Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Solved! Go to Solution.

Hello @ramkaji1999-gmai,

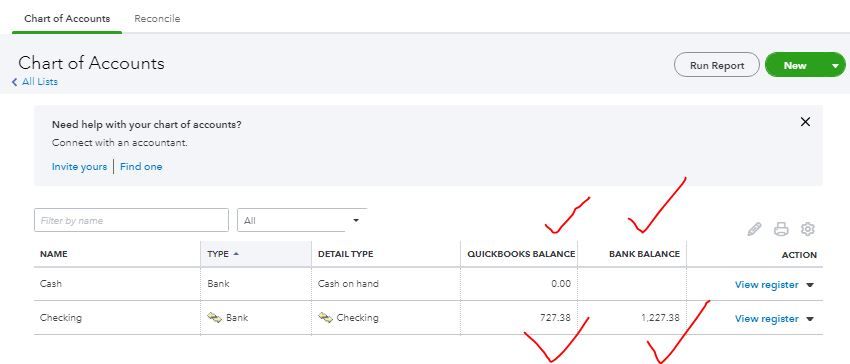

In QuickBooks Online, there are factors that affect the balance of your bank accounts. Among these factors are mainly your downloaded bank transactions.

The QuickBooks balance is affected by all your transactions in the register and the ones you haven't reviewed yet. While the bank balance is solely determined based on the transactions on the register.

Now to fix this and if you want to make sure they're equal, let's consider categorizing and matching your downloaded transactions based on your bank statement. You can do so by following the steps outlined in this article: Categorize and match online bank transactions in QuickBooks Online.

On top of that, I've also included this reference helpful with the resources needed while working with bank feeds and reconciling accounts: How to reconcile your accounts so they always match your bank and credit card statements?

Don't hesitate to post again here if you have other questions or concerns with QuickBooks tasks and navigations. I'm always around happy to help. Take care and stay safe!

Hello @ramkaji1999-gmai,

In QuickBooks Online, there are factors that affect the balance of your bank accounts. Among these factors are mainly your downloaded bank transactions.

The QuickBooks balance is affected by all your transactions in the register and the ones you haven't reviewed yet. While the bank balance is solely determined based on the transactions on the register.

Now to fix this and if you want to make sure they're equal, let's consider categorizing and matching your downloaded transactions based on your bank statement. You can do so by following the steps outlined in this article: Categorize and match online bank transactions in QuickBooks Online.

On top of that, I've also included this reference helpful with the resources needed while working with bank feeds and reconciling accounts: How to reconcile your accounts so they always match your bank and credit card statements?

Don't hesitate to post again here if you have other questions or concerns with QuickBooks tasks and navigations. I'm always around happy to help. Take care and stay safe!

Hello,

I am having the same issue that is listed above and have tried all troubleshooting steps, including speaking with QuickBooks multiple times. The account I'm referencing is a new account as of 1/1/23, therefore there aren't many transactions to sort through to begin with. I have verified/reconciled all transactions and checked for any pending and still can't get the balances to match. Any ideas what could be going on? It seems as though the balances should match at all times assuming the bank transactions are being downloaded daily.

Thanks.

Hey there, @nikkiricha11.

Thanks for joining in on this thread. Allow me to point you in the right direction to get some answers as to why the balances aren't matching.

Since you've spoke to our support and none of the troubleshooting instructions worked for you, I recommend having your accountant review both balances. They'll be able to give you advice on how to fix this or at least an answer to why this is occurring.

Keep us updated on how the call goes with your accountant. We're always here to have your back. Best wishes!

Hello there, @Darleny99.

Is there something you want to share with us here, or do you need help managing your QBO account? If so, please feel free to share it here. We'll be happy to assist you.

Know that you're always welcome here anytime. Thank you, and have a good day!

Good day

I do understand the difference between the QuickBooks balance and the bank balance and my bank reconciles every month. The problem is that the QuickBooks balance is almost 3 times higher than the actual bank balance. How do I fix it?

