Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowI'll share some information about why payroll taxes are not deducting from your paychecks, @vandervoort1976.

There are various reasons why payroll taxes aren't calculating. Among these are:

Let's make sure your QuickBooks is in the latest version as well as your tax table. You can also review the employee's tax setup since it affects how QuickBooks calculates it.

Once done, please revert your employee's paycheck. This refreshes your payroll information to calculate the taxes on the transaction.

Here's how:

Additionally, you can check out these articles for more troubleshooting solutions when payroll taxes are not withholding:

Feel free to reply to this post if you need a hand with running employees' payroll reports. I'll be here to help.

Hi Customer, @vandervoort1976.

Hope you’re doing great. I wanted to see how everything is going about the paycheck taxes issue you had yesterday. Was it resolved? Do you need any additional help or clarification? If you do, just let me know. I’d be happy to help you at anytime.

Looking forward to your reply. Have a pleasant day ahead!

Hello -

I'm having the same issue. I checked the 3 items that you suggested and it still is not working... Any other ideas?

I'll make sure that you can run your payroll accurately, Lindajp747.

To further isolate the issue, you'll want to make sure that you're using the latest release of the payroll tax table and QuickBooks Desktop. This is to ensure that you'll get our newest payroll updates, security patches, and bug fixes.

After that, you'll have to revert your employee's paycheck to start over fresh. Here's how:

If you've already issued the paycheck, you may need to void or delete it. Then, start all over again. For additional troubleshooting steps you can visit this link: QuickBooks Desktop calculates wages and/or payroll taxes incorrectly.

I'm also adding this article to help manage and track your payroll transactions in the program: Customize payroll and employee reports.

Don't hesitate to visit this thread again if you need additional assistance in accomplishing your other payroll tasks. I've got you covered.

I have tried all the suggestions listed here

I have run all the updates

I ran the tool hub and the file doctor

No luck - no taxes are being taken out

Hi scrappersam,

Thanks for trying all the steps that my colleagues shared. At this point, I recommend contacting our QuickBooks Desktop Payroll Support. That way, they can check your setup and your payroll transactions.

You may also call the number in this article: Contact Payroll Support. Just expand the QuickBooks Desktop Payroll section.

Let me know if you need anything else. Take care and have a good one!

Why is quickbooks not calculating taxes on my payroll

Hello, @Csd1984. I'm here to help you isolate the issue with why payroll taxes aren't calculating.

You'll need to make sure that your QuickBooks is in the latest version as well as your tax tale.

Here's how:

Once download is complete an informational window will appear and revert your employee's paycheck.

Here's how:

In case QuickBooks calculates payroll taxes in correctly, you can refer to this article for the steps to fix it: QuickBooks Desktop calculates wages and/or payroll taxes incorrectly.

Ping me a reply if you need more help in managing your payroll taxes. I'll be sure to get back. Have a good one!

This is so frustrating to many of us. Part of the problem is income tax laws changing and part of it is the user friendliness/setup of QB payroll.

A few questions..

1) did this person make gross wages per paycheck that are so low that no federal taxes are taken out anyways?

2) was there any mid year changes on their personal deductions? For example, did they have a kid this year and change deductions? did the kid they who is no longer a deduction? Did they get married this year?

3) sometimes it goes back all the way to how you set up your payroll items in the first place, do you have an accountant to help you review that?

Issue is that QB customer service folks are NOT accountants nor payroll gurus. They are simply employees of a software tech company, they are not bookkeepers or accountants. They know how QB was intended to work properly, and it will, IF you have it set up right, I have had many times that QB support folks tell you to do something that is correct solution from a software standpoint, but it is NOT correct from an accounting standpoint.

Hi, I’ve set up an employee and trying to run pay roll should QB calculate and remove tax & Ni? The employee only does 10 hours per week @ £15.00 per hour. The employee has another job not sure if this makes a difference. Please help

Help has arrived, Robert. I’m here to provide insights how your payroll taxes are calculated.

