Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI've got some information about 1099's in QuickBooks, @caryngreenspan.

Currently, we're unable to generate the 1099 forms for the prior tax years in QuickBooks Online. This is in line with the IRS updates made to the 1099-MISC and NEC. Thus, you're not seeing the option to select a tax year.

Meanwhile, I can share several solutions and workarounds to get you back up.

First, you can get copies of your 1099's if you've filed them through our 1099 E-file service.

Here's how:

If this isn't the case, you may have saved PDF copies before printing or filing the forms.

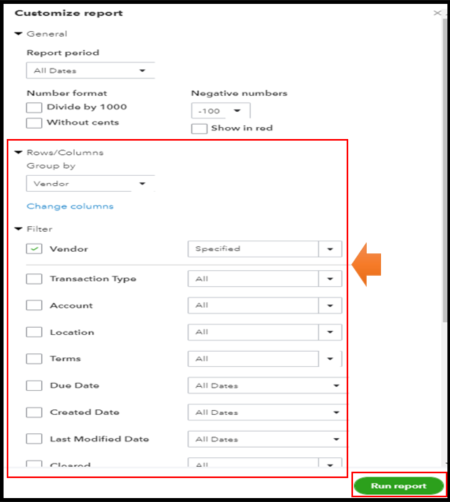

If you didn't save a copy or generating it for the first time, you can run and customize the Transaction List by Vendor report in QuickBooks. Then, manually fill out the form available through the IRS website.

Here's how to do it:

While our engineers and compliance team are working on this form, I'd encourage you to visit our QuickBooks blog page. This way, you'll keep abreast with the recent cascades and product developments.

Once ready, you can do your usual submission process in QuickBooks. Please head to Step 4 in this article to get started: File 1099s in QuickBooks Online.

You can always count on me if you have more payroll questions or any QuickBooks-related concerns. I'll be around to help you.

There is no longer a funnel Icon on the left that allows choosing a year. How do we choose a previous year?

Your answer was spot-on for what I needed! Thanks!

I recently filed 1099-MISC, when I pressed the option to "Print and Mail". It completed the filing without giving me the option to print and mail. Please let me know what I need to do to access the 1099-MISC that I have already filled.

I can help you with accessing your filed 1099-MISC, @bayareapa.

At this time, you can re-prepare the form to review your 1099-Misc. If you wish to print the form, click on the Print and Mail, or No, I'll print and mail tab.

Here's how:

If you want to review the filing status of your 1099-MISC, you can either log in to the Intuit 1099 E-File Service Account or open the email sent from Intuit.

For additional resources about filing Federal 1099s to the IRS, I recommend checking out these links:

Please feel free to get back to me here for any additional questions about 1099 filings. I always have your back. Thanks for dropping in, and cheers for more success!

https://iop.intuit.com/1099/login

worked for me

This does not work for me. Just takes me into payroll accounts and back to QBO when I click on a client name.

Thanks for joining us here today, @Wwhite361.

I have some information about accessing previously filed 1099s. You can only view the form from this link https://iop.intuit.com/1099/login if you e-filed it from QuickBooks.

Since you're not able to see it, I recommend contacting the IRS directly. From there, you can request a copy of your 1099 forms. Here's the link to reach out: IRS Telephone Assistance.

In case you need help with other tasks in QBO, feel free to browse this link here to go to our general topic with articles.

Don't hesitate to leave a comment below if you still have questions or concerns with 1099s. I'm more than happy to assist you. Take care and be safe.

There is a faulty instruction, my screen does not offer a funnel icon or a place to request the year (dates)

I need the 2019 contractors 1099 forms to reprint for an audit and I am very frustrated. I have spent hours/ days trying to track these down. Get this fixed please and thank you. I need them now. I have a deadline and this is just ridiculous.

Hi Kate,

The funnel icon with a year in my answer is not a function anymore. The setup was changed when we made an update due to the introduction of the 1099-NEC form.

I understand you need copies of your 1099-Misc form in 2019 and have been working to recreate them. I will share the steps to download them from the 1099 E-file Service portal if you filed them through it. If not, you can proceed to the steps for creating a report.

Download the copies from the 1099 E-file Service portal:

Use the 1099 Transaction Detail Report to get the 1099 data:

Be sure to remove the transactions that don't belong to 2019 in the exported data. Then, you can use Excel's functions to sort, group, or filter the transactions that you only need.

On the other hand, here's an article related to your concern for your further reference: How to correct or change 1099s in QuickBooks?

If you have questions about the steps, just comment below. More power to your business!

i do not have a drop down box for previous years

the dropdown box only has options for contractors above or below the threshold or not marked for 1099.

How do i get choose tax year option.

Yes I am on section 4

Nice to have you joined this thread, @kymberdair.

The option to select prior year isn't available in QuickBooks Online (QBO). This to ensure QuickBooks is in line with IRS updates to 1099-MISC and NEC.

As a workaround, you can log in to your 1099 E-file service account ang get a copy if you filed through them. If you haven't, you can generate the 1099 Transaction Detail Report. Then, filter it to show the data you need and export it to Excel. To be guided, you can refer to the steps shared by my colleague above.

Once done, you can process your 1099 in QuickBooks. For reference, please see this article: File 1099s in QuickBooks Online.

I'll be here to back you up in case you have other questions about your 1099's. Keep safe and stay healthy!

HERO!! Thank you! Really thankful for these boards. Don't understand why QB can't answer but you are the real mvp

THANK YOU for this CRITICAL last step. Quickbooks Online support is THE WORST but I so appreciate that an end user always comes through with the intuitive method of explaining how to get what the question is, done!

Thanks for taking the time to join us on this thread, businesscycle. I understand how important it is to secure a copy of your 1099s. I've got some information about this.

When printing your previous 1099s, it'll depend on how you submitted them. If you've filed the forms using QuickBooks Online, you can view the data by logging into your 1099 E-file Service account. Otherwise, you're unable to access them in the program.

For now, you can run the Transaction List by Vendor report in QuickBooks. Then, manually fill out the form available through the IRS website. Here's how:

You can also contact our QuickBooks Support Team. They're equipped with tools to access your account and further check the cause.

Additionally, I've added these resources that'll help you file your 1099 forms in the future. By reading these articles, you can keep your record accurate:

You can always count on me if you have more payroll questions or any QuickBooks-related concerns, businesscycle. I'll be around to help you.

How can I access old vendor 1099s

I can help you access your old vendor 1099s, @Visitingangels1.

Since these annual forms aren't stored within QuickBooks Online (QBO), you can log in to your 1099 E-file Service account to get a copy if you have filed your 1099 through them. If not, we can export your 1099 data to an excel file by creating a 1099 Transaction Detail Report. To be guided, you can refer to the steps provided by my colleague, @JessT.

In case you need help with other tasks in QBO, feel free to browse this link to go to our general topic with articles.

Moreover, I've added this article for any additional information about filing Federal 1099s to the IRS: Create and file 1099s using QuickBooks Online.

Let me know if you require further assistance with your 1099 forms. The Community is here to help. Keep safe!

I was notified today that IOP was sunsetted, is no longer available to the public, there was no notice sent to the customers, no one at IOP will email you, your past forms, and if you had current work pending, it has all been lost. 1099 through INTUIT has been discontinued and all forms are gone. I used them to file my 1099 forms with the IRS, and all the work I did this year has been lost. My account was deactivated and all my prior vendor 1099 forms and the work I put into the forms this year, completely gone with no notice.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here