Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Let's see if I can explain this right. Charged "Bob" $1165.94 for his monthly invoice through our credit card processor. The same day I refunded "Sally" $2088.07 back to her credit card for another invoice that was not supposed to be auto charged that month. This created a withdrawal from our bank account of $922.13. I have created the credit memo and refund check for Sally and that shows in my bank ledger, so her account balance is right, but I can't record the deposit from Bob because there is no actual deposit for the day since we refunded more than we charged.

I have spent days reading through threads but I just can't find the answer to this particular question.

Solved! Go to Solution.

Good morning, @MacH.

I'm here to help you get this issue resolved.

You'll need to delete the unmatched transaction and manually recreate the bank deposit.

Here's how:

Delete unmatched transactions in Express mode

Delete unmatched transactions in Classic (Register) mode

There's no option to delete a single unmatched transaction if you're in the Classic Mode.

To remove multiple transactions from a statement:

Record deposit

1. On the Homepage, select Record Deposits / Make Deposits.

2. In the Payments to Deposit window, select the payments you want to combine. Then select OK.

3. In the Make Deposits window, from the Deposit to drop-down menu, select the account you want to put the money into.

4. Make sure the deposit total and selected payments match your deposit slip. Use your deposit slip as a reference.

5. Enter the date for the deposit.

6. Add a memo as needed.

7. When you're ready, select Save & Close.

Each bank deposit creates a separate record. Make deposits one at a time for each of your deposit slips.

Important: All transactions currently in your Undeposited Funds account appear in the Bank Deposit window. If you don’t see one you need to add, put it in the Undeposited Funds account.

That's all there is to it!

If you have any other questions, please feel free to reach out.

Good morning, @MacH.

I'm here to help you get this issue resolved.

You'll need to delete the unmatched transaction and manually recreate the bank deposit.

Here's how:

Delete unmatched transactions in Express mode

Delete unmatched transactions in Classic (Register) mode

There's no option to delete a single unmatched transaction if you're in the Classic Mode.

To remove multiple transactions from a statement:

Record deposit

1. On the Homepage, select Record Deposits / Make Deposits.

2. In the Payments to Deposit window, select the payments you want to combine. Then select OK.

3. In the Make Deposits window, from the Deposit to drop-down menu, select the account you want to put the money into.

4. Make sure the deposit total and selected payments match your deposit slip. Use your deposit slip as a reference.

5. Enter the date for the deposit.

6. Add a memo as needed.

7. When you're ready, select Save & Close.

Each bank deposit creates a separate record. Make deposits one at a time for each of your deposit slips.

Important: All transactions currently in your Undeposited Funds account appear in the Bank Deposit window. If you don’t see one you need to add, put it in the Undeposited Funds account.

That's all there is to it!

If you have any other questions, please feel free to reach out.

Well that was definitely easier than I was making it out to be. Thank you so much for your help!

Thanks for taking the time to post an update, @MacH.

It's great to know that you found the solution helpful and were able to record the deposits!

The Community is always here should you need help in the future. Cheering you a great rest of the week.

I have the same issue but through QBO. I have a refund for 5000 and two deposits for 260 and 225. Same batch - 3 different customers. I refunded the customer through merchentcenter.ituit. I can't seem to match all three transactions. Im not sure what to do as I did try creating a refund receipt for the 5000. When I do go to the bank deposit screen and select those three transactions, I am getting and error message "You must specify a transaction amount that is 0 or greater."

I'm not sure how to match this and close out these transactions. I have been trying to figure out since Auguest and had called QBO and its still not resolved. HELP!

Thanks for reaching out to us, prestigeairhc.

We're unable to create a bank deposit in QuickBooks Online if the amount is less than zero. That's why you received an error message.

You can record the refund using a refund receipt since you processed it through the Merchant account. Then, you can manually deposit the $260 and $225. Once done, you can clear these transactions in your register and exclude the downloaded transaction instead of matching them.

