- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Reports and accounting

- :

- Re: Discontinuation of Trial Balance questions QBO in the Accounting Community as Reputable Accou...

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Discontinuation of Trial Balance questions QBO in the Accounting Community as Reputable Accounting Software

I am Deeply concerned with the notice that QBO will be discontinuing the Trial Balance Report for QBO users. Any educated accountant knows that a Trial Balance is the Heart of Accounting. I understand that Intuit is trying to force its users to use its Tax Software. However, a Trial Balance is used for WAY more that just for Tax purposes. The removal of the Trial Balance makes question the legitimacy of QBO as a reputable and dependable accounting software. Explaining to Auditors, etc that I can not provide them a Trial Balance because QBO does not understand the accounting principles of it, also puts into question the legitimacy of my accounting practice to my fellow colleagues.

I ask that they greatly reconsider this discontinuation.

Solved! Go to Solution.

Best answer April 26, 2019

Solved

Best Answers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Discontinuation of Trial Balance questions QBO in the Accounting Community as Reputable Accounting Software

Hi there, @Assurance.

Please allow me to help share information about the notice of discontinuation of QuickBooks Online Accountant old Trial Balance feature.

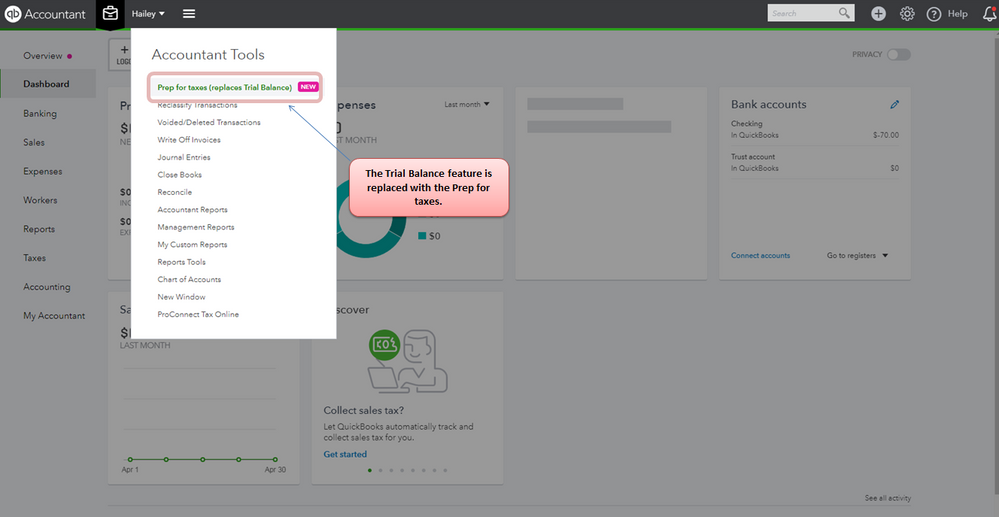

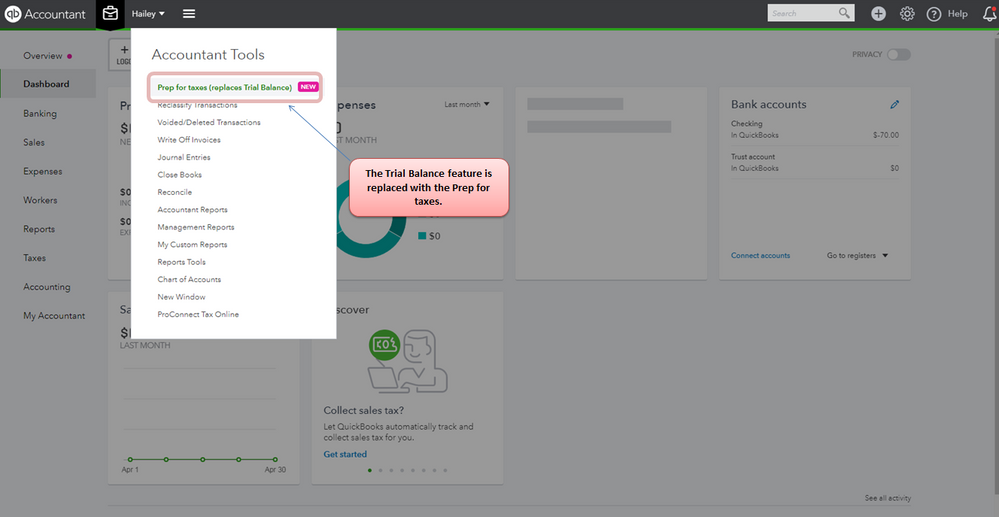

Yes, the Trial Balance feature under the Accountant Tools in QuickBooks Online Accountant will be discontinued effective on May 31, 2019. However, this will be replaced by the new Prep for taxes feature.

