Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

SALE EXTENDED 70% OFF QuickBooks for 3 months* Ends 12/8

Buy nowHi @mfpreston.

Welcome to the Community.

Please feel free to post any suggestions you have here, I'll be happy to put that feedback to our engineering teams so that it may be possible for them to be implemented in the future.

I love seeing all sorts of suggestions, as it helps to make Intuit's products the best it can be.

If you would prefer, you can also submit your suggestions here.

I'll be keeping an eye out for your response, I look forward to seeing what ideas you have.

When using the reconciliation screen, if you resize the columns to better see the contents in the account field, quickbooks will undo your resizing the next time you sort or move a column sizing. It's quite frustrating. Currently I can see about 20 characters of the Account field but reference, payment and deposit fields appear to be about 70 characters wide. I resize, you undo my change, every time. I've deleted several fields from the view, hoping that account will default to a longer field, however it doesn't. Payee seems to be about 150 characters wide, by default. Please let me set my column widths, and do not refresh/revert to the standard settings.

Hi tbelanger,

I can see how challenging it is for you to always adjust the widths of the columns every time you reconcile.

I’ll personally share your feedback with our product development team. That way, they’ll be aware of the things that you’ve been through, and they can add an option to retain your preferred column widths. This option will also be useful to other users who are going through the same challenges when reconciling an account.

If you have suggestions or other feedback to share, feel free to post them. We'll take them as an opportunity to improve QuickBooks, making it more suited to your business needs.

Hello SterlingD,

We are working with Estimates and Progress Invoices. We have multiple clients that we place on 24 month payment plans. I am sure that many businesses have payment plans of this type.

Currently, we create an Estimate and then enter 24 Invoices, each for a future dated month, which have identical amounts in each invoice due for each month until the balance is paid in full. It is a VERY tedious process to enter all those invoices. What about an option to create "X" number of identical invoices or to "Create "X" number of Progress Invoices to pay the Estimate in full"

This would save MUCH time and also save tired fingers.

Thank you!!

"Please feel free to post any suggestions you have here, I'll be happy to put that feedback to our engineering teams so that it may be possible for them to be implemented in the future."

I have a couple of suggestions

1) When multiple users have admin access to payroll, only one admin can be in the payroll or employee information area at a time. For security and accuracy purposes, that is understandable. However, the wait time after an admin has logged out of an area until the next user can access that area is 30 minutes. That's ridiculous, especially if you are remotely collaborating on troubleshooting or resolving an issue. Please please lower this to something more reasonable like 5 minutes, maybe 10 max.

2) For a professional services company such as mine with several repeat clients, some of them with multiple projects at the same time, I need to be able to bill the client for multiple individual projects separately. Currently the only way that QBO offers me is to create a "sub-client" for each project under the "parent" client. While it can work this way, it's not ideal, especially with automated invoicing that lists a project as a "client". p.s. the customization features of creating invoice templates are way too antiquated for the 2020's+. I *always* have to go in and manually print the invoice and edit the pdf before i send it to my client, if i want it to look professional

"Please feel free to post any suggestions you have here, I'll be happy to put that feedback to our engineering teams so that it may be possible for them to be implemented in the future."

I have a couple of suggestions

1) When multiple users have admin access to payroll, only one admin can be in the payroll or employee information area at a time. For security and accuracy purposes, that is understandable. However, the wait time after an admin has logged out of an area until the next user can access that area is 30 minutes. That's ridiculous, especially if you are remotely collaborating on troubleshooting or resolving an issue. Please please lower this to something more reasonable like 5 minutes, maybe 10 max.

2) For a professional services company such as mine with several repeat clients, some of them with multiple projects at the same time, I need to be able to bill the client for multiple individual projects separately. Currently the only way that QBO offers me is to create a "sub-client" for each project under the "parent" client. While it can work this way, it's not ideal, especially with automated invoicing that lists a project as a "client". p.s. the customization features of creating invoice templates are way too antiquated for the 2020's+. I *always* have to go in and manually print the invoice and edit the pdf before i send it to my client, if i want it to look professional

I agree with suggestion number one. It makes it impossible to work as a team if we have to wait 30 minutes every time someone gets into payroll. Also, we need to be able to dictate which checks deductions come from during payroll. It does not work to have health insurance premiums come out of every check when there is a third payroll.

We appreciate your feedback, sschar17.

We'll take note of this for future feature updates. We value your security, thus, the strict compliance in accessing your payroll.

Furthermore, QuickBooks Desktop set up on payroll deductions is to deduct the amounts per paycheck created.

You can check this article for more information: Get started with Payroll.

I'll be here if you have additional questions.