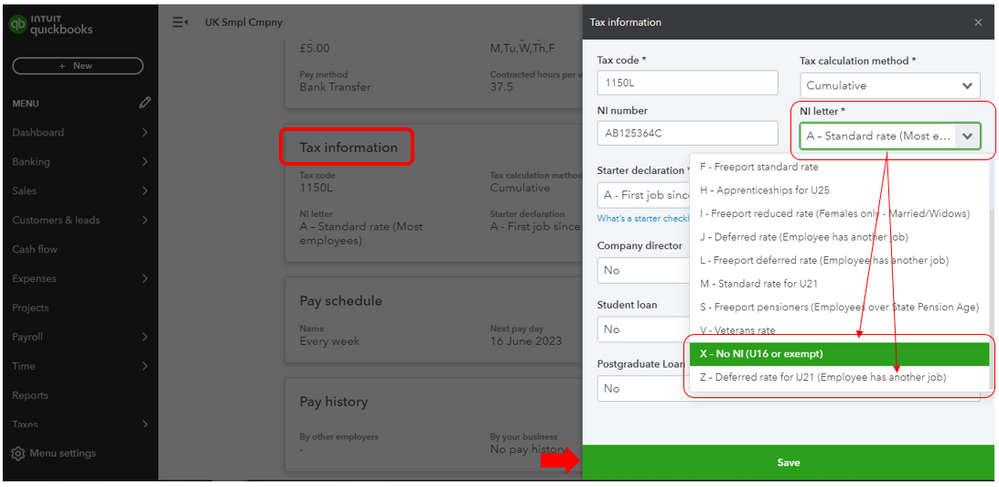

With QuickBooks Payroll, taxes are calculated automatically. If your employee isn’t required to contribute to a specific tax, you can set them as exempt. Here are the steps to do it:

You can consult your tax professional or agency if you aren’t sure if an employee should be excused from certain taxes. They can provide more information about it and help ensure you can process payroll accurately.

If you don’t have a tax advisor yet, check out our ProAdvisor website to find one. Our consultants can also guide you further from technical and accounting perspectives. Just enter your city, state, or ZIP code in the box.

Once the setup is complete and accomplished running payroll, you can email and print your employee payslips or invite them to QuickBooks Workforce to save time.

I’ll be here anytime to help if you need further assistance operating your payroll. Just let me know by posting another comment below.

i have two companies. one company payroll was fine. 2nd co. payroll does not deduct payroll taxes from pay checks

Thanks for getting involved with this thread, peh2.

There's a few reasons payroll taxes may not be calculated from paychecks:

Initially, I'd recommend confirming your books are updated to their latest release. Next, you'll want to make sure you're using the payroll product's most recent tax table.

After you've confirmed you're using your product's latest updates, you can try reverting the employee's paycheck:

You can also refer to some of our additional troubleshooting processes in the Troubleshoot paychecks calculating incorrectly article.

If you've checked each possible scenario in our article, but didn't find a reason taxes aren't being taken from paychecks, you'll want to get in touch with our Customer Care team. They'll be able to pull up your account in a secure environment, conduct further research, and create an investigation ticket if necessary.

They can be reached while you're using QuickBooks:

Be sure to review their support hours so you'll know when agents are available.

I've also included a detailed resource about system requirements for QuickBooks which may come in handy moving forward: System requirements

I'll be here to help if there's any additional questions. Have a great Friday!

If you have ever signed up for Direct Deposit and then decided that it's not worth it (it's not) and you don't use the feature anymore, unfortunately you are in for a special kind of hell in quickbooks.

Even though you aren't using DD, the system thinks you are using it, and ques the paychecks into a "to be sent" folder. Once this folder is full, you can't update your payroll taxes anymore, and can't run a proper payroll.

You have to jump through some hoops to clear the folder of paychecks waiting to be "sent" even though you aren't using DD anymore. There's no way out of this. You can't "unenroll" from DD service. The fees for DD are outrageous and the time between running payroll and when your employee receives his/her hard earned pay is ridiculously long.

Quickbooks - figure this out. It absolutely sucks.

Judi Martin

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here