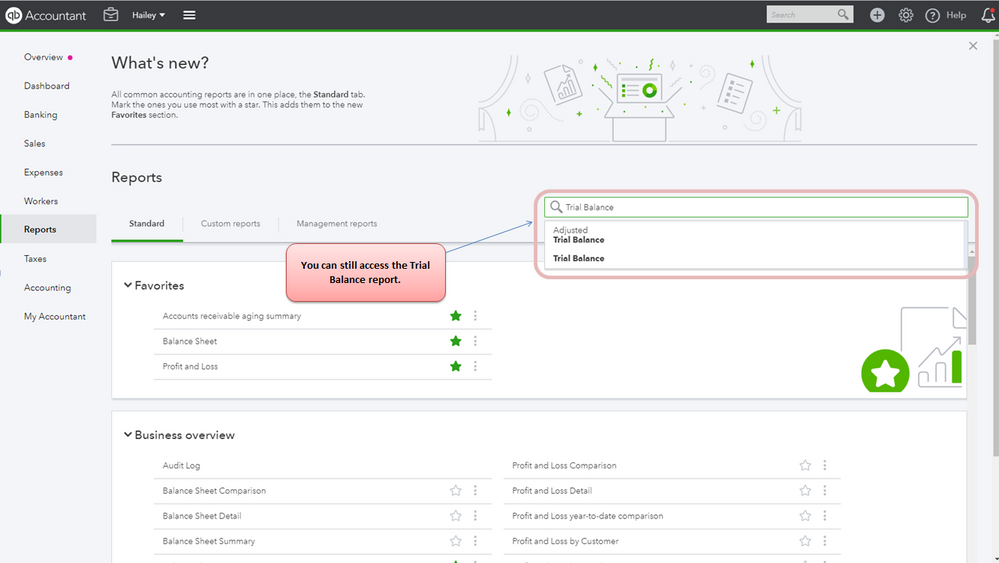

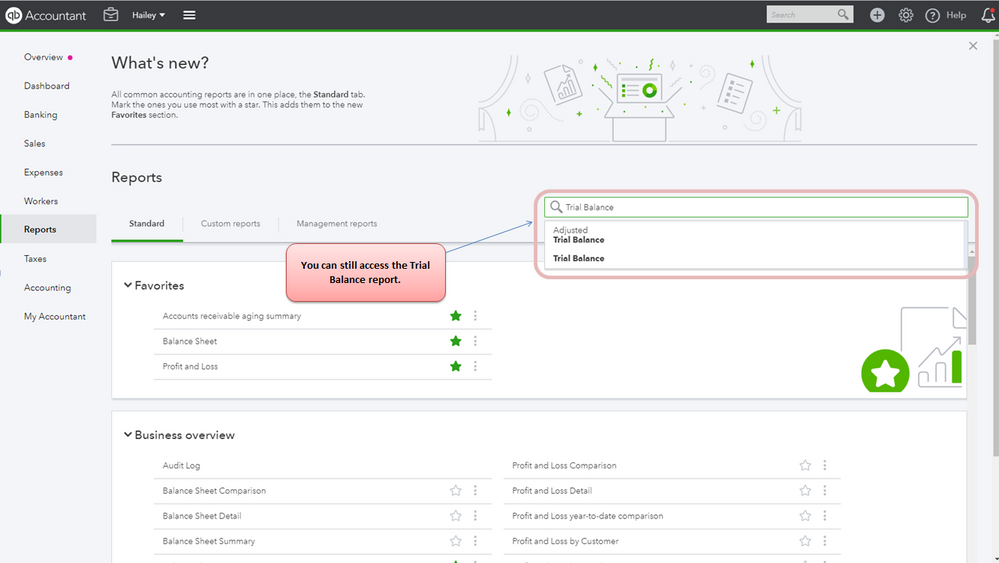

Just know that this discontinuation won't affect the Trial Balance report. You can still access and pull this report.

Please don't hesitate to add a post/comment below if you have any other QuickBooks questions. I'll be always here to help you!

