Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWe use a cash basis system. However, even thought I set the Summary Report basis to cash in the preference option, My company reports always default to Accrual basis and I have to remember to change it in the settings option. Is there a way to set that company reports default to cash? Thank you

Solved! Go to Solution.

Hi there jaccolon3,

It's good to know that you're changing the Summary Report Basis from the Company Preferences.

When you change the Summary Report Basis to Cash, all Company & Financial reports will default to Cash basis other than the Details report (Profit & Loss Detail, Income by Customer Detail, and Balance Sheet Detail). You'll need to manually change them to Accrual basis.

Please let me know if you have any more questions I can help.

Hi there jaccolon3,

It's good to know that you're changing the Summary Report Basis from the Company Preferences.

When you change the Summary Report Basis to Cash, all Company & Financial reports will default to Cash basis other than the Details report (Profit & Loss Detail, Income by Customer Detail, and Balance Sheet Detail). You'll need to manually change them to Accrual basis.

Please let me know if you have any more questions I can help.

I have the same problem. If a default is set to "cash" they should ALL default to "cash". It is annoying to have to manually change any report to a setting that should be global. Also, in your answer, "You'll need to manually change them to Accrual basis.", I think you meant to say, "You'll need to manually change them to CASH basis."

Thanks

Thanks for joining this conversation, @MagnoliaPMG.

Allow me to step in for a moment and help make sure this is taken care of.

I can see how this feature would be helpful for you and your business. Since this isn't currently an option to all reports in QuickBooks Desktop, I'm going to submit feedback directly to our Product Development team for consideration in future updates.

QuickBooks is constantly evolving and I can assure you that your voice does matter, so I encourage you to submit feedback as well. Here's how:

1. At the top menu bar, go to Help, then pick Send Feedback Online.

2. Enter your request/product suggestion, then select Next.

3. Click Skip and send a message, and choose Feedback as the Category.

That should answer your concern for today. Please don't hesitate to post again or leave a comment if you have any additional questions. Take care and have a great weekend.

Please Learn from the input here.

Yes, this is Available in all QB Desktop programs and has been a basic Preference all these years.

Edit menu > Preferences, Reports and Graphs (on the left), then Company Preferences, on the right. Confirm Cash Basis here. Also, use the Format button and mark in Fonts & Numbers that you always want to see negatives in Bright Red; your computer has a Bajillion million colors, so let's Use them. Also, on the My Preferences tab, change it to Automatically Refresh; this is a leftover from when our computers took Forever to update reports; but now you can set it to Automatic. And on Company Preferences tab, I like to show Account name only and Item Name Only, not including Descriptions.

I cannot get this feature to work, not through Preferences and not within an actual Report. What is the explanation?

Hello there, Jdklein33.

I've replicated your concern and when I changed the report basis (in the preferences and report), it changed the way I set it up. This is a QuickBooks unexpected behavior that can be caused by data or file corruption. Let's run the Verify/Rebuild utility to detect the damaged data.

Here's how:

After running the utility, changed the preferences and check the report again.

You can keep us posted on how things once you've tried the steps. We're just around.

Please Learn from this input.

Make sure you are Logged into that data file as the Admin User. You might not have the Access Rights to make that change.

Time to fix this in all reports.

Hello OrangeSkies33,

I'll pass along this thread to our engineers for them to take a closer look on the issue. If you have more questions, please don't hesitate to post them here in the Community.

Thank you.

I have the same problem the whole time we have used Quickbooks. Hopefully, Engineering will get to it pretty soon. It is most annoying but more importantly, when it comes to tax planning, it is critical.

We hear you, Jo Scott.

We appreciate you sharing your experience. We'll send this feedback to our product engineers.

If you have other suggestions, you can always reply on this thread.

Hello. I am operating on a cash basis and see open invoices in my P+L as though I'm set to accrual.

I'm running Quickbooks for Mac 2019 and receive the attached error message when I try to rebuild the corrupt data.

I don't know what to do, short of manually changing the date of each invoice to next year, which will really disrupt the history of each invoice. Advice would be greatly appreciated!

Thank you for the response, @BuzzRegular.

I understand how it felt when something isn't functioning properly as wanted. To check the error message, I suggest connecting with our phone agents to help you investigate further.

Here's how to contact them:

You can check our support hours and contact us at your convenient time.

You can always go back to this thread if you have additional questions. We'll be around.

I am new with the company and see that when I run a Balance Sheet on cash basis it shows my cash as negative even though the bank has a positive balance - it should not include all checks only those that cleared the bank. Also, my P&L has Depreciation Expense when I pull the P&L on a cash basis. How can I fix this?

Welcome aboard to the Intuit Community, Pinacle2580.

A negative cash balance happens when the cash account on the general ledger has a credit balance. This credit is caused by paying more than it has in the account.

Also, checks will not clear from the bank account until three or four days later. To offset the balance of the uncleared checks, let’s create a bank deposit.

