Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Greetings, lsefcik.

I can share information about how nonemployee compensation works in QuickBooks Online.

IRS has split out the 1099 MISC into 2 separate forms. Nonemployee compensation which was previously reported on Box 7 of the 1099 MISC is now in a separate form 1099-NEC.

If you need to file both the 1099-NEC and the 1099-MISC, you'll need to create a new expense account and transfer all the expenses for that Contractor from the old expense account to the new one for mapping in 1099 NEC.

This write-up will provide you more details about this: How to modify your chart of accounts for your 1099-MISC and 1099-NEC filing.

You can still report the 1099 payments into various GL accounts and make sure that whatever expense account is on those contractor's checks, you have that same ledger mapped to Box 7 on the 1099 setup screen.

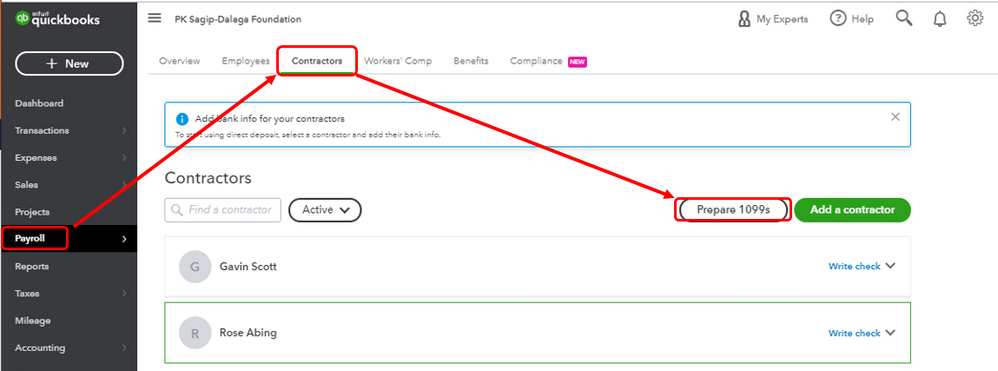

Here's how:

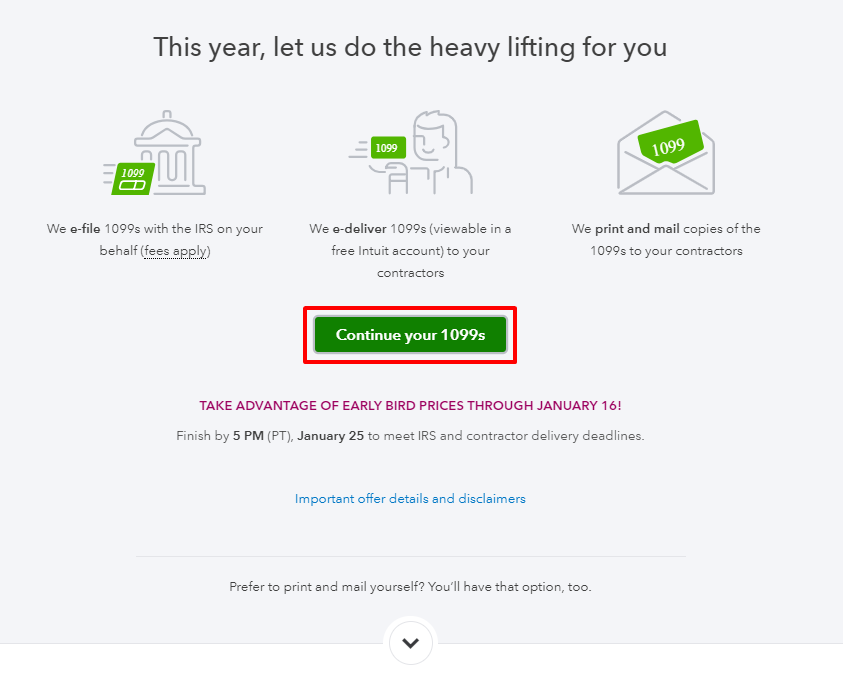

To know more about this process, here's an article for your reference: Create and file 1099s using QuickBooks Online. On the same link, you'll find the steps on how to E-file your 1099s as well as a guide on how to check the filing status.

