Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI'm trying to enter a refund from a vendor, but QB help is worse than useless. I've tried following the directions, but directions indicate things that simply are not on the screen.

I'm trying to enter a refund from an insurance company that came to me before the period had expired, because I'd sold the rental property.

I can get through the deposit screen (why am I depositing something that hasn't been entered is beyond me).

I then go to Enter Bills and follow the directions, which are as clear as mud, and enter the refund account and amount.

I then am supposed to go to Pay Bills and check the entry that agrees with the refund, accept there is no entry at all. In addition to that, I can't track any entry from any of this. It's like I never entered anything as nothing seems to be recorded.

How do I record this refund? How do I get it to show up anyplace?

(Instead of being so obtuse, QB should simply let you enter an amount received and show which account it went to. It should also show up in the Undeposited Funds account so you can deposit the refund along with the rent receipts.)

Hello there, @neyerbj. Welcome to QuickBooks Community! I'd be delighted to assist you in entering a refund from a vendor in QuickBooks Desktop.

If a vendor sends you a refund check for a bill that is already paid, you can follow these steps below.

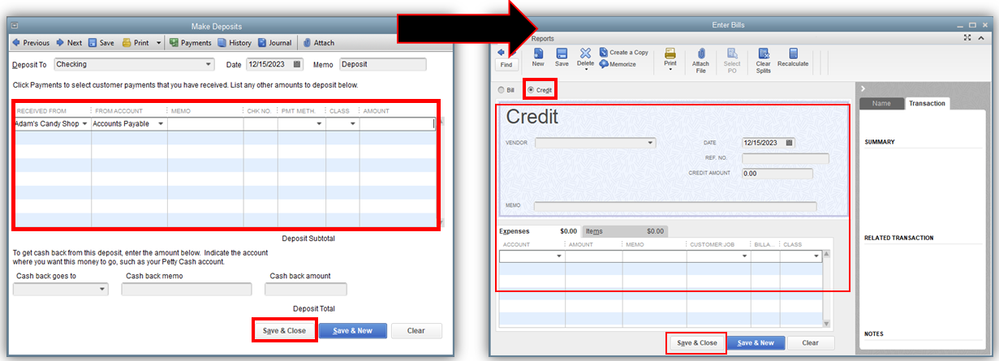

First, record a deposit from a vendor check. Here’s how:

From there, you can now record a Bill Credit for the refunded customer. Let me guide you on how:

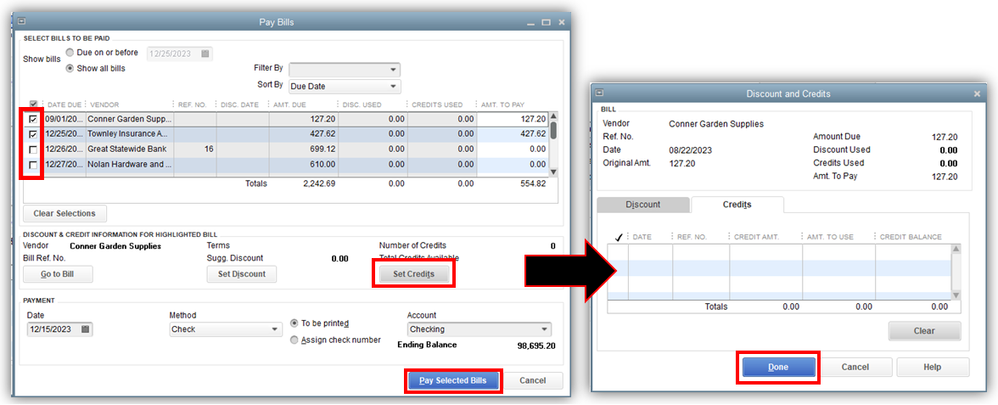

Lastly, link the deposit to the Bill Credit. Here’s how:

Here's an article you can refer to for more recommended steps in each scenarios when recording refunds you received from a vendor: Record a vendor refund in QuickBooks Desktop.

Keep me posted if you still have questions or concerns about managing vendors in QBDT. I'll be around for you. Have a great day!

So, you have a couple of options:

1) If you don't care that the refund is showing under the insurance co. in the Vendor Center, then just deposit the check and assign the insurance expense account(s) under "From Account". This will book the bank deposit and a corresponding reduction in the insurance expense account(s) that you assigned to the deposit. If you go this route, just know that the transaction will not show when running reports by vendor but your financial statements will be correct.

2) If you want the refund to show in the Vendor Center and show up in reports for the vendor, then you need to follow the directions from @Carneil_C . The directions are accurate. First, make a deposit and assign the deposit to accounts payable under "From Account". Then create a bill credit. Make sure you enter a bill credit and not a bill. When you enter the credit, this is where you are recording what account the refund is credited to. Assign the insurance expense account that the refund should be applied to. Then, go to Pay Bills. You will see the deposit in the Pay Bills screen, select it. Then you will see the bill credit down toward the bottom of the screen. The amounts should match if you entered the same amount for the deposit and the bill credit. Click "Set Credits". Select the credit in the Apply Credits pop-up. Select Done.

That's it.

