Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowYou can change your contractor or vendor to 1099-NEC when preparing their 1099, @gtalovic.

I’d be glad to guide you on how to achieve this in your QuickBooks Online (QBO) account. Here’s how:

For more details about this, you can check out this article for reference (read Step 3: Create your 1099s in QuickBooks Online section): Create and file 1099s using QuickBooks Online.

To learn more about the difference between 1099-MISC and 1099-NEC, you can refer to the links below that provide the complete details:

In case you made some errors or mistake in filing your Forms, you can utilize this resource that can guide you on how to handle the situation seamlessly: Correct errors on Forms 1099-MISC.

You’re always welcome to get back to me if you have other queries about preparing your 1099. I’d be more than happy to work with you again. Keep safe and take care.

I have the same question, but for QB Desktop!

I have the same question, but for QB Desktop!

I got you covered, suzymassel17.

To achieve this in QuickBooks Desktop, we need to adjust your Chart of Accounts. This is to ensure accounts are set up on each form. By adding a new account to your chart of accounts, we can track the payment separately. Here's how:

You can follow the same process for each new account to report on the 1099-NEC.

Then, we need to add a journal entry to move the amounts to the new account. For more details, you can check out Step 4: Move the payments to the new account outlined in this article: How to modify your chart of accounts for your 1099-MISC and 1099-NEC filing.

Lastly, I recommend visiting the links below to help you in preparing your company and tax forms for the upcoming 2020 tax season:

I'll be here if you have additional questions.

I am curious why I cannot just Edit my Account? Why do I have to make a new Account? My Account is for Independent Contractors. Why can't I just Edit that account?

How do I make sure the new Account will be reported on the 1099 NEC? Why can't I just Edit the Account I need to report on the 1099 NEC?

Thanks for getting back to us, suzymassel17.

The 1099 NEC and 1099 MISC should be mapped into separate accounts so they won't mix up in the tax forms. The IRS separates the non-employee compensation into a new form. We'll have to track the transactions separately by creating a new account.

I recommend following the steps outlined by my colleague to create a new 1099-NEC account, then move the payments to the account to ensure they'll be reported.

For more information about 1099 forms and how to file them, I suggest checking this article: What is a 1099 and do I Need to File One?.

Additionally,

I'm adding these articles for further details about the 1099-NEC FAQ and various updates in QBDT.

Let me know if you have other questions about 1099. I'm here to assist you.

What if we only send out 1099 NEC's? We don't need both misc and nec. Can't we just make a simple change for that? Instead of creating new accounts etc.?

Welcome to the Community, BethJep.

If you paid anyone $600 or more, you're required by U.S. tax law to file a 1099-MISC form. Payments found on these forms are geared towards vendors, attorneys, and other individuals who aren't proper contractors.

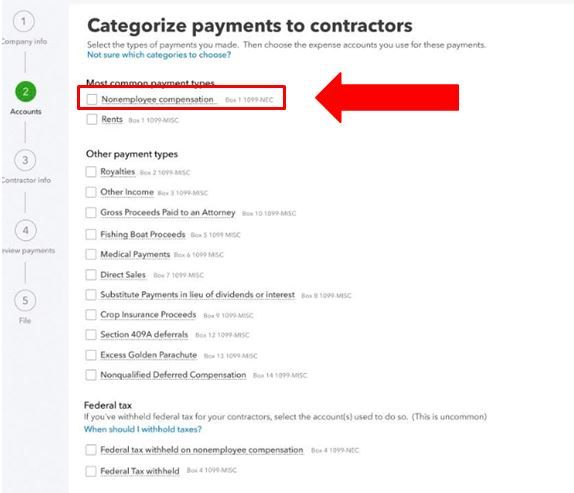

Since you only need to generate 1099-NEC forms, you'll want to access your Categorize payments to contractors screen and confirm all of the appropriate checkboxes are selected.

Here's how:

Once you're finished, you'll be able to find a few useful articles about creating/filing, understanding payment categories, and correcting errors on forms in JasroV's post. Our help article archives also have many extensive resources that may come in handy moving forward.

Please feel more than welcome in sending a reply if there's any additional questions. Have a wonderful day!

We don't use the Payroll option though. Is there another way?

Good morning, @BethJep.

Thanks for following up with us. I'm happy to lend a helping hand with filing your 1099s without a payroll service.

If you don’t have payroll, you can use the standalone 1099 e-file service to file the 1099-NEC with the IRS. You'll only need to ensure you've added your contractor and payment information to create and e-file 1099s. Then, once they're completed, you can email them or print and mail them. I've included the steps to do this below.

That's all there is to it! Check out Create and file 1099s using Intuit Online Payroll or no payroll for more details.