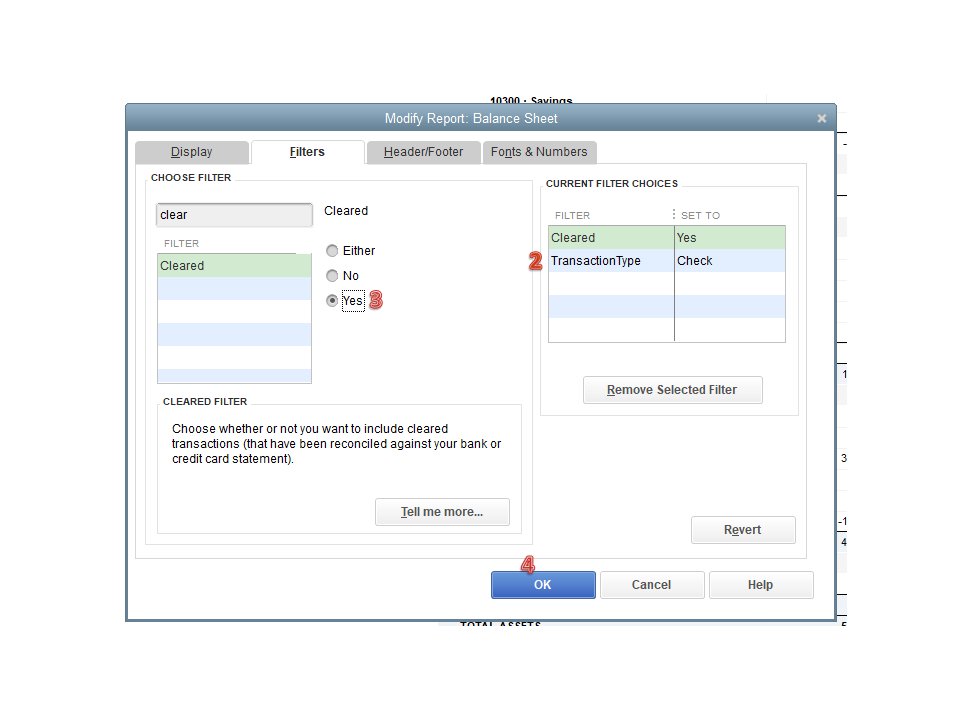

All checks will show on the Balance Sheet Report since the business is using the Cash accounting method. You can filter the data so only all cleared entries will only show on the report.

Here’s how:

When running the report, you'll see all the cleared entries.

In regard to the Profit and Loss Report, double-click on the amount to open the transaction history.

It will display the Transaction Detail by Account page. From there, you’ll see what consists (Depression Expense) the entry.

For additional resources, I’m adding an article that can help fix issues about the Balance Sheet report: Fix a Balance Sheet that's out of balance.

Additionally, the Customize reports in QuickBooks Desktop guide provide an overview of building reports and refining the data.

Keep me posted if you have any other concerns or questions about QuickBooks. I’m always ready to answer them for you. Have a good one.

How do I manually change a customer / transcations to accrual?

Hi there, @RahulS92.

If you have created a deposit or sales receipts, you have to take note of those transactions, delete them and then, create an invoice or a bill transaction. This is done to create accrual base transactions since you are going to record two separate events.

Example transactions of the accrual basis of accounting are:

However, if you haven't created anything yet, you can start off by creating an Invoice transaction or a Bill transaction.

I also include this article that can be handy in the future with setting up accrual reports in QuickBooks Desktop that would help you verify your business' money movement: Differentiate Cash and Accrual basis.

Please don't hesitate to comment below if you need anything else with QuickBooks. I'll be here to help. Keep safe always!

This is a frustrating issue and we see also on the app where there is no option to even change if wanted.

QB team please support those using your products faithfully! We are counting on you!!!

I appreciate you for joining this thread, midtownnow.

At this time, the option to change a transaction's accounting method is not yet available. You'll want to delete and recreate them just like what my colleague MarsStephanieL mentioned.

I understand the convenience it can bring being able to enjoy the said feature. While we continue making improvements with the product, I want you to be updated to the latest future release in QuickBooks by visiting this website: QuickBooks Updates: New QuickBooks Accounting Software Updates.

I've also got you this article to learn more about how QuickBooks Apps work: QuickBooks App for Windows and Mac: General support.

You can always get back to me for more questions, Take care and have a wonderful day ahead!

This does not work in the QBO Accountant version. Tried multiple times to no avail.

Hello @JayM2,

Let me walk you through the steps on how you can change the default accounting method of your reports.

Additionally, I've also included this reference for a compilation of articles you can use while working with us: Use accountant tools and features in QuickBooks Online Accountant.

If you have any other questions, please let me know by leaving any comments below. I'll be here to lend a hand.

I tried several times following exactly the steps you mentioned, but it's not working for me. Every report defaults to accrual.

Hello there, JayM2.

When you run a QuickBooks report, it'll automatically set to accrual. And yes, you're correct about that. However, QuickBooks always gives you the option to change the accounting method every time you open the report.

If you want, you can memorize the report to save what you have customized. Make sure to toggle the Accounting method to Cash if this what you need. To learn more about customizing reports in the program, check the link below:

I can see how setting up the Accounting method to your desired option helps you more. However, doing it in QuickBooks is unavailable. For now, you can read the latest news and updates in QuickBooks by following our blog.

Visit again if you have other questions. Stay safe and healthy.

Here is a link to the real solution:

If you are using sales tax centers, it will default on a accrual basis to pick up that liability. If you really don't have sales tax and things are ending up being tracked with zeros, you should be able to fix that and have all reports report out on a cash basis.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here