Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowMy company has set up an integration between QBO and Bill.com. If we process an invoice dated from earlier in the year (a financial period that has been closed), the expense will post to that corresponding month in QBO. This issue forces us to constantly restate our financial reporting. Is it possible to lock a period so no entries can be posted after it has been closed?

I've got you covered, @JSuelto.

QuickBooks Online (QBO) offers the option to Close the Books by finalizing financial statements for a specified period and then password protecting any changes to that information. Follow these simple steps to get started:

Close the Books in QBO

This information is also available in our detailed guide on closing the books here. Check out this awesome video tutorial on the process for a visual demonstration:

This allows you to lock whichever periods you need and avoid entries after that period is closed. Please feel free to keep in touch with me here with anything else you need, the Community always has your back. Thanks for bringing your question here, I hope you have a safe and relaxing holiday season.

For more information on taxes, forms, filings, payroll and other Year End activities, make sure to check out our Year End Resources page.

This is exactly what I was looking for @MichaelDL. Thank you!

As a follow up, how does QBO handle prior month expenses posted from a sync with integrated software (Bill.com or Expensify for instance)? Is it possible to force the expenses to post in the current fiscal period?

We want to set 12 periods. In other words, we want to lock each calendar month. Can QBO handle this function for multiple periods vs closing one year?

Hello there, @Niki Schoggen.

I’d be glad to share some information with you on how closing the books works in QuickBooks Online.

Closing your books monthly allows you to review the transactions recorded into the system to ensure they are accurate. This is also to make sure all the adjustments made properly reflects in the business’ activity for the month.

The ability to set QuickBooks to close your books per month automatically is currently not available. What you can do is to change the closing date each month, from November 30 to December 31 (As of Date closing). Please refer to the screenshot below:

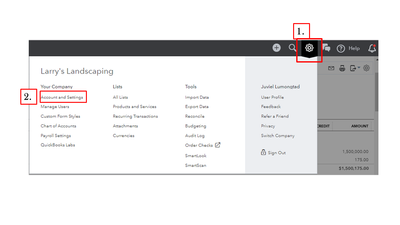

To set the closing date of your books “As of Date”, here’s how:

Once your books are closed for November, all the books from January will also be closed.

On the other hand, I can see how this specific feature is beneficial to you and your business. I’d be delighted to forward this to our Product Developer for future considerations. You can directly share your suggestions and feature requests for product improvements.

Here’s how:

You can be sure we’ll continue enhancing this program so it grows alongside your business. Stay tuned to our blog: https://intuit.me/2L2zqTv.

Don’t hesitate to visit the Community page if there are any app features you’d like to get more familiar with. I’m always here to help.

Hi,

I followed all the steps. However, I did not see the Close the books checkbox for me to click. Could you advise? Thank you!

It's possible you're a standard user, Abby7700.

Only the master and company administrators have the capability of closing the books and setting a password.

You can refer to this article for more information: How to close the books.

If you have more questions, just drop a comment below. We'll get back to you as soon as we can.

Hi Kristine-

Thank you for your reply. But I am the master for the company account. In other words, the registered account is under my email. Is there any way to solve this? Thanks!

Good day, @Abby7700.

Allow me to step into this conversation and help you with closing your books in QuickBooks Online.

The master admin of the company file should be able to close the books. To better isolate this issue, you can try accessing your QuickBooks on a private browser. This is to test if the issue has something to do with your browser.

Here are the different keyboard shortcuts to open a private browser:

If it works fine, you can go back to your regular browser and clear its cache. Please follow the outlined steps in this article depending on the browser you're using: Delete or disable cache and temporary internet files in your web browser.

However, if the issue persists after trying these steps, I'd suggest reaching out to our Customer Care Team. They have the tools to check on your account securely and can do a screen-sharing that can help verify what's causing the issue.

This should get you on the right track.

Keep me posted how it goes. I'm just a reply away if you need further assistance with closing your books or any concerns with QuickBooks. Have a nice day!

This is the message I get when trying to close the books:

You can't close the books when any product has a quantity-on-hand of less than zero as-of the prospective close date. Products with negative quantity-on-hand: 1162

Anyone know a workaround?

That error message pops up because of your product item, ydweiss.

When your product has less than zero quantity on hand, it stops you from closing the book. To resolve this, you'll have to make sure that you don't have products that the quantity is less than zero.

Here's how to check:

This should now allow you to close the books.

I'm just a post away if you have other concerns with QuickBooks. Have a good day!

If you place this password on the closed period. Can you later go back and take it off completely, do what work you need then relock them?

Once you close the books and password protect it. Can you go back and open them back up and take the password protection off?

Thanks for joining this thread, @shanea777777.

