Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowThis question has not been yet answered.

”What would happen if I categorize the refund to the exact same vendor and expense account? For example, I label the credit as an expense and categorize it to the same vendor ? Would this put the money back where it came from and balance out the account? “

can you please answer that?

thanks!

Welcome to the Community, @CarlotaS.

When you categorize a refund to the same vendor and expense account, it will balance the vendor's account.

You may also check this article on how to handle vendor refunds in QuickBooks Online: Enter a credit from a vendor.

I've also added this resource that can guide you in running vendor reports in QuickBooks Online: Generate reports.

You're always welcome to post in the comments below if you have other questions. I'll be sure to get back to you. Have a pleasant day.

This is hilarious. I was looking into a solution to what I though was a simple question, then I came across this forum. After reading through this whole conversation, I have enough confidence that QuickBooks is not designed to do it yourself but rather pay someone else to do it. Small business's, especially since 2020 1. dont have the time to spend hours on reading forums and figuring out this hilarious maze, and 2. dont have additional money to pay for help in the amount of $500 to fix your current situation and then an ongoing $300 every month. Thats why people are ON THIS FORUM, to figure it out themselves. Then quickbooks has the audacity to say, "that a premium feature not available to QBSE" about a basic feature. You have to be joking.

I'm canceling my subscription to this laughable scam.

Hi -- I followed the steps but the deposit does not show up in the "pay bills" window so I cannot link the deposit to the bill credit. What am I doing wrong?

Hello, jmillergrant.

Thank you for posting in the Community. We need to ensure you've entered a vendor credit. After that, you can create a Bank deposit first to match or link to the bill credit.

To create a vendor's credit:

You can use the vendor credit as payment for an open bill. Here's how you can apply it to the open bill:

Once done, you can pull up the Transaction List by Vendor report to see the vendor's payment, bill, and the credit's applied.

You can also check the article: How do I handle vendor credits and refunds?

The Community is always here if you have other questions. Please don't hesitate to reach out anytime. Stay safe!

Here is my solution for QBSE:

1. Exclude all the transactions that are refunded

2. Exclude enough transactions to be equal or greater than the amount refunded

3. Manually add transaction of difference if excluded transactions are greater than refunded amount

This way you don't get hit with extra income and you don't over report your expenses.

Hope this makes sense and helps some of you folks.

The final step DOES NOT WORK. The credit does not appear under "Pay Bills".

I have no open bills to apply the vendor credit (refund) toward. What to do?

Thanks for becoming part of the Community, LISADAWSON.

Once you have open bills to connect vendor credits with, you'll be able to apply them using AileneA's steps.

You can additionally find many detailed resources about using QuickBooks in our help article archives.

Please don't hesitate in sending a reply if there's any questions. Enjoy the rest of your day!

Hi there,

I too have questions on how to enter a credit/refund where I exchanged a product from a vendor for money back.

Because of this, I cannot balance my Quickbooks with my bank account and going to the forum on how to 'enter a refund from a vendor' will take me to 'pay bills later' which technically isn't a bill for my inquiry.

What do I do?

Thanks for joining the thread, @AesthA.

You can record a barter transaction in QuickBooks Online (QBO). You'll need to set up the vendor as a customer at the same time.

Just a heads up, before entering your barter transaction, make sure your barter partner is a customer and a vendor at the same time so you can give the product to them and exchange for something at the same price that will serve as your refund.

Then, let's create a barter bank account that serves as your clearinghouse for the price/amount.

Once done, follow steps 2 to 3 through this article: Record a barter transaction.

If in case you need a reference on how to create a vendor refund for an item or service, see this article to learn more: Enter a credit from a Vendor.

Please if you have additional questions with recording vendor transactions in QBO, let me know. I'm always around to help. Enjoy your day!

Hello, I do have the same problem in QBSE, but I was wondering if i came across a different solution.

I didn`t find an option how to track a refund I had from a supplier. I tracked the original expenses as my "cost of goods for resale" with -£80.00, so when the refund showed up in my QB I sorted it into the same category, as like a "positive expense" with +£30.00, thinking it would reduce the overall expenses.

After reading the support articles here I thought this way would not be the right way, but checking on my quickbooks again and doing the split-cost-method, I realised that my option also would have reduced the overall expenses in the right way and also would be much easier to understand and quicker to handle.

Could you tell me if this would be an option too or if this will mess up something in the end?

In my opinion it should work, as it is both categorised as expenses, and a positive expense in my head is a refund?

Thank you

I have to agree on this, I am paying almost £10 for my QBSE subscription per month for my TINY Business, adding a refund from a vendor should really be an absolute BASIC feature and included if you are subscribed to a service. I get it might not have all the features for that price than other QB Packages, but a refund? Then you may aswell just say you only can track vendors starting with letters A, B, C, all others are premium services.

I tried the above technique for recording a vendor credit and am running into difficulties.

1. I created the vendor credit as specified.

2. I create the bank deposit as specified. I select the bank account that the credit was received in in the Account field in the upper left corner. In the Add Funds to Deposit section, I use Accounts Payable in the Account field.

3. When I do the 3rd step, Pay Bills, funds are removed from the bank account that I received the vendor credit into, so this bank account is out of balance.

Any ideas?

I appreciate you for joining the thread, @Yo_Be_Low. Let me share with you some additional information about handling vendor credits in QuickBooks Online (QBO).

To avoid issues with your balances, please make sure to enter a vendor credit transaction aside from the bank deposit before going to the Pay Bills page.

Here's how:

Once done, use Pay Bills to connect the bank deposit and vendor credit. It keeps your vendor expenses accurate.

