Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowA transaction was deleted after it was reconciled. It SHOULD be deleted but now I can't reconcile without clearing it somehow. How do I do this?

Solved! Go to Solution.

I was able to speak with a QBO agent. After 1.5 hrs, the problem wasn't fixed but she was able to guide me thru an acceptable work-around by adding a new Balance Equity entry for the next month to be reconciled.

Hi there, @Kathy GreenBudBooks.

Thanks for dropping by here in the Community. I can help you correct the bank reconciliation in QuickBooks.

Once you delete a reconciled transaction, it will affect the specific period and the opening balance. If your accountant have access to your company file, I recommend you request to undo the reconciliation.

The ability to perform the process is only available in QuickBooks Online Accountant (QBOA) version.

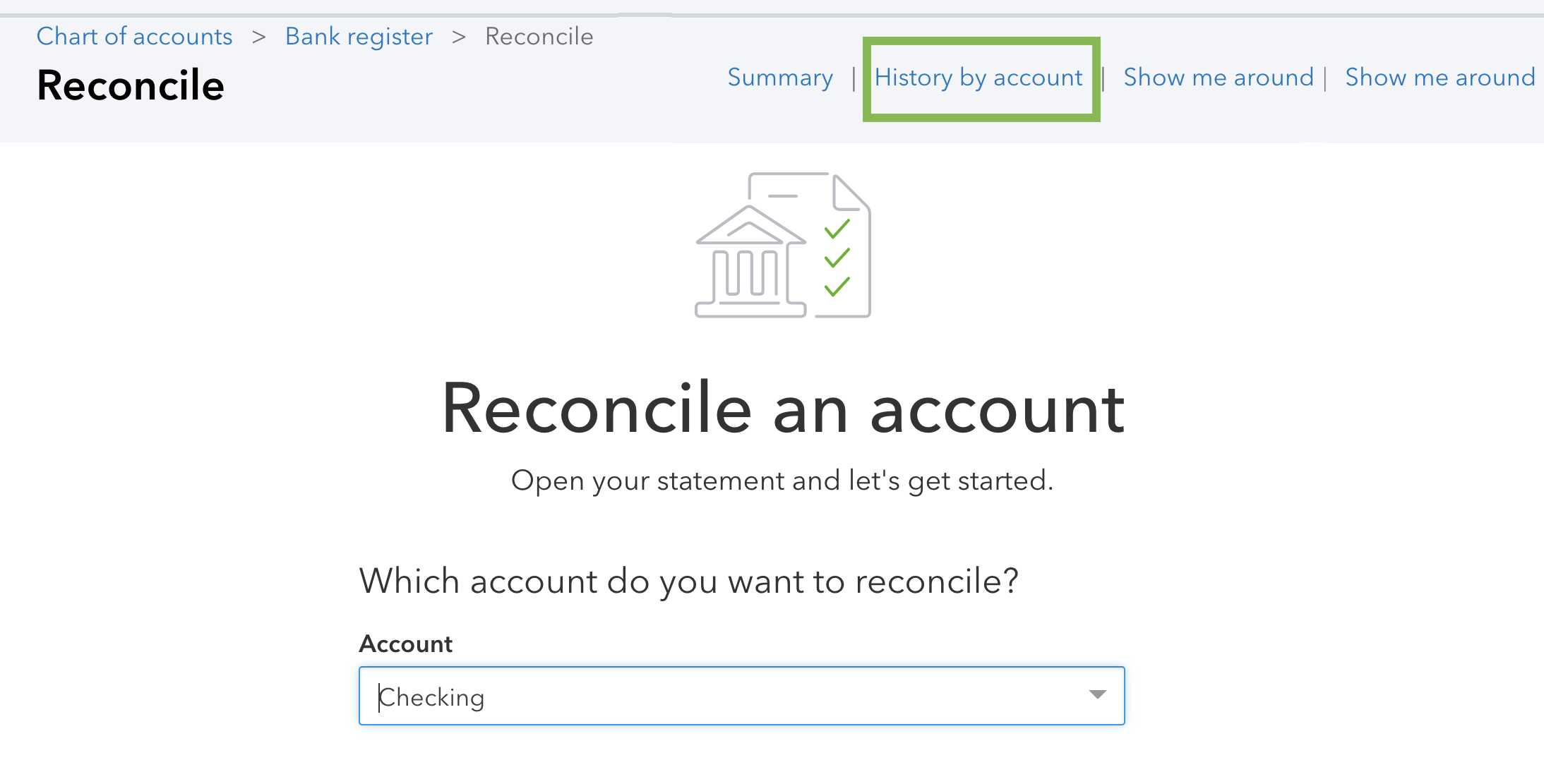

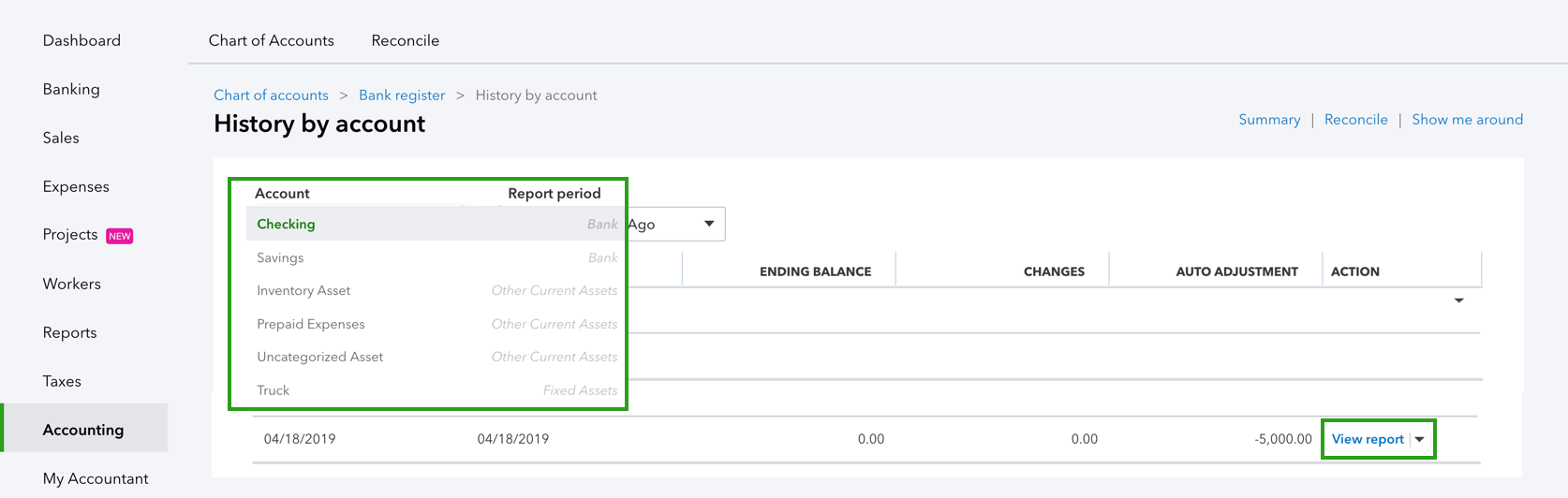

Here's how:

If you don't have an accountant, you may need to unreconcile transactions individually. Please follow these steps:

Additionally, I recommend visiting the following article to resolve problems with reconciling accounts: Fix issues when you're reconciling accounts in QuickBooks Online.

Please let me know if you need anything else. The Community and I will be here to help you.

Hello and thank you for your response. Unfortunately, I'm still stuck.

When I tried following the steps you outlined for QBOA, after going from History by Account and then to View Report, I can't find the Action column and am unable to complete steps 7 and 8 below.

When I try doing it manually, the transactions (which show on the History by Account/View Report) do NOT show in the registry because they've been deleted.

These transactions were intentionally deleted after reconciling and should stay deleted. Where do I go from here. There are several of these in each of the 2 bank accounts.

