Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

SALE EXTENDED 70% OFF QuickBooks for 3 months* Ends 12/8

Buy nowHi there!

I am using desktop Enterprise QB and not online. How do I do it using desktop?

Thanks.

Hi Rejeil_O,

I am using Desktop enterprise and not online. I appreciate if you can tell me how to do it using desktop.

Thanks.

Allow me to chime in, @Nerak1.

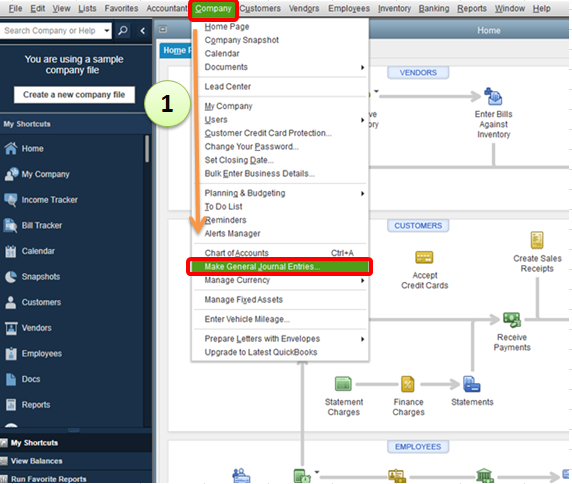

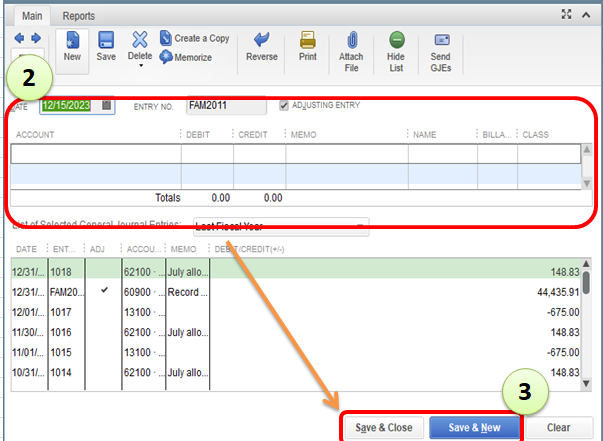

I'd be glad to show how you can create a journal entry in QuickBooks Desktop Enterprise. Below are the steps:

For your second question, yes, creating a journal entry will affect your Profit and Loss report so I highly suggest consulting your accountant for the best advice. This way, you can explore several options so your data and reports won't be messed up.

You'll also want to learn how to customize reports in QuickBooks Desktop. This way, you'll be able to pull up the desired details for your reports: How to Customize reports in QuickBooks Desktop.

Please let me know if you have more questions by leaving a comment below. I'll be around to help. Have an awesome day and take care!

Hi there,

If i do the bank deposit, my payables will have unpaid invoices. What should I do? Do I just delete the invoice?

Thanks

Hello, @Nerak1.

You can only make bank deposits for payments that you’ve placed into the Undeposited Funds account.

It’s when you choose Undeposited Funds from the Deposit to drop-down when creating sales receipt and invoice payments.

Technically, creating bank deposits won't affect your unpaid invoices.

Check these articles for more information:

You can also run Deposit Detail report to review all your past deposits. See the following article for detailed guidance: Use Check or Deposit Detail Reports to show transaction links and mimic Cash Receipt Report.

Let me know if you still have questions. I'm always here to answer them for you. Have a wonderful day!

Hi there,

I have a bunch of uncleared checks in QB from last fiscal year. Some of them were just cleared the bank this August. I am trying to match the transaction but I can't bring up those checks. When I try to add them to QB, I find the uncleared in bank reconciliation and their total amount appears as DIFFERENCE amount. Any idea or solution? I really appreciate your help.

Hello, Somi.

Thanks for joining this thread. I'm here to help share some information about uncleared checks from the last fiscal year in QuickBooks Online.

The uncleared deposits in QuickBooks Online are not yet cleared in your bank, so you can leave those transactions as it is. You can filter the reconciliation page to show the cleared transactions only.

Though, if the uncleared check is not owed, then you can make a journal entry to clean the old uncleared items out of your outstanding checks listing. However, you'll need to consult your accountant first before trying out this option to ensure if this is the best practice for your business.