Quickbooks desktop premier. When making a lengthy sales receipt for a walk in customer and then realize they have a 30 account, we have to void and re enter all the items in to an invoice. I and a lot of people would like to have an option to convert the sales receipt to an invoice.

Welcome to the Community space, @hydraulic house.

Finding new ways to adapt to our customers’ needs is how QuickBooks gets even better. Your feedback helps our Product Development team decide which feature will be implemented on the next future update. The change is also based on how popular a specific feature request is.

For now, I recommend using a third application in our QuickBooks Desktop Apps Center. All of the apps listed on this site are integrated with the program.

While waiting, you can always visit the following links below for future product updates:

Please know that you can always get back to me if you have any questions with QuickBooks. I'm always here to help. Have a good day.

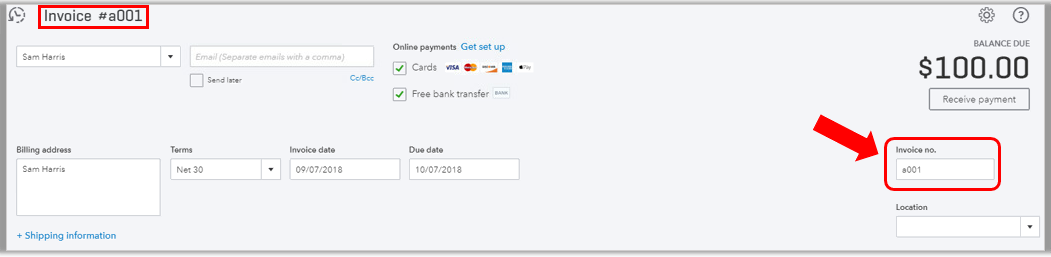

When creating a new invoice, the invoice number always defaults to the last invoice that was created, and I have to constantly change it. In my case, my invoice numbers are always the same as my job numbers. It would be helpful if the invoice box was left blank, or if it would auto-fill with the same information as the job number.

DHM1

Welcome to the QuickBooks Community, DJ221! I will be delighted to assist you here.

With QuickBooks Online, you have the opportunity to change the invoice number to a specific format. What QuickBooks will then do is recognize the pattern and keep it going for future invoices. For example, if you set the invoice as DMH1, the program will automatically make the next invoice number DMH2. Here's how:

You can refer to this article for more information on how to change the invoice number on the sales invoice. I encourage you to pay attention to the note at the end of the article, which is basically saying once you set the pattern, remove the invoice number box so it won't change the number and throw off the pattern.

Please let me know if you have any concerns. My team and I will be here to help you at any time. I hope you enjoy the rest of your day.

I was helping a QBK with an SMB (RE Building and Construction.) The SMB categorized over 1200 transactions without adding a payee. According to standards, QBKs cannot undo these to batch add payees. To save time, I suggest adding a PAYEE column in Banking under the CATEGORIZED tab so we can batch add the payees. Also, the SMB accepted many suggested rules but the payee was missing there, too. I suggest changing the payee box in bank rules from RECOMMENDED to REQUIRED.

I often have several tabs of QBO open at the same time. It would be great if I could login the next day and pick up where I left off. Currently I have to close all tabs but one, re login on the one, and then reopen (and remember) all the tabs I was working on.

Thanks for following the thread and sharing your concerns, @Newsy.

I agree. Having the option to come back from where you left off would be an excellent feature. This would be the perfect opportunity to submit a feedback request to our Product Development Team. Our developers review each request and consider them for future updates. You can use the link I've included below to submit your suggestion.

Please feel free to reach out any time you have questions or concerns. Take care!

I am a Turbo Tax customer. Last year and this year I received emails telling me something was wrong with my payment info. So, I tried to change it, but, it was not accepted.

Lat year I was eventually told by your support folks that I would have to place a standalone order for TT. I did.

Happened again this year. I worked with Sue Y who had be try several troubleshooting tasks. Nothing worked. My payment info was rejected with every attempt.

Eventually, Sue talked with your (or your banks) credit card support group and found out my credit card account had been put on hold because I mis-keyed my CC info by one digit. I am told now the hold has been released and I should be getting my TT download info in a day or two.

My problem is that SOMEBODY - you or your CC department or your back should have told me about the hold. Everybody wants to say it is a security issue. Well, the bank that apparently did the hold takes my money when I make payments - surely they could send me a little note to tell me that was something that needed my attention. The excuse of "security" is an important buzz word these days and is supposed to be a response to all issues. NOT TRUE.

There are secure ways to handle this kind of issue. You came within one phone call of losing a long time customer.

You MUST let customers know why payment info is rejected. Even a letter to the address on file with the bank would be okay. Don't rest on the "security" excuse.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here