Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Has the update been released?

I am having the same issue with the MC credit not populating as well. Did you figure out a solution?

Hi @Diana-reliant,

At this time, we're still waiting for the update to be released.

As my colleague @Anna S mentioned above, you can keep track of this update either by keeping tabs on this thread or visit our The QuickBooks Blog page.

If you have other questions in mind, share them in the comments below. I'll be sure to take care of them for you.

Hi, Were you able to fix the previous payroll and apply FFCRA to that payroll or no? I processed 2 payrolls without that FFCRA changes even though i had a few employees with COVID but wasn't aware of this. Thanks for your help :)

Thanks for joining the thread, @lilavalv.

I hope you're doing well. You can check for updates on the Family First Coronavirius Response Act with QuickBooks Payroll by referencing this article: How to track paid leave and sick time for the coronavirus. This article is updated frequently to let you and others know when changes are made to payroll through the FFCRA.

However, if you need to edit a prior check that you've already entered, you'll want to follow the steps in this article about editing a payroll paycheck. Here you'll find detailed steps that go over how to edit checks for each QuickBooks Payroll option.

Feel free to let me know if you have any other questions or concerns. Take care!

I think I figured out the Medicare credit problem... Somebody tell me if my thinking is right.

The instructions listed here [https://quickbooks.intuit.com/learn-support/en-us/set-up-payroll/how-to-track-paid-leave-and-sick-ti...] for the National Paid Leave & Medicare Credit say to point both the Liability and the Expense to the account COVID-19 Expenses, which makes them zero each other out, and is thus not correct. BUT, if you point the Liability to your regular Payroll Tax Expense Account, you will be reducing the amount of your payroll tax, AND showing the credit amount in the COVID-19 Expenses account. And we should be reducing our regular payroll tax...right?!

Somebody tell me I'm right, please!

I know how important recording your National Paid Leave & Medicare Credit correctly, @VickiGiampietro. That's why I'm here to share details about handling them in QuickBooks. This way, you'll be able to determine the actions you need to take care of this.

Based on your complete description of the issue above, it seems like you're using QuickBooks Desktop (QBDT) Payroll. This is because the article you've shared above applies to that product. I assure you that the steps provided in the said article are the standard process in tracking the Medicare Credit.

We do appreciate the method you've discovered to correct the Medicare Credit problem. However, I'd recommend consulting your accountant if you'll be using the process moving forward. This is to make sure your books are up to date and your payroll taxes are accurate.

To learn more about the Families First Coronavirus Response Act (FFCRA), kindly check out this IRS article for the complete details: COVID-19-Related Tax Credits for Paid Sick and Paid Family Leave: Overview. It also contains links (i.e. General Information FAQs) for the answers to the most frequently asked questions about FFCRA.

Please let me know if you have other concerns. I'm just around to help. Take care always.

I can't open the PDF file, is there a way to make that so we can all open and read it?

Hi there, @MJWSquared.

I'm happy to share with you some troubleshooting steps so you can open and access the PDF file in your QuickBooks Desktop (QBDT).

First, let's download and install the QuickBooks Tool Hub, please refer to the steps below:

Once installed, let's run the QuickBooks PDF & Print Repair Tool.

If you still experience the same thing, let's reset your temp folder permissions:

For the next step, please proceed to Step 2 under Solution 2 (Reset your temp folder permissions) of this link: Troubleshoot PDF problems with QuickBooks Desktop.

Also, you might consider reading this article if in case you'll encounter some errors when creating, printing, emailing, or accessing your payroll reports in QBDT: Troubleshoot Issues with Printing and .PDF Files.

You can always get back to us if you need help in accessing PDF files in your QBDT software. Take care always.

I can open PDF files just fine within QB. What I was referring to is another person posted a link to a PDF file that had their fix/work around to what INTUIT was saying. I wanted to read that file... and it doesn't take me anywhere.