No that isn't it. Following the directions, the final step is to select Bill to be Paid and then select the bill, which is supposed to be a refund, accept there is nothing there to select. There are no bills, as I haven't entered anything other than this refund and there is nothing else there to select.

There at least should be a deposit showing under my checking, there isn't. There should be credit showing under the insurance expense account, there isn't. There is nothing showing anyplace. Zip. Zero. Nothing.

Now I can scan back to see where I entered it under Bank Deposits. I can also scan back to see where I entered it under Enter Bills. In each case I've checked it multiple times to be sure I clicked every box, entered very account, and still nothing in showing up in the accounts that should get credits and debits.

GAWD, this would be so much easier if QB allowed you to just receive the money and maybe select refund. It would then show in the Bank Deposits with all the other receipts I've gotten.

Yep, neyerby is correct. There is absolutely nothing on the Pay Bills screen that relates in anyway to this vendor or the refund deposited. Such a stupid process that doesn't even work! Another Quickbooks failure...

Yep, neyerby is correct. There is absolutely nothing on the Pay Bills screen that relates in anyway to this vendor or the refund deposited. Such a stupid process that doesn't even work! Another Quickbooks failure...

When I enter the deposit and select the appropriate expense account it definitely increases my bank balance and decreases my expense. However at the end of the year when I'm cleaning up my undeposited funds account, these transactions appear. I never touched Undeposited funds so I'm confused.

Thanks for any help!

Thank you for joining the thread, @NHBookkeeping1.

It might be that there is a duplicate account on the transaction that you weren't able to notice. I'll be happy to help you how to check it.

Here's how:

Afterward, review the Undeposited Funds report and check for duplicates and transactions that weren't placed into the right accounts.

Once done, take note of those transactions and then remove those duplicates, keep in mind that removing these accounts will depend on the mode you use.

For transactions that weren't put into the right accounts, you can edit them and place them in the correct accounts.

If you want to know what it means if you see two undeposited funds accounts in QuickBooks Desktop. You can read through this article: Undeposited Funds appear in the QuickBooks Desktop Point of Sale chart of accounts.

For additional questions come back to us here. We'll be willing to attend to your queries. Take care and have a blissful week!

The reason for this is for the from account column, you are selecting an expense account such as "insurance expense", or etc. Please select Accounts Payable account and not an expense account. You should then see it.

Hello, this doesn't work. I overpaid a vendor by $80 and they sent back a check for the $80. I applied the payment check to 2 bills, in paying the 2 bills, it didn't put the overpayment anywhere except in the balance for the vendor in the vendor center. Then I created a credit, now there's a balance of -$160. I've gone through your steps and there's nothing listed in the 'Pay Bills' under the vendor so I can link the deposit or a bill or the credit. I created the credit memo but it doesn't show in the 'Set Credits' area or anywhere else. And, as I mentioned, it's doubled the credit to $160.

Please help!

Thank you in advance.

Hey there, @TrishFlaherty.

Thanks for getting back to this thread. Upon replicating the steps, the workaround shared above works on my end.

To help rectify the issue, can you share with me the complete details of the steps you've made when recording this transaction inside QuickBooks?

Any additional info would be much appreciated.

Please add your details to this thread and I'll get back to you. Have a good one.

Hello,

I am trying to do this on QB Desktop Mac 2020, and I can get as far as scenario 2 step 3c, but there's no "set credits" button.

Background: I made a purchase from a vendor by credit card, entered it with an associated customer and billable job, billed it, customer paid it, closed it. Since then, a pricing error was discovered, and the vendor needed to make the refund by check. I entered the check to be deposited (step 1). I created a bill credit, with the associated customer and billable job information (step 2). When I go in to pay bills from the vendor menu, I can select the credit, but that's when I hit a wall. How do I make this work on a Mac?

I can provide you with some clarification about the QuickBooks Desktop (QBDT) Mac process in recording refunds from a vendor, tom.

Yes, you're right. The Set credits button is unavailable in the QBDT Mac version, only in the QBDT Windows version. Sometimes, the process of recording transactions in QuickBooks Desktop Mac and QuickBooks Desktop Windows versions is a bit different.

On the other hand, the steps you've done are correct in recording vendor refunds. Also, you've already applied for the credit from the vendor when you select the Credit option in the Pay bills window.

You'll want to check out this guide for managing your QBDT Mac: QuickBooks Desktop Mac 2020 User's Guide.

Keep me posted if you need more help managing vendors and bills in QuickBooks. I'll be more than happy to assist you at any time. Stay safe!

The problem I have now is that the vendor is showing as having a credit on our account with them, when the check was received to pay it off. I would like to have that check recorded against the credit to zero out both sides. Since the set credits button isn't there, what's the process for doing it on the Mac version?

Thank you for keeping us updated, tom. I'm here to guide you through recording the check against the credit.

