Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am successfully using the most recent update to QuickBooks 2019 Desktop.

I go to FILE > PRINT FORMS > 1099s/1096.

I have successfully mapped my accounts and my subcontractors are successfully going on the NEC and my rent and lawyer fees are successfully going on the MISC. All seems good on that. I have successfully printed both my 1099-MISCs and 1099-NECs.

However, when I print my 1096, QuickBooks generates two separate 1096 forms. One for my combined 1099-MISCs and a different 1096 for my combined 1099-NECs.

I would have assumed QuickBooks would generate and print one single 1096 that combines all 1099-MISCs and 1099-NECs?

Should I actually file two 1096s (one for my MISCs and one for my NECs)? Or, am I doing something wrong and I should really be filing only one combined 1096 (for both my MISCs and NECs)?

I hope that makes sense?

Thanks!

Solved! Go to Solution.

Look closely at the bottom of the 1096 and the instructions 2020 Form 1096 (irs.gov) only 1 type of forms can be submitted on a single 1096. There are many different 1099 forms and each type grouped together gets its own 1096. So QB is correct in producing one 1096b for the 1099MISC and one for the 1099NEC

Look closely at the bottom of the 1096 and the instructions 2020 Form 1096 (irs.gov) only 1 type of forms can be submitted on a single 1096. There are many different 1099 forms and each type grouped together gets its own 1096. So QB is correct in producing one 1096b for the 1099MISC and one for the 1099NEC

This makes sense.

BOX 6 of the 1096 Form clearly states, "Enter an 'X' in only one box below to indicate the type of form being filed."

Thank you for pointing this out to me.

There has been a lot of confusion around the new 1099 rules. Hopefully this helps someone else out as well.

Thanks again!

Where is the section to Print 1096's

How do you print Form 1096.. there is not tab?

Welcome to the Community family, @Steiskal.

With QuickBooks, you can easily e-file your 1096's form along with your 1099's instead of filing manually. However, once you've filed the form, it’ll go along with the IRS.

To print your 1096’s, you’ll need to contact the IRS and get a copy from there.

In case you need to print your 1099’s in the future, see this link for your reference: How do I print my 1099 forms?

Let me know if you have other queries printing forms in QuickBooks. It’s always my pleasure to lend a helping hand. Have a good one and keep safe.

So I see there are options to add many different 1099 forms to 1 single 1096. The issue is there is not a way in QBDT to combine the 1099NEC and the 1099MISC 1096 amount and print only 1 1096. Am I missing something?

Thanks for joining us here today, @JHARP.

I have some information about combining 1099-NEC, 1099-MISC, and 1096 forms. The IRS has separated nonemployee compensation onto a new form called the 1099-NEC for the tax year 2020. Thus, combining them into one isn't possible.

To print your 1099-NEC, 1099-MISC, and 1096:

For more information about printing 1099 forms, check out this link.

Additionally, you can visit our page for the available 2020 pre-printed 1096 forms.

If you need help with other tasks in QBDT, feel free to browse for specific topics here and look for responses that fit your concern.

I'm always here if you still have clarifications or questions with 1099s. Just drop a comment below and I'll be glad to answer them for you. Take care and have a lovely day ahead.

Thank you for explaining!

Replying to this line: "To print your 1096’s, you’ll need to contact the IRS and get a copy from there."

if that is the case, why is the 1096 form included in the packet of 1099-NEC I purchased directly from QuickBooks?

If we need to get the 1096 form directly from the IRS, why is it included in the 1099-NEC and 1099-MISC forms that we purchase directly from Quickbooks? If I use the form provided to me by Quickbooks, will the IRS reject it?

Hi there, 3Drywallers!

I'd like to clarify that we can actually print the 1096 form in QuickBooks Desktop. Simply follow the steps in the QuickBooks Desktop section of the article that Jasro shared. It is specified in Step 5.

Let me know if you still need more help with your 1096 form. Happy weekend!

Yes you can print the 1096 from within QB, you can even print a 1096 from the IRS website, but these are for your own consumption. As a copy of what you submit electronically. Unless the IRS has changed their tune, only the official red form can be used for mail in submission and the warning about big fines is there for all to see. Something about tge color red you print at home causing scan errors. It is the same with a W3, you cannot under threat of fine print your own W3 to mail in.

Both of these are readily available at loc office supply stores, online at Amazon, or free from the IRS except from the feds good luck receiving it in time.

