Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have asked my Qs several times and also talked to 4 technicians on the phone on efiling NC W2 for 2021. I followed all the instructions on how to efile NC W2 but QB failed to make it work.

I have QB Desktop Enhanced Payroll; am using MS Edge as a browser. Have been updating the Payroll Update almost every day.

Look like the feature of enabling efiling NC W2 for 2021 is NOT there yet. The deadline is end of this month. Do not want to do this at the last minute. This is unacceptable.

When will QB make this feature available???

I want to make sure you can e-file your North Carolina W-2 forms in QuickBooks Desktop, 105274462.

You can follow these steps below and file your North Carolina W-2 forms.

If the issue persists, let's revalidate your payroll service key to refresh your payroll subscription. Here's how:

If you get the same result, let's run the repair tool to help fix company issues in QuickBooks Desktop. Let me guide you on how.

If none of this works, I recommend reaching out to our QuickBooks Support Team. This way, they can further investigate this matter and provide in-depth troubleshooting steps to get the e-file option available for NC W-2 forms.

Feel free to check out these articles that will help you manage your state payroll taxes:

You can always get back to me if you have other concernsa about filing your taxes. I’m always around ready to help

NO, not resolved. Followed your instructions but it does not help.

Can a tech contact me to make an appointment to walk me thru the process?

Call me or Send me an email for setting up an appointment with me please.

FYI already called 4 times with a live tech but all could not help The last tech told me that Intuit is having big problems with the federal W2 with IRS and once that issue is resolved, my NC W2 efiling issue should be fixed????

Hello, 105274462.

The e-filing options for North Carolina have been temporarily removed from the most recent payroll update. Our engineering team is still working with the IRS to resolve some minor issues. We'll make sure you don't miss the deadline for submitting those forms.

A new update will be rolled out soon. You'll receive an in-product notification to update to the latest release. If in case you missed it, you can manually update your QuickBooks Desktop.

Here's how:

You can also check this resource for more details: Latest payroll news and updates.

Thank you for your great understanding. Rest assured, you'll be able to e-file your NC W2 soon once the issue is fixed.

Also, we're unable to collect personal information or pull up your account here in the Community space due to security reasons. I recommend reaching out to our QuickBooks Desktop Support again to schedule a callback or start a chat.

You can get back to me if you have other concerns about filing your taxes. I’m always around to help. Stay safe!

How are you going to notify me when the NC W2 efile is fixed? I cannot even change my email address which is not updated in QB Payroll notice.

I really do not like to do things in the last minute; this is nerve wrecking.

I can share some information about e-filing your state payroll tax forms, @105274462.

You can reach our Payroll Support team to help you get notifications about when to e-file your North Carolina W-2.

Follow the steps below on how to reach them:

Check this article for more information about the different types of support we offer and their availability: Contact QuickBooks Desktop support.

You can also set your QuickBooks Desktop to update automatically. It'll automatically download updates when they're available.

Just follow the steps below:

You can also download specific updates directly from our website, for more information refer to this article: Update QuickBooks Desktop to the latest release.

For more information about creating your W-2s and uploading Copy 1 directly to your state agency, or file them electronically depending on your state, refer to this article: File your state W-2s with Quickbooks Desktop Payroll Enhanced.

I'm always here if you need help submitting your forms. Let me know by leaving a reply below. Keep safe and have a wonderful day!

Can I give you my email address and pleas notify me when the NC W2 efiling problem has been resolved. I found out that I cannot change my email (outdated) and I did following ALL the instructions and all failed. I talked to 4 technicians but they could not help me every time calling the tech support, I had to put in 1.5-2 hours on the phone (and screen sharing) and all failed. So I spent lots of time on this issue.

I'm having the same issue. I did receive an email on January 6 announcing the "new simpler way to e-file" NC W2s. It seems like a follow-up email to alert on the failure would have been appropriate.

Thank you for the info and I did do the Payroll Updates but after the Update the Payroll version is still 01140200 - NOT version 01140204. I did update the Tax Table which is 22202.

How do I get the Payroll version 01140204??

Hi, 105274462.

I understand that you've been through a lot already. I'm here to ensure you'll be able to get the updated payroll version in QuickBooks Desktop.

You may want to try it one more time and make sure to enable the Reset Update option. It fixes issues related to any critical update, as well as other possible errors within the product.

Here's how:

Once updated, I recommend closing QuickBooks and restarting your computer once again.

I've included this article about sending your W-2s to your state agency: File your state W-2s with Quickbooks Desktop Payroll Enhanced.

I'd appreciate it if you'd update me on how the steps work. I want to make sure you everything is taken care of for you.

This is [removed]. Unfortunately, still the NC W2 efile is still NOT working. And I did follow all the instructions but still it is NOT working. After the Updates the Payroll version is still 01140200 - NOT 01140204. The Tax Table has been updated 22202.

