Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

SALE EXTENDED 70% OFF QuickBooks for 3 months* Ends 12/8

Buy nowI appreciate you joining the thread, Fifaleaf. I'll show you where to locate the +New icon so you can proceed with recording a check transaction.

Once you open your QuickBooks Online (QBO) account, you can hover your mouse on the left panel to see the +New menu. From there, you'll be able to enter the transactions you need under Customers, Vendors, Employees, and Other. For check entries, click on Check from the Vendors column.

I'm adding this screenshot for your visual reference.

However, if you're using QuickBooks Desktop (QBDT), follow these steps to create a check:

I'm adding these materials for more tips while managing your checks on both platforms:

Aside from checks, you may also use bills to track transactions that you need to pay at a future date. Here are your references:

I'm happy to help you today! If you have other questions, let me know by leaving a comment below. Keep safe!

Am Esther

Hello there.

I want to ensure this is taken of. First, may I know more about your concern? Any information can help us resolve the problem.

It could also be best if you can send us a screenshot.

You might also want to consider changing your QuickBooks Community username as it appears to contain your company ID, which may compromise your privacy and security.

Please know that we're always here to help you out. Have a great day.

Hello. I am using QB On line, I am trying to pay a bill using a credit vendor. I entered the invoices and credits vendor. I go to Pay Bills, then select the vendor, then select the invoices; and even if I add the credit, or edit the total amount, when I schedule the payment, it gives me the total amount not considering the credit or the amount I entered to pay. In all cases, it gives me the total amount for the invoices selected, even if it is only one invice with one credit, when I schedule the payment, it is not consider the credit or the payment I entered manually. It schedule the total amount of the invoices.

Can you help me?

I can definitely help with your concern about bill payments , 12345678905.

I created the same set of transactions and the system is giving me the right amount to pay after saving for online payment. I have additional steps to share to make sure the bill is paid with the correct amount.

Here's how:

If you're still getting the same result, it's possible that a browser issue is causing the system to disregard the credit when scheduling for online payment.

I have steps to share that can resolve some of the most common browser and unexpected results when working in the program.

Let's start by switching or using other browsers like Google Chrome, Mozilla, Microsoft Edge, or Safari. They are all compatible with QBO and can help us isolate the issue. Use these keyboard shortcuts on how to do that:

After that, try to schedule the bill for online payment and check if the credit is applied. If you're able to it, follow the steps in this article on how to clear cached or delete internet files; Clear Cache and Cookies to Fix Issues When Using QuickBooks Online.

Allow me to give you these articles as well in case you need more guidance when managing bills and other vendor-related transactions in QBO:

The Community is always here if you need anything else.

Hello there, Lu2015. I'm delighted to have you join the Community thread.

I understand how time-consuming it is to experience runtime issues when performing QuickBooks activities. When applying a vendor credit toward any open or future bill in the Pay bills window, please verify the date by clicking the Filter button.

Additionally, QuickBooks periodically exhibits weird behavior and generates runtime errors as a result of a problem with the browser. In the interim, let's fix the issue via standard browser troubleshooting. Begin by applying for vendor credit to a bill in your QuickBooks Online account through a private window. The keyboard shortcuts are as follows:

Return to your default browser and delete the cache if it was successful to start over. You can also use another compatible browser because the one you're using might experience a brief issue with QuickBooks Online.

You may want to visit this link to learn how vendor credits are applied in Online Bill Pay powered by Bill.com.

Please get in touch with us if you have any more queries or run into problems when using QuickBooks. We've always got your back, and I'm ready to lend a hand, Lu2015.

FINALLY! Someone had a solution (even if it is RIDICULOUS that you can't just apply a vendor credit directly to an invoice upon entering the VC).

Thank you!

How can I do this currently in quickbooks online. I’ve followed the steps and the add invoice/credits don’t pop up on the right side like pictured.

I'd be happy to help accomplish your task in QuickBooks, @Amlawnequipment.

Are you trying to apply vendor or customer credits in QuickBooks Online? If so, this will only show once you're in the credits section of the Receive Payment or Pay Bills window.

Please check the screenshot below for your reference.

In addition, only billable and purchase order transactions will pop up in the right-side section of the transaction window.

I’ve added this link that tackles expenses and vendors in QuickBooks. This will give you more details about your business and your cash flow through proper bookkeeping practices.

The Community team is always here to find a solution. Just leave us a message below, and I’m sure it will be taken care of.

Hello,

I'm trying to enter vendor credit.

I chose the vendor, but not sure why "credit applied" colum showed "Not available."

What do I do then?

Hello,

I'm trying to enter vendor credit.

I chose the vendor from "Pay Bill", but not sure why "credit applied" colum showed "Not available."

