Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowYes, your insurance company is a vendor even though you may get a refund from them.

I find it is best to rarely use 'other names'. About the only instance would be a shareholder or officer.

how do you account for a Vendor who also purchases your products? IF you sell to screen printers who also sell your retail goods how would you bill them for the goods they buy, AND pay them for the work they do? QB will not let you enter a new vendor who is already a customer.

Hi there, SooSacks.

To do this, you can either use a Bill or an Expense transaction. A bill is used when you pay the supplier on a later time. Use expense when you pay your supplier right away.

Also, there's a way to enter a new vendor who is already your customer. You can add other characters to their name to make it slightly different.

For example, if the customer's name is Abbie Marge, you can enter the supplier's name as Abbie V Marge. This way, QBO will let you have a vendor and customer with the same person.

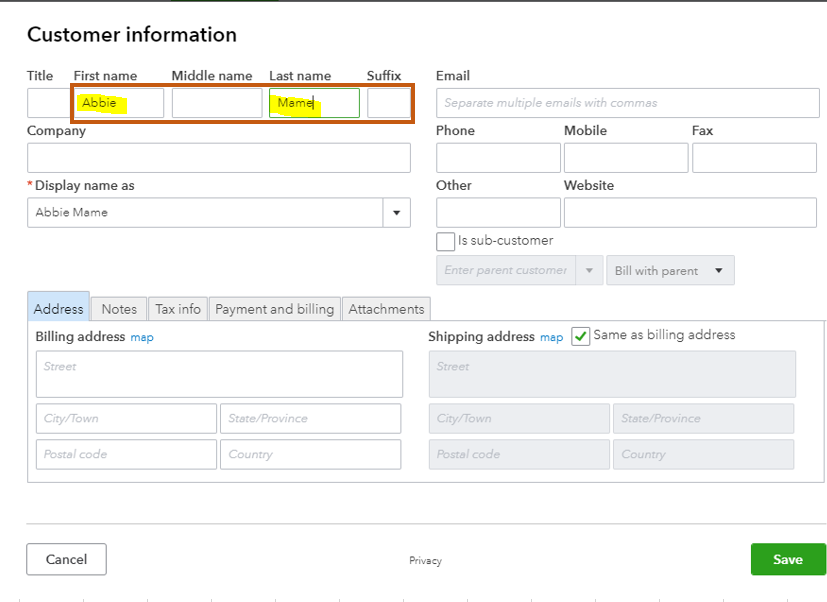

I've added a sample screenshots for you:

Customer:

I've added an article about: How to record a barter transaction.

Just tap on me whenever you need help with the vendors account.

Should I always use the Vendor field when reconciling transactions? And if so, I'm curious as to why?

Yes, you can use the Vendor field to reconcile transactions, Sbeara11.

A vendor in QuickBooks Online is a person or business who sells products or provides services. On the other hand, a customer is a person who pays for your products and services.

To keep track of your payables, you need to use the Vendor field. And, here's the link to help record your expenses: Learn the difference between bills, checks, and expenses in QuickBooks Online. It provides additional details and how to use them.

For additional information about your vendors, here's an article with a video tutorial: Add a vendor in QuickBooks Online.

Stay in touch with me if there's anything else I can help you with reconciling your vendor's transactions. I'm always right here whenever you have follow-up questions about this.

I run an auction company and take consignment. Would my consignors (whom I pay once goods are sold at auction) be considered vendors or customers?

I can certainly help set up your consignor in QuickBooks Online, OneSourceEstate.

The consignor keeps ownership of the product until it's sold. With this, you can set them up as a vendor. Here's how:

For more details about managing consignment sales, I'd suggest checking out this article: How to Record Consignment Sales.

Additionally, monitoring your business expenses and accounts payable is a breeze in QuickBooks Online. The program has ready-made vendor reports you can open at any time and customize depending on your business needs.

I'm only a post away if you need more help setting up your consignor in QuickBooks Online, OneSourceEstate. It's always my pleasure to help you out again.

What if a customer is also a vendor? I sell products to restaurants but I also dine there. How should I categorize?

Hello there, @wineguyatl. I’ll make sure everything will be sorted out for you.

Let's create a customer and vendor profile before categorizing transactions in QuickBooks. Make sure to register different names to avoid getting an error.

Here’s how to set up a Vendor:

Here’s how to set up Customer:

You may generate a billable expense to link the expense to the customer's income. This article will serve as your guide. You can also choose an expenditure account from in the Category Section.

Additionally, I added this article for your future references:

Keep us posted for any additional queries managing customers and vendors in (QBO). I’m just a post away.

If I am billing a company for work that my client did for them, am I classifying those companies as customers or vendors?

Thanks for joining this thread, Jessica585.

I can see how important it is for your business to properly set up vendors and customers. This allows you to easily track their transactions and ensures accurate records.

Based on the details shared, you’ll have to classify the companies as customers. This is because you’re the one billing them for the work that your client performed.

When adding them in QuickBooks Online (QBO), you’ll have to go to the Customer Center to accomplish the task. To set up each company, I recommend following the steps shared by my peer above.

For more insights about setting up a vendor or customer in QBO, feel free to click on the links below. These resources outline the complete steps on how to add one or set it to inactive.

Keep in touch if you have additional questions about setting up a vendor or customer. I’m always ready to answer them for you. Have a great day.

I run an automotive shop. I buy parts to fix cars through various companies like O'Rileys, Autozone etc. Would they be considered "vendors"?

Yes, you can consider them as vendors, MM608.

A vendor is a general term used to describe any supplier of goods or services. They sell products or services to another company or individual.

In case you need some related article in managing your vendors and transactions, you can always visit our Income and Expenses article for reference.

Don’t hesitate to post a comment if you have any other QuickBooks concerns. I’ll be right here to answer them for you. Have a great day ahead.

Would this also apply to insurance payments rovided to our business . We receive payments on behalf of services we provided their members .We are a medical business if that helps clarif.

Hi there, @Hope and healing.

Being able to track the insurance company that paid for the services provided to patients would be beneficial. In medical billing, you need to know who paid what, when, and for who. However, QuickBooks Online only operates on the customer level.

I recommend seeking professional advice from your accountant about this. They may have other options to record and properly handle this scenario. If you don't have one, you may visit our ProAdvisor website to run a search.

Here's how:

Additionally, I'm adding these articles about the Class Tracking feature, which may be helpful for monitoring income, expenses, and profitability for each part of your business:

You can count on us if you have any other questions about QuickBooks. It's our pleasure to help!

Do you have to make a refund label, under category with the vendors name? I'm having a hard time figuring this out

We have a board of directors, and the members get mileage, etc., reimbursed for meetings; are thy customers or vendors?

Hi there, @PeaceinPAwilds.

You can consider them as vendors. If you haven't already, you can set up a vendor profile for your employee and a special expense account to track the reimbursements. I'll guide you on how:

To learn more about the process, kindly visit this link: Reimburse employees' mileage and vehicle expenses in QuickBooks Online. This will guide you to the next steps you need to take.

If you have clarifications while doing the process or have additional QuickBooks questions, feel free to leave a reply. We'd be glad to answer them for you. Keep safe.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here