Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowJournal Entry net=0

Debit old loan

Credit new loan

Unless cash is involved, then you can use either "check" if you had to add money or "deposit" if you received extra. In both of those transaction types you can directly enter the old and new loan accounts in and out

If i have an existing line of credit for $50,000 and I am getting a new line of credit for $75,000, how would i enter the new loan so it would pay off the one loan but leave the available monies in the new line?

I am curious as well. When we received a new loan, the amount financed paid off the old loan that the lending company sent on our behalf. I can not seem to figure out how to apply it to the old loan while keeping a balance on the new loan.

I'd like to know this myself as I am in the same situation.

Hello, Cindy G.

Thanks for utilizing the Community. I'll be glad to sort this out for you.

You'll have the option to create a Journal Entry(JE) to keep the new loan balance. I'll show you how.

1. Click + New icon.

2. Select Journal entry.

3. On the first line, choose the liability account you created from the Account drop-down. Enter the loan amount in the Credit column.

4. On the second line, select your bank account from the Account drop-down. Enter the same loan amount in the Debit column.

5. Click Save and close.

Here's how to create a check to pay the old loan balance:

1. Click + New.

2. Select Check.

3. On the first line, choose the liability account for the loan from the Category drop-down. Then enter the payment amount.

4. Hit Save and close.

I'll include this article that lists available reports included in your QBO subscription.

Let me know if you have more questions about your account. We're here to back you up.

Hi,

This was an auto loan. He traded a car with an outstanding balance in on a new car. I need to close out the old car loan and open a new one. No check involved.

I appreciate the additional clarification to your concern, Cindy G.

Even if it was an auto loan, the suggestion shared by john-pero and the instructions provided by Giovann_G is still applicable except the check creation. However, I suggest consulting your accountant to determine the correct posting accounts to use while creating the Journal Entry (JE).

In case you want to review the entries made, you can pull up or print a report for Journal Entries.

To do that:

Be sure to get back to me if you have additional questions. It would be my pleasure to help. Have a good one!

can anyone translate this for QBs Desktop Pro Plus 2021?

Let me provide the steps on how to access and the Transactions Journal in QuickBooks Desktop, krissy.

The Transaction Journal can be accessed in various ways depending on the transaction type. Here are the steps you can follow on how to use it.

You can use this article to learn more about this: View the Transaction Journal report in QuickBooks Desktop.

To help track your loans, you can read through this article: Learn how to set up accounts for your loans, and manually track them. It includes steps on how to record the loan amount and its payment.

Let me know if you need anything else by commenting below. I'll be around whenever you need help you.

Can you explain how to handle this situation?

I have one loan that pays off a previous car loan. The new loan amount is $50.00 more that the payoff for the previous loan. I made the journal entry to debit the old loan, and credit the new loan. However, I can't think of how to properly get that additional $50.00 that should be added as part of the new loan. The $50.00 does not show as an expense of any kind, but instead is just listed as a part of what is owed on the new loan.

I would love some input.

Thanks!

I'd be glad to help you with adding your new loan in QuickBooks Online, JE26.

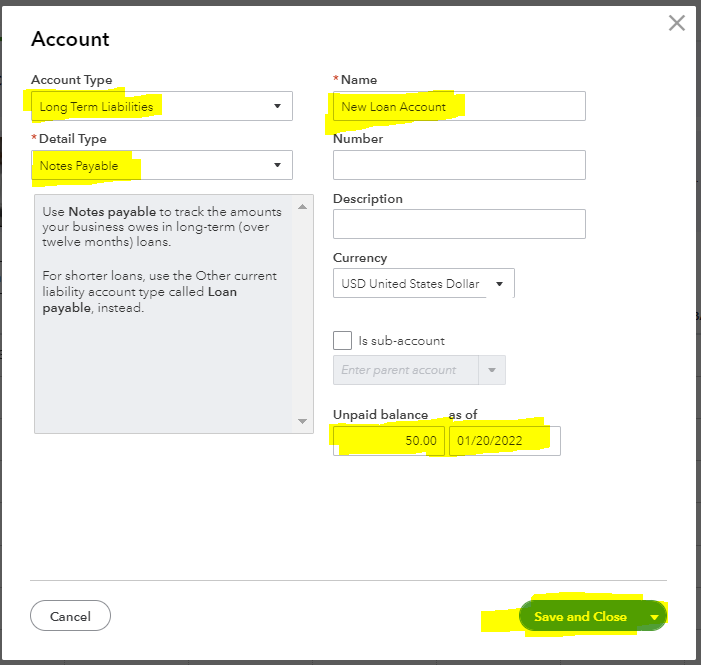

You can enter the additional loan in QuickBooks Online by setting up a new liability account and recording a journal entry (JE).

