Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I bank with First Financial and they have a two step authentication. So it will not automatically sync transactions. Is there a fix or a post with answer already that I missed?

Solved! Go to Solution.

Hi there, MDCincy.

Some financial institutions require multi-factor authentication code. This is new industry-standard security to safeguard your account. With this, QuickBooks depends on the security protocol your bank has implemented. That being said, the ability to disregard this or to remove the required code within QuickBooks in performing a manual update is not yet available.

However, I suggest contacting your bank's support to see if they have an option to disable the code every time you manually update the transactions.

You can click this article to see information on how to update your bank's login credentials: How to update your bank account sign-in information.

Please check these articles on how you can assign and categorize your downloaded transactions and reviewing them to avoid duplicate entries in your end.

Please let me know if you have other questions related to QuickBooks. I'm always here to help you.

Good Morning, @MDCincy.

I hope your day is going well so far. Yes, QuickBooks will automatically sync your transactions after you have successfully connected your financial institution. The two-step authentication is required from your bank and needs to be entered to connect the bank account.

Once your bank is synced with QuickBooks, then you can click the Update button within the Banking page to upload the transactions. Here's how:

It's that easy! If you have any other questions, don't hesitate to ask. I'm always here to lend a helping hand.

Take care!

This is my first post and I realize I posted in the wrong section. My apologies, should have been in banking!

I appreciate the quick reply, but I already have my bank connected. I’m just trying to see if there is a way around having to enter the code every time, since I have to manually sync with the Update tab that you mentioned.

Hi there, MDCincy.

Some financial institutions require multi-factor authentication code. This is new industry-standard security to safeguard your account. With this, QuickBooks depends on the security protocol your bank has implemented. That being said, the ability to disregard this or to remove the required code within QuickBooks in performing a manual update is not yet available.

However, I suggest contacting your bank's support to see if they have an option to disable the code every time you manually update the transactions.

You can click this article to see information on how to update your bank's login credentials: How to update your bank account sign-in information.

Please check these articles on how you can assign and categorize your downloaded transactions and reviewing them to avoid duplicate entries in your end.

Please let me know if you have other questions related to QuickBooks. I'm always here to help you.

I am very angry at the lack of support from Quickbooks. They won't talk to you on the phone and when they do they can't speak English. My bank has not synced in months now. They tell me it's a problem they are working on and will update me. But no updates and I am still paying full price for half service. They promised a discount but once again charged me full price. Now I have been waiting 45 minutes for my response in 5 minutes. I think it's time to look for a company that cares about our business and move all of our accounts to them.

I see this issue was last address in June 2020. Has there been any change to the support for 2FA for quickbooks integration as of 3/7/21? Our bank started requiring 2FA as of 3/1/21, and QB is no longer able to automatically update transactions. Any information would be appreciated!

It's great to see you here, @CatCCC,

Thanks for requesting some updates in the forum. Regarding the two-factor authentication, this is something set by your bank to secure your access when using of Online Banking.

Since QuickBooks only receives data from your bank, the security process depends on what the bank imposes. If you need help with the access, you will need to contact your bank for physical tokens or One-Time-Password.

Don't worry, if there are new updates for QBO Banking, it will be communicated through in-product ads. You can also check out these links to be updated with the recent and upcoming changes for our QuickBooks products:

Let me know if there's anything else you need help with. I'll be more than glad to help you whenever you need it. Have a good one!

Utilize the trial version of SlickConnect to isolate the issue. It supports First Financial.

https://www.moneythumb.com/?ref=110

We recently "upgraded" from Quickbooks Online to Quickbooks Enterprise Desktop. We are running both versions concurrently to ensure accuracy, prior to shutting off Quickbooks Online.

Quickbooks Online is able to update ALL my multiple bank and credit card accounts with a single click.

The New and Improved Quickbooks Enterprise cannot perform this simple task?

Assigning blame to the banks requiring 2FA is not flying with me since QB Online can still accomplish with one click. There MUST be a solution to this...

Hey there, @WillTref2000.

Thanks for sharing your concerns with us here in the Communtiy. I'll be sure to take note of them.

In QuickBooks Desktop, you can update the bank feeds just as you do in QuickBooks Online. The difference is you'll need to click on the Refresh button on each individual account.

However, the ability to refresh all accounts at once isn't available at this time. I can how this would be beneficial for you and your business, so I've submitted a feedback request on your behalf to our Product Development Team. Our developers analyze new feature requests and sometimes include them in future updates.

Please let me know if there's anything else that I can do for you. I'm happy to lend a hand. Take care and have a wonderful weekend!

I'm at the 55-minute mark discussing this issue with a support rep. Well, we're having a text chat where she disappears for 5-10 minutes between comments.

