Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowwhere is "edit?"

Where is EDIT???

Go to edit?? Where is any menu or tab that says 'EDIT?"

I'll guide you where you can see the Edit menu in QuickBooks Desktop, @pigi.

I'll make sure that you can see the Edit tab in your account. This way, you can start customizing your 1099 forms without a moment's delay.

You can see the Edit menu on the upper left side and click Preferences. See the sample screenshot below for your reference:

In addition, check out these articles below on how to troubleshoot 1099 issues and check tax submission of your forms:

Leave me a comment below if you need help finding various buttons in QuickBooks or 1099 questions. I'm happy to help you again. Take care always, pigi-.

When I click on those it takes me to the Print/efile 1099 forms and will not let me change anything.

Hi there, @buchanan.

I want to make sure your issue with 1099 gets resolved.

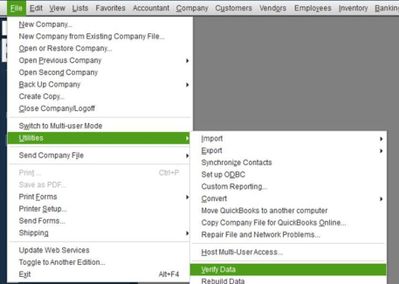

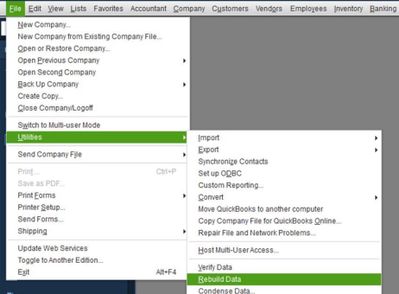

Your company file may be damaged that's why it doesn't let you change anything when printing or filling 1099 forms. Let's run the Rebuild and Verify Utility tool to fix data damage on your company file. Here's how:

If you get the same result, you can check out this article for more troubleshooting steps: Fix data damage on your QuickBooks Desktop company file.

If the issue persists after performing all the troubleshooting steps, I recommend reaching out to our QuickBooks Support Team. This way, they can further check on this matter and help you print/file your 1099 forms.

You might want to learn more about 1099 forms. This article will provide you the detailed information: Get answers to your 1099 questions.

I'm still open to your replies, @buchanan. If you need further assistance printing 1099 forms, just comment below or post again.

I believe that the heading for this problem is misleading. I was successful in running my 1099-MISC. There was not issue and my report prior to printing them was fine. However, when I went to print the 1099-NEC, the system could not find any vendors. I tried a variety of ways to make it work. Then I checked my Vendor master file and ALL of my vendors had "no" in them for 1099 eligibilty. Something in printing the 1099 MISC changed all of the vendor files. I have now created and edited the Vendor Master file. I am hopeful that I can print the 1099 NEC now but am worried that it may overwrite the Vendor file once again. Do you have any ideas on why this happened?

Thanks for sharing and successfully running the 1099-MISC, @Lonnie5.

Let me help you understand why the system wasn't able to catch 1099-NEC for some of your vendors when installing the latest release in your QuickBooks Desktop version.

This is because of the Reset Update option that removes the previous 1099-NEC setup for vendors. It also allows the system to replace the previous update with the latest fix to print the 3 to a page 1099-NEC.

So when you restart QuickBooks Desktop to install the latest updates, you'll want to make sure to remap the accounts and omit all mapping under the MISC tab. Doing this will push you to remap NEC and MISC accounts again and be able to print the 3 to a page 1099-NEC form without worrying about overwriting the vendor file.

I’m adding some resources below to help easily process your 1099s. These articles outline the complete steps on how to process and produce copies for the tax forms.

I'm always open to your replies, @Lonnie5. If you need further assistance printing 1099 forms, place a comment below or create a new post again. Take care!

this is incredibly incompetent roll-out of 1099 third-party integrated software...blows my mind...can't delete vendors inside the UI. Can't add any today post submission. it's a deal interface to view submitted 1099s. Ifg you can access it, you have basically one shot to submit...go boldly my friends...sad...