What should I do then?

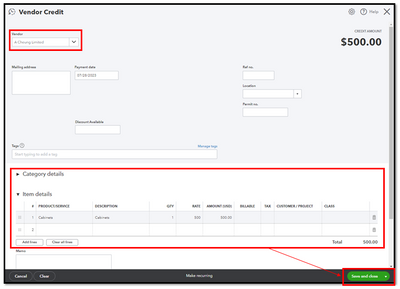

It's nice to see you joining this thread and sharing your concern, @jp209. I'm here to chime in and ensure you can see the amount on the Credit Applied field.

Since the credit applied column shows as not available on your end, you may haven't recorded a vendor credit yet.

You can use these steps if you don't enter bills to track your expenses. Here's how:

Otherwise, you can follow the steps in the If you enter bills you plan to pay later section of the article to ensure the credit hits the expense account you use for this vendor: Enter vendor credits and refunds in QuickBooks Online. This includes other scenarios for recording a vendor credit.

If you're still unsure, you can still reach out to your accountant for more alternatives about this issue.

Moreover, these handy articles can help you with keeping track of your business and handling reports as well as saving their current customization settings:

You can post anytime if you still have queries about your vendor transactions in QuickBooks Online. Please know the Community has your back. Take care always.

I received a vendor credit and added it to QBO. Even though I apply it to the invoices in the appropriate months, the expenses in the given month are not reduced and the full negative expense amount is in the month that the credit was issued.

Is it possible to allocate the negative amounts to the months where the credit is applied?

Hello there, @tlehman1.

I can see the importance of being able to allocate the negative amounts to the months where the credit is applied in QuickBooks Online (QBO). Aside from it can make your records accurate, it will also reduce the expenses for that given month. However, it isn't available in QBO.

As QuickBooks Online is good for tracking purposes, its main job is to record everything accurately and that includes applying the vendor credit to when it was actually created or issued. Thus, allocating that for the month where it was applied isn't possible.

With that being said, I'd recommend consulting with your accountant so they can provide hands-on support from technical and accounting perspectives and suggest how to properly handle this considering your type of business. If you don't have one yet, you can visit our ProAdvisor website to find an expert. Simply enter your city or ZIP code.

Additionally, how you enter refunds from vendors depends on how you record your purchases. To discuss more about this and to learn how to record one depending on which applies to you, refer to this article: Enter vendor credits and refunds in QuickBooks Online.

I'll be here if you've got additional queries with regard to managing vendor credits in QuickBooks Online. It's always my pleasure to be of assistance. Take care.

Hi. I am trying to pay some bill where a credit for an early payment has been applied. Ill try and explain properly. I have lets say a statement of 3000 to pay and all the bills are posted for it but because these bills were paid early I can take 75$ of my total to transfer. How do I make that work in quickbooks online? Also, why aren't my credits that I posted showing up in vendor bills to pay along with the bills?

Thanks for joining in on this discussion, @LENE. I'll be glad to assist you in applying vendor credits to your bills in QuickBooks Online (QBO).

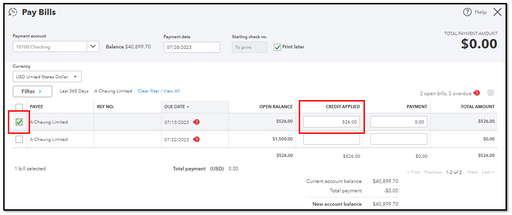

From your scenario, it appears that you're receiving rebates from your vendor for your early bill payments. To apply it, let's create a vendor credit. Here's how:

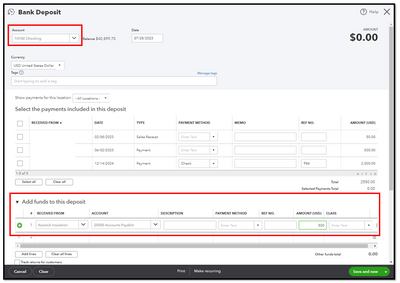

However, if you want to place the rebate into your bank, we can record a bank deposit affecting Accounts Payable. To do that:

Once done, follow the first procedure to create a vendor credit and link them together through Pay Bills.

Furthermore, the vendor credit will appear in the CREDIT APPLIED column when paying bills. If it's not showing, it's most likely set up incorrectly. That said, we'll appreciate it if you'll walk us through how you've created them in QBO, so we can identify whether there's an error in the process.

Additionally, check out this article if you want a breakdown of the many aspects of your company, such as sales and expenses: Run reports in QuickBooks Online.

Keep in touch whenever you have additional questions concerning bills and vendor credits. We're always around to help. Stay safe and have a wonderful day ahead.

Thank you so much for the answer:) It was easy to follow and worked perfectly.