This is QB Desktop Payroll. I am thinking of what are other things that made the NMC W2 efile not working>

Is there a limit of the # of companies that can be maintained on One subscription? I only have 12 companies within my accountant's subscription.

I use MS Edge.

About contact Payroll Support Team - they are all entry level people and I had talked to them (with screen sharing) 4 times already all they could not help me. They had to spend a long time just to understand what I was talking about. They put me on hold several times and then at the end we were cut off (time limit of phone tech support?). What kind of support is that???

So what do I do now. There are less than 10 days left to efile NC W2!!!

Can you get me a higher level of Tech Support such as the engineering team that knows the software???

Hello, 105274462b. I can see the effort you've done to get this fixed.

There's actually no limitation on the number of companies you can open or create in a single subscription.

You'll want to follow these steps want to create multiple company files.

If these steps are not succeeding, please let me know the errors you've got.

Also, I see that you've contacted with our Support Team, however, I'd still suggest giving us a call. We'll have to conduct further investigation on this concern. One of our specialists will look into your issue further using their appropriate tools.

Within your QuickBooks Company file, select QuickBooks Desktop Help from the Help menu. You can also press F1 on your keyboard to bring up the same Help panel.

To route you to the correct support expert, we need to know what type of question you have. Give a brief description of your issue and click Continue.

You'll want to check this article for additional details: Common W-2 questions.

Visit again if you need anything else. We'll be around.

I followed ALL instructions provided and still cannot efile NC W2. Called TechSupport with Scree Share and they could not help either.

Need high level assistance - walking thru each step with me on the phone (and screens share).

The due date of efiling NC W2 is Jan. 31 and I have 10 companies that I need to efile NC W2. NC imnposes $200 per company for NOT efiling on time by 1-31-2022.

I used QB Desktop Payroll with an active subscription.

This isn't the kind of service that you should experience, @105274462.

Let me help point you in the right direction to resolve this issue.

I know you already contacted our support, however, this is the best option we have for them to further investigate what's causing this issue.

Here’s how:

You can also check out our support hours to ensure that we address your concerns on time.

For more instructions about sending your state W-2s to your state agency, open this article: File your state W-2s with Quickbooks Desktop Payroll Enhanced.

To get some answers about W2s, you can also check out this link: Get answers to your W-2 questions.

Please let me know if you have any other questions about the NC W2 E-file. I'm more than happy to help. Have a good one!

I did do the support via QB Desktop Payroll an hour ago and of course today is Saturday and so no one is available to help yet. I entered my preference of contacting my phone.

Very concerned that I have to pay $200 per company (10 companies) to NC of NOT efiling NC W2 on time (due Jan 31, 2022 !!!

I understand the urgency of filing your NC W-2, 105274462.

However, the latest payroll update doesn't include e-filing for North Carolina. You can also check this link for more details: Latest payroll news and updates.

We'll keep you updated through this thread once there's an update from our Payroll Team. You can also request a callback from our Live Support Team this Monday.

Here's how:

You can also browse this link in case you want to call them: Contact Payroll Support. Choose QuickBooks Desktop Payroll and dial the phone number.

I appreciate your patience about this and hope to hear an update from you again after contacting them.

There is only 1 week to the due date of 1-31-2022 and QB has NOT yet updated to make NC W2 Efile work???

This is unacceptable!

Seems that different QB moderators have different answers - one said the NC W2 eifle feature is there and one said Not yet.

Let me make it up to you, @105274462. I want to ensure you can file your tax form electronically.

With the recent updates, customers are now able to electronically file W2s in QuickBooks Desktop Payroll for the state of North Carolina. Preparing and filing this form can be done in the Payroll Center. Let me show you how.

Use this article to read and learn more: File your State W-2s for North Carolina with QuickBooks Desktop Payroll.

I'm adding this reference for tips and guides to utilize in preparation for the coming year-end: Complete Certain Tasks in QuickBooks to Prepare for the New Fiscal or Calendar Year.

It'll always be my pleasure to help if you've got questions other than filing your tax forms. Let me know using the Reply option below and I'll surely be around to help. Take care!

This is very frustrating b/c I followed all the instructions provided and all failed. Cannot submit the NC Efile worksheet b/c I have to go to Payroll Interview first and there is NO Payroll Interview???

Only have 7 days left. HELP!!!

Hello 105274462,

I can see that you've been posting your concern here several times about submitting your NC E-file worksheet. I'd like to provide additional information about it.

The Payroll Setup Interview in QuickBooks Desktop is where you can access it by going to the Employees menu and selecting the Payroll Set up. Afterward, you're asked to set up the information.

Basically, you'll have to go through with the payroll setup or payroll interview when getting started with the payroll service in QBDT. It guides you through setting up everything you need to run payroll and pay employees.