Please check these links for the detailed steps in recording refund and deposit in QuickBooks Online:

Here's how to exclude:

These are the steps to manually clear the transactions you created:

In addition, it's best to process the refund in QuickBooks Online moving forward if your QuickBooks Payments account is linked. That way, it'll be recorded automatically so that your accounting stays accurate. Here's the link if you have more questions about processing payments: QuickBooks Payments FAQ.

Leave a comment again if you need anything else. Take care!

I am wondering if my situation would be similar to these. We are a non-profit. We receive donations through a 3rd party site. They automatically deposit the donations to our bank account. Most days the deposits include several different people. We have to post each amount to each donor. When the deposits have made it to the bank account I usually go in and create a sales receipt for each donation made and then do a deposit which matches the deposit the 3rd party made and our bank account.

The issue I now have is that the ACH from one of our donors bounced back. I had already entered a sales receipt for their donation because the 3rd party had already sent the payment. Now, a few days later, they took it back. The problem is another donation was attached to it. Let me explain this a little easier:

Donor #1 made a donation in the amount of $150 on 4/25 - 3rd party sent it to our bank account and I recorded it in QBO

On 4/27, Donor #2 made a $25 donation. The same day Donor #1's donation bounced back. The 3rd company then charged us (as opposed to a deposit) $125.

I need to show the deposit for Donor #2 plus the charge for Donor #1 so that I can match the $125 bank charge.

I have the steps you need, @kimmy-lifechoice.

You only have to record the bank fee since your check was processed.

Here's how:

1. Go to the +New icon.

2. Under Vendor, select Expense.

3. Click the Payee drop-down arrow:

• Select the vendor if the bank charged it to them.

• Click the bank if they charged it to your account.

4. From the Payment account drop-down, choose the account you use to pay expenses.

5. To distinguish it from other expenses, enter “NSF fee” in the Ref no. field.

6. Under the Category column, select Bank Charges.

7. Enter the amount you were charged for.

8. Hit Save.

Once done, unlink another donation from ACH that was bounced.

Additionally, I'm attaching a great resource that you may find helpful in the future: Handle a rejected or failed bank transfer payment.

Reach out to me if there's anything else I can help you with. I'll always be here to assist you. I look forward to hearing about your success.

This is not through the bank, it is through the 3rd party processor. I mean technically it is through the bank via the processor but it is not a "NSF fee", they are taking the entire $150 back minus the $25 donation that was processed at the same time.

I have to have a record of the donor who paid $25 but have to give the $150 back. I could easily do separate transactions but they would not match in QBO nor the bank reconciliation at the end of the month.

I appreciate your prompt reply and for sharing some clarifications, Kimmy.

Allow me to chime in and provide additional information on how to record the bounce back.

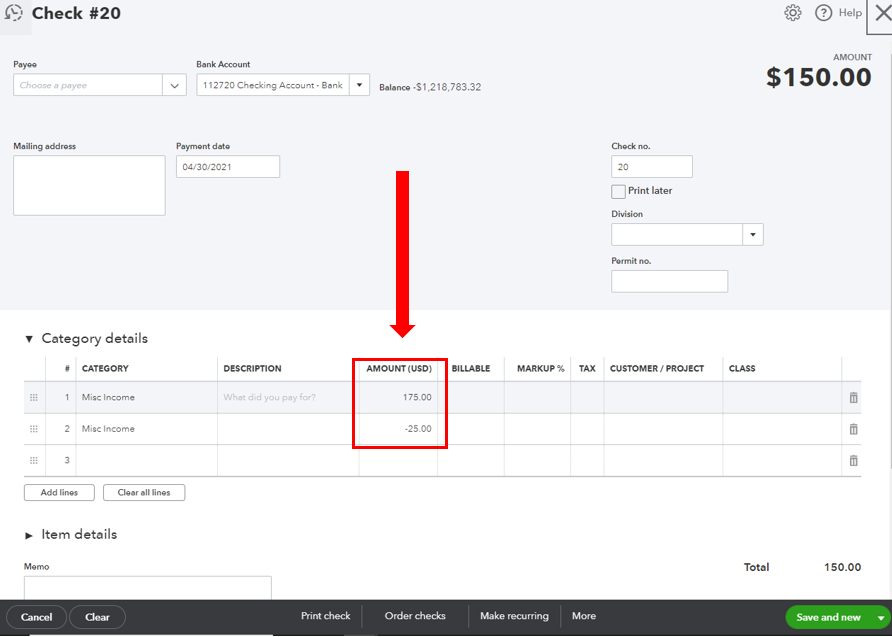

You can create a check amounting to $175 and enter a negative line item of -$25. This way, it'll only show that only the amount of $150 is taken back. Let me show you how in your QuickBooks Online (QBO) account.