Reminder, a 1096 is good for 1 and 1 only specific type of payment and ypj cannot combine. You cannot combine 1099 for rent with 1099 paid to a realtor for a purchase. Or regular contractor on NEC with fish for resale. One checked box per 1096

I need to file a copy of the 1096 with my California filing of 1099 NEC, since QB e file only does Federal, how can I generate a 1096 to then print on a scannable 1096 to send to California, or even a copy of a 1096?

Hello, I am able to print the 1099-NEC forms that I needed to, no problem. But I am unable to find an option to print the 1096 form. This is not an option anywhere on the "Print/e-file 1099 forms". I have QB desktop Pro 2020. Any thoughts?

Sure thing, @saracomforti.

I'd be happy to walk you through how to print the previous year's 1096 form. It can be a bit confusing because you go through the whole 1099 workflow and then it shifts to 1096 at the last step.

Here's how:

While those steps are for 1099's, they lead you to the place in which you can print 1096 forms as well.

I'd love to hear how this goes! If there's anything else I can do to help in the meantime, feel free to reply to this thread. Take care.

There is no tab in my QuickBooks to print 1096, only 1099? Where do I find that? I have the form from the IRS

There is no tab to select and print up 1096 in my vendor menu. Just 1099!

Hello there, PrincetonYoga.

The steps provided should work. You will see the 1096 option when printing forms at the last part of the process. It could be that the vendors didn't reach 600 for the threshold of the IRS. That's why you're unable to print the 1096 form.

On the other hand, if your vendors have reached the required threshold amount, we can verify and rebuild your company file. It helps identify issues in Quickbooks Desktop files and fixes them right away. Here's how:

To Verify:

To Rebuild:

Also, you can check this article about filing status in QuickBooks: Check e-file or e-pay status.

Let me know if you have other questions. Take care always.

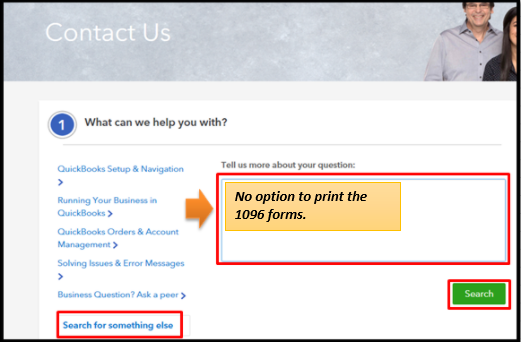

I can print my 1099-NEC and 1099-Misc, but there is not an option to print my 1096s. Any suggestions?

I agree. Same with mine. No option to print 1096

I've got your back in printing your 1096 forms, @kkleman.

First, let's make sure to download the latest QuickBooks Desktop (QBDT) and payroll tax table release to have the recent features and patches.

Then, make sure to run QBDT as an admin. To do that, right-click on the QuickBooks icon, and then select Run as administrator.

You can also follow the suggestion provided by my peer @SarahannC.

If the issue persists, I recommend getting in touch with our live support. One of our agents can review your account in a secure space and determine why you're unable to see the option to print your 1096's.

Before you proceed, please check our support hours so they can assist you promptly.

Here's how to contact our support:

When you're all up and running again, you can now file your 1099's to submit them promptly and stay compliant.

You can count on me if you have more payroll questions. I'd be glad to provide a guide or two for you.

Please advise on 1096 forms.

I printed 1099 NEC + 1096 forms and sending them by mail.

My question about another 1099 MISC form which I filed on line. How to file second 1096 for 1099MISC if they don't even giving you an option for this. Is that mean that since I filled on line then I don't need to submit a second 1096 to IRS?

Please help

Natalya

Hello there, @NataG.

Yes, you're right. Once you use the E-file service in submitting your 1099-MISC, you'll no longer need to submit a second 1096 to the IRS.

Since you already submitted your 1099s to the IRS, you can go back to your account to check their status. Follow the steps in this Tax 1099 article: How can I check the submission status of my tax forms?

If you need help with other tasks in QBDT, you can browse for specific topics here and look for responses that fit your concern.

Please feel free to reach back out if there's anything else you need help with concerning 1099 or any other QuickBooks related. I'm always here to help. Have a great day!

How do I print previous 1099's/1096's? I updated my qb desktop recently and it seems now that I can't go back to any year prior to 2020 to print my 1099's. I need to pull a report for a legal matter; however, qb will not let me.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here