Please let me know if you have additional questions or concerns. I'll be here every step of the way. You can reach out to the Community or me at any time. Take care and have a great week!

I don't have those options in my QBO account. All my 1099s need to be NEC this year, and the e-file program is automatically putting them all in MISC without any input from me. How do I set up this expense type to be seen as reporting to NEC?

Allow me to provide the steps so you can file 1099-NEC forms, AngelaGoodner.

You need to modify the Chart of Accounts to ensure those contractors' payments are tracked correctly for the form to use. Let me guide you through the steps:

Step 1: Create a 1099 Transaction Detail Report to identify the amounts paid and to which accounts.

You can also use the 1099 Contractor Balance Detail or 1099 Contractor Balance Summary reports if either of them adds more information.

Step 2: Add a new account to track separate payments.

Once done, you can follow Step 3 and 4 through this article: How to modify your chart of accounts for your 1099-MISC and 1099-NEC filing. Then, choose QuickBooks Online for instructions and detailed steps.

Once these steps are completed, you are ready to begin filing your 1099-MISC and 1099-NEC forms.

If you're done mapping the accounts and 1099-NEC is still not generating, I recommend contacting our Live Support Team. They can verify the set up of your accounts and track payments correctly.

Stay in touch with me if there's anything else you need while preparing your 1099s. I'll be right here to help you if you need anything else concerning payroll.

For Step number 5 below, how can that be edited if you have already clicked Next? I chose the 1099 form for NEC and Rent, but forgot to also choose 1099 MISC and now need to add it.

THank you!

Great to have you joined this thread, @eemahaffey.

I'd be delighted to help you prepare and file your 1099s in QuickBooks Online (QBO).

You'll want to click the Back button to start from the beginning. This way, you'll be able to add your 1099-MISC and continue with the process. I've added a screenshot below for your visual reference.

If the option isn't visible on your end, I suggest logging out and logging back in to your account to refresh the system. Then, prepare your 1099s again.

Once done, you might want to check out this link that provides details on how to print your 1099: Print your 1099 forms.

I'll be around whenever you need help with your 1099s or with QuickBooks. Just add the details in your response and I'll get back to you as soon as possible. Keep safe!

Thank you very much for the quick response. Logging out and back in solved the problem for me. I reallly appreciate the suggestion!

Have a great day,

E

That's great to hear @eemahaffey.

Thank you for taking the time to circle back and let us know this worked for you.

Please don't hesitate to reach out if we can be of any help in the future. The Community is here for you any time.

Enjoy your day!

My QB is printing only two forms to a page and the only 1099-NEC forms I can find are three to a page. Is there a box I need to click. Last year they were all MISC vendors...

Thank you for posting here in the Community. I can provide steps about printing 1099s, @eehargis.

You'll have to run as the administrator in QuickBooks Desktop and update the file to the latest release. To confirm which release you have, press the F2 button when logged in to QuickBooks. This opens the Product Information screen. Look at the release version extension. It'll be the underscore and a number:

If your product release and version are lower than those listed, you’ll need to update your QuickBooks. Let me show you how:

You need to close and reopen your QuickBooks account when the update is finished. Once done, click Yes to install the updates, then restart your computer.

If you're using QuickBooks Online, you'll have to buy the pre-printed forms that are compatible with QuickBooks to avoid any error. From there, you can now print the 3-page form of 1099. You can get a compatible pre-printed kit from this link: https://www.intuitmarket.intuit.com/tax-forms/1099-forms.

Also, you can manually align the form and choose three (3) horizontal then zero (0) vertical to be able to print the form.

Here's a reference on how to print your 1099s and provide copies to your contractors: Print your 1099 forms.

You'll want to know how to access and print your other tax forms to save a copy for future use. Please refer to this article for the detailed steps: View and print payroll tax forms.

Click the Reply button anytime you have additional questions about the process or printing forms in QuickBooks. Have a great day ahead, @eehargis.

I understand the frustration and disappointments that you've been through, eehargis.

Allow me to help and provide one more step so you can print 3-part 1099s. You can run QuickBooks as an Administrator go to the 1099 Wizard and print Form 1099-NEC.

If you're still unable to do so, I recommend contacting our QuickBooks Desktop Live Team.

By doing so, they can check your company file and ensure you don't miss any of the updates for the print 3-part 1099s. They'll also do screen sharing with you and guide you through the process.

Please follow the steps I've outlined below.

You can also call them through this link: Contact Payroll Support. Then, proceed to QuickBooks Desktop Payroll for the phone number.

Please get back to me if for updates about your printing 1099 concerns. I'm always right here to guide you.

How do I get to the 1099 wizard? I am the only person using QB so I am the administrator.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here