For future reference, read through these helpful articles to share more details:

Should you have any additional questions or concerns, the Community will have you covered. Thanks for reaching out. Have a great day!

thank you so much for such a quick response. Actually they are cleared now and the transaction is transferred to QB directly from the bank website. When any routine check clears the bank I can easily match them with the check issued in QB (EXPENSE). But for this one the original check doesn't come up. If you see attached picture the black circled check is a current one an the red ones are from previous fiscal year and there is no way to match them. Even when I add them manually the don't sit as a payment to the check and create a new expense!!! Duplicate!

Thanks for getting back to this thread and adding a screenshot, @Somi.

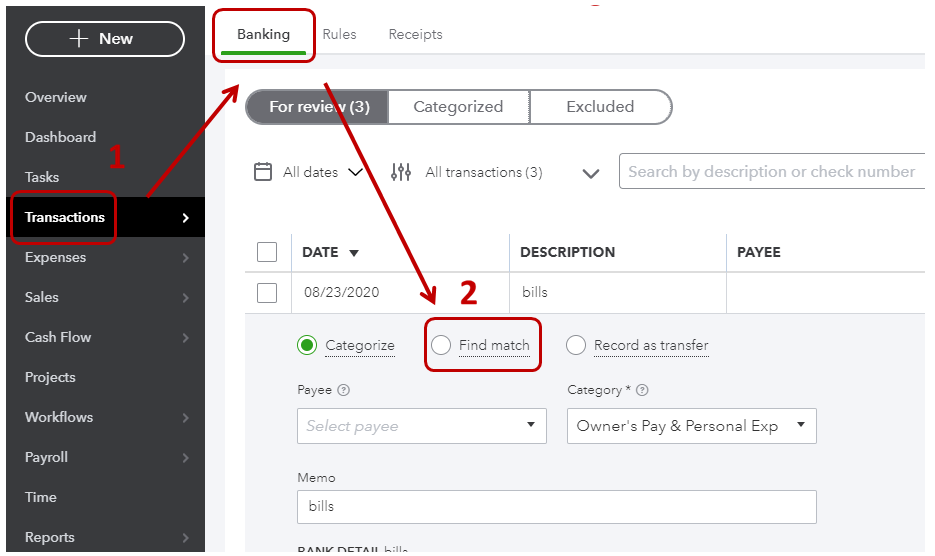

Let me share with you some information on how QuickBooks categorizes and finds a match for banking transactions.

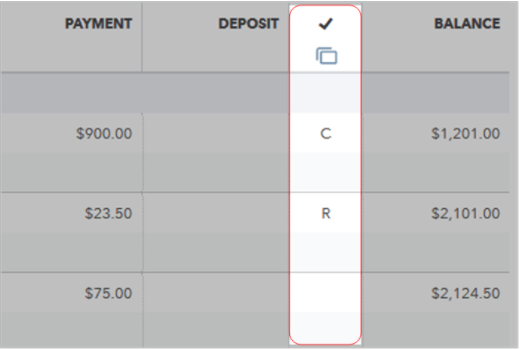

QuickBooks will consider them a match if the downloaded and the recorded transaction dates are within 90 days from each other. Also, it will no longer match a transaction that was already cleared or reconciled.

If the transactions aren't yet reconciled/cleared, you can still manually change the date range when finding a match. Let me show you how:

If the transactions are already reconciled/cleared, you can exclude them so that it won't create a duplicate.

In case you want to speed up the process of categorizing your bank transactions, you can use the bank rules feature in QuickBooks. This will automatically categorize your downloaded transactions for you.

I'm always here to help if you have any other concerns or questions. Just tag my name in the comment section and I'll get back to you as soon as I can.

Wow, wonderful. It worked. I really appreciate it.

I had to create a journal entry for a check that was never cashed by a vendor. I don't understand why the journal is reversed afterwards. Can you explain? I'm trying to reconcile a month and it is off by the check amount still.

Welcome to QuickBooks, wdennis.

May I know how did you enter the Journal Entry for this check?

Normally, there's no need for you to create a journal entry since this check was never cashed. Instead, you can enter it as a deposit using the same expense account as the check.

Here's how:

After that, clear both once you reconcile. Please read this article for more information: Undo And Remove Transactions From Reconciliations in QuickBooks Online.

You also have the option not to include this in your reconciliation to avoid any issues.

Once done, you can run reports in QuickBooks Online to track the information you need: Run Reports In QuickBooks Online.

Keep me posted on how everything goes. I'll be glad to help.

Thank you - that makes more sense. Do I need to put the vendor name in the "received from" box or just leave that blank?

Thanks for coming back to this thread, wdennis.

