Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Thank you for the screenshot added, @Roie.

I can see how hard you've tried just to record the payment in QuickBooks Online (QBO). I'll help you ensure this will get sorted out.

First, go to the sales tax settings and check if there are state agencies. Then, make sure that they're not deactivated.

Next, run the Sales Tax Liability report to check if there are transactions recorded during a specific period.

Once completed, go back to the Sales Tax center and check your sales tax due from there.

If you're getting the same experience, I encourage following the steps in a private window. Sometimes, the regular browser tends to hold onto information, and over time it could cause problems while working with QuickBooks.

To save you time, use either of these keyboard shortcuts:

If that works fine from there, go back to your original browser and clear its cache to start fresh. Also, using other supported browsers can help us narrow the cause of this behavior.

You may find these articles helpful about sales taxes in QBO:

I am looking forward to hearing from you, @Roie. Just add a comment below if you have any other questions. Have a great day!

Hi ,

I'm trying to set up an automated sales tax in QBO. But unfortunately, I can't do it.

If I click on the "Tax" page, the below screen will have appeared.

Kindly provide the steps to setup automated sales tax

I'll make sure you're able to set up the automated sales tax feature in your QuickBooks Online (QBO) account, @Sasirekha.

When you select the Taxes menu, you'll automatically be routed to set up the automated sales tax feature. Since you're unable to do so, this might be because your browser is full of your frequently accessed pages. This will result in some unusual responses to the system. You can isolate this by logging into your QuickBooks Online (QBO) account using a private browser (incognito).

Here's how:

Once signed in, let's go back to the Taxes menu and set up your automated sales tax. Kindly refer to the step-by-step guide below:

I've attached screenshots below that show the first five steps.

If it works, return to your default browser and clear its cache and cookies. This will refresh the system and remove older data that cause viewing and performance issues.

If the issue persists, I'd recommend using other supported browsers in setting up your sales tax.

QuickBooks lets you do the sales tax calculations automatically. This will make it easy for you to file your sales taxes accurately. To learn more about how the system calculates sales tax and for the complete guide, kindly refer to this article: Use automated sales tax in QuickBooks Online. It contains related and helpful articles to add your tax categories to your products and services and checking your customer's info to name a few.

After setting up your sales tax, you're able to file your sales tax return. For the detailed steps, you can refer to this article: File your sales tax return and record tax payment in QuickBooks Online.

You're always welcome to comment down below if you have other concerns or follow-up inquiries about the automated sales tax feature in QBO. I'm just around to help. Take care.

Bad Mistake:

Well I couldn't resist that little invitation from hell. I selected to convert and now my accrual account has went from $2,000.00 to $12,000. The new automated system is properly tabulating the sales tax from the previous transactions all the way back Q4 2019. But us bit properly accounting for all the payments previously showing in the lower half of the old method. What kind of mess will I generate If I try to match the previous payment amounts to the existing accrual account. Will I then find duplicate payments in my Bank Register?

Hi there, @arta1963.

Let me some information with regard to this issue that you have. If you try to match previous payment amounts to the existing accrual account, there will be a sales tax increase after switching to an automated sales tax. Also, it will duplicate payments in your Bank Register.

To learn more about how you can manage sales tax in an easier way. You may check this article for newly improved sales tax management: Sales tax in QuickBooks Online.

In addition, you can also change the sales tax rate in QuickBooks online. Refer to this link for the complete process: Edit sales tax rate in QuickBooks Online.

Feel free to post any additional questions in the comment section. I'll be delighted to help you further.

I have been in this current situation for months! Did you ever get this fixed?

Hi there, @cadarland. It's our priority to ensure you can switch from manual to automated sales tax.

Have you already performed the troubleshooting steps provided in this thread? You can try opening your account on the private/incognito browser. This helps rule out the possibility of a webpage issue. You can refer to these shortcut keys to open an incognito window in all supported browsers:

Once logged in, try switching to automated sales tax. If it works, clear your browser's cache. You can also switch to a different supported browser to see if it has something to do with your browser. Additionally, to start calculating your sales tax automatically, refer to this article: Set up and use automated sales tax.

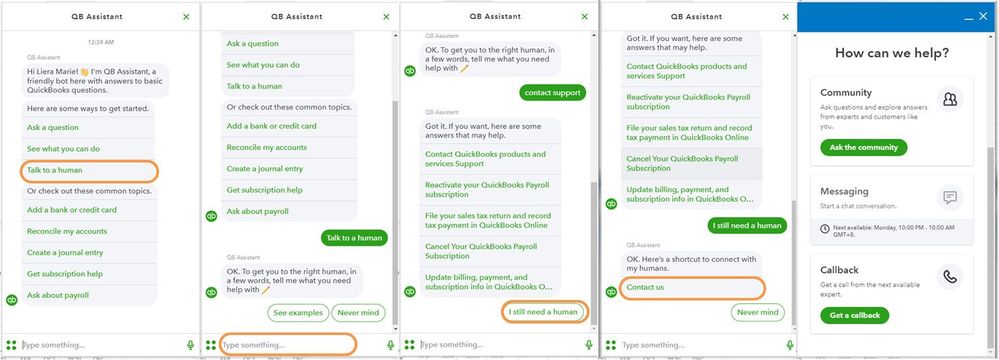

If the problem continues after trying this step, I'd suggest getting in touch with our Customer Care Team. They have the tools that can help determine the reason behind this matter and have the ability to create an investigation if necessary.

Here's how:

To ensure we address your concern, check out our support hours and types.

Feel free to leave a comment below if you need further assistance with tracking your sales tax. I'd be more than happy to help. T

I'm using the automatic sales tax option and I tried using a private browser window, but it still shows $0 in the taxes section.

There are several factors on why you're sales tax isn't calculating, info-atamahats-c.

First, let me share with you how Automated Sales Tax calculates. Here are those:

I can help you verify the settings so you can review the sales tax is correctly set up.

To start, let’s make sure that the company address is in the correct country so that the tax calculation is correct. Let me walk you through how to change the company address.

1. Go to the Gear icon, then select Account and Settings.

2. Choose Company, and click the Pencil icon beside Address.

3. Enter the Company address.

4. Hit Save, then Done.

Once done, let’s check the set up of the Sales tax in your account. Let me show you how:

1. From the Taxes menu, select Sales tax settings located in the upper right corner.

2. Choose Add agency, and in the Filing frequency box choose a tax period.

3. Hit Save.

After that steps, let’s create a sample invoice to check if the address and tax are saved. Here’s how:

1. From the Plus (+) icon, select Invoice under Customers.

2. Select the Customer’s name and enter the email.

3. Under Product and Service, choose the product and enter an amount.

4. Make sure that the box under Tax is checked, then click the see the math link below the Sales tax amount.

5. From the pop-up window, under Your tax agency and standard rate, verify if the amount is correct. If you have another rate, you have an option to Override the amount. I've attached a screenshot for your reference.

The next steps, use another supported browser as an alternative.

Lastly, you’ll want to contact our Support team if the issue persists. They can securely check your account and investigate this matter. Here's how to contact them in your QuickBooks account:

I'll be adding a few related articles for you to be familiar with Automated Sales Tax:

I'd appreciate it if you'll keep us posted once your sales tax is already calculated correctly. We're always here to assist you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here