17 Comments 17

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Discontinuation of Trial Balance questions QBO in the Accounting Community as Reputable Accounting Software

Hi there, @Assurance.

Please allow me to help share information about the notice of discontinuation of QuickBooks Online Accountant old Trial Balance feature.

Yes, the Trial Balance feature under the Accountant Tools in QuickBooks Online Accountant will be discontinued effective on May 31, 2019. However, this will be replaced by the new Prep for taxes feature.

Just know that this discontinuation won't affect the Trial Balance report. You can still access and pull this report.

Please don't hesitate to add a post/comment below if you have any other QuickBooks questions. I'll be always here to help you!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Discontinuation of Trial Balance questions QBO in the Accounting Community as Reputable Accounting Software

Angelyn,

I appreciate your response however you only repeated what the email issues this morning stated. The fact that QBO states that is will replace the Trial Balance report with a "Prep for Taxes' proves that there is a lack of understanding the variety of ways that Accountants use the Trial Balance report. I have 20 years experience working in Audit and Tax in large public accounting firms along with being a Financial Controller in the private sector. A Trial Balance is NOT solely used for Tax Purposes. Also practicing Accounts also know that downloading a Trial Balance at the current date will not help me with year end Financial Statement Audits. I have already provided my Feedback as mentioned in the email issued this morning.

QBO has already forced my clients to upgrade and pay more with the new usage limitations. Now they are taking away essential accounting reports. So I am deeply concerned with the downward direction that QBO is taking.

Thank you,

Tricia

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Discontinuation of Trial Balance questions QBO in the Accounting Community as Reputable Accounting Software

Hi there, @Assurance.

Thank you for getting back. I've now updated my answer above about the trial balance discontinuation notice. In case you have any other questions, just add a comment below. I'll be right here to help you.

Have a great day ahead!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Discontinuation of Trial Balance questions QBO in the Accounting Community as Reputable Accounting Software

Hi,

If the Trial Balance report is removed I may need to look at transferring clients to a provider that understands "Accounting" as it appears that QBO do NOT.

A trial balance is a fundamental accounting report.

I have one client with 2 files in Real Estate, it is a Legislative requirement for them to provide a signed Trial Balance for their Trust Account every month, I will definitely be moving them over to another software if the Trial Balance is being removed.

Yours Disgusted

Glenn Bird

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Discontinuation of Trial Balance questions QBO in the Accounting Community as Reputable Accounting Software

Unfortunately, tax season just ending and some large projects also finalizing, I am sad to say I did not stay on top of the blogs, webinars and news of changes over the last 4 months. When we received this email about the Trial Balance I was gravely upset and concerned. Then I had the partners of our firm all coming to me to asking what this was all about, I had to tell them, “It must be an error” and I would find out more. It was to my dismay to see you I was wrong. QBO / Intuit is making serious mistake which will profoundly impact all accounting firms and bookkeeper worldwide. The Trial Balance is the Heart of Accounting. We use this for more than just for tax returns. We use this Financials, Audits and tax return. But somehow QBO thinks we only need the new "Prep for taxes feature". SO WRONG! I am genuinely troubled about all these changes QBO is making. Are you really listening to the Accountants and Proadvisors out here who are on the front line, using and selling your product to our clients?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Discontinuation of Trial Balance questions QBO in the Accounting Community as Reputable Accounting Software

Hello @Assurance @Jasmineak4 @Glenn Bird @Angelyn_T

I wanted to reach out to each of you to let you know that the Trial Balance report and the Adjusted Trial Balance report are not being replaced or discontinued. Both of these reports are and will continue to still be located under Reports > For my accountant.

We had a feature called Trial Balance located under Accountant Tools that helps you prep clients tax returns. This feature was replaced by the feature called Prep for taxes. However, in the case of both features, the Trial Balance report has not been affected by this change.

It looks like there may have been some confusion but I want to assure you that the Trial Balance report is here to stay.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Discontinuation of Trial Balance questions QBO in the Accounting Community as Reputable Accounting Software

Ms Grindell,

I greatly appreciate your clarification on the issue regarding QBO's notice of the Discontinuation of the Trial Balance Report. I hope though that this brings to greater light the rapidly growing concerns of accounting firms with QBO. I highly suggest that QBO form a panel of Accounting Professionals to review its proposed changes and/or correspondence before they are implemented.

Thank you,

Tricia

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Discontinuation of Trial Balance questions QBO in the Accounting Community as Reputable Accounting Software

@Assurance wrote:

I highly suggest that QBO form a panel of Accounting Professionals to review its proposed changes and/or correspondence before they are implemented.

