Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowSolved! Go to Solution.

Hi there, @myndheal.

Welcome to the Community. I can help you get rid of the error message when importing invoices.

You usually encounter the notice when the sales tax feature is enabled. If you don't collect sales tax on products and services in QuickBooks, I recommend turning off the feature.

Here's how:

Additionally, I recommend visiting the following article to learn more about the accepted CSV formats in QuickBooks: Format CSV files in Excel to get bank transactions into QuickBooks.

Drop me a comment below if you have any other questions related to importing data. I'll be happy to help you some more.

Hi there, @myndheal.

Welcome to the Community. I can help you get rid of the error message when importing invoices.

You usually encounter the notice when the sales tax feature is enabled. If you don't collect sales tax on products and services in QuickBooks, I recommend turning off the feature.

Here's how:

Additionally, I recommend visiting the following article to learn more about the accepted CSV formats in QuickBooks: Format CSV files in Excel to get bank transactions into QuickBooks.

Drop me a comment below if you have any other questions related to importing data. I'll be happy to help you some more.

Hi, turning off taxes does not work after even one invoices has a tax checkbox next to a line item.

Please advise. I am in the same place, but already have invoices in the system, and 100s more to import.

Thanks

Hello, Homecook. I understand how important it is to import your invoices.

You'll want to look for a third-party application that can import invoices. This way, you'll have an option to import multiple invoices with QuickBooks Online. Just go to the Apps menu or through the QuickBooks App Centre.

I've got you these resources for additional reference and guide about importing invoice in QBO:

Keep me posted if you have any additional questions about importing concerns. I'll be right here to help.

I am having the same problem. I do not have the option to "turn off" the sales tax. Any help?

You're unable to turn off the automated sales tax in QuickBooks Online, @Anonymous. I've come to provide additional information and provide a workaround so you can tax-exempt your transactions correctly.

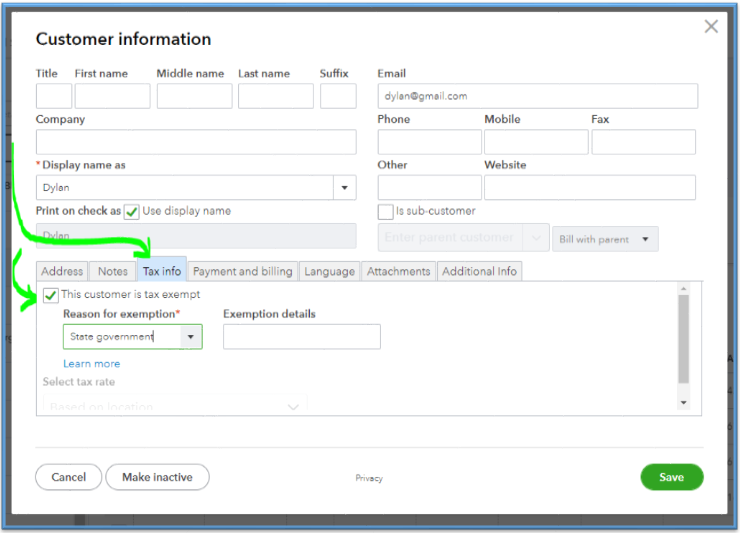

You can set the products and services as nontaxable and set each customer's tax info to tax-exempt if you’re not collecting any sales taxes from them. I'll show you how:

Next, navigate to the Sales menu and go to the Customers tab. From there, locate the customer and follow the steps below:

In order to prevent QuickBooks from calculating sales taxes, you can also uncheck the Tax column on all of your sales forms (such as invoices, credit memos, and sales receipts). See the screenshots below:

You’ll want to check out this article to learn how the sales tax feature works: Set up and use automated sales tax in QuickBooks Online.

I'm adding these resources for additional guide on tracking and calculating sales tax:

Don't hesitate to post again here if there's anything else you need to know about the automated sales tax feature. I'd be happy to assist you further. Take care always.

I have come across this error and sales tax function is turned off in my company & customer setting. Still the import invoice is not working. Called Intuit and they cannot help (keep insisting I need to get Quickbooks Advanced). I'm currently on Quickbooks Plus, I was able to import back in Oct 2022. Do anyone have any solution to help me out, I have over 1k invoices to get in Quickbooks.

I'm having the same problem. I am trying to import invoices from an excel file that was exported from QB desktop software, and the below message comes up. I have tried to turn off sales tax settings, but that doesn't work. This message comes up before I can choose the file to upload, so it isn't my excel file.

