Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Thanks for sharing the details with me, @turnerjason97.

You’ll want to ensure you changed the hire date of your employee and update their W-4. This way, you’ll be able to successfully run their payroll. Let me guide you how:

You can also check this article to learn more about 2020 Form W-4: FAQs on the 2020 Form W-4. Once done, you can now run payroll to your rehired employee.

Additionally, let me add this article that you can use for future reference: Invite your employees to QuickBooks Workforce to see pay stubs, W-2s and more. This link can walk you through the steps on how you to let your employees view their pay stubs online.

You’re always welcome to post in the Community space whenever you have other queries about running payroll for your employees. I’ll be around to help you. Take care!

We are having a different issue regarding a rehire. This employee cannot access his workforce. He shows in the cloud that he has signed up. However he no longer has access to the email address he signed up with, nor the phone number he was using. I have updated QB to the new email, which updated the cloud, but he still cannot access his workforce. I see no way to send him a new invitation or deactivate the previous login so he can set up a new one. Please help.

I've got you covered, @RollinsOfficeAdmin.

Thanks for joining in on this thread. I can point you in the right direction of how you can get your rehire access to his workforce. All you need to do is cancel the current access they have with the old email and phone number, and then update the email to send a new invitation in your QuickBooks Online (QBO) account. It only takes a few easy steps.

Here's how:

In addition, you can give your employee this guide about setting up their QuickBooks Workforce account.

Once you've done these instructions listed above, your employee shouldn't have any problems accessing their Workforce account. Should you need any further assistance, don't hesitate to contact me. I'm only a comment away. Bye for now!

Hi Candice,

Thank you for the steps. It appears these directions will not work for me as I am using the Desktop version. I do not have the "Revoke Access" option and have not been able to locate anything similar in either my main view or the Admin profile. Please let me know how to do this using the Desktop version of QuickBooks.

Let me share additional information so your employee can view their paycheck, @RollinsOfficeAdmin.

Updating your employee's email in QuickBooks won’t affect their account or access once they accept your invite and logs in to QuickBooks Workforce. However, you need not worry, you can cancel the initial invitation and resend it.

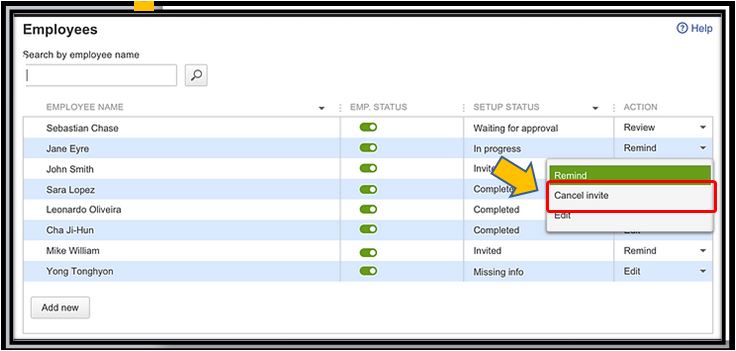

Here's how to cancel an invitation:

Now, you can review the employee's detail and enter his or her updated email and phone number. Once completed, you can send the invitation again. You can read through this article for more detailed steps: Use employee self-setup for QuickBooks Desktop Payroll.

Also, I've added these articles as an additional reference in managing your employee's Workforce account:

I'm here for you if you have any other questions, just leave a comment below. Have a great day!

Thank you. I tried to do this, however, I do not have the "cancel invite" option in the dropdown. None of the employees show this option. The only option that appears is the 'edit' option.

Thanks for coming back to the Community, RollinsOfficeAdmin.

I appreciate your efforts in trying to resolve the issue and sharing the result.

Since you’re unable to see the Cancel Invite option, I recommend contacting our Payroll Care Team. One of our agents will ask for your personal information and email address of the employee to access your account. From there, they’ll configure the setup to make sure you can resend the invitation.

Here’s how to reach them:

For future reference, here’s an article that will guide you on how to invite your employees to enter their bank and other info for payroll: Use employee self-setup.

Feel free to drop me a comment below if you need help with QuickBooks. I'll be around to assist further. Have a good one.

I have several employees who were sent an invite to view their paychecks. They are no longer able to view and I can not re-send their invite. How do I handle that?

I can see the importance of having your employees to view their paychecks with no issues, @Rosemark1.

To help determine the reason behind the problem that was encountered by your employees, I suggest contacting our Customer Care Team. They have the tools to further investigate the root cause of this matter including why you can't resent the invite.