However, using this method (JE) needs the assistance of an accounting professional for the accounts you need to use. They can also help and guide on which account to debit and credit.

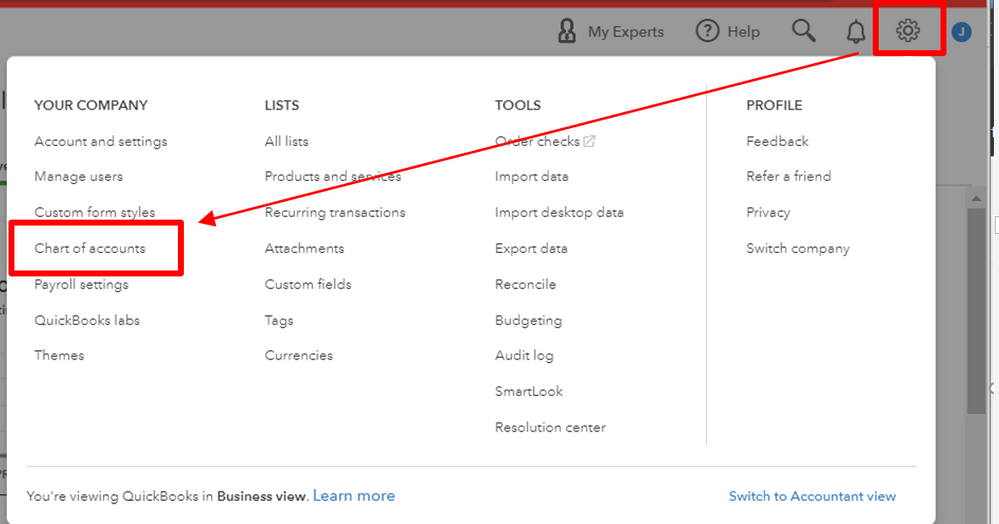

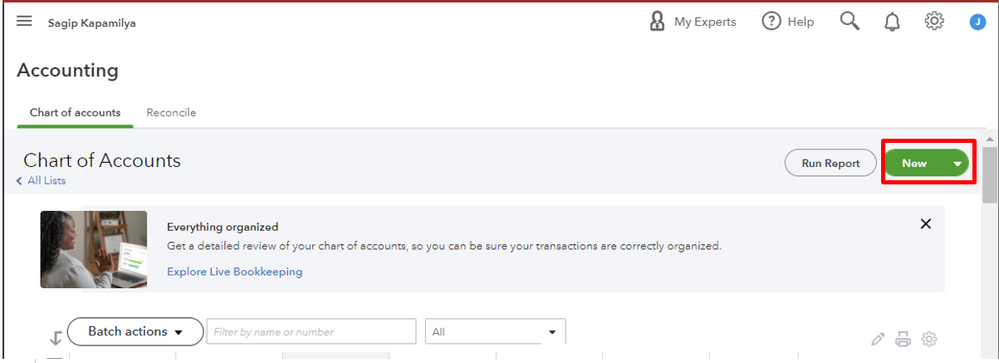

Here's how to set up an account:

Once done, you can proceed in recording a journal entry, You can refer to this article: Set up a loan in QuickBooks Online. This will provide you with the step-by-step process of handling a loan.

Should you have any other questions, please let me know. I'd be more than happy to help.

Hello!

I already know how to set up new loans, and enter journal entries. I was just trying to think of how to get that last $50.00 on the loan. I did end up removing my first journal entry to transfer the old loan to the new one, and then I was able to change the beginning balance to the $50.00. Once I did that, I redid the journal entry that transfered the original loan balance to the new loan balance. All is now correct for the amount of the new loan.

Thank you!

I'm reading through this and I see your writing a check to pay it off, but I don't want to do this since that isn't the reality. A bank wrote a check and I just need to replace one loan with another. I see an old journal entry when I did this before with the help of an accountant, but I'm not sure I fully understand it. I want to get rid of the previous loan and not write a check. I don't want those funds to go against my banking

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.