MD Robin, THANK YOU SO MUCH FOR THIS!!! You saved me from crying many tears over this!! Your explanation is nice and concise.

I found that after you run the report, and nothing is populated in it,

look at top of report page where it says 1099 options:

Change “Only 1099 Accounts”. To All Allowed Accounts”

this worked for me

help,

my QB is grouping all of the accounts listed on one bill to 1099 in the total amount, even though I am only selecting the commission account in the mapping... I have NO time to figure out why this is happening. But if there is anyone still there that can provide some guidance... I would be forever grateful.

I'm here to assist you in accomplishing your 1099, @faith26.

We can perform basic troubleshooting to isolate the issue. You can run the Verify/Rebuild tool. Verify will detect any damaged data that causing your issue with preparing 1099s. Rebuild will attempt to fix the damaged data detected. It also allows your QuickBooks software to refresh the data inside the company file. Make sure to create a backup copy of your company file before doing the Verify and Rebuild process. If there are changes that occur, having a backup copy allows you to restore it to undo the changes.

Follow the steps below on how to verify data:

Next, here's how to rebuild data:

After that, update your QuickBooks Desktop to its latest release. Additionally, this article provides detailed information about 1099 forms.: Get answers to your 1099 questions.

Please come back and post again if you need more help with preparing your forms. The Community is always here to help.

is this under each contractor? I don't see it. I'm having the same issue. Please advise

Hi there, Jackie-7.

May I know what issues are you experiencing with 1099's? What specific area do you have questions about your contractors? Please let me know so I can address your concern properly.

If you have any other concerns, you can always get back to us. I'd always be glad to help.

What screen do you edit presences from ??

I can guide you through the Edit option on your preferences, Fancy face.

You'll want to go through the Edit menu to map accounts for your 1099s. Here's how:

I'm adding these articles as guides when you manage 1099s.

Let me know if you have additional questions about the Edit option. I'm always around here in the Community to help you.

I am trying to run a 1099 report for a past period (7/1/2020 through 6/30/2021) for the worker's compensation folks. The report isn't letting me run it either as NEC or MISC. I can only get 1/1/2021 through 12/31/2021.

Message says: "Form 1099-NEC is used to report nonemployee compensation you paid to your vendors beginning January 1, 2021. select a date range starting with January 2021."

NEC filing was implemented for tax year 2020 so I don't understand why I can't make a report for a past period as I usually do for the w/c audit.

Can you help?

I am unable to run a NEC report either. I've done all of the above. Help!

My problem on the 2021 1099s they would not print anymore. I never could get a straight answer as to what is going on. I seen where QB was advertising they would do them for a charge, so does their software not print 1099s anymore? I had to hand write the few I had. Wonder what 2022 will be like?

It's nice to see you here in the thread, @RRubin. I've got your back, and I'll help you out so you can run the 1099-NEC report in your QuickBooks Desktop (QBDT) company.

To view NEC report, you'll need to run the 1099 summary report. I can input the steps below so you can proceed. To begin, here's how:

2. Go to Reports then select Vendors & Payables.

3. Select either 1099 Summary or 1099 Detail.

Additionally, see this article in case want to edit your COA for your 1099-NEC filing: Modify your chart of accounts for your 1099-MISC and 1099-NEC filing.

You can also check this page if you need to add contractor or change amount when creating your 1099s in QBDT: Fix missing contractors or wrong amounts on 1099s.

@RRubin, it was a pleasure to have you in the Community today. If you need further assistance with this, feel free to click the REPLY button below. I'll be more than happy to help you out again. Take care, and have a nice day.

I’ve been wondering that as well. Hope their techs are on it now. I had to buy a separate software pkg to print those 1099s. I feel the fee we pay QB should ensure their software runs smoothly. Fingers crossed.

Thank you! This is what helped me get my report back.

You're most welcome, @Lindsey-JR633.

I’m glad that you've finally gotten your report back. Please know that you can always reach out to us whenever you need help.

If you need more information about managing your company, feel free to visit our Support page. It contains ways and tips to make sure everything is accurate and organized.

Have a great day, and keep safe!

I have the same problem. I am using 2023 desktop version of Quickbooks and the report shows no data.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here