I'd recommend adding the vendor name in the Recieve From column to easily track and identify the transaction. You can also add a memo to the bank deposit stating that this is for the uncashed check.

Once you're all set up and ready, it's time to perform a bank reconciliation. Additionally, you may exclude the check when reconciling your account since it wasn't been cashed out.

To help keep your accounts balanced and up-to-date, I encourage reading these articles:

Fix common issues when you're reconciling accounts in QuickBooks Online

Fix beginning balance issues if you've reconciled the account in the past

If I can be of any additional assistance, please don't hesitate to leave a comment below. Stay safe and have a great rest of the day.

I have 2 payroll checks from 2018 that were never cashed and the employee is no longer employed. They were only for $1.10 and $1.63. How do I clear them out of my bank reconciliation? What kind of entry do i need to create?

Thanks for joining this conversation, @chaga. You can make a journal entry for those 2 payroll checks that were never cashed. This is to clean the old uncleared items out of your outstanding checks lists.

Here's how:

I'd also suggest you consult an accountant before taking this option to ensure the accuracy of your books.

For future reference, I'd recommend reading through these resources to learn more details about fixing reconciliation discrepancies:

Feel free to post again should you have any additional concerns. We're always here to listen and help in any way we can.

I would like to make sure I understand lyndaartesani's reply about recording uncleared checks that vendor's have not cashed in years and would appreciate clarity in the steps to take. I am using QBs Pro desktop. Please help me with the following:

1. I will click "Record Deposits"

2. For "Deposit to", do I deposit to the same bank account that the check was written from?

3. For "Date", should I date it for today?

4. For "Received From", what do I select since we aren't technically receiving a deposit? Should I list my company's name since we originally wrote the check for a vendor?

5. For "From Account", would I use the same account that the original check to the vendor was written for.

Thank you in advance for your help!

Hi Ruthie2!

Thanks for joining this thread. Let me share some details about the steps shared here.

You're basically depositing the money back into your bank account.

Also, it'd be best to seek some help from your accountant so they can better assist you on how to handle the uncleared checks. For your reference, you may check the detailed steps here on how to create a bank deposit: Record and make bank deposits in QuickBooks Desktop.

Need help in reconciliation? Please check this link: Learn the reconcile workflow in QuickBooks.

Keep on posting here if have more questions. Take care!

JanyRoseB, I followed your instructions (thank you for being so clear) but the outstanding checks are still in my reconciliation statement. How do I remove them?

Nice to have you join this thread, @Village2590.

I appreciate for going through the steps shared by my colleague above. I'm here to share extra steps on how you can remove your outstanding checks from your reconciliation statement.

You can undo your reconciled account to remove your outstanding checks. You can also invite your accountant and let them undo it for you. They have a special tool to undo the reconciliation at once.

If you’re not affiliated with one, you can visit our ProAdvisor page and find one from there.

If you wish to undo the reconciliation by yourself, you can refer to these steps for guidance. Before you begin, I’d recommend working with your accountant for guidance. This way, we can ensure your accounts remains accurate after making these changes. Let me show you how.

You can also see this link for more detailed steps: Undo or remove transactions from reconciliations in QuickBooks Online.

Once done, you can now redo the reconciliation process. In case you run into some issues in reconciling your accounts, you can utilize this link on how to handle the situation: Fix issues during a reconciliation in QuickBooks Online

You can always leave a reply if you have any other concerns or questions about reconciliation. I’ll be around to assist you. Take care and have a good one!

Hi JanyRoseB - does this entry then affect prior periods? There is no way to get rid of a stale check in just my current fiscal year? I don't want to affect prior periods. Please let me know. Thank you!

Hey there, @jperryMPA.

Thanks for following the thread. I hope you're enjoying the day so far.

In QuickBooks, if you edit any transaction in the past, it will affect the reconcile. However, an accountant may be able to assist with an adjustment entry that can be reconciled to correct it in the current period.

If you don't have an accountant, don't sweat. You can find one here in our Resource Center.

Please let me know if you have any additional questions or concerns. Take care!

Does this apply to uncleared checks to a vendor from a prior year? I'm trying to do this for a few checks that were never cashed for 2021, but those books are closed.

Hello,

We closed one of our bank accounts and we have two checks that are from 2022 that need to be cleared out, so I can zero out the bank account in QB.

Help! Thanks!

For past unreconciled transactions (after tax returns are filed) - what is the simply way to remove the transaction. Is it proper to move clearing the transaction using retained earnings?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here