Please help!

I just got off a lengthy chat session with the QB team regarding this issue.

There are two ways to import invoices after setting up sales tax:

1 - Delete the account and open a new one. Don't set up sales tax this time

2 - Pay an additional fee to access a third party app that fills this gap in the QB functionality. Even though a bug created the need for this app, QB will not offset the customer cost associated with this solution.

We don't have much data in yet, so we'll probably choose to delete the account and deal with the refund process.

What a bummer... I wish I had known this. I only setup sales tax to try it with the QBO Advisor training. Otherwise I would have never set it up! UGH!

So I just created a new QBO account and automatic sales tax is my only option in this new version of advanced, could that be true? I need to import my invoices on a weekly basis and was not able to do so in my old version because a coworker turned on automatic sales tax. I would rather have the import function than the sales tax function. Did the manual sales tax function get removed from new versions of advanced? How do I override this system in QBO?

I was told about three months ago that once my new account is opened I would not need to use the automated sales tax system and would be able to import my invoices which are all tax exempt sales.

What is the current status of the automatic sales tax system? Is it true that all new QBO are forced to use this new sales tax system? Please let me know.

I want to join you here and add more details about sales taxes and importing invoices in QBO, Rooneyjkk1.

First, I'd like to clarify that importing invoices can be only be done if you have not activated the Automatic Sales Tax feature. You can see more details about this here: Import Multiple Invoices at Once in QuickBooks Online.

Second, please take note that all new QBO accounts uses the Automated Sales Tax function. At the moment, there's no option to turn if off once activated or use the manual sales tax system. Let me share these articles for more details:

We appreciate all customer feedback and suggestions. In fact, most of the new features and updates are based from the input that we receive in this forum.

I would recommend sending a feature request about this to our product engineers directly from your QBO account. Here's an article for more details: How Do I Submit Feedback?

For additional and references when collecting sales tax, feel free to check out these articles:

Feel free to reach out to me again or post your follow-up questions below. You can also drop by the Community again if you need anything else.

If not using the automatic sales tax system how do I manually apply sales tax on the invoices created in QBO? I have a few customers I like to invoice in QBO directly, in my new advanced account how do I add sales tax to an invoice? The old manual option does not seem to be there in the new account, my only option is to turn on automatic sales tax.

My current invoicing is very local so I only need to deal with two sales tax rates, so I am hoping to manually add the sales to the invoices. Thanks.

I saw this was solved which is great but I don't have those prompts on my version which is QBO advanced. Called customer service and they told me to do exactly what I did and it still doesn't work. So does anyone have a real way to change sales tac because I need to import invoices.. Thanks

Hi there, @vandalen1.

I can see the importance of being able to import invoices. As mentioned by my colleague above, once you set up sales tax on your account, you can no longer import invoices. As a workaround, you can look for a third-party app you can integrate with QuickBooks Online (QBO) to help you import invoices. You can go to the Apps menu inside your QBO account and look for an app.

We recognize that each company has unique needs, and I can see how the feature you're looking for would benefit and empower your business. I recommend sending this request straight to our product engineers through feedback. It helps us improve the features of the program.

To send feedback, follow the below steps:

To be updated with the recent and upcoming changes for QuickBooks products, visit these sites:

Additionally, I'm attaching our Community link if you need help managing your sales: Invoices and payments.

If you have any other questions about invoices and QuickBooks, you can always add them to your reply. I'll be more than happy to take care of them for you. Have a dazzling day ahead!

@Hayzee- I feel your pain. I was on the phone with Intuit support over 8hrs or more in a course of 2 days. Intuit support and I went through all the possible troubleshoot, remove all sale tax setting in Company file and each customers setting. The main issue sales tax is auto -enable in Intuit Qb end and users can't remove on the app. It is the most mind blowing thing that they CAN NOT fix the issue and would ONLY recommend us to use a third party vendor. Plus it is at our own cost. I end up using Transaction Pro (third party) to help with the import. I hope this help.

Correction...you absolutely CAN import invoices if you have the Automated Tax, you just HAVE TO HAVE QuickBooks Advanced version because I had it for a year, but because SIMPLY that was the ONLY feature I used between Plus & Advanced, it was not feasible to pay $100 difference for ONE thing as I do not need ANY of the other features in Advanced.

I have advanced and I get the same error message. Cannot import because can't support sales tax. This is absolutely the most unacceptable issue to date. We are fed up with all of the online issues.