It's really insane. I just asked "Is this normal and expected?"

They have no idea what I'm talking about. Eventually I searched here and found this thread.

I've seen no solution yet, but evidently their strategy is to just drag out the process of explaining the problem until you go away. Perhaps a customer attrition policy? "The problem isn't bad enough you'll cancel your service?"

Good luck, hope we all get a consistent and actionable answer to this problem. If it's something to raise with our banks, that's an option. I can't get anyone at Intuit to even register the brain activity necessary to help.

It looks like this is a duplicate post, dennisk.

I'd like to route you to the thready where our AllStar and my colleague answered a similar post of yours. Just click here.

If you have other questions, please don't hesitate to post them here. Take care and keep safe!

Hello, I have Quickbooks Desktop. I'm having a hard time syncing my bank feeds with the desktop software. When I go to Banking > Setup Bank Feed For Account > Enter Bank Name (BANK OF CHERRY) Quickbooks takes me to a screen that says I need to manually download the transactions from the bank website and then upload to QuickBooks. I spoke to the bank and they said the systems should sync so not needed. When click on the bank link on QuickBooks pop-up and login, it redirects to the main banking page. New user, struggling here....

I'm here to help you set up your bank account for Bank Feeds in QuickBooks Desktop (QBDT), @rgarg0130.

In QBDT, you can use Bank Feeds to connect your bank accounts to online banking. I've visited the Participating Financial Institutions (from the Banking menu, select Bank Feeds) page to find out if your financial institution (BANK OF CHERRY) supports online services for QuickBooks. Then, I've learned that your bank isn't on the list.

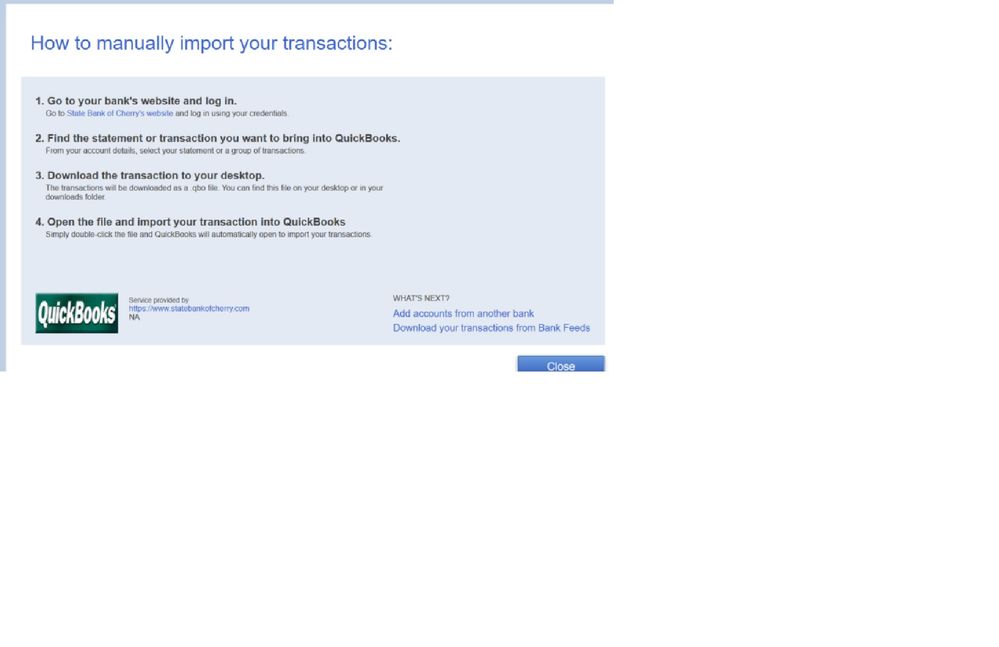

That being said, you'll have to manually sync your bank transactions or download them from your financial institution's website and upload them to QuickBooks. Before doing so, make sure to back up your QuickBooks company file for future use. Then, whenever you're ready, follow these steps on downloading a Web Connect file through QBDT:

I've attached a screenshot below that shows the first four steps.

You can also refer to this article to know more about downloading bank feed transactions to QuickBooks: Download Bank Feed transactions in QuickBooks Desktop.

After downloading, import your Web Connect (.qbo) files to QBDT. For the step-by-step guide, I'd recommend checking out this article's Import Web Connect files section: Set up bank accounts for Bank Feeds in QuickBooks Desktop.

Once imported, you'll have to review and/or match your transactions to the existing entries in QuickBooks to keep your account updated. You can refer to this article for the complete details: Add and match Bank Feed transactions in QuickBooks Desktop.

Also, I encourage you to reconcile your accounts every month. This is to effectively monitor your income, expenses, and detect any possible errors accordingly. For the detailed steps, check out this article: Reconcile an account in QuickBooks Desktop.

