Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowNot sure what you mean by "upload." There is no calculation done from a W-9. I would think at most you might be able to attach a copy to a Vendor setup file to have available as reference to create your 1099.

Let me give you the details on what you can for your contractor's W-9, Teri.

You'll have to advise your contractor that they will be the ones who'll submit their W-9 forms. To simply do this, invite contractors to fill out their forms and sign them electronically inside an Intuit account. Here's how:

Once done, we'll send an email inviting them to fill out and submit the form. After your contractor submits their W-9, their profile will show in the Contactors and Vendors tab and you'll be able to view a copy of the form. Here's how:

A contractor can claim they are exempt from backup withholding when they complete the W-9. Follow the IRS guidelines in Instructions for the Requester of Form W-9 for more information.

Fill me in if the steps above work for you. I'd be glad to assist you further if you have any other concerns.

I am not the person looking for this information so you might want to send to the person who asked.

I see your answer says the same as I did, but explains the whole process so that should help them.

@MariaSoledadG wrote:Let me give you the details on what you can for your contractor's W-9, Teri.

You'll have to advise your contractor that they will be the ones who'll submit their W-9 forms. To simply do this, invite contractors to fill out their forms and sign them electronically inside an Intuit account. Here's how:

- Go to the Workers tab then select Contractors.

- Click Add a contractor.

- Enter the contractor's name and email.

- Check the box to invite them to enter their information.

- Click Add contractor.

Once done, we'll send an email inviting them to fill out and submit the form. After your contractor submits their W-9, their profile will show in the Contactors and Vendors tab and you'll be able to view a copy of the form. Here's how:

- In QuickBooks Online go to Payroll then Contractors.

- Select the contractor’s name.

- Select the Details tab to see the contractor's personal info and the Documents tab to see a copy of the W-9.

A contractor can claim they are exempt from backup withholding when they complete the W-9. Follow the IRS guidelines in Instructions for the Requester of Form W-9 for more information.

Fill me in if the steps above work for you. I'd be glad to assist you further if you have any other concerns.

unfortunately, I don't believe I can upload a W9 in quickbooks. It looks like only the contractor can do it. However, I don't want to make them do that since they already provided me with the w9s.

Not sure on QB but on my accounting system and payroll service, we can attach copies as the accountant and the contractor can ALSO add to his "W-2 pay file" on payroll service.

IK, R?!

This completely ignores that until one HAS QB, one has PROBABLY already been getting this info from elsewhere. I'm not going to make people supply it all over again because QBO hasn't seen fit to just allow me to attach the PDF document I already have to the Contractor file on the Documents tab that's RIGHT THERE!

Also kind of sad that so many respondents didn't actually read the OP -- it's clear that what's being asked is exactly the solution I'm in search of (that doesn't seem to exist).

Hello? My contractor won't cooperate and fill out the Quickbooks invite. I withheld payment until I received a hardcopy of his W9 now how do I add the W9 to QuickBooks?

Thanks for joining this 1099 discussion, @Rattledbythedetails.

To add the vendor's W-9 in QuickBooks Online, you can enter it manually. Here's how:

You'll want to read these related articles to learn more:

Please come back here if you need further assistance with QuickBooks and other payroll forms. I'll be right here if you need anything else.

I also have hard copies of W-9s from contractor's, so asking them to fill out again is redundant and a waste of their time. Feels to me like it is a ploy by QB to capture their information and solicit their business. Is there any option to manually upload the hard copies of the W-9s?

Thank you for reaching out to the Community, @michael186. Let me share some idea about W-9 in QuickBooks Online (QBO).

You’ll have to inform your contractors that they will be the ones who’ll submit their W-9 forms. Invite your contractors to fill out their documents and sign them electronically inside an Intuit account.

Here’s how:

We'll then send them an email requesting them to complete and submit the form. Your contractor's profile will appear on the Contactors and Vendors tab after they submit their W-9, and you'll be able to view a copy of the form.

Here's how to do it in QuickBooks Online:

You also have the option to manually enter this into your QuickBooks Online by following the steps that my colleague @Jen_D provided above.

Know that you can always leave a comment if you have further questions in mind regarding tax forms. Have a great day!

Just entering the TIN and checking the box to track for 1099 in vendor profile DOES NOT track the 1099 detail in Reports. Very inconvenient. If the contractor does not fill out the W9 through QBO it will not track the detail. QBO needs to fix this.

This reply from the admin does not explain how to upload a vendor/contractor's W-9 form to QuickBooks. It just tells you how to enter the Vendors name, address and EIN (if they have one).

This is from the "Admin" at Quickbooks:

To add the vendor's W-9 in QuickBooks Online, you can enter it manually. Here's how:

Then what is the point of having a 1099 checkbox and space for TIN?

I did all of the above but the contractor is saying that the link in the email is no longer working and they cannot upload the W-9 form and I am unable to send them an email that allows them to go into Quickbooks. How do I get the W-9 form into Quickbooks?

Thank you for taking the time to raise your concern here in the community, @carka3. I’m here to help you with regards to your W-9 in QuickBooks Online.

You can request that your employer or client invite you to complete your W-9 form. To access the form, you must have an active QuickBooks account.