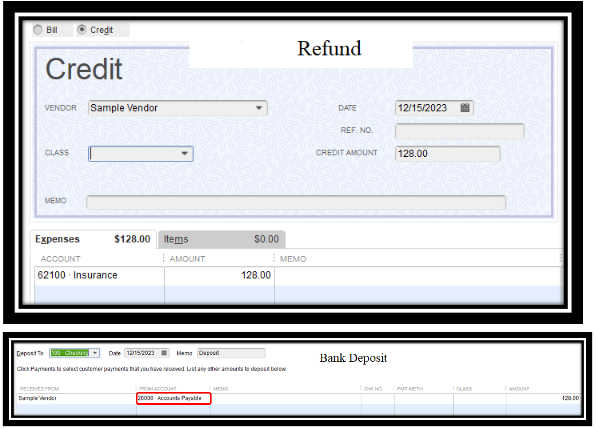

You'll need to first record the vendor check as a deposit and use the Accounts Payable account. Let me show you how:

Once done, you can link the deposit to the credit using the Pay Bills option.

See the image below for visual reference:

That should now zero out both the vendor balance or credit.

For future reference about QuickBooks Desktop Mac-related concerns, visit our Help page.

Feel free to post back in case you need extra assistance regarding vendor refunds or QuickBooks in general. We're here to back you up 24/7. Stay safe.

We already established in the previous response that the set credits option is not present in that location in QB for the Mac. I was asking for the workaround for the Mac version, what you described is apparently the Windows answer once again.

How do I link the deposit to the credit in QB for Mac 2020?

Thanks for coming back and clarifying things out, tom.

I've already updated my response above. Since the Set Credits option is available only on the Windows version, you can use the Pay bills and manually select the credit and deposit from the Pay bills screen. Kindly refer to the steps above to link the deposit to the credit.

Don't hesitate to reach us back so we can assist you further with vendor refunds, bills, or QuickBooks in particular. Stay safe always.

Thank you, that was the trick I needed to get it to work.

Thanks for following up with the Community, tom_strong.

I'm happy to hear Mich_S was able to help you with applying a credit to a vendor bill and linking your credit and deposit together.

You'll also be able to find many detailed resources about using QuickBooks in our help article archives.

Please feel welcome to post a reply here or create a new thread if there's ever any questions. Have an awesome day!

So after reading this entire thread I'm still stuck on Step 3 - and I am NOT using a Mac. I'm on the Desktop version on a PC. There is nothing in the "Set Credits" option because there are no bills to pay to the Vendor. So how the heck do I link the refund back to the deposit? And PLEASE do not tell me to select the deposit in the Pay Bills window -- because it is NOT there either... my window doesn't look a thing like the one you showed as an example.

For a little background... a paid a vendor. The same vendor has 4 companies and 4 separate bank accounts for essentially the same service. Turns out we were double billed by accident and we paid the second bill. They are honest and notified us and returned the funds. I did Step 1 and Step 2 - no problem . But I can't get the deposit applied to the credit -- how do I make that happen?

Thanks for joining the Community space, @HCValerie. I appreciate you for reading the thread and following the steps to record the transactions that are double billed.

You'll want to make sure that you choose Accounts Payable when recording the Bank Deposit. This way, you have the option to see the Set Credit option when recording the bill.

Here's how:

Once done, follow the second and third steps in Scenario 1 to see the set credits option and link the deposit to the bill credit. For complete steps, open this article: Record a vendor refund in QuickBooks Desktop.

I also encourage checking this article to help with outstanding bills for you and track the money you owe your vendors: Accounts Payable workflows in QuickBooks Desktop. To help you manage vendor transactions, you can run reports on QuickBooks Desktop.

Please let me know how the steps go, I want to make sure that you can apply the deposit to the credit. If you have any other questions about QuickBooks, please let me know. I'm always here to help. Stay safe.

Doesn't work -- Accounts Payable doesn't show up in "From Account" list.

And my screen in the QB Desktop version looks nothing like your example above...

Thanks for the reply - but it doesn't work. There is no "accounts payable" option in the "from account" list.

And my screen in QB Desktop for the PC looks nothing like your example above.

Hi HCValerie,

Thank you for following up on your concern about your vendor's refund and for trying the steps shared by my colleague. I will continue to help you.

You said you're done with Step 1 and 2 (in Scenario 1 in the article). Therefore, we can disregard my colleague's instruction about finding the deposit in your bank register and changing its account/category to A/P. That's already done in Step 1.

Here's how the transactions work: The deposit in Step 1 will become a credit and the vendor credit transaction in Step 2 will become its partner entry on the Pay Bills screen. Therefore, in Step 3, both will appear and can be linked on the said screen.

That's basically how to link the credit to the deposit.

Let me know if you're able to follow. If not, please add screenshots, so we can better determine the missing part. We're dedicated to help you on this. It's a vendor refund, which is usual transaction in a business and should be easy to enter in QuickBooks.

I figured it out -- no thanks to any of your explanations which were not at all helpful.

It seems that by default the "accounts payable" account is not active in the "Make Deposits" screen in the current version of QB Desktop. So the super secret fix is to manually type in "accounts payable" in the account field. A magic pop up will then appear asking you if you would like to make the "account payable" field active -- of course the answer is "yes"! Then bing-bang-boom -- all problems are solved and everything magically balances. You can now proceed to Step 3 of the instructions given at the top of this page and they will actually work!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here