If you have other banking concerns or inquiries about managing your transactions in QBDT, please don't hesitate to drop a comment below. I'll gladly help. Take care and stay safe always.

Please see screen shot. State Bank of Cherry does participate.

What does WebConnect mean?

Thanks for getting back to this thread, @rgarg0130.

Allow me to answer your banking queries in QuickBooks Desktop (QBDT).

QuickBooks Online (QBO) and QBDT are two separate platforms. The biggest difference between these two QuickBooks products is that QBO is cloud-based and runs using the Internet, while QBDT is downloaded and installed on a computer.

Therefore, security measures and available automation can also affect how a financial institution integrates with the product. Although, you can reach out to your bank and apply for an online banking application. This way, they can review your request and activate your account in QuickBooks for online use.

In the meantime, you can follow the recommended steps that were shared by my colleague Rea_M. Simply import the bank transactions so they become available in your Bank Feeds. For additional reference, you check out this article: How To Import Web Connect (.qbo) Files into QBDT.

After importing them, you can now add and match them depending on your banking mode.

The Community always has your back, so please let me know if you have any other questions. I'll be more than happy to help. Keep safe.

So the question was never answered - Does QBDT bank feeds have the ability to support multi-factor/2-factor authentication? This should be a must have for a modern accounting program that connects to financial institutions. Most financial institutions require two-factor authentication for access. I upgraded to QBDT 2021 so I could continue to use the bank feeds and the product is the same as it was, no new features. Still looks circa 2005.

Hello LuxuriaMusic,

As my colleague shared above, the multi-factor authentication feature is something that is set up by your bank.

Since the system is reliant to your bank, I'd recommend reaching out to your financial institution's support to verify this one.

I've also added these articles that have information on how you can group transactions based on their accounts: Add and match Bank Feed transactions in QuickBooks Desktop.

Please let me know if you have other questions related to QuickBooks. I'm always here to help you.

I need up with syncing my local bank with qb

Hi there, @terry drone. Syncing your local bank to QuickBooks is easy and I'm here to guide you how.

The process will depend on the QuickBooks program you're using. To get started, please refer to the steps below.

If you're using QuickBooks Online (QBO), here's how to sync your local bank:

You can check this article for more details about the process: Connect bank and credit card accounts to QuickBooks Online. It also includes instructions on how you can update your bank info, such as your username or password, or refresh the connection.

If you're using QuickBooks Desktop (QBDT), you have first to reach your bank to know if there's a fee. Once done, follow the steps below to sync your local bank:

For more information about this, visit this page: Set up bank accounts for Bank Feeds in QuickBooks Desktop. This article also provides steps on how you can import your bank transactions using Web Connect files.

Once transactions are in, you'll now need to categorize and match them in QuickBooks. This is to ensure that they are in the correct account. Feel free to check out the links below:

You can count on me if you ever need additional help in syncing your local bank to QuickBooks. I got your back. Keep safe always.

If you are using QBo/QBSE, utilize the trial version of SlickConnect to isolate the issue. It is designed to import into any bank or credit card, so there is no specific setting needed. If the same error persists, there is an ongoing problem at your bank.

https://www.moneythumb.com/?ref=110

My online QB is currently synced to an A/R software Bill.com. I am changing to another A/R platform-AxisCare. Is QB able to be synced to two (2) A/R software's at the same time during a period of transition? I'll be accepting payment for Bill.com to close out that platform and I'll be accepting new payment for the new platform.

Suebaru

Thanks for joining the Community, Suebaru.

When switching from Bill.com to other billing integration services, only one service can be connected and run concurrently for the same QuickBooks account.

I can certainly understand how an ability to sync both services at the same time could be useful and have submitted a suggestion about it as of today.

You can also submit your own feature requests while using QuickBooks.

Here's how:

Your feedback's definitely valuable to Intuit. It will be reviewed by our Product Development team and considered in future updates. You can stay up-to-date with the latest news about your product by reviewing Intuit's Product Updates webpage.

I'll be here to help if there's any questions. Have a lovely day!

We had a few clients with similar cases and we recommended the following way:

1. Open a new blank QBO account.

https://quickbooks.grsm.io/us-promo

2. Create a duplicate QBO account to connect with the new AR platform. You may purchase a 3rd party service to duplicate data from your old account or utilize the Copy tool.

3. During the transition period, utilize a connector to mirror data from the old QBO account to the new one.

https://www.make.com/en/register?pc=quickbooks

4. As an additional option, utilize the backup restore app to minimize the risk.

https://rewindio.grsm.io/quickbooks

Hi there,

I’m needing to go back a few years with my taxes to redo them. Can quickbooks self employed sync bank more than one year?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here