Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI'll give you a few steps to file your prior year 940 forms, @nachufusi.

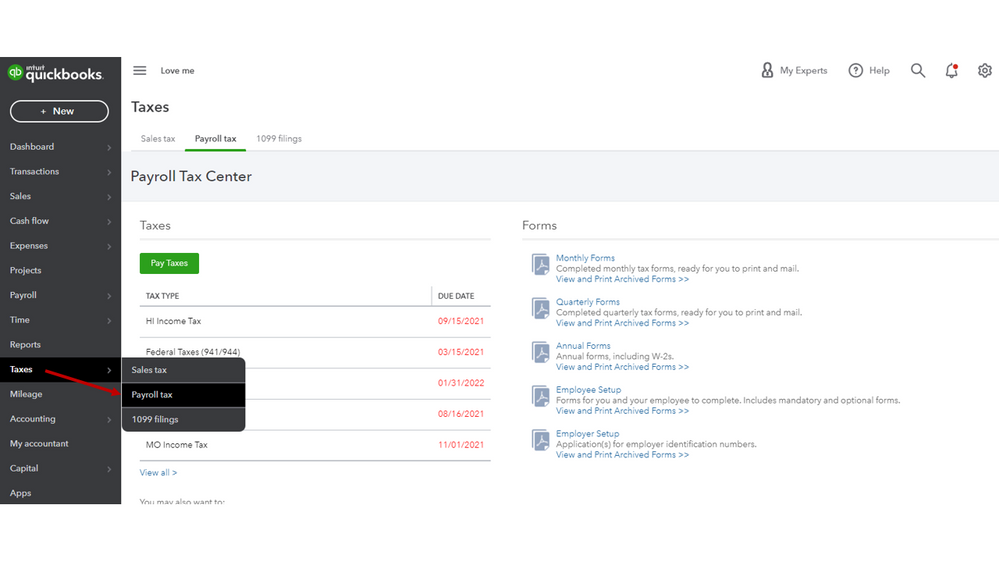

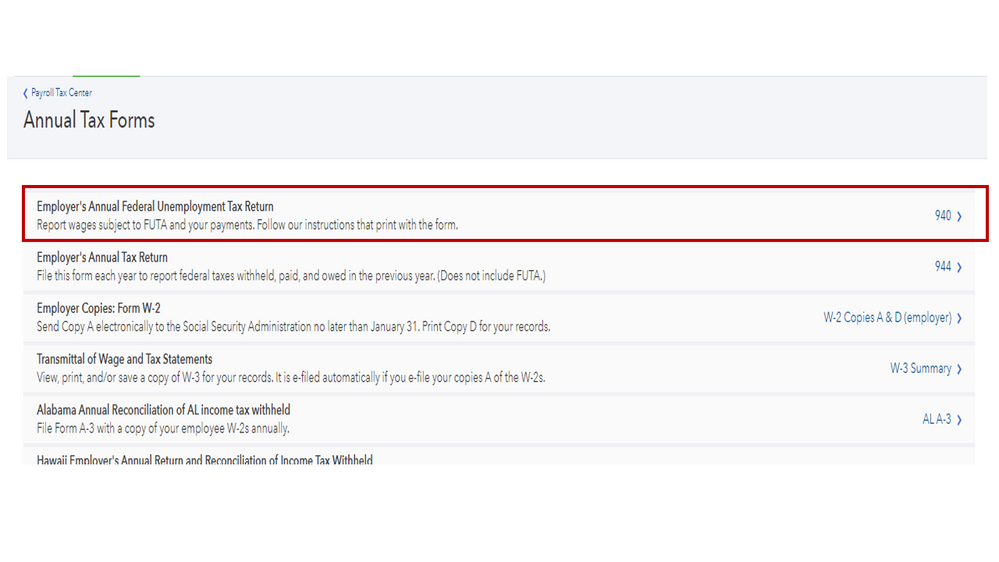

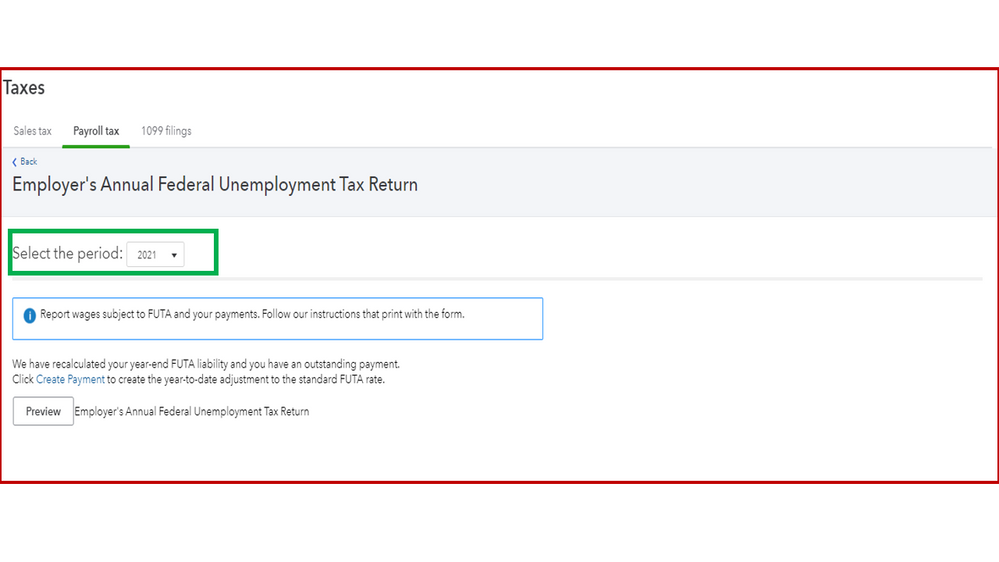

You can still print your last year's tax form through the Payroll Tax Center window. Then, manually submit it to IRS. Here's how:

After printing, you can now manually submit it to the IRS.

Additionally, you can run some payroll reports in QuickBooks. This way, you can get a closer look at your business's finances and view useful information about your business and employees.

Stay in touch if you need further assistance while working in QBO. Please know I’m always here ready to help and make sure you’re taken care of. Enjoy the rest of the day.

Hi @nachufusi,

Hope you’re doing great. I wanted to see how everything is going about the form 940 tax filing concern you had the other day. Was it resolved?

Do you need any additional help or clarification? If you do, just let me know. I’d be happy to help you at anytime.

Looking forward to your reply. Have a pleasant day ahead!

My copy says "DO NOT FILE - ERROR ON FORM" in bold print across form. How do I get that removed to print?

I had to find the form on the IRS website. https://www.irs.gov/pub/irs-prior/f940--2020.pdf

I had to find the blank form on the IRS website. https://www.irs.gov/pub/irs-prior/f940--2020.pdf

Thanks for dropping by, @BNISSEN. Let me answer your concern about printing 940 form in QuickBooks Desktop.

The message appeared because the IRS has the draft form. Let’s make sure that you have the updated version of IRS.

You can follow the steps below to help resolve this concern.

Once done, let’s try to prepare the 940 form.

If you need further assistance with printing IRS forms, you can always hit the Reply button. Have a great day!