Here’s how to open the invite:

You'll receive an email when your 1099-MISC is ready for download once your employer reports it to the IRS.

Moreover, if you didn’t receive an invitation from them, I suggest asking for a copy personally from your contractors.

In addition, I added an article that can serve as your guide to the 1099 form in QuickBooks Online.

You can always reach us for more concerns and clarification on your 1099 form in QuickBooks. Take care!

Jen_D,

Your advice fails to acknowledge that we cannot create new contractors/vendors in QBO, so there's no record to edit. Until - that is - the prospective vendor replies to the email and creates their own account, which is exactly what we're trying to avoid. I'd also like to point out that this requirement is highly discriminatory (lots of folks lack computers, internet access, etc etc) in addition to being unattractive to folks who already mistrust such systems.

For the rest of us, here's a possible workaround: if you have some old/inactive contractors in your list, you can edit one of their records and replace their info with the new W-9 info! (Our database was ported over from the far-superior Intuit Online Payroll, and in that process, all the existing contractors were reset to Active but all their payment records were deleted. What a disaster.) I'm sure this isn't database-kosher, and the moderators probably won't like it, but it's not like the programmers have left us much choice. And it seems to work just fine.

What "Workers" tab? I have a "Payroll" tab of which "Contractors" is one of 3 choices, but clicking on that i get a "404 Page Not Found" error message.

Hi there, @jfarbs.

In the new interface of QuickBooks Online accessing the contractor's page is now under Payroll in the left menu. And for the 404 error code that you encounter, it is likely related to a cache issue. We can isolate this by using an incognito browser as it doesn't use the existing cache data:

Once an incognito window is open, log in normally and check the Contractors page. When the 404 error code doesn't show up, you can now start doing tasks for your contractors. Then, to resolve the issue completely, go back to the regular browser and clear the cache.

To help you manage your contractors or vendors for the 1099 form, you can check this article: Understand which contractors need 1099s.

If you have any other concerns about QuickBooks or your contractors, let me know in the comment section. I'm always here to help.

More specifically, I already have a W9 for all the contractors I work with and am just converting over to Quickbooks Online. I have the info and would like to add it for each of the 15 contractors I have. Am I able to do that? I don't want to require them to set up an account anyway, but also, I have the info already!

Is there a difference in making them vendors as opposed to contractors?

I appreciate you for joining us here in the Community, @AmandaBlue.

You can add your vendor as a contractor if you'd like to track their 1099 payment.

Here's how:

Now that you entered vendor as a contractor, you need to start tracking their payments. Let me show you how:

For more detailed steps, you can check out this article: Set up contractors and track them for 1099s in QuickBooks

QuickBooks will start tracking all of its payments. When you're ready to file your 1099s, you can easily add the tracked payments to the form.

I'm also sharing this link on how to prepare and file your 1099s during tax season.

Don't hesitate to drop a comment below if you have any other questions about setting up vendors or contractors in QuickBooks. Have a great day.

My contractors are stuck at this point as well. They're receiving notices to complete their profiles but then can't log in, repeatedly receiving this error message.

I've already paid these contractors and am now concerned these payments will complicate future tax filings. This is beyond frustrating when I have hard copies of their W9s and cannot input the information myself.

How do I rectify this if the contractor is unable to even log into the system to update their W9 information?

Hi there, @WR11211. Thanks for reaching out and providing a screenshot of the error message that your contractors encounter.

As per checking our tools, there was a previous investigation about the error message that you're contractor received that is already closed and resolved. But since they still encounter the problem, I suggest reaching out to our QuickBooks Support Team. They have the tools to further check the root cause of this issue and might raise an investigation.

To reach them, click the ? Help button at the top-right corner of your QBO account and select Contact Us to talk with a live agent. Ensure to review their support hours to know when agents are available.

For future reference, I've got you this helpful article in case you need some ideas about your contractor's 1099 forms and payment: Get answers to your 1099 questions.

Let us know if you have any other concerns. We're here to help.

It's really dumb that QBO removed the ability to upload a scanned hard copy of a W9. Really the only reason you would even need the W9 in quickbooks is so you or your CPA can prepare 1099s.

What I do is this:

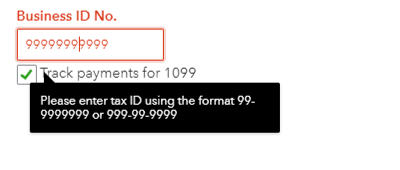

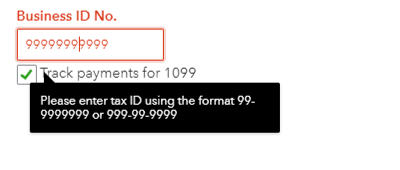

1. Add them as a contractor and fill out all the personal details (IE - Business or Individual and put their EIN info in etc.)

2. Click on Vendors

3. Search for the name of the contractor

4. Click on it

5. Go to EDIT on the right

6. Make sure "Track payments for 1099 is selected"

7. In that same menu there is an option to "Upload Attachments". I just upload the hard copy of the W9 here and when it comes 1099 time, my CPA knows right where to look.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here