Don't hesitate to drop me a reply below if you have any other 1099 payment concerns or anything about QuickBooks. I'll be your helping hand today. Have a good one.

I don't have the multiple accounts choice. I am showing that for each type of 1099 payment I only have one account choice: See attached screenshot

the multiple accounts selection would be the answer, but it isn't an option on my screen. I'm trying to include a screen shot. It says "choose an account" and no option for multiple accounts

The screenshot that you gave is a big help for me to picture out what's going on your end, @lsefcik.

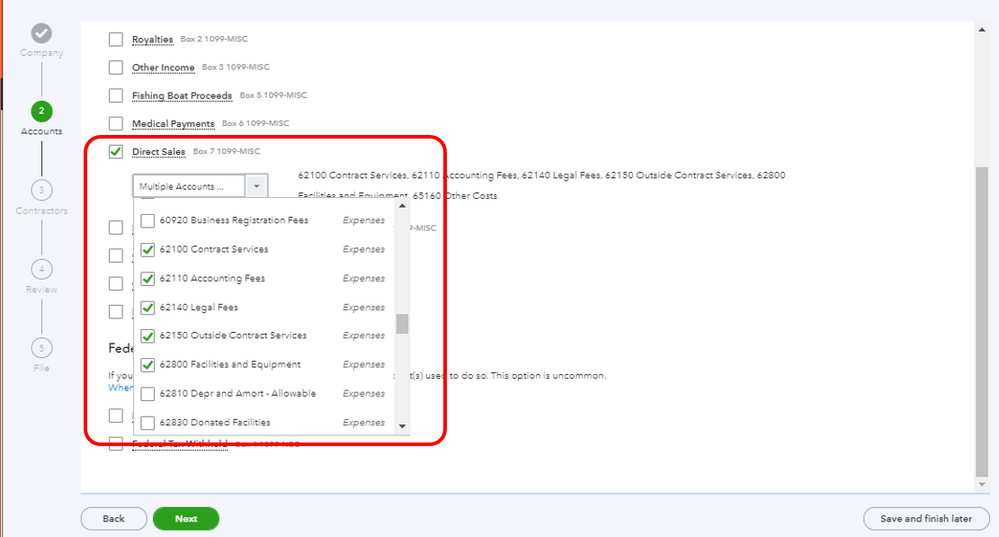

You can select the drop-down arrow for the Direct Sales section and select the accounts that need to be included. This allows you to choose multiple accounts.

Please see the screenshot attached for your reference:

To add up, you can always check out this link to help you in modifying your 1099-MISC and 1099-NEC filing in case you need it: Learn what you need to do in QuickBooks Online if you have to file both a 1099-MISC and 1099-NEC.

Keep me posted on if there's anything else that I can assist you with. I'm always ready to help. Happy holidays!

Thank you very much! I will try this!

I am having the same problem with QBO. Now I can get one account identified as a 1099-NEC in the non-employee compensation box, and one in the Direct Sales box. But I still need one more! Direct Sales does not allow for multiples.

Thanks for bringing this attention to me, @finallysue1.

I’m here to help and share with you some insights on how to get around this issue. Let’s try logging out and logging in to refresh your QuickBooks Online (QBO) account.

Once done, prepare your 1099 again to double-check. If the issue persists, log out to your account and clear your regular browser’s cache. QBO uses cache file to help load the page faster on your next visit. When this gets outdated, this causes issues and affects the views and performance of your account.

Clearing your browser cache file helps your browser to function swiftly and efficiently. If this is not the case, try using other supported browsers to see and check if this is a browser-related issue.

You can also check this link for additional reference in mapping your 1099’s in QBO: How to modify your chart of accounts for your 1099-MISC and 1099-NEC filing.

