Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello, @LindseyMem.

When correcting a direct deposit paycheck, you’ll have to delete the check before 5 PM, two banking days before the check date. Otherwise, you can have an arrangement with your employee to include any overpayment or underpayment in their next paycheck.

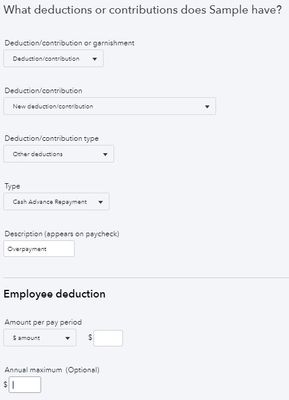

You can create a deduction payroll item to denote the overpaid amount. I can guide you on how to do it.

You can check this article to learn more about deleting or voiding your paycheck:

I’m always here to help if you have other questions about running direct deposit payroll in QuickBooks.

what if the employee paid back the amount in cash ?

Thanks for joining in on this thread, llmcnair.

I'd be glad to share some info about your situation.

If you are subscribed to QuickBooks Online Payroll Enhanced, you can void the paycheck after they're submitted. This changes your paycheck records and updates the paycheck dollar amount to zero.

Here's how:

Once voided, re-create the paycheck with the correct amount by following these steps:

Once recorded, you can run the Payroll Details report in the Reports tab to see the totals for each employees.

For reference, you can read these articles:

On the other hand, if you have QuickBooks Online Payroll Core, Premium, Elite, and Full Service, you may attempt to void the paycheck. However, if you're getting an error message, I recommend reaching out to our Payroll Support Team. They can pull up your account and help you correct the paycheck.

Here are the steps:

If you have the new QuickBooks Assistant help update, you can follow these steps:

I'm also adding this guide to learn more about overpayment for employees: Reduce paycheck wages for an employee who has been overpaid.

Please reach out to me again if you have more questions related to payroll or other concerns with your QuickBooks Online account. I'd be happy to help you out again. Have a wonderful day ahead.

Hi, I have the same issue, except that it was an entire paycheck (employee advised the bank account was closed after the payroll was run, and we issued him an emergency check while we waited for the DD to bounce bank. The bank account was not closed, and so the DD went through). The emergency check was for the net amount. I want to withhold this from his next pay, and what is described above seems to meet our needs. My question is...is this deduction after tax (i.e. will this reduce net pay or gross pay)?

Also, how do I record the emergency check?

Thank you for joining the thread, @dLearned.

I've come to help record an emergency check for your employee.

Firstly, you'll want to contact our QuickBooks Payroll Team to ensure the processed direct deposit paycheck will be deleted since you've already issued an emergency check.

However, since the emergency check you've issued is for the net amount only, you'll need to run payroll using a paper check. This way, QuickBooks will include after-tax deductions that will reduce the gross pay. Here's how:

Most importantly, I recommend seeking help from your accountant. They may add extra steps on how to handle this situation based on your business recording practices.

You may need to run payroll reports in QuickBooks Online. This will help you view useful information about your business and employees.

Come back to this post and let me know how it goes, @dLearned. I want to make sure you're taken care of.

Why would I want to delete it? The DD went through, and the employee has been paid twice (both payments at net tax (but tax only deducted once). If I delete the DD, the employee has still received double, and my bank is still out, isn't it?

Appreciate the timely update, @dLearned.

I'm here to help share information and to make sure you're able to record the emergency payroll check in QuickBooks Online.

Thank you for sharing additional information concerning your inquiry about a paycheck for one of your employees. We are now getting closer to getting the correct transaction detail of the payroll check to record.

Saying the direct deposit in question did go through, I would also agree not to delete it since it has been taken out from your payroll bank account. Now to record the emergency check, you may need to create a paper check using the steps above since the employee already received the appropriate funds for the payroll transaction.

This is to ensure your bank account has the correct record of transactions to avoid miscalculating the difference in-time of reconciliation. Kindly read and use this article to learn more: Create and run your payroll in QuickBooks Online.

After recording the emergency check, here's how to print a payroll check for reference in case you needed the steps to do so: Print Paychecks in QuickBooks Online Payroll. And I've got you this article in case you'll bump into errors in printing your payroll check so that'll you'll know how to get rid of them: Troubleshoot Printing Paychecks, Pay Stubs, and Forms in QuickBooks Online Payroll.

Keep me update in the comment section below if you have any other payroll questions in QuickBooks. I, @JonpriL, will always be around happy to lend a helping hand. Take care and stay safe!

Thank you for your response, but I'm not sure I understand.

The check was issued to him last week, and was cashed and cleared our bank. It was a handwritten check as it needed to be done immediately (i.e. emergency). Both payments have cleared our bank.

How would I produce another payment through payroll when I do not yet know what his hours will be (it is an hourly employee, not salary)?

At this point, it is as if the employee received an advance equal to his previous net pay, and we want to withhold it from the next payroll run. No tax has been paid on this additional amount, so can we not just withhold (as a deduction) from his next net pay? Then taxation would still be right. I just need to know how to do that (so that it withholds from net pay not gross) and how to encode the emergency check (does it get coded to wages?).

Thanks for getting back with the Community, dLearned.

Since you've already paid your employee with a paper check and through direct deposit, I'd recommend voiding the direct deposit transaction.

Here's how:

In the event your deadline to cancel it has passed, your worker will receive the funds in their bank account on the specified pay date. You can still void your payment and try to collect the funds back from your employee. If this isn't possible, you may qualify to request a direct deposit reversal.

After voiding the transaction, you can enter their paper check.

I'll be here to help if there's any questions. Have an awesome Monday!

Thanks for your reply, but I seem not to be making myself clear.

The check and the DD are both cleared - the money is long gone out of our bank account. There is no value in cancelling either of them as the employee has the money. Voiding the DD will cause more problems for the employee than we wish to inflict. I want to collect the money back directly from the employee...I want to do it by withholding it from their next check.

I know how to void DD/checks - don't want to do that.

I know how to issue paper payroll checks - don't want to do that.

I want to record the check already issued and cashed. I assume this will be an expense, and I would charge it to the wages account (just looking for confirmation).

When I next run payroll, I want to withhold the amount from his net pay - I can add a deduction to his employee record, I just need confirmation that it would come off the net pay not the gross.

Thanks for getting back to this thread, @dLearned. Let me chime in and clarify things for you.

Once you receive the amount from your employee, you'll need to record a bank deposit.

Then, create a deduction for the employee on the next paycheck. You can set up pre-tax or after-tax deduction items. If you aren’t sure how the deduction is taxed and confirm that it would come off the net pay and not the gross, talk to your plan administrator or an accountant. They may provide extra steps on how to manage this situation based on your business recording practices.

You can also review this steps for more information in adding deductions your employee: Set up, change, or delete employee-paid payroll deductions.

You may need to run payroll reports in QuickBooks Online. This will help you view, print, and customize relevant information about your business and employees.

Keep me posted if you have other questions about handling and creating deductions to your employee. I'm always around to help. Keep safe!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here