Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

SALE EXTENDED 70% OFF QuickBooks for 3 months* Ends 12/8

Buy nowSolved! Go to Solution.

Hello there, @rameet.

I'd be glad to help link the deposit to the open invoice in QuickBooks Online (QBO).

Once done recording the deposit in QBO, you must record a Receive Payment under your customer's name and use the deposit check as a credit on the invoice.

You can see attached screenshots for additional reference.

To learn more about linking a deposit to an invoice, you may check this article: How to link a deposit to an invoice.

On the other hand, you can also check our Help articles for your future reference: Help articles for QuickBooks Online.

You can always add a post/comment below if you have any other questions about deposits or invoices. I'm always here to help you!

Hello there, @rameet,

There isn't an option to revert an invoice once voided.

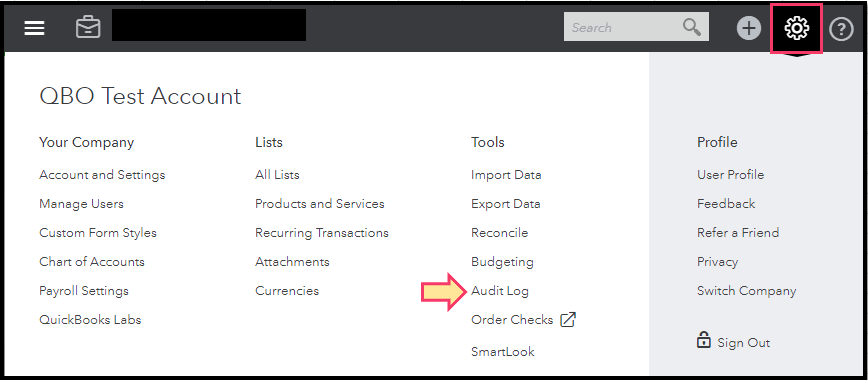

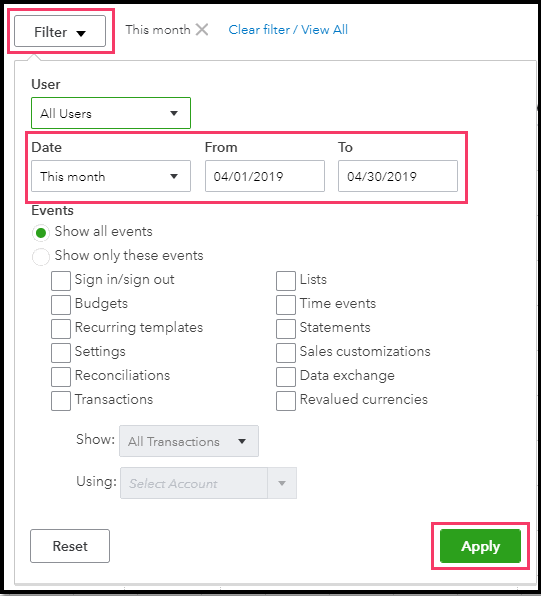

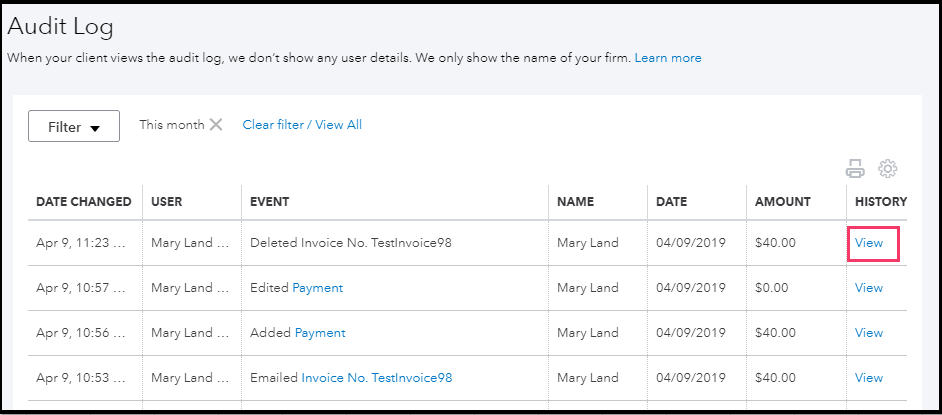

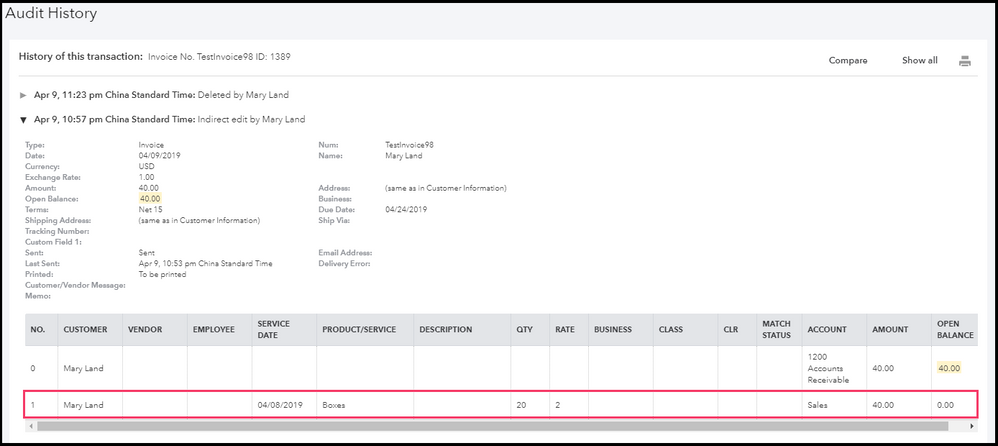

As another workaround, you can use the Audit log to view the details and re-enter the voided transaction.

Here's how to locate the invoice:

Please check out to this article for additional information with voiding or deleting transactions in QuickBooks Online: How to void or delete an invoice or other transactions.

Keep me posted if there's anything I can help you with navigating your sales forms in QuickBooks. I'm always around whenever you need help.

Thank you!

Another question I have is that the customer for this invoice mailed us a check. When I deposit the check can I link it to the invoice and designate it as PAID?

Hello there, @rameet.

I'd be glad to help link the deposit to the open invoice in QuickBooks Online (QBO).

Once done recording the deposit in QBO, you must record a Receive Payment under your customer's name and use the deposit check as a credit on the invoice.

You can see attached screenshots for additional reference.

To learn more about linking a deposit to an invoice, you may check this article: How to link a deposit to an invoice.

On the other hand, you can also check our Help articles for your future reference: Help articles for QuickBooks Online.

You can always add a post/comment below if you have any other questions about deposits or invoices. I'm always here to help you!

Thanks!

You're always welcome, @rameet.

Please know that I'll be right here to help you if you any other QuickBooks concerns, just add a post on our Community page or add a comment below.

On the other hand, you may also check these articles to learn more about receiving payments and recording deposits:

Have a great day ahead!

hi i want to know how to unvoid a invoice which is overdue

Hello there, @priya123.

Currently, the option to undo the deleted invoice is unavailable, even if it's overdue. As mentioned by my colleague @MaryLandT, you can create a new invoice and get the details in the audit log. I'll show you how to do that.

Now, you can re-create the voided invoice and send it to your customer.