In case you have other questions about 1099, you’re always welcome to share them with me. I’ll be around to listen and help you out. Keep safe and take care!

The problem is that you should be able to identify the type of 1099 each different recipient should be receiving and then regardless of which GL account a payment to that recipient was charged to, the total payments to that recipient should be added into the 1099. For instance, our rent gets charged to rent expense, except the month that we were able to use 1/4 of our security deposit which came out of prepaid. So when our 1099s printed the amount that was charged to rent expense for our landlord came out as a rent payment (correctly), but the amount that came from prepaid showed up as "other income" (not correct, it is still rental income). The 1099 prep should be driven by the payee and you should identify what type of income that payee is receiving (1099 misc, rent, legal, NEC, etc) and then QB should pull the total payments to that payee and insert the total payments into the 1099 as you have identified it. This is also a problem where accounting fees and legal fees are in one GL account. I would like to identify the accountant as 1099 Misc income and the legal firm as legal fees, but because they are both in the same GL account it is all going to legal.

I am now able to indicate which accounts should be included by adding the other two on the Direct Sales box. But when I run the 1099 report it ignores that completely! In one case the contractor would need the 1099 if a second account was included. He is not in the report. Another contractor is in the report, but the amount does not include the money from the second account.

Let's get your contractor and amount shows in the 1099 report, @finallysue1.

There are reasons why a contractor won't appear on the report, and we'll use them to guide you in fixing this.

First, let's ensure that the Track payments for 1099 box is selected in their profile.

Second, if you paid your contractors with a credit card, debit card, gift card, or PayPal through your Payroll product account, you'll want to edit those transactions and use a different method like check or expense.

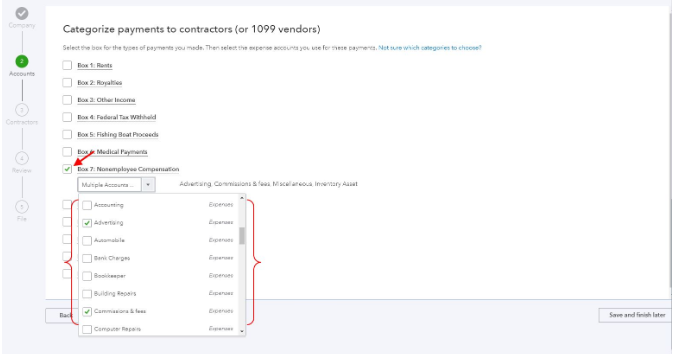

Third, if the accounts and amounts you used on your vendor transactions are not mapped for 1099, then the transactions will not show on the report. This includes the accounts you used on your items. Here's how to map them:

You can run your 1099 report after checking and correcting your records.

For more information, please check out this article: Fix missing contractors or wrong amounts on 1099s.

Please click the Reply button if you need anything else. I'll get back to you as soon as I can. Have a nice day.

When I go to choose an account for NEC which is contractor it is blanked out and I can only choose that for 1099-Misc.? Why is that?

Thanks for joining on this thread, @kkhosch.

I'll share some troubleshooting about creating 1099-NEC in QuickBooks Online, so you're able to submit it as soon as possible.

Let's make sure that your contractor is active and set up for 1099 tracking. You can follow the first steps presented by my colleague Rubielyn_J above to check their profile.

Second, ensure that your 1099-NEC accounts are mapped correctly. That way, you'll able to choose the appropriate account in the box.

Please run the 1099 Transaction Detail Report to verify the amounts are showing in the correct accounts for the 1099-NEC and 1099-MISC. After that, create a new account by going to Chart of Accounts.

Once done, you can now transfer the payments to the new account using Journal Entry. Please go to the Plus icon, then under Other select Journal Entry, and complete the required data.

For the precise instructions, you may refer to this article: How to modify your chart of accounts for your 1099-MISC and 1099-NEC filing.

The last step is to re-process the 1099-NEC. From there, the 1099 accounts are visible.

