Running a business means facing risks every day. Some are small. Others can have big financial consequences and shake your company’s future—and lower your enterprise value. A 2025 QuickBooks survey found that 45% of small business owners lost over $10,000 in profits due to low financial literacy, underscoring the need for better financial planning.

That’s where enterprise risk assessment (ERA) can help.

ERA helps you find, understand, and manage risks early, before they turn into problems. It’s a smart approach for better financial management and long-term success. Learn more about ERA, how it works, why it matters, and how you can use it to grow your business.

What is enterprise risk assessment?

5 key components of enterprise risk management

How to implement enterprise risk management practices

6 types of risk that enterprise risk assessment addresses

Business tools your company can use for enterprise risk assessment success

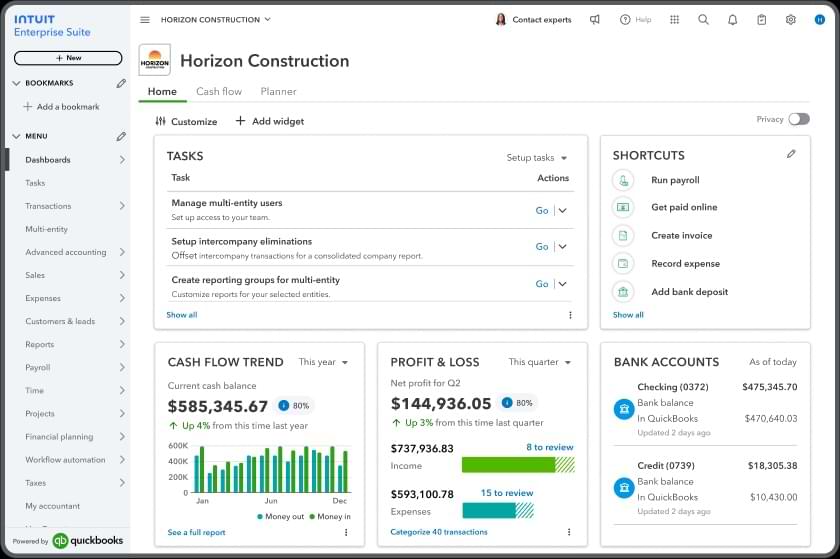

Use Intuit Enterprise Suite to simplify strategic enterprise risk assessment

Ensure that everyone—from leadership to team members—understands which risks matter most and knows how to respond. Write your priorities down and communicate them often to keep everyone aligned and ready to take quick, consistent action when risks arise.

Ensure that everyone—from leadership to team members—understands which risks matter most and knows how to respond. Write your priorities down and communicate them often to keep everyone aligned and ready to take quick, consistent action when risks arise.