A lot of confusion on this board in my opinion because INTUIT Team members are jumping in and giving instructions - without identifying if they are talking about ONLINE or DESKTOP. Also, seems like INTUIT could go back and correct all the mis-guided instructions so the end user doesn't have to weed through all the erroneous posts, causing even more confusion.

I am using DESKTOP, and when I use your instructions for "Set up a new tax item, step four says on the "Other Tax" window, select National Paid Leave Credit, then select "Next". That is NOT an option. There is no National Paid Leave Credit" in the drop down window.

I had the same problem with my QB Desktop. It turns out the payroll item was already set up. I assume it was done so during a payroll update. There is a note after Step 4 of the instructions that says

Note: If National Paid Leave Credit isn't there, it means the item was already set up. Look for the item on your Payroll Item List, you may have changed the name.

These were the instructions that I used.

Good luck!

Hello again, MJWSquared.

Thanks for adding more details about the issue and a screenshot. This gives me a clearer picture of what’s happening when setting up the National Paid Leave Credit.

I appreciate you for sharing with us your opinion on how the instructions should be posted. Aside from improving the product’s features, we do the same thing with our level of support and how the answers are laid out (specific for QBO and QBDT). Please know your voice is important because it guides us on what areas we need to enhance (product and support).

Allow me to share some troubleshooting steps to help the National Paid Leave Credit item to show in the Other tax drop-down. Let’s download the latest QuickBooks release and then update the tax table version.

The previous enhances the software’s functionality and fix known issues while using it. Meanwhile, the latter provides the most current and accurate rates and calculations for supported state and federal tax tables, payroll tax forms, and e-file and payment options.

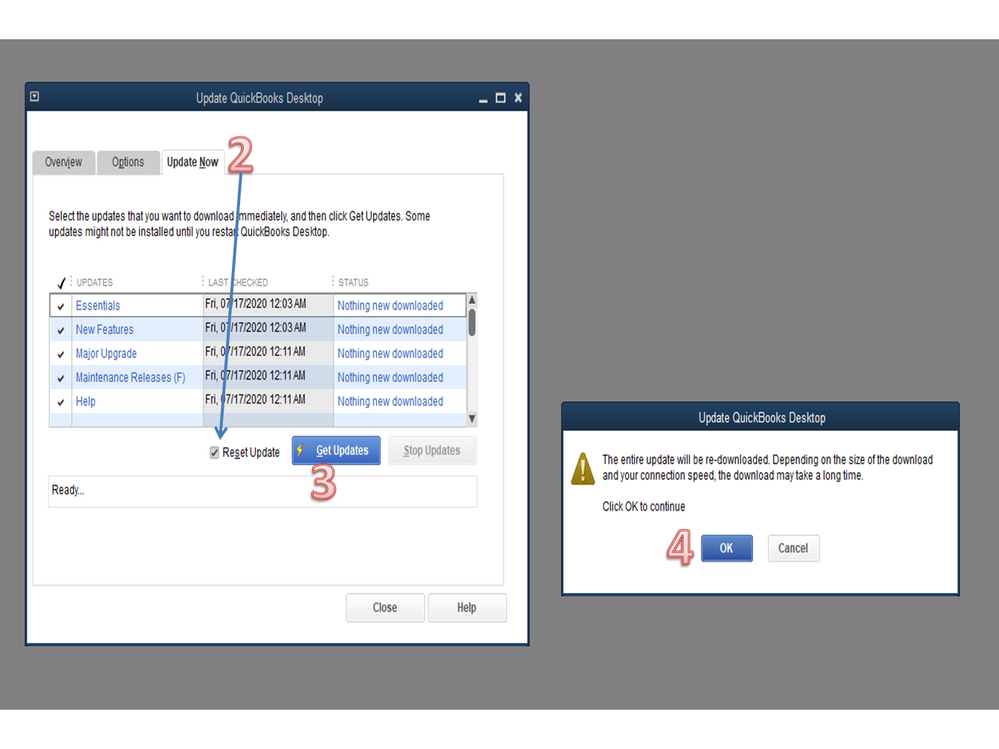

To download the latest QuickBooks release, follow the steps below.