Yes, you're able to take the password protection off and relock them in QuickBooks Online. I'm happy to provide steps to accomplish this. Before doing that, make sure you sign in to QBO as a master admin or company admin. So you're able to modify it.

Here's how:

For more details about the process, check out this article: Edit your closed books.

After you've made changes to your books, you can always access the Exceptions to Closing Date by going to the Report tab.

I've attached an article about the different tasks for the incoming tax season and other topics.

You're always welcome to post anytime if you need our help. Keep safe!

Hello,

Is this something that is recommended weekly? Or is monthly just as effective? Thank!

Hi there, Brothers In Law Installations.

It would really depend on how you'd like to manage your books. Most of the time, small businesses close their books at the end of the year to prevent unwanted changes that could affect their financial reports before filing the taxes. Although, you can also your books on a monthly or weekly basis to easily track and monitor all their business activities within that period.

Whether you’re closing the books at the end of the month or year, the process is the same. A best practice is to collaborate with your Proadvisor or CPA in reviewing your account and performing the formal closing process to ensure that everything is accurate and up-to-date.

Here are some tips you can follow before closing your books:

If you have need some resources in accomplishing your other tasks, you can always visit our Help Article page.

Feel welcome to reach out to me again with any concerns you may have. I'll be more than happy to assist you again.

How does QBO handle prior month expenses posted from a sync with integrated software (Airbase or Expensify)? Is it possible to force the expenses to post in the current fiscal period?

did you get an answer to this? im having the same problem as well

I'm also interested in this - where in bills.com we're voiding a transaction, for that voided transaction to be posted towards the most recent open period.

Hello, leehchris.

I can help you with how to handle this in QuickBooks Online.

You can record a reversing entry to void a transaction in another period instead of removing it. Let me guide you through the steps of voiding transactions without deleting any of your records.

Step 1: Void the transaction:

Print the transaction journal for reference

Once done, create a reversing Journal entry to void a transaction. Please follow the steps below:

Please check this article and proceed to Step 2 to complete the process: Void a transaction in another period.

You can count me in if there's anything else you need.

I've never seen this before. I try to reconcile my accounts and it says This transaction is in a closed period. Not sure how that happened but how do I unlock it?

Elaine

[email address removed]

Is there a way to leave "non posting" entries editable, even if they are dated in a locked period? I want to close out my prior year, but I have a large number of Sales Orders and Purchase Orders that remain unfilled, and will for several months. It would be great to be able to lock posting transactions, invoices, bills, etc., but not the other transactions.

Thanks for joining us here, amartin.

I understand that non-posting entries does not affect your financial reports. However, all transactions are locked out after closing your books. Please note that closing your books ensures everything stays the way you want it to.

You'll want to enter the password when clearing out or editing the pending sales and purchase orders. Let me share this article for more details:

I would also suggest sending feedback about being able to exempt non-posting transactions when closing books in QBO. Our engineers are collecting and reviewing customer input when designing product updates.

Here's how to send your feedback or feature request from your QBO account;

All feedback can also be viewed and tracked though the QuickBooks Online Feature Requests website.

Let me know if that's all the questions you have with regards to closing books in QBO. You can always get back and ask for help whenever you need it.

I am still really confused. Can a month be closed or not? When I click on the link of how to close a month, it shows how to close a year. What is process for closing a month? Does each month have to be closed or once a year is closed, then each month is closed? Please help me understand.

Hello, Craig.

I'm dropping by to clarify some details about closing a month in QuickBooks Online.

To clarify a bit, are you trying to close a specific month? Or do you want to leave that month's transactions closed while still having the option to edit the rest of the months in a year?

We're unable to close a specific month. QuickBooks uses a closing date to prevent any transactions before that date from being changed.

In a sense, it closes off a portion of the year (which includes the entries from the prior years). So, it's not exactly a year unless you set the closing date to December 31st, which closes all months.

All we really have to do is to select a specific closing date. So, if you want to close off the month of March, we'll want to set the closing date to March 31st or April 1st. So, any entries before this date would be locked. This includes all transactions from the previous years as well.

Also, if you want to edit an entry before the closing date, we can do so. QuickBooks will prompt a warning and wants us to enter a password (if the password option is enabled).

However, note that changing an entry's date, mapped account, or amount will affect your reconciled balances. We'll want to seek an accountant's advice before doing so to ensure the accuracy of your books after changing.

If you haven't done it yet, I suggest checking out this article for more details about setting a closing date: Close your books in QuickBooks Online.

Would you like some assistance reconciling your accounts? Take a look at this article as a guide: Reconcile an account in QuickBooks Online.

Feel free to drop by again if you have more concerns about the closing date. Let me also know if you have questions about your entries. I'm here to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here