Monday - Friday, 5 AM to 6 PM PT

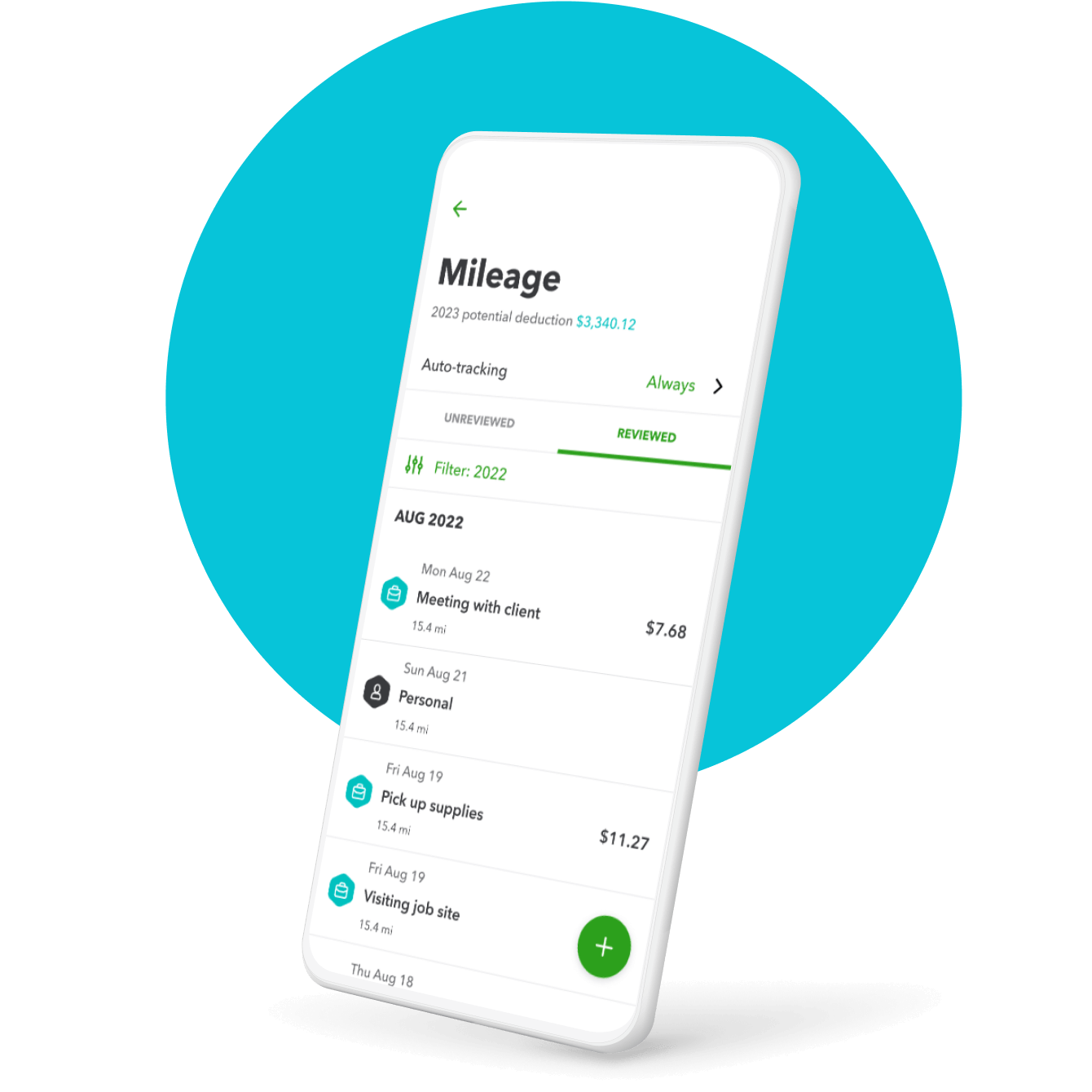

Mileage tracking is built into QuickBooks

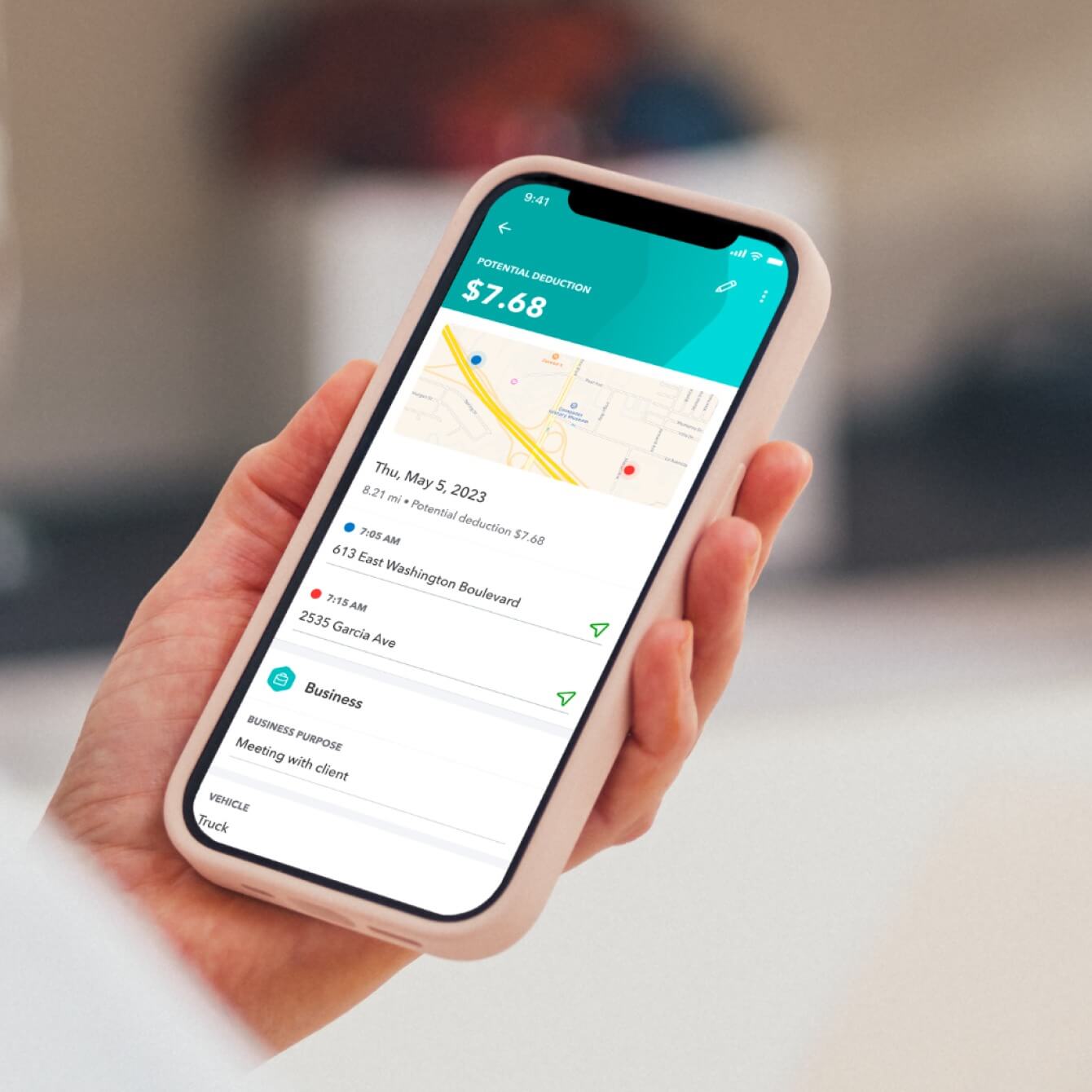

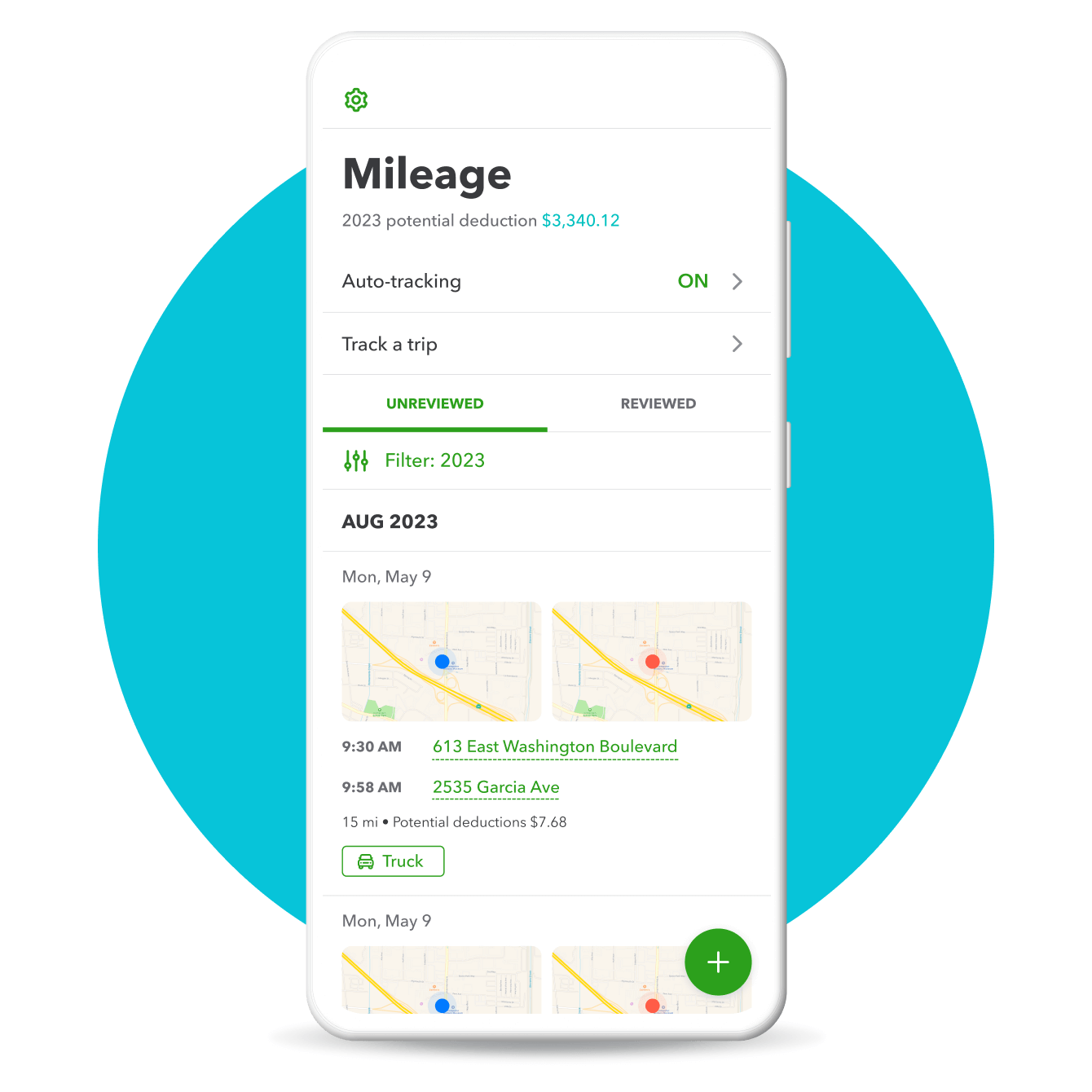

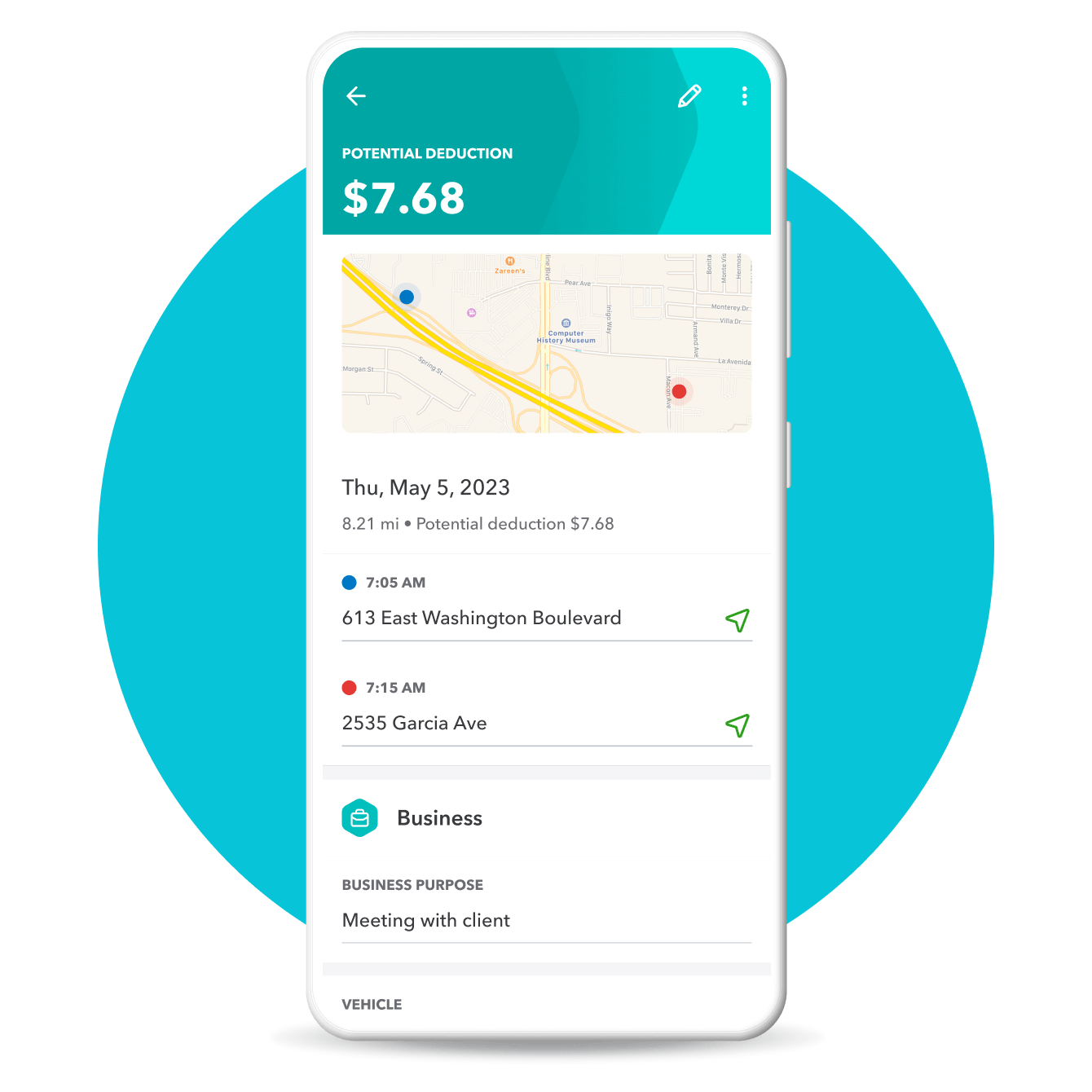

Automatic GPS tracking

Easier than doing nothing. Just drive, and we’ll use your phone’s location to detect when you’re driving. Or, add a trip manually.

Swipe left for business miles

Easily categorize individual trips as business or personal to accurately rack up potential tax deductions.

Detailed mileage reports

See the breakdown of miles and potential deductions. Plus, it’s easy to share when you need to.

Bring your miles with you

As your business grows, you can automatically transfer your current mileage from QuickBooks Self-Employed to QuickBooks Online.

Plans for every kind of business

Now with Live Assisted Bookkeeping (add $50/month)

- Add $50 per month

- Add $50 per month

- Add $50 per month

- Add $50 per month

NEW

NEW

Get help from our bookkeepers when you need it. They’ll provide guidance, answer your questions, and teach you how to do tasks in QuickBooks, so you can stay on track for tax time and run your business with confidence.

QuickBooks-certified bookkeepers can help you with:

- Automating QuickBooks based on your business needs

- Categorizing transactions and reconciling accounts correctly

- Reviewing key business reports

- Ensuring you stay on track for tax time

Add $50/month

QUICKBOOKS LIVE

Real experts. Real confidence.

All QuickBooks Online plans come with a one-time Guided Setup with an expert and customer support.

Need more help? QuickBooks Live helps you stay organized and be ready for tax time with:

- Live Assisted Bookkeeping

- Live Full-Service Bookkeeping

Ready to get started?