Still, I recommend following the steps outlined by my colleagues AbegailS_ or JonpriL. Note: Make sure you're using the QuickBooks Desktop Payroll product when performing those steps.

If you're using QuickBooks Online (QBO) Payroll, these are the steps applicable for you:

You can also use this article as your reference when e-filing your W-2 form from the Payroll menu in QBO. Go to the QuickBooks Online section to view the details.

You'll want to check this article to know more about Payroll Tax Compliance: North Carolina.

If the same thing happens, please give us a short call. This way, our specialist can help us determine the issue why you're unable to do it.

Please let me know how everything goes. I want to make sure you're able to process the form. I'll be around anytime.

I've read through this thread and I'm in the same situation as [removed]. I am unable to file my W-2 with NC. The E-File button is greyed out. Clicking on "How can I e-file this form" opens a page with possible reasons why the F-File button is unavailable. The first item in the list says:

Set up this form for e-file in the payroll setup interview. The payroll setup interview guides you step-by-step through the process. How do I set up forms for e-file?/Intuit/QuickBooks%202020/QBFormhelp.chm::/button_expand_green_open_lo.gif)

Yet if you hover over the "How do I set up forms for e-file" a javascript error pops up.

Going through the Payroll setup process there is no step or mention of setting up forms for e-filing. The section on taxes has only State withholding and State Unemployment. Both are already there and set up. There is no mention of setting up the W-2 form for filing to the state.

I've updated Quickbooks DT to the latest version and reset the updates as listed here numerous times.

Honestly the responses from Quickbooks here appear to be little more than bots spewing out the same steps to update or run the payroll setup. It's not helpful as none of it is working.

The "instructions" on the form itself aren't even instructions at all.

"Your North Carolina State W-2s are to be electronically filed by January 31, 2022 to the North Carolina Department of Revenue. If the due date falls on a Saturday, Sunday, or legal holiday, the W-2s must be filed by the next business day. DO NOT MAIL THE W-2S"

Well HOW I might ask?

The implementation of this and communication to customers about it has been pathetic. I too received the email about e-filing the W-2. It has the same instructions regurgitated here by the support bots numerous times. I've not received one single piece of communication informing me the e-file has been temporarily removed or reinstated.

Some on here say it's working again just to be contradicted by posts that say it's not available.

The messaging on this issue is failing miserably.

I'm lost. HOW do I file my W-2 with the state of NC? I need help, not bots with steps.

Thank you

I posted an lengthy reply that I'm having the same problem and the post never got published.

How do I file my W2 to NC? The steps provided numerous times in this thread do not work. The E-File button is greyed out. I have updated everything including reset to the latest everything. Restarted and still it's greyed out. Communication on this issue has been horrible as the filing deadline is a week away. The button is greyed out.

How do I file my W2 to NC?

Hello [removed],

I got this to work tonight no thanks to any of the steps provided by support in this thread though. Here's what I did. Rather than going to Payroll Setup, which doesn't have settings for how to file which forms.. Go to the File Forms tab under Payroll. Choose "Change Filing Method" at the bottom.

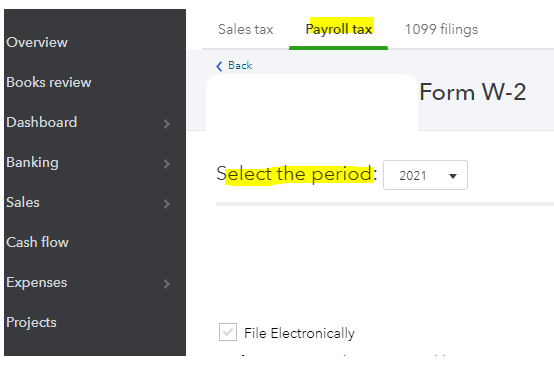

And this dialog will come up. Choose "Filing Methods" on the left, select North Carolina Form NC-3, choose Edit and then enable E-File. Like this:

After doing this the E-File button became active for both the NC-3 and W-2 Worksheet for NC. I filed both of them and got filing confirmation dialogs within QB.

Hope this helps..

A Bunch of Thanks to this user. I followed his/her instructions, and it did work after trying to file Change Filing Method on my Desktop Payroll. The filing method is in very small fonts at the very bottom.

Thank you very much to this user. FYI I started doing the manual method of uploading the NC W2 on NC DOR's eNC3 for 1 company with 1 employee and it worked but of course that is not feasible for other companies with many employees.

I do hope that QB Payroll would improve their support and communicate workable workaround to their clients.

I agree. This should have been one of the first things noted in the instructions for NC e-file. I also spent hours on the phone with Quickbooks and got mixed messages. The first tech did mention changing my filing option which I already had done. I actually need the excel option to add two companies together to file. One tech said they would add it back and another said NC requested it to be removed. The e-file option is great for most. What about others that need the excel option? I can't see why it would be an issue to add it back in. Glad you got your answer.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here