Reaching out to our representatives would be the best way to get this issue sorted out if you've tried the steps presented above and the problem continues. Doing this can help them check your employees' credentials in the system to get this working.

Here's how you can contact them:

For now, you may print the paychecks manually and send them to your employees so they can have their own copy.

Keep me posted on how it goes, Wendy. I'll be around to help if there's anything else you need. Take care!

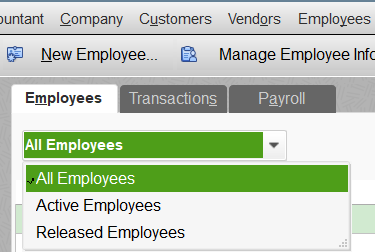

What are the steps to reactivate a terminated employee in Quickbooks desktop?

How do I reactivate a terminated employee on Quickbooks desktop?

Hi, @tinateen4_benson. I'd gladly help you reactivate a terminated employee in QuickBooks Desktop (QBDT).

The following steps will guide you on how you can get your employee active and back on payroll:

You can get more details about modifying an employee's status in this article: Terminate or change your employee's status on payroll.

Once done, you can pay your employee right away and might want to invite them to QuickBooks Workforce to view their pay stubs.

You can always get back in the forum whenever you have payroll concerns or if you need help managing your employees, @tinateen4_benson. The Community team always has your back.

SAME ISSUE HERE - so re-entered his same info and id with a . after his first name. NOW I have tax nightmares - he is left off all State tax reports, all job cost reports. WTH.

QB shows me NO Way to merge those two together.

Help.

When reinstating or rehiring an employee, we recommend only to use the existing profile, suzi102. Let's get this corrected for you.

Before we begin correcting the payroll data of the affected employee, let's create a backup copy of your company file. We can restore this file if we encounter issues while correcting the data.

Based on the details you've provided, the rehired employee now have two profiles with payroll transactions. This situation will surely give us a hard time, but it is not impossible to correct them. I'll guide you all through out the process.

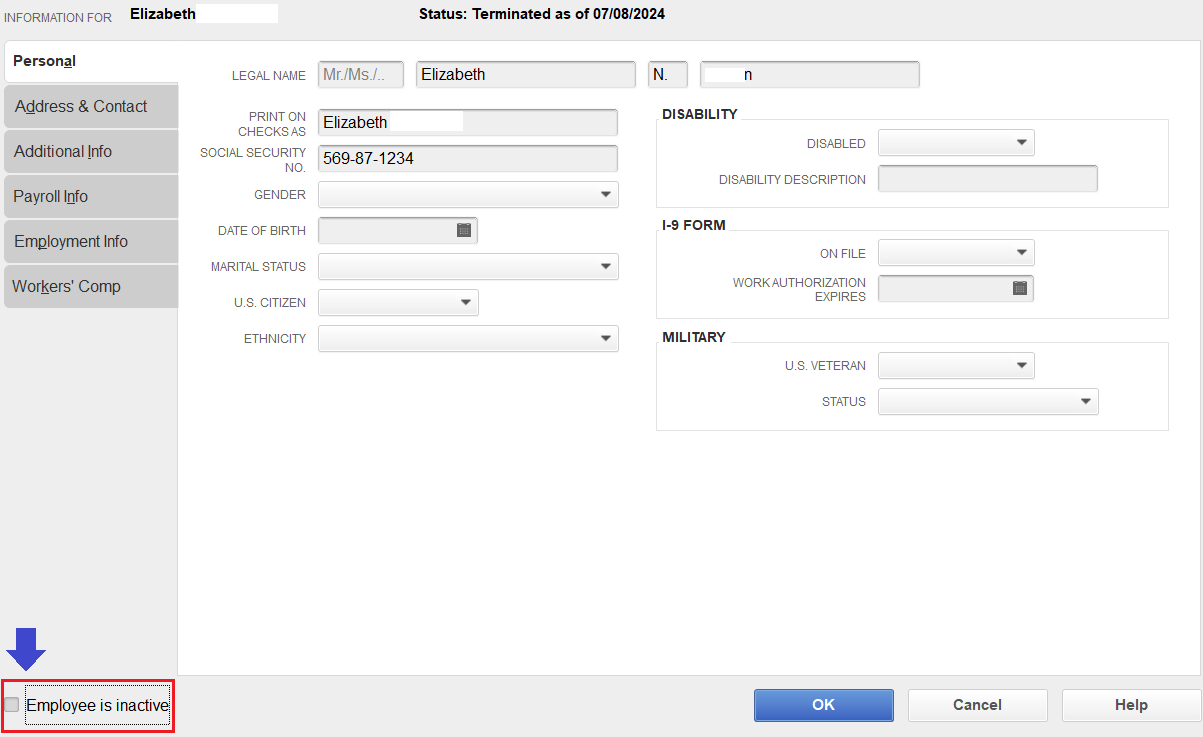

First, let's make sure the original employee profile is active.