Or call 1-800-365-9606

Keep up with standard mileage rates

Every year, the IRS publishes the standard mileage rates for calculating mileage deductions.**

Mileage rate 2023

The 2023 rate is 65.5 cents per business mile. Simply multiply the total business miles you drove last year by the standard mileage rate. Then, claim that number on your tax return as your business mileage tax deduction.

Previous standard mileage rates

Compare rates that the IRS published over the past few years.***

2022: 58.5 cents per mile from Jan-June and 62.5 per mobile from July-December

2021: 56 cents per mile

2020: 57.5 cents per mile

2019: 58 cents per mile (For 2019 taxes filed by July 15, 2020)

2018: 54.5 cents per mile

2017: 53.5 cents per mile

2016: 54 cents per mile

How to calculate your mileage deduction

There are two ways to calculate your business mileage deduction — the standard mileage method and the actual expense method. You won’t be able to take both deductions, so choose the method that best fits your work.

Standard mileage method

Use the standard mileage method to calculate the amount of business mileage you can claim on your tax return. Just multiply your total business miles for the year by the standard mileage rate. See all mileage rates

Actual expenses method

The actual expenses method is more complex, but it may result in a bigger tax deduction for you. With this method, you can deduct vehicle-related costs if at least some of your driving is for business purposes.

How to choose the best mileage deduction method

By logging miles and keeping records of your vehicle expenses, you can calculate which method will give you the biggest tax deduction at the end of the year. QuickBooks Online makes it easy to automatically track your mileage and expenses year-round, and get estimates of your standard deduction.

Points to remember

- Once you use the actual expenses method, you cannot revert back to the standard mileage rate in the future.

- In the first year you drive your vehicle (whether leased or owned) for business, you’ll need to use the standard mileage rate method.

Make every mile count

Track mileage to get the biggest tax deduction you deserve. Think of the mileage tracking app as a hands-free digital mileage log.

Mileage logs

A mileage log is a written record of your trips that you submit with your business mileage deductions. The IRS requires that you keep your mileage logs for three years—whether a paper-and-pencil mileage log you keep in your glove box or a digital mileage log stored on your phone.

Get started with QuickBooks mileage tracking

The QuickBooks mobile app acts as a digital mileage log by tracking and categorizing the miles you drive for work.

Using a mileage tracker app like QuickBooks Online ensures that your business mileage is recorded in real time and organized so that it’s not lost or forgotten when you need it. At tax time, you have all the details necessary to claim your mileage deduction.

Download the QuickBooks mobile app from the Apple App Store or Google Play Store.

Points to remember

- Once you use the actual expenses method, you cannot revert back to the standard mileage rate in the future.

- In the first year you drive your vehicle (whether leased or owned) for business, you’ll need to use the standard mileage rate method.

Get started using the app to track miles

It’s easy to get started tracking mileage. First, get the QuickBooks mobile app in the App Store or from Google Play. Then, log into the app using your QuickBooks login information. Next, open the app and tap the Miles tab at the bottom of your screen (iOS) or tap Miles from the menu (Android). Switch the toggle to turn on automatic mileage tracking. Make sure you also enable location services in your device’s settings. That’s it. When you start driving, we’ll start tracking miles.

Business miles vs personal miles

After you finish driving (whether you are a rideshare driver or you are self-employed and going to a client meeting), you need to identify business miles versus miles used for a personal errand. Keeping an accurate mileage log ensures that miles for business trips are tracked for tax time. Swipe right on the trip to categorize it as a personal trip, and swipe left to put it in a business mileage category.

Claim the mileage tax deduction

The self-employed can take advantage of many business-related tax deductions, including the mileage deduction. And for many, such as rideshare drivers and delivery service providers, mileage is one of the largest tax deductions they claim. With the QuickBooks Online app, you can track mileage automatically to get the biggest tax deduction you deserve.

IRS compliance for the self-employed and independent contractors

Whether you’re driving part-time for Uber, full-time as a truck driver, or occasionally making deliveries on weekends, it’s important to track mileage. Stay IRS compliant by using a mileage log that includes the date, the destination, the reason for the trip, odometer readings, and total mileage. The QuickBooks Online app includes a digital mileage log and tracks these items for you, automatically.