I hear your sentiments, @jo. Know that this isn't the experience we want you to have while using the service.

I can see how the feature to import invoices with be helpful for you. However, this isn't available in QBO at the moment. In the meantime, it's best to put your suggestions and feedback regarding this option with our product developer. Here's how to send feedback:

Our product engineers will consider your suggestions, and you can always check the status of your request through this link: QuickBooks Online Customer Feedback.

Additionally, I recommend visiting the following article to learn more about the accepted CSV formats in QuickBooks: Format CSV files in Excel to get bank transactions into QuickBooks.

Drop me a comment below if you have any other questions related to importing data. I'll be happy to help you some more.

Prepare your Invoice data with the following template

| RefNumber | Customer | TxnDate | DueDate | ShipDate | ShipMethodName | TrackingNum | SalesTerm | Location | Class | BillAddrLine1 | BillAddrLine2 | BillAddrLine3 | BillAddrLine4 | BillAddrCity | BillAddrState | BillAddrPostalCode | BillAddrCountry | ShipAddrLine1 | ShipAddrLine2 | ShipAddrLine3 | ShipAddrLine4 | ShipAddrCity | ShipAddrState | ShipAddrPostalCode | ShipAddrCountry | PrivateNote | Msg | BillEmail | BillEmailCc | BillEmailBcc | Currency | ExchangeRate | Deposit | ToBePrinted | ToBeEmailed | AllowIPNPayment | AllowOnlineCreditCardPayment | AllowOnlineACHPayment | ShipAmt | ShipItem | DiscountAmt | DiscountRate | TaxRate | TaxAmt | DiscountTaxable | LineServiceDate | LineItem | LineDesc | LineQty | LineUnitPrice | LineAmount | LineClass | LineTaxable |

| 101 | Janice Johnson | 01/10/2020 | 01/12/2020 | Ground | Net 30 | 110 Main Street | Suite 2000 | Dallas | TX | 99875 | 110 Main Street | Suite 2000 | Dallas | TX | 99875 | Special Handling | Thank you for your order! | 0 | N | Y | N | N | Y | 12 | Shipping | 0.02 | Y | MP3 Player | Blue MP3 Player | 2 | 55 | TAX | |||||||||||||||||||||

| 101 | Janice Johnson | 01/10/2020 | 01/12/2020 | Ground | Net 30 | 110 Main Street | Suite 2000 | Dallas | TX | 99875 | 110 Main Street | Suite 2000 | Dallas | TX | 99875 | Special Handling | Thank you for your order! | 0 | N | Y | N | N | Y | 12 | Shipping | 0.02 | Y | Leather Case | Leather Case | 2 | 10 | TAX | |||||||||||||||||||||

| 101 | Janice Johnson | 01/10/2020 | 01/12/2020 | Ground | Net 30 | 110 Main Street | Suite 2000 | Dallas | TX | 99875 | 110 Main Street | Suite 2000 | Dallas | TX | 99875 | Special Handling | Thank you for your order! | 0 | N | Y | N | N | Y | 12 | Shipping | 0.02 | Y | Gift Cards | Gift Cards | 2 | 5 | TAX | |||||||||||||||||||||

| 102 | Leonard Walker Inc | 01/10/2020 | Net 30 | 9 Winding Road | Winchester | NY | 12345 | 9 Winding Road | Winchester | NY | 12345 | Thank you for your order! | 0 | Y | N | N | N | Y | Y | Handhelds | Portable Game Player | 1 | 100 | TAX |

then use an importer tool to proceed

https://get.transactionpro.com/qbo

I do not have the option to "turn off sales tax". I tried to deactivate the agency but the error message still pops up when I try to import invoices. Any suggestions? Thanks

I have a suggestion for you to successfully import your invoices in QuickBooks Online (QBO), @TT860. This way, you manage them in your account as soon as possible.

Before that, please know there's no option to turn it off once activated or use the manual sales tax system. I'd recommend using a third-party app as an alternative solution to eliminate the error and successfully import the invoices.

Here's how:

Feel free to read through the following articles below to learn more about how to handle tax payments, use sales tax for specific transactions, and import items in QBO:

For additional QuickBooks-related concerns, don't hesitate to post them here in the Community. We're always available and willing to lend a hand to your queries. Keep safe always.

@Fiat Lux - ASIA I don't have that option. I looked in Accountant and Business View.

I am not wanting to use a third party app for this anyway. Seems like a standard feature that should be working.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here