Now, the original employee profile is active. Note that we cannot merge the original and new profiles because there are transactions associated which will impact your filings and the employee's W2. We'll have to move those transactions manually.

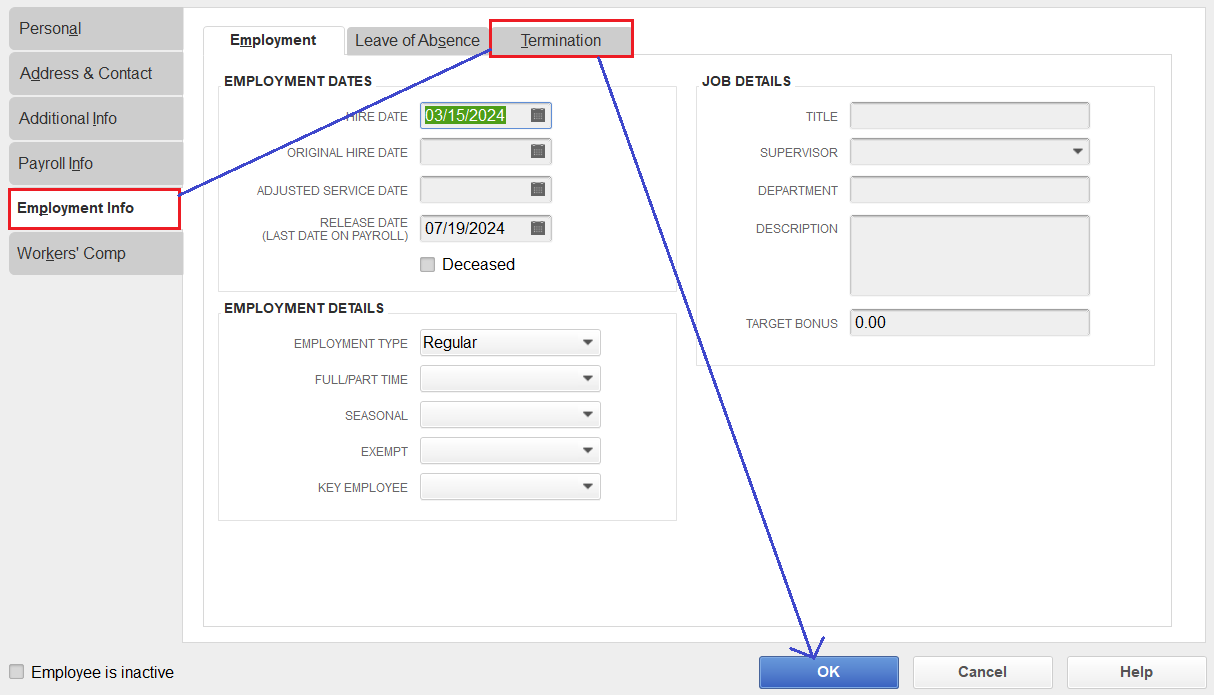

Let's go back to the original employee profile. We need to remove the TERMINATION DATES and the RELEASE DATE (LAST DATE ON PAYROLL).

For the next process, let's go to the new employee profile. We'll have to take note all the details of the existing paychecks.

Then, let's recreate the paychecks under the original employee profile. We can use the Start Unscheduled Payroll if needed. Here's an article for reference: Create and run your payroll.

After that, we can already delete the paychecks under the new employee profile. And from there, let's delete the new employee profile.

Lastly, let's run a Payroll Checkup to see if there are still missing information that we need to enter: Run Payroll Checkup in QuickBooks Desktop Payroll.

Once we are settled with the data correction, make sure to create an updated backup copy.

I'd also recommend reaching out to IRS or to your accountant for any advice regarding the previously filed forms. Here are some references to it:

The process is a little lengthy, but it will give us a peace of mind that we have already corrected the payroll data.

Feel free to drop a commend if you have questions of the process I've shared for you in correcting your employee's data. We got you on this!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here