Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

When will this form become available as part of the 941, I have clients who can qualify for the credit but they did not take a Form 7200 advance of the credit. I need access to worksheet 1 to correctly account for this on their 941 for the 3rd quarter.

Newest payroll update for desktop payroll which includes accommodation for the optional employee ss deferral also includes an updated 941. Run payroll update and then check out the form

Thank you but I need it for the employee retention tax credit and not to defer the Social Security tax, they have a spot to enter the Form 7200 advances but the client did not take any. We are trying to take the credit on the 941 form which requires a worksheet 1.

Hello again, @Stan99sp.

Form 941 Worksheet 1 is designed to accompany the newly revised Form 941 for the second quarter of 2020 and beyond. Thus, any employer who files the Quarterly Employment Tax Form to the IRS under CARES Act and Employees Retention Credit should use this Worksheet.

To make sure the Worksheet 1 will populate when opening Form 941, you should claim a credit under the Family First Coronavirus Response Act (FFCRA).

To learn more about the calculation of Employee Retention Credit. See this resource from the US Department of Treasury about the Employee Retention Credit:

Read through also the IRS topics about how Employee Retention Credit (ERC) works: COVID-19-Related Employee Retention Credits: How to Claim the Employee Retention Credit FAQs.

If you have further questions, let me know by commenting below. I'm always here for you. Have a great day.

I updated and still no Worksheet 1 with the 941. Is there some box I have to check?

Downloaded the latest payroll update and still no worksheet one to go with Form 941. Do I need to check a box somewhere to get it to calculate?

Thank you for joining the thread, @RHBird.

I'm here to share some information about the Worksheet 1 and help ensure it'll populate when opening Form 941.

The Credit for Sick & Family Leave Wages and Employee Retention Credit (Worksheet1) will show up if you've claimed a credit under the Family First Coronavirus Response Act (FFCRA). Also, if these payroll items are set up correctly including their tax tracking type in QuickBooks Desktop. You can check out this article as your reference in verifying your payroll items: How to track paid leave and sick time for the coronavirus.

You may also reach out to our Customer Support Team so they can take a further look at your account with their tools.

Here's how:

Please let me know in the comment section if you have any follow-up questions or concerns. I'm always right here to help get the form available. Keep safe!

We are having the same issue. We do not want to use the Family First benefits as that does not apply to our small business clients. We only want to manual adjust the Form 941 for retention credits. We have already prepared the payrolls. Is there a way to manually override the auto population of the Form 941? We only need to access the Worksheet 1 as we did in Q2/2020.

I'll share some information about the form, SHANNON R.

If you're able to generate the 941 form, you can right-click on the number and select override. Before doing so, please consult with your accountant or payroll tax advisor. Once done, the Worksheet 1 will be generated at the end of your 941 form.

On the other hand, if the override option is grayed out and you're unable to get the worksheet, please reach out to our Customer Care Team for further assistance. Before doing so, please check out our support hours here.

Feel free to leave a reply if you have other concerns regarding QuickBooks Desktop Payroll. I'm here to lend a hand. Thanks.

We also have the latest update and we can't override Line 11c or get to Worksheet 1. It seems like this needs to be fixed asap!

I can see how important it is for you to have Form 941 Worksheet 1, @WheelsCPA.

Since you're unable to override Line 11c or get to Worksheet 1, I suggest reaching out to our representatives. They have the tools to check your account and have a remote session for further assistance.

Here's how:

You can also check our support hours to make sure you're concern will be addressed at your convenient time.

You'll want to print forms like 941, Schedule B, and Form 940. Feel free to check this article: Learn how to prepare and print Form 941, Schedule B, and Form 940.

I'm just here to keep an eye on your reply. I'm always here to help you. Take care and have a great day!

Seems like a BS response; just get them to let us override the line 11c; we do not each need to have a frkn personal relationship with support! This is basic.

Should also provide an data enterable worksheet 1 to coordinate with it. Nowwhere has programming considered the less than 50% of revenues question that enables the credits!

Problem is their programmers may think the credit is a function of Payroll, but that is just the side-product in the calculation. Eligibility is based on other things like 50% drop in revenues. They could use a check the box approach that would open up line 11c and/or part3 , line 21, which then could make Worksheet 3 fillable. For now they just need to enable the overrides and make a worksheet 1 fillable. But no one seems to understand or even be listening!

I agree with everyone here - this is possibly the worst service by a company I've experienced in a long time. Please, please, please, please, please Intuit will you just enable the Worksheet 1 so we can manually adjust and override (like we did in Quarter 2)!!!!!

Finally found a fillable worksheet 1:

https://formslibrary.com/editor/free-write/b9c2e522ce6847088c791dc629f8bb23#pagecanvas20

Can use and write in #s to line 11c and part 3, line 21 until QBooks gets their act together?

Agree, poor service-I expect more from Intuit!

I retract that "forms" fix; they require a subscription. It is time for Intuit, who we already are paying for a fix, to come through!