Apparently i did not file the 940 tax form for 2020. I just got a notice yesterday. Help.

My quickbooks says the tax rates have been updated so it won't print correct amounts> ? How could i have missed it when QB's gives me the reports due on my reminder? It doesn't leave the screen until it is paid.

I did the report, i just found it. So how i prove it to the IRS? I don't know.

Hello BodyshopBiz,

Thank you for reaching out to the QuickBooks Community! That's awesome that you were able to find the reports. Just to clarify, are you trying to prove the payments or the tax filing to the IRS? I will be looking forward to your response. Take care in the meantime.

yes now that i have found the report which i mailed in March to prove it the first time. Obviously they did not note i had sent it in and that it had been recieved. So if i mail it again, who's to say it will be documented? How can i assure it is documented that it has been done?

Thanks for responding, @BodyshopBiz.

I'll share some information about the submission of tax forms. To ensure the validity and proof of received, I recommend contacting the IRS directly. They can assist you with the verification process. Just visit the IRS website for details.

I'm also attaching this link to help you manage your taxes: Year-end checklist for QuickBooks Online Payroll.

Please know that you're always welcome to reply if you have follow-up questions with tax reports. Don't hesitate to reply. Take care and have a nice day ahead.

Hello.

I have the same problem. Need to submit 2020 940. I have enhanced payrolll subscription. Where is the "Taxes" menu? IRS website?

Thanks for joining the thread, @carelink5. Let me share additional information about filing the 940 forms in QuickBooks Online (QBO).

For your concern about the Taxes menu, you can see it in the left navigational bar once you sign in to QBO.

As for your query about filing the 940 forms, you can visit the IRS website.

