Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

SALE EXTENDED 70% OFF QuickBooks for 3 months* Ends 12/8

Buy nowI just started using QB and have not signed up for Online Banking until I become more familiar with the product. I need to know how I can enter credit card interest charges so I can reconcile my credit card.

Solved! Go to Solution.

Enter credit card charges, assign your expense account. Or use the service charge field when you reconcile the account.

Enter credit card charges, assign your expense account. Or use the service charge field when you reconcile the account.

Where is the service charge field? The only fields I have are Beginning Balance, Ending Balance and Ending Date.

*Edit: Sorry, my question is about QBO. I just saw this was desktop.

That's not a problem, @jesserain.

I can help you locate the service charge field when reconciling in QuickBooks Online (QBO).

When you reconcile an account in QBO, you can locate the service charge field at the bottom of the Reconciliation Window.

Here's how:

1. Click the Gear icon at the top, then pick Reconcile under Tools column.

2. On the Reconcile an account window, you'll see the Service Charge field under Enter the service charge or interest earned, if necessary.

You may also refer to the sample screenshot below.

That's it! I hope that this response finds you with a smile. Please don't hesitate to post again or leave a comment below if you have any follow-up questions. I'm always here to help. Have a great rest of the day.

Hi @FritzF, I was wondering if you could help me. I have QBO and I don't seem to have the same type of window that you have when reconciling my credit card account (your picture below).

Below is what my window looks like when I hit "reconcile." How do I get to your type of reconciliation window?

Hello there, Rai1.

For accounts connected to online banking, the Service Charge, Interest Earned, and Finance Charge (credit cards) fields do not appear. This is because these entries are downloaded automatically from your bank.

If the account that you're reconciling is connected to your bank, then proceed with reconciling it.

Please let me know if you have more questions.

"continue reconciling" doesnt help with the interest charge. my reconciliation will be off. how do we add interest when theres not fields to enter it? we cant enter it as an expense as it doesnt show on hte line items

Glad to have you back, @Troni!

You can post your interest charge to your interest expense account. Let me help you enter it to your QuickBooks Online.

First, you can enter it as an Expense transaction but not under the Item details. Instead, you'll post it to your Interest Expense account.

Let me show you how:

Once completed, you can continue reconciling your account. In addition, I've included a screenshot below for your visual reference.

Feel free to hit the Reply button below if you have any other questions about interest charges. I'll be happy to help you further.

jonpril_L,

Hello,

I was just reading about entering interest and credit card finance charges and your response prompted a question for me.

I have just set up 2 loan liability accounts and made sub accounts for the interest underneath them... as other liability and loan payables.

Should I be recording these to an Expense loan interest account under the PARENT Interest Paid account that came with the templated COA instead of sub accounts under loan payable/liabilities area?

Or do I just leave as is for the recording of the 'debt' there and then create the Interest Paid sub account for each loan under Expenses?

Sorry, very new to accounting and QBO.

Thanks so much!

Thank you for joining the thread, @Anonymous.

I'd be glad to help share ways so you'll be able to record your transactions correctly.

If you're paying the interest on time, you can just create an expense transaction using the Interest Expense account. However, if you're paying it on a later time, you can create a journal entry debiting your Interest Expense and crediting your Interest Payable. Once you'll be paying the interest, you can create an expense transaction using the Interest Liability account. You can also make the Interest Payable Liability as a sub-account of the loan account if the interest is being incurred by the loaned money.

On the other hand, I'd also recommend consulting with your professional accountant for the accuracy of your accounts.

Please keep me posted if you have any other QuickBooks or entering interest and credit card charges questions by adding a comment below. I'll be always here to help you!

Thank you very much!

I have a follow-up question. My credit card and checking account for my small business are linked to QB through QBO. And, yet, my finance and late fees from an old statement do not seem to have downloaded into the register for my credit card. As a result, I cannot reconcile my credit card account from that month. However, because my accounts are already linked, I do not get an option to add in fees or finance charges when reconciling. In this case, how should I handle the fee and finance charges?

It's good to hear from you, jlbrooksconsulti.

To record the fees and finance charges, you can create a Bank Deposit. You'll use an Income account if you don't have an invoice involved. However, if you have an invoice, use the Accounts Receivable. Enter the full amount and the customer's name. Add another line item for the small fees and use an Expense Account, then enter the amount as negative.

See the steps below for your reference:

You can learn more in the following article below: Deposit payments into the Undeposited Funds account in QuickBooks Desktop.

If you have any QuickBooks questions besides this topic, please feel free to let me know by adding a new comment below. I'll be right here to help at any time. Have a wonderful day!

Hi. I was having the same problem as you. It is true that it is necessary to add an expense. But the person who explained forgot to mention that even if the expense is created successfully, you should adjust the date of the expense to be between the period you are trying to reconcile. It is very possible that you are trying to reconcile a period on your credit card that is earlier than today. So when you add the expense it will automatically take today's date and the quick book will not include it in the reconciliation because that charge for financial interest did not occur within the statement period. It did, in fact. You just added it with the wrong date.

Thank you

Hello -

I have this window on several credit cards - but on one card when I reconcile, it never comes up?