You can also customize your invoice to add contents or change the design in the future.

I'll be here if you have any questions or concerns with QuickBooks Online. Let me know in the comment section. Have a wonderful day ahead.

I accidently voided an invoice (not delete it). After reading many suggested work arounds I decided to play around and see what I could come up with. What I found was, if I opened up the voided invoice and re-entered the amount on the line item(s) then saved it the invoice it became valid again. Now the invoice shows the correct invoice number, date and amount due as before it was voided.

You may not be able to unvoid an invoice but what I found was if you open the voided invoice and re-enter the dollar amounts and save it, the invoice once again showed the open balance. Hope this helps.

What if the voided invoice had been paid, the deposit is still showing the correct amount in the register

What if the voided invoice had a payment applied and deposited already. My deposit amount on that date did not change when the invoice was voided. I don't want to repost the payment if I don't need to but the invoice obviously has a balance now.

Let me provide you with some information about voiding a transaction, ssc6.

We don't recommend voiding invoices that are linked to a deposit. QuickBooks Online (QBO) doesn’t void any payment you’ve recorded to the invoice. However, this creates an open credit to your customer account. There are a few ways to handle credits, we can create a credit memo to reduce a customer's current balance or enter a delayed credit to use it in the future.

For the deleted or void transaction, we can recover some details of the transaction using the audit log in QuickBooks, but we can't recover the whole transaction. Here's an article you can refer to for more details about voiding or deleting transactions in QBO.

If you need to create an invoice, we can link the deposit again. Before linking a deposit to an invoice, here are a few things to check:

To run all invoice reports and customize the date. Here's how you can do it:

Also, you can run an accounts receivable aging report and customize it if necessary. Feel free to visit our Sales and customers page for more insights about managing your company's income and customers.

Tag me in your reply if you any other follow-up questions or concerns about managing your invoices. Just reply to this thread and I'll get back to you. You have a good one.

This was EXTREMELY helpful, thank you!

Good day, BeerGuy!

It's a relief that the steps shared by my colleague are great to help you.

If you have other QuickBooks-related concerns, you may visit our Help Articles page.

Don't hesitate to reach out to us again whenever you have other questions. We'll be happy to assist you!

If you know the amount it was originally for, just change the amounts not to be zero anymore and save it. Original answer at https://quickbooks.intuit.com/learn-support/en-za/manage-customers-and-income/all-the-void-does-is-c...

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here