It's crucial to identify the variances to maintain accurate financial records when the bank balance and QuickBooks Online (QBO) balance don't align, Teres. Let's work together to fix this and ensure the integrity of your financial data.

Normally, both amounts should match to avoid any discrepancy. Since there is a huge difference, several causes are contributing to this issue, and I've listed them below.

To fix this, I recommend matching and categorizing all your downloaded transactions and making all the necessary corrections to your entries. You can use your bank statement as a reference when performing these procedures. For the complete guide, please see this article: Fix issues for accounts you've reconciled in the past in QuickBooks Online.

Once you're done, reconcile your account. I'd recommend doing this every month to help monitor your income and expense transactions and detect possible errors accordingly. You may want to check out this article as your reference in doing and fixing reconciliations in QBO: Learn the reconcile workflow in QuickBooks.

I'm all ears if you have other concerns about managing your accounts and transactions in QBO. You can drop a comment below, and I'll gladly help. Take care, Teres.

Hello, I have reconciled a client's books to date, taking over where another accountant had left off. All months are matched, however when I look at the chart of account that is used for his banking, it shows 9k as the bank balance which is correct, but my QB balance is 30k. Could that possibly be errors from prior years of another accountant not reconciling correctly? Or open invoices that haven't been collected?

It's nice to see you here in the Community, Ryan.

Let me provide some information as to why your client's bank balance and QuickBooks balance are mismatched.

Yes, it's possible that past incorrect reconciliations may cause the mismatch. I'd suggest further checking the previous reconciliations to locate any discrepancies. Once you've identified the issues, you can fix them accordingly.

Additionally, many other factors could cause the balances to be different. It's essential to investigate the root cause and make the necessary adjustments.

Here are the possible reasons why balances may not match:

Furthermore, it's worth noting that open invoices that still need to be collected post to the Accounts Receivable (A/R) account in the Chart of Accounts. This doesn't affect your client's bank and QuickBooks balances. Once the invoice is marked as paid, the amount flows into the designated income account.

For more information on accounts receivable, you may refer to this article: What is accounts receivable?

Once you have resolved the balance mismatch, I recommend reconciling your client's bank account every month to ensure that the balances correspond. You can find a detailed guide on how to do this here: Reconcile workflow.

Please feel free to reach out if you have any other questions about the balances in QuickBooks. I'll be around to lend a helping hand. Keep safe.

The issue I have is different. I understand the difference between Bank Balance and Quickbooks balance. The issue I have is that the Quickbooks balance on the register view is different than the Quickbooks balance on the bank feeds update window for one account. For all accounts the Register balance and the Bank feeds balance are the same since they are both Quickbooks balance and not bank balance

Hello RayJ2,

Thank you for reaching out to the QuickBooks Community! Let's go ahead and connect with us on a screen scare in a more secure environment to investigate this matter more. Our Support team would be able to dive in further and run some tests to figure out the root of the issue. Here's how:

Please let me know how the conversation goes! I will be around. Take care.

I'm posting my experience (with a question at the end) in hopes that it may help others who have not found an answer in this thread.

I took over a company account that had 2 bank checking accounts. One account was closed in late 2021, and in 2024 I reconciled 4 years of bank statements through quickbooks. Bank balance was $0.00, quickbooks balance was $7,524.69. After other attempts to make sense of/correct the problem, I realized the last bank feed download occurred roughly 4 months before the account was closed. Specifically, in the bank account register, the last 4 months of transactions do not have the green box icon in the cleared/reconciled column. Those transactions total $7,524.69. This seems to be less a function of accounting than a useless visual aid.

My question: Without a way to download from the closed account, is there another way to reduce the quickbooks balance to zero?

Ensuring your QuickBooks and bank balance match is crucial to maintaining the accuracy of your books, D Law. I'll provide the necessary steps to rectify the issue.

First, I recommend pulling up your bank statement for the last four months before the account was closed. You can reach out to the financial institution to get a copy of the statement.

Then, compare the transactions recorded to your QuickBooks Online (QBO) account. If there are any missing transactions, enter them in the program until the QuickBooks balance matches the bank statement.