Furthermore, follow these steps to look for Form 940 in QBO:

Additionally, feel free to check out this article for additional guidance and reference:

Our doors are always open to help you again if you need further assistance with 940 forms in QBO. I'll be glad to help. Take care!

Thank you for the response. Appreciate the help.

Just to make it clear, for others like me looking for answers, we cannot file previous years of 940 from our QuickBooks Desktop. We can only do it manually and send it by mail or do it electronically (e-file) through a company or website which is IRS approved. I did it using Tax1099.com.

Hello

I'm needing to reproduce a 940 from from a previous year. I read your instructions but are unable to locate the TAXES selection. What menu is it in? I don't see it in my home page.

Thanks

Welcome to this thread, mike400.

Thank you for following the solution shared by my colleagues and letting us know the result. Let me help and guide you on how to get to the Taxes menu in QuickBooks Online (QBO).

If you wish to file the form to the IRS, you’ll have to manually submit it to the agency. However, if the year is no longer available from the Select period drop-down, I recommend contacting our Payroll Support Team. They have extra tools to get the tax form for you. Click here to view the contact details and choose QuickBooks Online Payroll.

For additional resources, I’m adding some links below to learn which taxes and tax forms Intuit handles for your business. Aside from that, you’ll see the steps on how to archive payroll tax forms.

Drop a comment if you still need assistance with processing your 940 forms. I’ll get back to make sure this is taken care of for you. Have a great day ahead.

I'm missing 2020 940 completely. I have no clue where to get the information to fill out the form. QB does all the tax work for me. QB online has file 940 every year since, except 2020? Why? How do I go back and have QB fill out the form?

Thank you!

Thanks for following this thread, @velvet-thedoc. I understand the need to get the 940 info. I'm here to help ensure you'll get all the details you need for your tax forms.

I can see you're using the Full-Service Payroll. I'd recommend contacting our Payroll Support team to further assist you with this.

Here's how:

Let me know if you have additional or other concerns. I'm always around here to help you some more.

I can't find this in Quickbooks Desktop. Can you help with that?

I appreciate you joining the thread today, jch84. Let me share some ways to file your older 940 forms.

At this time, you can file your prior forms manually either by mailing or submitting the completed documents directly to the IRS. The good thing is that you can utilize QuickBooks Desktop (QBDT) to prepare or print the information required.

To start:

Alternatively, you may run your payroll reports to obtain the payroll data for the years you want to file. Ensure to accurately track all income, withholdings, and other payroll information needed.

You can gain further insights to effectively manage your forms and taxes in QBDT from these links:

Additionally, here's how you can check payroll tax payments and forms you made within the system: View your previously filed tax forms and payments.

Please let me know in the comment section below if you have follow-up questions while filing your forms. I'm just a few clicks away to help you again. Keep safe!

quickbooks 940 form cannot be printed for the year 2021. how do i get a completed form for year 2021?

Let me help ensure you'll get the support you need in acquiring payroll 940 forms for the year 2021, Sher22.

In QuickBooks Online, archive payroll forms only apply a two-year coverage copy of your previously filed form and the current tax year. Thus, printing of 940 forms for the year 2021 can be acquired through our Payroll Support Team.

With that, I recommend contacting our support experts to further review your account and provide assistance to help you obtain this form so you can print them anytime. Here's how:

I'm also including our customer support hours, so you can set an available time to reach them out.

Moreover, you may utilize these references to help you manage federal taxes and review specific business finances in your account: Run payroll reports.

I'll be leaving this forum available, so you can always reply to this post whenever you require additional assistance managing payroll forms in your account. Stay safe and have a good one!

that doesnt work, message on quickbooks says cant file previous years 940

Thank you for your message in this thread, @chub1. I'll point you in the right direction to help file the previous year's 940 forms inside QuickBooks Online (QBO).

Since there's no option to file form 940 from previous years directly inside the program, I highly recommend working with a ProAdvisor. This way, they can guide you through sorting this out and having prior year forms filed as soon as possible. If you don't have one, feel free to check this page to find one:

To check the support availability, please see this page: Get help with QuickBooks products and services.

On top of that, I'm also including this article to help you in wrapping out this year's payroll: Year-end checklist for QuickBooks Online Payroll.

I can always get back and provide further assistance handling form 940 and other forms inside QuickBooks or if you have any additional questions about the program. Feel free to drop by so I can extend a helping hand. Keep safe.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here