Allow me to share additional info about reconciliation, Kathy GreenBudBooks.

When reconciling, even small changes can unbalance your accounts. To correct your reconciliation, we'll have unreconcile the transactions and start over from the beginning. I recommend reaching out to your accountant to undo the entire reconciliation. Doing so can help QuickBooks detect that the deleted transaction is already excluded in the data.

You can use the reconciliation report to serve as a guide to see all the transactions that need to be unreconciled.

Here's how to run the report:

If you'd like to unreconcile the transactions manually, you may follow the steps shared by my colleague.

Once done unreconciling, let's reconcile the transactions again. Here's how:

For more details about the process, you can check out our reconcile guide.

Additionally, I've included our Year-end guide and checklist. This helps you complete the important task to maintain accurate data of your books.

You can count on us if you have other questions in reconciling your accounts in QuickBooks. We'd be glad to assist you.

Thank you for your response. I'd like to un-reconcile everything and start over. We don't have an accountant working with us, except in March/April for year end taxes. There are 2 bank accounts. Each has over 1,000 entries. How do I un-reconcile everything myself?

Hi Kathy!

I'd like to jump in and shed light on the process.

I've read your original post, and I thought we're only talking about one transaction. However, you have several, and the number of transactions you have per bank register is quite a lot.

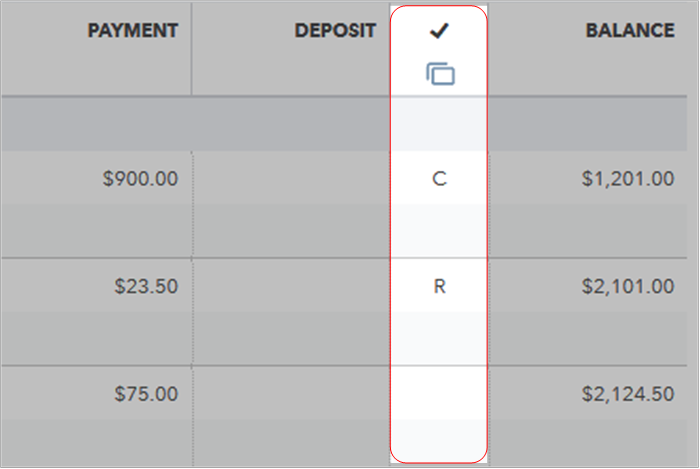

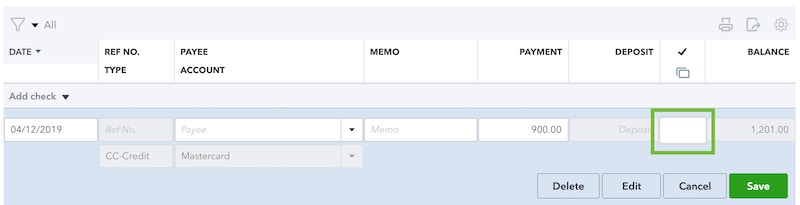

If you'd like to do this on your own, you can remove the R (Reconciled) mark in each transaction to redo your reconciliation. This means you'll open the register, click each transaction, click the R mark until it turns into C (Cleared) or blank, and then save the changes.

In case you change your mind and want to have an accountant do this instead, you can find one near you.

If you'll have questions as you unreconcile your transactions, please don't hesitate to go back to this thread.

Thank you for your response... albeit disappointing. Can I unlink and delete the entire account? It may be easier to re-link and start over.

If the check was reconciled, then it is a valid transaction and should not be deleted, it did clear the bank.

Please explain the issue

Hi Rustler,

The business owner reconciled the transactions for each bank account, but didn't realize that 1 bank account was a sub-account at her bank. Transactions were entered twice in QBO when both the parent and sub-account were linked to QBO. Both sets of transactions were reconciled in QBO based on the separate QBO accounts for the parent and the sub-account. I went in and deleted everything from the sub-account and then made the sub-account inactive. But, to reconcile the parent account in QBO, the Reconciliation Discrepancy Report gives me a list of 5 transactions that were deleted after reconciling that I now need to handle. When I click on "View" from the Reconciliation Discrepancy Report for the individual transactions, I get a blank screen. The previous answers in this post didn't help me get rid of these.