Hello there,

We're delighted to hear that the posted recommendation is of help. If you require further assistance working on specific tasks in QuickBooks, the Community is willing to assist you at any time. Have a great day ahead!

How would you handle applying a credit if paying bills online, NOT BY CHECK?

Thank you for jumping into this thread, @bookkeeper-eurod.

Please be informed that the vendor credit won't apply when making a scheduled payment through the bill. Instead, after saving and closing the bill, let's create an expense so that the vendor credit will apply. With this, the bill amount will be offset, and manage to pay the remaining bill amount online.

Allow me to guide you through applying for credits when paying bills online.

Here's how:

Additionally, you can check out this article for further references about Bill Pay: Learn about QuickBooks Bill Pay.

Furthermore, I've added these articles to help you learn how to track bills, record payments, and set up roles and permissions for paying bills with QuickBooks Bill Pay:

Feel free to reach out if you have further concerns about applying credits when paying bills online or any QuickBooks-related queries. The community is always here to help you. Keep safe.

This doesn't work. When I click "Next", I get the error "We're working on it. Currently, online payments can't apply vendor credits or carry over partial payment amounts. Enter payment amounts on the next screen."

I'll share details about the issue scheduling a bill payment and route you to the right support team to assist you further on this matter, afleming-rebelli.

This occurs when we are unable to successfully bill the merchant for subscription fees. With this, I'd recommend getting in touch with our support team so they can have your payment info updated. Rest assured that once the review is completed you will be notified via email.

To contact our support team, here's how:

You can contact us from Mondays to Fridays, 6 AM to 6 PM PT, and Saturdays, 6 AM to 3 PM PT.

Moreover, you can check out this article to learn about running a report that shows all vendor payments: Run a report with vendor totals.

Feel free to swing by if you have other concerns about merchant billing subscriptions or any QBO-related concerns. I'll get back to you as quickly as I can. Take care.

I will preface this with the fact that I'm a new business owner and only 6 months or so into my Quickbooks Online knowledge/experience. I'm hopefully that I'm just missing something, but pretty sure I am not. My accountant, who is also a high level Quickbooks certified user/trainer couldn't figure it out.

Mindboggling to me that not a single "expert" from QBO have been able to resolve this issue. I have spent many hours trying to figure this out to no avail. One would think it would be a pretty simple process to "apply" a single (or multiple of your choice) vendor credit to a bill.

Long story short, I have 10 or so vendor credits on one vendor's account, and would like to apply 8 of them to a single bill. Early on in this thread, they show the ability to "Make Payment" within QBO, once on a vendor bill, then select the vendor credits you'd like to apply to the bill. The current version of QBO doesn't have "Make Payment" as an option, only "Schedule online payment" (and don't get me started on how AWFUL the QBO billpay feature is... MANY hours wasted on that subject).

Melio was kind enough to show me a "workaround" after multiple QBO experts couldn't figure out a solution. However, that workaround really isn't a great way to manage such a simple thing (& could wreak havoc on my books).

See screenshot below.

1. I'd like to apply one of my 10 vendor credits the the first bill (01254567). Only way to do this is to type in the amount of the vendor credit that matches this bill amount (not actually select/link the vendor credit to this bill).

2. I'd like to apply 7 vendor credits to bill #01266885. Only way I see to be able to do this is to calculate out the 7 credits & type in the amount (again, not linking the vendor credits to this bill).

Gotta be a better way for someone to link specific vendor credits to a bill, so that if my vendor ever asks/questions what credits were used against which bill, I could easily pull that history. Without a way to link them, I'd have to go back & figure out which were used.

Extremely frustrated with QBO, for multiple reasons, not just this issue....

Hopefully I'm just missing something & someone is able to help!

I'll provide ways to make it easy to determine which vendor credits applied to a specific bill inside QuickBooks Online (QBO), @RVLR.

When you select or apply multiple vendor credits to a specific bill, the system automatically calculates the total amount that needs to be paid using those vendor credits and will only apply the same amount the bill has. To track which vendor credits were applied to pay the bill, you'll want to click 1 payment made below the Paid status inside the transaction. Doing this will route you to the Bill Payment page and show you which vendor credits paid the transaction.

Another way to get through this is to run the Bills and Applied Payments report and filter it to show a specific period associated with the transactions you need to review. I'll write down the steps to get you going:

You can check this page about generating a report inside the program: Run reports in QuickBooks Online.

Moreover, here are some articles to help you manage expenses and add more details when you run a report inside QBO:

The Community team is always ready if you have other questions regarding handling vendor transactions and credits or need assistance performing specific tasks inside the program. Visit us or comment below, and we assure you you'll get a response from us.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here