Search for "How to Set up and track the Employee Retention Credit Under the CARES Act". The link is below.

You will have to add a few accounts and edit your paychecks to use these new accounts. Worksheet 1 will pop up if you follow the instructions below.

Much more complicated than it had to be. QB could have just allowed for an overide.

@Luckynodak I've found a little bit of a workaround. Follow the link in @dchan post (also, link here -- https://quickbooks.intuit.com/learn-support/en-us/pay-schedules/how-to-set-up-and-track-the-employee...)

Then, ONLY follow a small portion of the instructions in that link -- specifically, in Step 2, create the 1st payroll item (called CARES Retention Cr.-Emp). Since you didn't create the new expense account in Step 1 because we skipped that step, when it comes to selecting the expense account, go ahead and pick any account you want. We are only going to temporarily post $0.01 to that account.

Next, once that payroll item is set up, start an unscheduled payroll, select only one random employee, change paydates/payperiod end to match quarter end (09/30/2020 in this case), then open paycheck detail and remove all entries from the "earnings" section up top. Also remove any "Other Payroll Items" to the left that might be feeding unnecessarily into health insurance, retirement, etc. Essentially, you want to zero out all items for this payroll. Then, in the dropdown under "other Payroll Items", select CARES Retention Cr.-Emp item. For rate put $0.01, for quantity put "1". Then save this payroll as a $0.01 net check payroll. Finish payroll and create the paycheck in Quickbooks.

Now, the worksheet 1 should populate in your 941, and so you can override the worksheet (and override the wages on page 1 back down one penny for the $0.01 paycheck you just created, if that bugs you).

After e-filing the 941 and it is accepted, I went in and deleted the $0.01 paycheck I created. Voila! A couple extra steps, but at least nice to have a workaround.

My payroll would not let me enter the retention credit under the other items; kept referring me to edit employee other items and after trying 5 times, recalled definition of "insanity"

I'm ready to do the whiteout and shop for another program?

I appreciate your time coming back, Luckynodak.

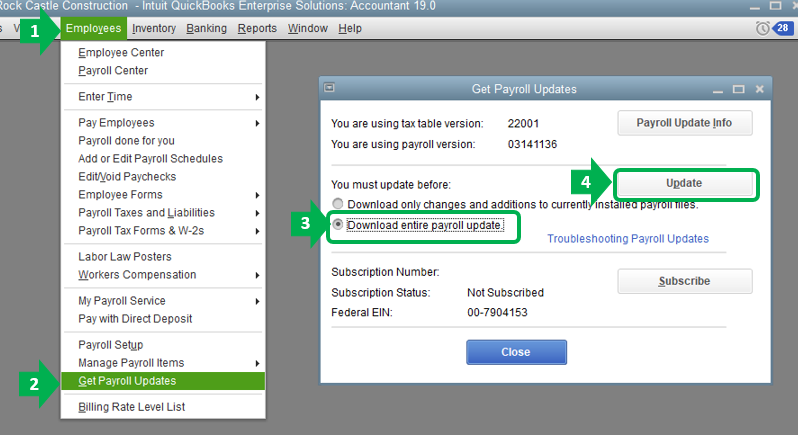

Your tax table version may be outdated reason why you're unable to enter the retention credit. To get the most recent tax updates, I recommend updating your payroll to the latest release. I'll show you the steps below:

Once done, you can go back and try setting up the item for retention credit again. Here's an article for detailed instructions on how to do this: How to set up and track the Employee Retention Credit under the CARES Act.

If you have other payroll questions, feel free to visit this link for related articles.

I'm always here whenever you need help with QuickBooks. Let me know if you have additional questions. Have a good one.

That’s unfortunate - not sure why it’s doing that exactly. When you set up the payroll item, did you set it up as an “other tax” or as an “addition” type of payroll item (I believe it’s the second window). I know “other tax” items will come up with the message you mentioned, but “addition” items don’t normally.

also, my quickbooks file created several different items for the ERC with similar names, so when you select the item in the paycheck detail window, are you maybe grabbing the wrong item?

thats all I can think of for now,

chris

Thanks, but I do know how to update my payroll; we pay enough for them relative to the service we are being provided concerning this problem; some people are losing faith in QBooks! Now here is the solution we keep crying out for. Simply provide us a fillable Worksheet 1 for the 941 form and the overide capability for lines 11c, 13d, etc. You could run over to ProSeries and get one of their people because we've been doing it for years!

Having the exact same problem, trying to apply the credit for a large loss of gross receipts. If they would just update the form to allow overides to all boxes empty or not it would solve everything. Please let me know if you find a solution and I will do the same. Quickbooks support clearly is not understanding the issue.

I could not find a solution and I am running out of time. I ended up downloading a fill-able 941 and Schedule B directly from the IRS that I will just fill out, print, and mail. Disappointed QB did not have a solution for the gross receipts part of the employee retention credit.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here