Thanks for getting back to us, @Kathy GreenBudBooks.

I have some information to share about the reconciliation discrepancy report. This report will display cleared transactions that were changed or deleted since you last reconciled. Clicking on "View" will route you to the audit history page that contains details of the changes. Here's how it looks like.

In your case, you can leave the transactions in the report or ask your accountant to undo and reconcile that period again.. Just make sure your opening balance matches with your bank statement. Here's a link that'll guide you through the process: Learn the reconcile workflow in QuickBooks.

If you need help with fixing issues when reconciling, click this link. It has step-by-step instructions to help you finish your reconciliation.

Let me know if you if you still have questions or concerns. I'll be here for you. Take care and stay safe.

Hello SheillaGrace and thank you for your response.

As I mentioned previously, when I click on "View" from the Reconciliation Discrepancy Report, it takes me to a blank screen....similar to the blank space in your answer when you said, "Here's How It Looks". Without that transaction audit connection, I don't know the date of the transaction at issue since there are several with the same amount.

Also mentioned previously, the business owner only uses an accountant in March/April for year-end taxes.

Hi Kathy GreenBudBooks.

Thanks for dropping by the QuickBooks Community. If the steps provided by my colleagues haven't help. I would definitely recommend reaching out to support, they will be able to dive into your personal account with you in a 1-on-1 setting to diagnose what's going on.

To reach them, you can follow these steps:

If there's anything else I can help with, feel free to post here anytime. Thank you and have a nice afternoon.

I was able to speak with a QBO agent. After 1.5 hrs, the problem wasn't fixed but she was able to guide me thru an acceptable work-around by adding a new Balance Equity entry for the next month to be reconciled.

I am unable to "view" the discrepancy report. I am currently using qb premier plus edition 2022. Where can I go in to click the "view" button.

What if our company doesn't have and "accountant" user but have "admin" that can make changes

Seems like we have limited to view to fix the discrepancy bank reconciliation.

Let me help you run the discrepancy report in QuickBooks Desktop, mary_c.

This report can be found in the Reconciliation Discrepancy option under Banking. This shows any transactions that were changed since your last reconciliation and they're sorted by statement dates. Let me show you how:

To reconcile the discrepancy report, follow the steps below:

On the other hand, you'll have to inform the QuickBooks Admin to grant access to reconcile accounts. Just follow the steps and details in this article: QuickBooks Desktop Users and Restrictions. To fix when your accounts in QuickBooks Desktop don't match your bank statements at the end of reconciliation, check out this article: Fix issues when you're reconciling in QuickBooks Desktop.

Also, if in case you need information from your past reconciliation to review or fix a current reconciliation, just pull up a reconciliation report. For the detailed steps, please see this article: Get reports for previous reconciliations in QuickBooks Desktop.

Feel free to post here in the Community if you have any concerns about reconciling your accounts in QuickBooks. I want to make sure you're taken care of, and I'm here to help you anytime. Take care always.

You guys just automatically think that everyone that uses quickbooks has multiple users and has an accountant on staff that we can call to fix our problems. I have had quickbooks for years and never had a problem when it was the desktop version. However, the online version messes up reconciled accounts and all of the suggestions from quickbooks don't work or show useless information. I am the sole user and I have a accountant login which enables me to undo past reconciliations. That worked great on the desktop version but not on the online version. At this point, I would just love to add some money in the accounts and in the memo feild say "Whoops, somewhere I screwed up and have to fix this boo boo!

You guys remind me of Microsoft's wifi error messages that just say "Consult your system or Network administrator" which for 99 percent of laptop users is the very person that is having the problem.

I expect no answer that I have not seen a gazillion times !!! &%$#@*&%

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here