The panel will not stop misunderstandings

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Discontinuation of Trial Balance questions QBO in the Accounting Community as Reputable Accounting Software

The tax prep report renders the software virtually useless for my clients which are primarily non-profit. The drill down feature in the trial balance is critical for professional accountants. The trial balance is a requirement for an audit. I will be strongly recommending that my clients move to real accounting platforms as soon as possible. QuickBooks has gotten worse over the years as it is obviously not built for accountants, but touting itself as user friendly while ignoring Generally Accepted Accounting Principles is a travesty. The system is becoming unusable and frankly a joke in professional accounting circles.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Discontinuation of Trial Balance questions QBO in the Accounting Community as Reputable Accounting Software

Hi @ProfCPA

The Trial Balance report is not being discontinued. You will still have the same capability to drill down into the Trial Balance report as before.

The changes the original communication was referring to is the feature under Accountant Tools called Trial Balance (now called Prep for taxes), however, no changes have been made to the Trial Balance report.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Discontinuation of Trial Balance questions QBO in the Accounting Community as Reputable Accounting Software

An email should really go out explaining and clarifying the changes. I too was about to look to transfer services as the trial balance and comparison is critical.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Discontinuation of Trial Balance questions QBO in the Accounting Community as Reputable Accounting Software

Thank you for the clarification :)

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Discontinuation of Trial Balance questions QBO in the Accounting Community as Reputable Accounting Software

Perhaps this is not the proper thread to post this, but I use the TB report all the time, and am wondering if there is a way to make this a favorite report in QBO. I had it as a memorized report in QBE. The only way I've even been able to locate the report is by searching for it. I would like it to be readily available on my report dashboard. Is this possible?

Never mind, I found the way to add it. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Discontinuation of Trial Balance questions QBO in the Accounting Community as Reputable Accounting Software

Thanks for joining the thread, @SH-RL.

I'm glad to hear that you were able to favorite the report and will more readily accessible to you.

The Community is always here if you should need anything. Cheering you to continued success.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Discontinuation of Trial Balance questions QBO in the Accounting Community as Reputable Accounting Software

We are pulling our trial balance and its pulling information from the year before even though the dates at the top are for the current yea. Can you help me with this?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Discontinuation of Trial Balance questions QBO in the Accounting Community as Reputable Accounting Software

Hello, danyiel-slack.

Thank you for dropping by the QuickBooks Community this afternoon. When running a trial balance report you can customize the date range as desired. Below I'm including a .gif so you can see exactly how it works.

When you change the date ranges and hit run report, it will change the report displayed. If your report isn't working like you see above, you may want to try a few troubleshooting steps, follow along below:

I'd recommend checking the browsing application being used. It's possible this could have something to do with temporary internet files. You can open a private window and try repeating the same process to see if it works.

Here's how to access incognito mode in some of the most commonly used web browsers:

- Google Chrome: Ctrl + Shift + N

- Internet Explorer: Ctrl + Shift + P

- Mozilla Firefox: Ctrl + Shift + P

- Safari: Command + Option + P

If you're able to access the correct date range now with no problems and see your trial balance report, it's safe to say the browser is causing the issue. You can fix it by clearing cached data and Intuit-specific cookies. If following these steps still doesn't work, my suggestion would be to reach out to our support team. They can guide you on how to correctly run your report and fix any issues you may be experiencing. To reach them, follow the steps in this article.

If there's anything else I can help with, please don't hesitate to post here again. Thanks for dropping by and have a nice day.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Discontinuation of Trial Balance questions QBO in the Accounting Community as Reputable Accounting Software

Yes, the Trial Balance feature under the Accountant Tools in QuickBooks Online Accountant will be discontinued effective on May 31, 2019. However, this will be replaced by the new Prep for taxes feature. Accountant's Trial Balance (ATB) software link into ProSeries 2020 business tax returns is NOT currently working. This feature allows for business trial balances to be seamlessly imported into business tax returns. It saves me an amazing amount of time, since the links carry forward every year.

Accounting software recommendation platform at Techimply.

Thank you.

Need QuickBooks guidance?

Log in to access expert advice and community support instantly.

Related Q&A

Featured

Make your QuickBooks Online invoices, estimates, and sales receipts work

fo...

This episode of Quick Help with QuickBooks will guide you through

QuickBook...

Want to master your banking and reconciliation process in QuickBooks

Online...