's were submitted, but it wasn't itemized. I now have a contractor that says they haven't received an email or paper copy. How do I resend just one 1099 or find the previously filed 1099?

Hi there, @how to resend 1099 invites.

It's my priority to help you sort this out.

Upon checking with our engineering teams, there is an ongoing investigation where vendors are unable to print the 1099 form in QuickBooks. Rest assured, that our engineers are working hard to resolve this issue permanently.

To ensure you'll get notified about the resolution status, I recommend reaching out to our Customer Support Team. Provide this INV-41565 for easy tracking.

On the other hand, the company can able to print the 1099 form. You may want to print it and send it through mail to your contractor.

Here's how:

Once done printing, you may able to send the form 1099 to your vendor for copy.

I've also added this article for your reference:

Let me know if you need more assistance about printing form 1099. I'll be around to further help you. Have a great day!

Hi All--- these instructions did not do what I wanted, because they do not give you the full 1099 form-- But I figured out how to do it.

Go through the steps Quickbooks provided here, but at the end click "e-file for me (starting at 14.99)". It will not charge you or e-file again. It will instead take you to the Intuit E-file service, where you can click a link "View Past Forms" on the bottom. This will take you to a place where you can view all previously filed 1099s. They provide PDFs of all the forms in one PDF, but you can use a program like Adobe Acrobat to create a new PDF of just the page you want-- or better yet in your browser, do File, Print.. Select only the Page(s) you want.. Save as PDF... and you will get a new PDF with only the 1099(s) you need.

THANK YOU!!! Why was this not the first answer. REALLY appreciate a real answer.

Unfortunately, the link to submit them has now been replaced with a button that says "Come back after Jan 1" - I guess 2019 is no longer available.

Intuit, we need a way to get back to last year's 1099s. We are now in the time of year where vendors are emailing saying "Hey I lost mine, can you please resend it?"

Thanks for joining this thread, @AVPRVA.

I know the importance of having the 1099s for your vendors. I'm here to help you find the 1099s in QuickBooks.

Let's go back to Prepare your 1099s page and map the accounts from there. Here's how:

See this article for more details on how to Print and mail 1099s in QuickBooks Online.

You can always visit our Employees and Payroll Taxes articles in case you need some related references in managing your payroll account and transactions.

Please let me know how it goes in the comment section below. I'm only a post away should you have any additional questions or concerns.

Right, but the problem is, I need a 2018 1099 reprinted for a subcontractor who needs it for resolving an issue on her taxes. I cannot reprint a 2018 1099 in this way because I do not have a 2018 1099 blank form to print onto. I need to access the PDFs that were created in 2018 and I cannot get into the e-file service to do this. Any other suggestions?

Hey there, stephanieboozer.

I can help you create a 1099 for a previous year. You have the ability to produce them in QuickBooks Online. Here's how:

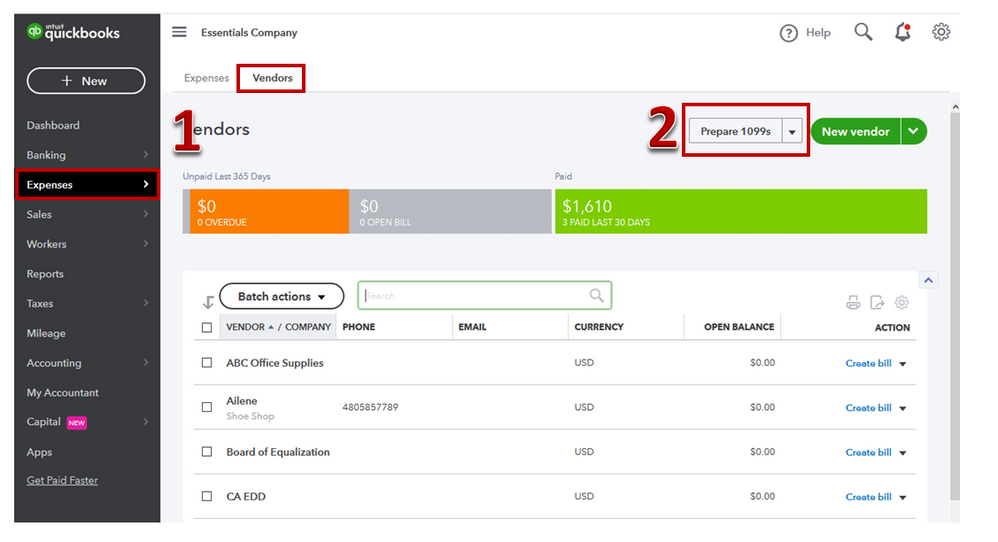

1. In the navigation bar on the left, go to Expenses, then Vendors.

2. Click Prepare 1099's. Follow the presented instructions.

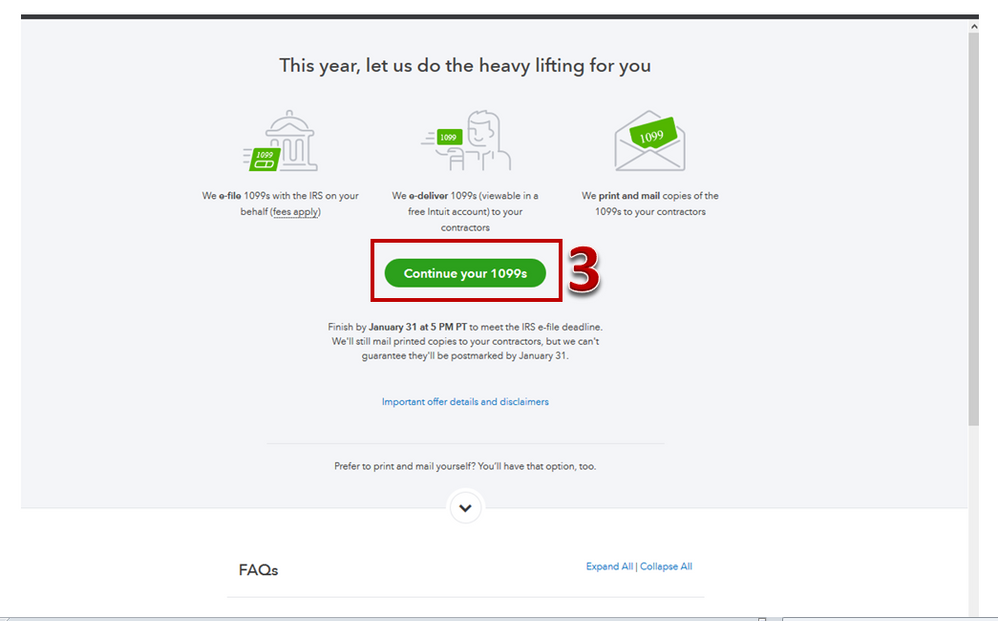

3. Select the filter menu in the top-left of your Contractor list and choose the Tax year you'd like to prepare.

This will generate a 1099 form using the expense data stored in your books. I'll also provide you with a helpful video tutorial which visually walks the viewer through the process:

Did you not read her question at all? She said she can't print on blank forms because she does not have access to blank forms. We are ALL looking for an easy way to access 1099's we've already completed, paid for, and SHOULD be able to have access to.

Typical inept Intuit.

Hey there, @taxdude11111111.

This isn't the impression I want to leave you with. Since you're still not able to access your previous 1009's, then I recommend contacting our Customer Support Team. They have additional tools to look further into your account to see why you're not able to access these forms successfully. Here's how:

Should you need any further assistance, just let me know. Have a great day!

Did anyone get an adequate answer to this? I'm also looking for PDF's of already filed 1099's that my vendors can no longer access because the links have expired. Is there any way to access these?

Try going to iop.intuit.com/1099/login to view past 1099's

The instructions are outdated and no longer applicable. As of now, there is NO way to access 1099 forms for previous years filed through QB Online. Yup, you heard me right. This cloud subscription service does not keep previous year tax forms for you to access. You need to make hard copies to save them somewhere or make sure to back up PDF versions. They are not available through QB.

Please remove the above video and instructions from 2018. They no longer correspond to the actual screens and there is no longer the ability to choose a previous year.

QBO,

Has this been resolved? We need to be able to resend these to contractors!!!

Hi bookkeeperempire,

Have you tried the troubleshooting steps shared by my colleagues? If so, yet the same thing happens, I'd recommend reaching out to our Phone Support team. This way, our Engineering team can make an investigation about this.

You can follow the steps shared by Candice C to get in touch with our support.

Feel free to reply if you have other concerns. Keep safe!

This did NOT work. There is no option to choose a year!

@Ryan_M wrote:Hi @BethCic,

Following the steps provided above, you can proceed to step 5 File.

Go through these steps so you can either print or download a PDF copy of your previous 1099s:

- Assuming you're still on step 5, click the I'll file myself button.

- On the Print 1099s page, select the Tax Year on the drop-down menu.

- Ensure the 1099 form is selected.

- Select Print sample on blank paper.

- On the print preview page, you can either proceed with printing the forms, or download a PDF copy.

Additional notes on this process can be found in this article: Print and mail 1099s in QuickBooks Online.

Let me know if you have other queries by posting a comment below. I'll be sure to get back to you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here