Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowLet's get rid of this, chenkg .

Sometimes our customers like you are experiencing this kind of behavior unexpectedly. It happened when our browser is holding too much cache.

Let's try performing some basic troubleshooting steps to better isolate this one. Click the Reload icon or press CTRL + F5 to refresh QuickBooks.

Aside from using the Reload icon, you can use a different browser like Google Chrome, Mozilla, Microsoft Edge, and Safari. Afterward, try to run the Profit and Loss statement or tax report, let's see if the business transactions appear now.

Afterwards, you can clear the cache of your previous browser. Alternatively, you can use other compatible browsers in QBO. Restart the browser.

Please give me an update on how things go on your end. I would like to keep an eye on this to make sure that you'll be able to get the things you want in your book. Take care! Thanks!

This is not a browser/cache issue. I see these business transactions - more than 20 of them for over $7000 in 2019. They are listed and counted towards my total expenses in 2019 in the "Transaction" view.

However, under the report view, in both "profit and loss" and "business and personal expenses", they are not included. The total sum is lower than the "transaction" view by more than $7000. I believe this is a bug in the software. My business should include expenses from both "health insurance premium" and "home insurance" categories. I've also answered the questions in the app to qualify counting health insurance premiums as business expenses.

Separately, how do I just get a sum for "health insurance premium" and "home insurance" categories in 2019? I can just add them back manually when I do my taxes.

Thanks.

Thanks for coming here with us today, chenkg.

In QuickBooks Self-Employed (QBSE), the Health Insurance Premiums is not considered to be part of your expenses but as personal deductions. Thus, it can be found in the Tax summary report instead of Profit and Loss.

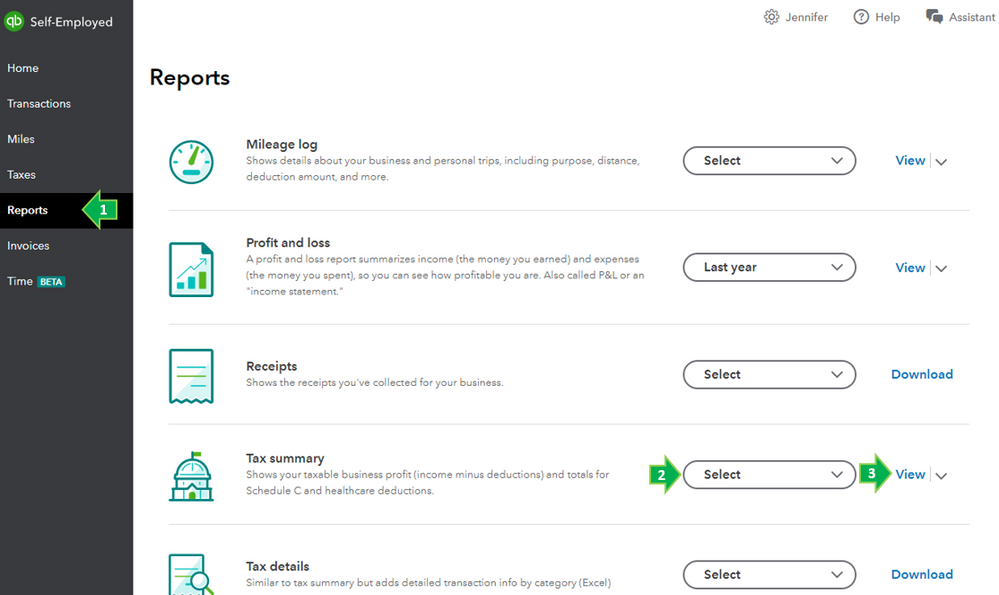

Here's how to open the Tax summary report in QBSE:

Here are some helpful links to become more familiar about how Health Insurance works in QBSE:

Be sure to get back to me for additional questions. I'm always happy to help. Have a wonderful day.

So I checked the total expenses for the major line items from the profit & loss statement vs. tax summary, they are exactly the same. Hence, it looks like health insurance premiums are not included in these consolidated reports. Also, what about home rental insurance.

I would say that, for this app in particular, I would be filing taxes based on my consolidated reports. The app doesn't do a good job to show 1) how does the total from the transactional view to the report view - e.g. I should be able to do an easy reconciliation. That is not the case, and leads to concerns about the accuracy of those reports. 2) just a mapping to show how the categories at the transactional level consolidate into the main categories at the report level. It is frustrating to be chasing these missing transactions at the report level after I spent hours going thru my transactions. Thanks.

Hi there, @chenkg.

Health insurance premiums and home rental insurance are considered personal and not business deductions, this will show in the Tax Summary report instead of Profit and Loss.

As provided by a colleague above, you can open the report through the Reports tab.

You can check this article about how healthcare deductions affect your taxes.

Don't hesitate to drop by here if you need anything else. I'm always here to help.

"Health insurance premium" and "home insurance" are not included in personal expenses report view or Tax summary either. Also, I've classified these expenses as "Business". Are you saying that the app automatically re-classify them? For "home insurance" it is referring to insurance cost for my rental property. It should be a business expense.

This is a bug. Per my feedback above, my expenses from those two categories are not included in the consolidated reports. Please do not send me more feedback on the tax summary report without validation. My tax summary report matches my profit & loss statement currently. Report summaries are missing $7k in 2019. I hope you'll have a tech or product person to investigate this bug and get back to me. My account is under "[email address removed]".

Thanks.

Hello chenkg,

I'd like to add some details about the insurances you mentioned.

The health care premium or homeowner/rental insurance are reported annually. That’s why they are separate from your Profit and Loss report. Only the Schedule C transactions are included in the said report. Also, healthcare is used to determine to claim tax deductions at the end of the year.

If you need to speak with Support about this matter, please reach out to them using the steps below. That way, they can navigate through your account as they explain to you how your insurances show on your records. We've removed your email for security reasons and for the reason that we’re unable to reach out to you via email.

Feel free to reach out if you have more questions.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here