Hi, there @jpb2525.

Those accounts that have a "Register" are the only accounts that you can reconcile. You can check the category associated with your account by following these steps:

For your future help, I'd also provide an article that helps you reconcile your account in QuickBooks Desktop.

Fill me in if you need more help by leaving a comment below. I'll be around in the Community to help. Take care and have a great day!

It's now June 2020. I can't reconcile because my interest charge is not included in my back statement in QBO. How do I add the interest charge to reconcile.

A previous response stated that we have to create an expense and call it Interest and Fees. Is it necessary that we have to go through all of that when all credit cards have interest fees?

I am still unclear on how to reconcile interest fees on my credit card.

Please advise.

Hi there, @lionc.

If you accrue interest on your credit card account, you must record it in your QuickBooks file to keep your records accurate. These types of expenses go into an Interest expense account. This account is helpful to let you know the interest expenses you are paying on your accounts from month to month.

Most standard Chart of Accounts in QuickBooks already include an interest expense account. Let me show you how:

That's it. Once completed, you can continue reconciling your account.

Please let us know if you have other questions. We'll be around to help. Have a great day!

Hi Sophia,

I do have the same problem with interest charge from my bank credit card. I use QB Online. The charge information only appears on the summary of account activity on the credit card statement, that is adding on the new balance but do not appear as a transaction. So, my reconciliation has a final difference. What do I do? Thank you

Hello! I have QuickBooks for Mac, desktop version. How do I record a payment toward a credit card purchase and interest?

Thanks for joining us here today, @Kelly_F.

I'll share the steps on how to record a credit card purchase and interest in QBDT for Mac. Let's go to your banking page to see it.

To enter a credit card charge:

To record the interest or finance charge:

You can refer to this article for details. The same steps apply to QBDT for Mac: Set up, use, and pay credit card accounts.

If you need help with other tasks in QBDT for Mac, feel free to browse this link to go to our general topics with articles.

Keep me posted if you still have questions or concerns with credit card account. I'll be around for you. Take care and have a good one.

Hi! When I'm reconciling a credit card account and there are a couple of Late Fee Reversals & an Interest Charge Reversal. I tried doing a negative expense and that wouldn't let me, then I tried a negative bill,still no luck. Also tried a negative journal entry and a negative interest charge (because the interest charged for that month was less than the refunded amount) and nothing is working! Anyway you can talk me through this?

Thanks for joining the thread, Kayla.

The steps shared by my colleague will let you record the fees in QuickBooks for reconciliation. If you need further assitance with the scenario you're getting, please get in touch with our Support Team. To get a representative, follow the steps below:

Refer to this article to learn more about our contact options and support availability: Contact QuickBooks Desktop support

Post here again if you need further clarification about the process. I'll be right here to help you with your data or any other QuickBooks related tasks. Have a nice day!

The latest version of Quickbooks Onine, this option is not available. How do you add the interest of an account in the current Quickbooks Online version?

Thank you for joining in on the thread, Kara Finance!

Yes, you're right. There's a slight change in the Reconcile screen because it doesn't have fields for bank charges and interest earned anymore. However, you can enter them as additional transactions within the register before reconciling. The effect is just the same as entering them on the Reconcile screen. Let me walk you through the steps.

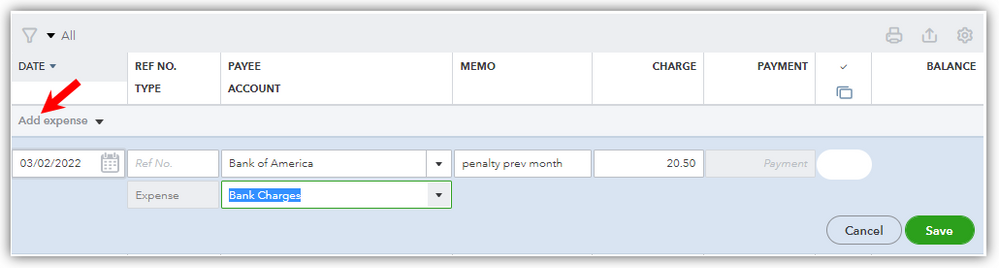

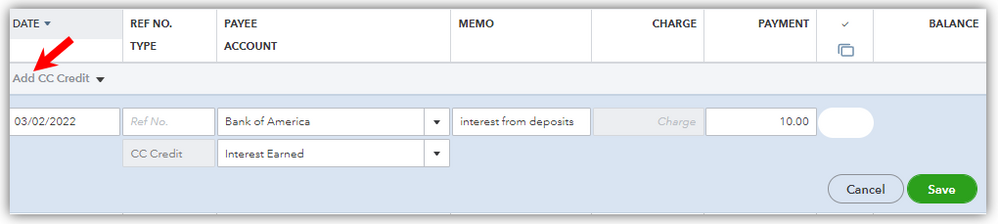

Add charges or penalties

Add interests earned

Now that you know how to enter your bank charges and interests, you can be sure to have a balanced reconciliation.

Let me know if you have any other concerns about reconciling your account. I'll be around to continue helping you. Have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here