Please note that the form 1099-NEC due date is February 1, 2021. Ensure to submit the form before the said date to avoid getting penalties. For more details, you can check this article: Tax year due dates.

You can also read these articles for other fixes and details about 1099s:

Please leave a comment if you have any other questions. As always, I'll be here should you need further assistance. Keep safe!

This has finally been fixed! Thank goodness.

Finally fixed.

Do I need to give a 1099 Misc to the landlord?

This depends on how your landlord is set up in QuickBooks, @Accutile.

As long as he’s part of your contactors and you file with us, we take care of mailing a printed 1099 copy so they can use it for their tax filing.

Contractors with email addresses will receive an invite to access their 1099 forms online. See Invite a contractor to add their own 1099 tax info for more details.

On the other hand, you can also provide him a copy if needed. I have here instructions to guide you more about the 1099 process.

Don’t hesitate to reach out again if you have other 1099 concerns. I’m always here to help you out. Have a great day ahead!

I am shocked .Why quickbooks hasn't asked for payment to e-file 1099-NEC. Can anyone please explain. I am confused is the filing even completed or not? All I see is this one?

Hi there, @tabassumr055.

Let me add clarifications on when QuickBooks set payments for the e-filing service for 1099-NEC.

You can click the Continue to e-file button. From there, you'll see the jump start pricing of $14.99. It includes creating and e-filing up to three 1099-MISC forms to the IRS. For each additional form, the price is $3.99. I advise you to check this link for more details and available discounts: E-file 1099s.

On the other hand, you can also pull up the form for free (as long as you have an active payroll subscription) and manually file it to IRS. The IRS requires you to send 1099s on pre-printed paper forms. You can purchase your 2018 Pre-Printed 1099 Kits with us. This kit includes paper forms 1099 and 1096 and compatible double-window envelopes.

For additional insights about 1099, please check this link: Common questions about 1099s.

Lastly, you can check out this article in case you will need them when e-filing your tax forms: Troubleshoot Common 1099 Issues.

If you have other questions in mind, feel free to place a comment here. I'd be happy to help. Take care!

Using a different browser solved the issue for me. I switched to Chrome when using QBO.

We have many payments that are annual or quarterly payments , so they go to prepaid and are amortized over the time period to which they relate. I just ran a 1099 transaction report and lo and behold, no payments that went to vendors but were charged to prepaid expense appear on that report!!! Why??? They are all marked to track payments for 1099s. Why does QB care where I choose to expense the payment (or in the case of ppds, set up and amortize)? How can I make the 1099s pick up all payments to the vendors I am tracking for 1099s, not just the ones whose payments hit an expense account directly?

So frustrating!

I acknowledge the convenience of having the ability to review all your vendor payments on the 1099 Transaction Detail Report, lsefcik.

There are several reasons why some transactions are not visible in its data. No worries, I'm here to share further information and provide steps to help you get going.

For context, here are some common factors that could affect the said report's transactions:

By default, the 1099 Transaction Detail Report will only display the data included in the 1099. However, we can customize it to show all vendor entries regardless of their associated account.

To proceed, let's change its Filter accurately:

You may also save the modifications you've made to the report. This way, you don't need to go through the given steps once you want to check all your vendor payments moving forward.

Tap the Reply button if you have follow-up concerns about your transactions on the 1099 Transaction Detail Report. I'm always ready to assist you.

I have done everything this solution suggests and the 1099 transaction report still is not picking up over half of my vendors designated as 1099 vendors and well over $600 in payments for 2024.

Ensuring your vendor appears on 1099, lsefcik. Let me guide you to the right support team to assist with your tax form concerns.

Since the issue persists, I recommend contacting our customer care team. They have the tools to pull up your account in a secure environment and to identify why your 1099 transaction report isn't capturing all necessary payments.

Here's how to reach them:

Here are some resources that you might need for additional information about managing 1099s in QuickBooks Online (QBO):

I'm always prepared if you have more questions or concerns about managing your 1099 reports. Kindly leave a comment below, and I'll promptly lend a hand.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here