You can also see this link for more details: Create and record checks in QuickBooks Online.

I also recommend working with your accountant for guidance in recording this. This way, we can ensure your account is well accounted for. If you don't have one, you can visit our ProAdvisor page and look for one from there.

Once you're all set, you might want to utilize this link for guidance: Reconcile an account in QuickBooks Online. This provides step by steps guidelines in matching your accounts.

Let me know in your reply if you have any other concerns or questions reconciling your accounts. I'm always around to back you up. Keep safe!

I was so hopeful with this and wish I could say that this worked but it did not.

I was not able to use the "check" option because I am not printing a check, it was an electronic charge. I tried using Expenditures, though it looked like it would work, it did not post to the donor accounts and we need them to because we are a non-profit.

I appreciate your prompt reply, as well as sharing an update on your situation.

Looking back on the thread, there isn't a need to match your downloaded bank feeds to your manually recorded transaction in QuickBooks Online (QBO). When it's time for you to reconcile the account in question, as long as the transactions were recorded to the correct account, the balance will agree to your actual bank balance. With that said, you can proceed and record separate transactions for the charge, as well as the donation.

As for those downloaded bank feeds that you no longer need to match, you can exclude them instead.

Follow these steps:

Open this article for additional details about this process: Exclude a bank transaction you downloaded into QuickBooks Online.

Please know that I always have your back here in the Community. Feel free to post a reply if you have other questions about recording deposits in QBO, and I'll get back to you.

I actually did something similar. I issued a refund receipt using payment type "Electronic" which I thought would bypass the need to print a check but it still wants me to print it. How can I clear that out?

Nevermind. I had used the wrong account that the refund would come out of and even though I changed it QBO did not change it. I deleted it and re-entered it and it worked.

So my work around was to issue a refund to the donor via "Electronic" payment method - which posted to his Donor account and deducted his donation out of our checking. I then entered the other donation in as a deposit and will follow your instructions for excluding the matches.

Thank you so much to everyone for commenting and helping me work through this!

Kim

I am super frustrated!! I was able to issue a refund receipt last month using "Electronic" as payment type and it did not make me print a check. Now when I have done the exact same thing this month, it comes up as "Print check" and a check is sitting in the "Print check" area.

We do not use Quickbooks to process payments, we use an outside company. If a donor sends in money, we are notified and we issue a Sales Receipt and then deposit. If the donor bounces an ACH through this outside company, we are then charged back for it. I then issue a "Refund Receipt" to show it was taken back but QBO keeps wanted me to "print a check"! I have tried creating the refund receipt using all kinds of payment methods and it does the same thing. I have created a dozen refund receipts and had to delete them.

I do not understand why it worked before and won't work now.

I've attached a picture of what I am seeing on the donor page and then how the refund looks - as you can see "Electronic" was selected and nothing about printing a check is on the refund receipt but then when you look at the donor list it says "print check".

You'll be provided the option to print a refund receipt as a check each time you create this transaction in QuickBooks Online (QBO), @kimmy-lifechoice.

If you don't want to record the refund receipt as a check, you'll need to ensure that the Check no. field is blank, and the Print later box is clear.

See the screenshot below for reference:

After you record this type of refund receipt, you'll get this:

You can also check out this article: Record a customer refund in QuickBooks Online. It lists different ways you can record refunds in QBO, depending on the situation.

Tag me in the comments below if you have other questions about refund receipts. I'll be sure to get back to you.

Fantastic! Thank you!!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here