I'm adding these links to learn more about handling vendor credits and refunds:

Moreover, you can get more hints about tracking your other vendor transactions through this link: Enter expenses, pay bills, write checks, and manage suppliers.

Please keep in touch if you need more help with this. I'm determined to help. Have a great day!

I followed the instructions to enter a vendor credit, a bank deposit using the accounts payable account, and gone through bill pay to apply the credit. Now my vendor shows the refund twice- a credit and a deposit. I'm using QB online. Any idea how to make this work correctly?

Thanks for joining this thread, SLRV.

I'll help you figure this out.

You'll want to make sure that transactions are linked properly. This way, it won't display the refund twice. Or you may delete and recreate all the transactions to ensure to link transactions correctly.

And if there is really a duplicate transaction, you can delete it to not show on your vendor's data. Here's how:

That should do it! Please let me know how the steps work, @ECHS-ME. I'll be right here to help.

how do you link a deposit to the credit in the vendor using quickbooks desktop?

I’ve got you covered, Val.

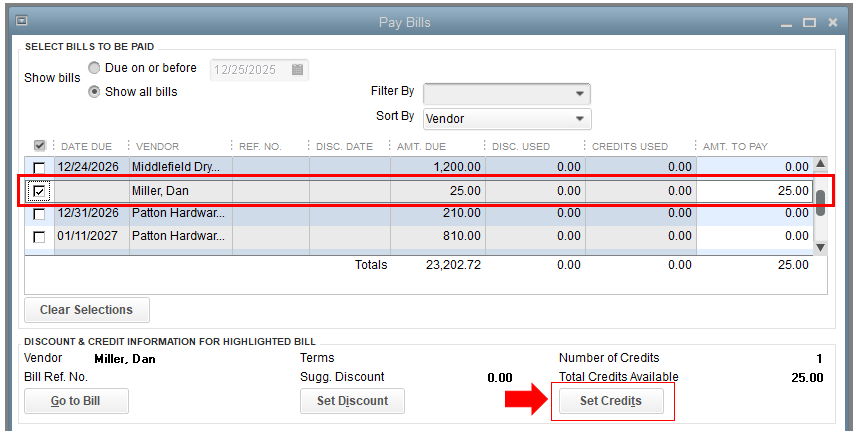

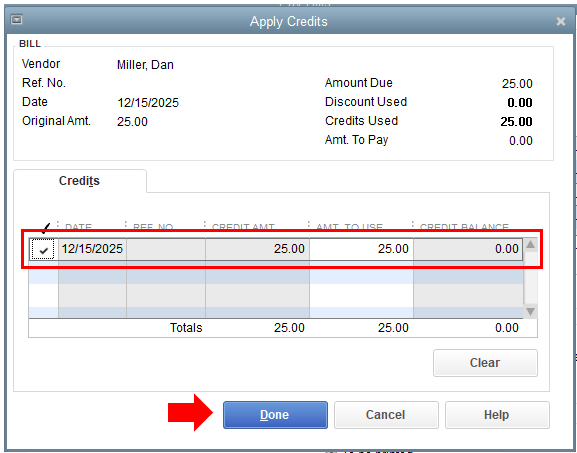

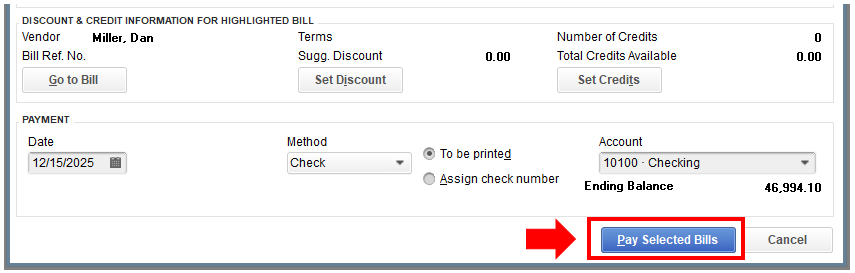

You can simply use the Pay bills feature to link the deposit to your bill credit. I’m glad to show you the steps.

For more information about handling refunds you received from a vendor, check out this article: Record a vendor refund in QuickBooks Desktop.

Also, here’s the complete list of workflows and other vendor-related transactions: Accounts Payable workflows in QuickBooks Desktop.

If you need further assistance in managing your vendor transactions, just leave us a message below. We’re always here to help. Take care!

Thank you so much.

You're most welcome, @FitGrandma.

I appreciate you for joining this thread. Do you still have other concerns? Please know that you can always reach out to us whenever you need help.

If you need more information about managing your company, feel free to visit our Support page. It contains ways and tips to make sure everything is accurate and organized.

Have a great day, and keep safe always!

Since we do not pay taxes on refunded amounts, there should be a way to categorize this "money coming in" as NOT income. This is the main concern and need to being able to tag income as a refund.

Hello 007108,

Nice to see you in the QuickBooks Community! This is an excellent idea and feature! Therefore, I will take note of this and submit feedback to our Product Developers. They are always looking for ways to enhance the program! You are also welcome to offer input as well! You are view our blog to see the latest updates!

If you have any other questions, I am only a click away! Please don't hesitate at all! I hope you enjoy the rest o your day!

This was just what I needed! I was able to show the refund in my checking, but I needed to apply that refund for materials to a client's account for accurate job profit/loss. THANK YOU!!

Hello there. @computermomof6.

I'm glad that my colleague @Angelyn_T was able to provide the help you need. If there's something in your mind that need clarifications about QuickBooks Online or any related concerns, never hesitate to reply to this post.

Keep safe and have a blissful week!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here