After that, I suggest manually clearing and reconciling the transactions. For further guidance, you can browse this article: Reconcile an account in QuickBooks Online.

Please know that we're here to provide you with continuous assistance and support throughout this process. Don't hesitate to reach out if you need further help. We're committed to helping you every step of the way.

I'm not sure if you understood my issue, because, although I appreciate the link you provided and to which I navigated, it appears that you are suggesting I simply reconcile my account. I also may have misspoke in my original post... I reconciled the account so the quickbooks balance and closing bank statement balance were in agreement at $0.00. I tried going into the register, clicking on the "R" in the cleared/reconciled column to un-reconcile the transaction, saving the transaction, then editing it again by enabling the "R" again, but no change. The BANK balance in Quickbooks is $7,524.69. How do I get the Bank balance to $0.00?

Thanks for getting back with the Community, D Law. I appreciate your detailed information and screenshot.

The In QuickBooks balance represents everything on your QuickBooks account. The account's balance is a figure pulled from your bank. No actions in the account will change its balance, since it's based on data from your financial institution.

You can try refreshing the bank connection if necessary.

Here's how:

If you need to update the bank details, you can use its Edit icon and choose Edit sign-in info.

I've also included a detailed resource about working with bank feeds which may come in handy moving forward: Troubleshoot & fix banking errors

Please feel welcome to send a reply if there's any additional questions. Have a wonderful Wednesday!

While I see the value of your response to future readers of this thread because it may offer them enlightenment as to how to view their own situation, it rings as tone-deaf to my particular issue...

You indicated:

"No actions in the account will change its balance, since it's based on data from your financial institution."

You have nailed the root of the problem in your advice. '...data from [my] financial institution" is what I am missing, as, per my original post, the last bank data download was 4 months prior to the closing of the account, 3 years ago, and, although you would have no way of knowing this, the bank in question has ceased to exist. I am missing those 4 months of data. So, yes, "No actions in the account will change its balance, since it's based on data from your financial institution," but how can we change the balance that is based on incomplete information? The transactions are entered correctly, but it appears to me (and I would love further elucidation) that Quickbooks is trying to match the transactions entered manually with data that *should* have come from the bank (which did not and never will) and is coming up short by $7,524.69. How do I indicate to Quickbooks that the $7,524.69 shortfall is spurious and erroneous so my bank balance matches the Quickbooks balance?

@D Law What the support staff are trying to say, without saying it, is that you can't.

I have this issue, too, on QB desktop. My balance sheet is incorrect because I am not a bookkeeper and stupidly didn't reconcile my expense account and then deleted that bank account from quickbooks and closed the expense account, so I can't reconcile, as far as I understand. Is there a way that I can fix this??

Yes, there's a way to fix your account balances, AmyE2. I'll guide you in completing the process below.

Before we begin, I'd like to clarify your statement regarding the closure of the expense account and how you did it. Any additional information would be much appreciated, as it'll enable us in the Community to assist you more effectively.

You can only reconcile checking, savings, and credit card accounts in QuickBooks. With this, for you to correct your balance sheet and perform the reconciliation procedure, I'd recommend reconnecting your bank account. This can be accomplished through either Direct Connect or Web Connect methods, depending on the options provided by your bank.

If you wish to reconnect with Direct Connect, here's how:

If you opt to connect with Web Connect (.QBO) files, please see the Connect with Web Connect (.QBO) files section in this article for the step-by-step guide: Set up or edit bank accounts for Bank Feeds in QuickBooks Desktop.

Once connected, transactions from your bank feed will be downloaded. You'll have to categorize them to ensure the accuracy of your financial data. Then, you can reconcile your account.

Moreover, you might want to run a Previous Reconciliation report to review your past reconciliations. For detailed instructions on how to do this, check out this article: Get reports for previous reconciliations in QuickBooks Desktop.

Stay in touch if there's anything else I can help you in managing your transactions and reconciling your accounts in QuickBooks. I'll be right here to provide the information you require.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here