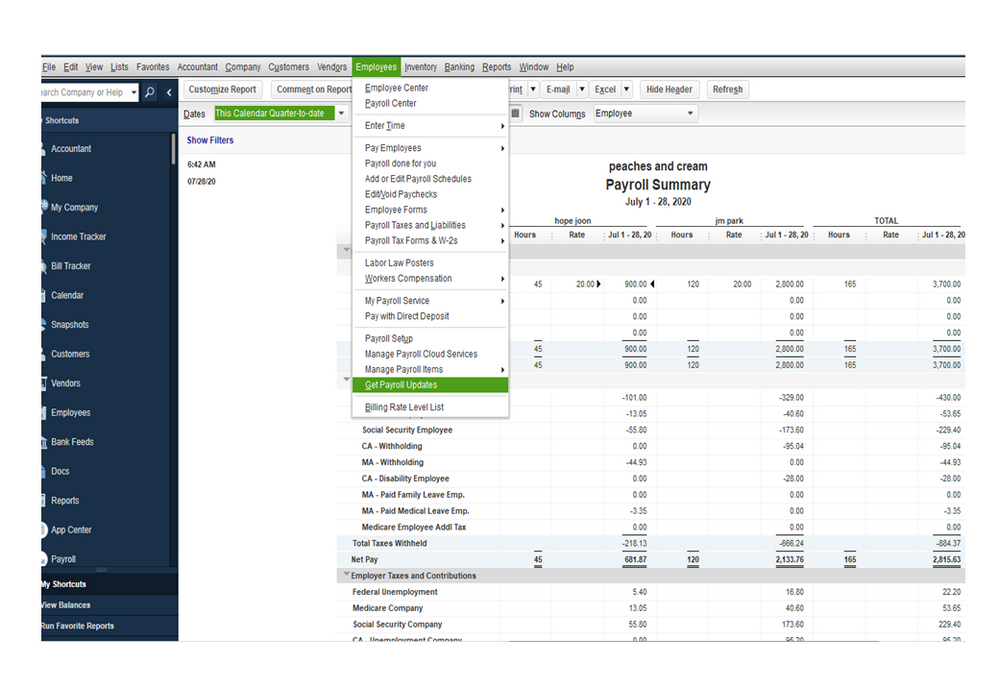

Once done, let's go ahead and update the payroll tax table.

Next, open the company file again and set up the payroll item. For more insights about the process, see the How to track paid leave and sick time for the coronavirus guide. It contains detailed instructions on how to add the payroll items to track sick time and steps to add them to the paycheck.

Additionally, the following article provides information and links to recent and previous updates: Latest payroll news and updates.

These will get you going in the right direction adding National Paid Leave Credit item.

If you need further assistance with any of these steps, post a comment below. I’ll get back to help and make sure this is taken care of for you. Have a good one.

I have followed the instructions I believe completely. However, when I run my 941 form I have an amount showing up on line 11b "Nonrefundable portion of credit for qualified sick aand family leave wages from Worksheet 1. I did not complete a worksheet 1. Where/Why would there be anything on this line?

Thanks for getting back to us, @MJWSquared.

To verify the amount showing in the new line 11b in Form 941, we can run the Quick Report to understand the balances of the credit. Here's how:

The report should show all the payroll items you’ve set up and run payroll on. The amount in the Total column reflects the amount of the credit.

For more information about the new lines in the form, refer to this article: How QuickBooks Populates The 941.

Please let me know if you have any other issues or concerns by leaving a comment below. I'll be here to help. Have a wonderful day!

Thank you for that reply. Currently, in my expense account COVID-19 it matches exactly with what we paid out as National Sick Leave. The amount showing on Line 11b doesn't match the SICK wages. I don't believe it should either? The amount we paid, is all allowable under the National Sick Leave wages.. 80 hours per employee.

We paid these wages prior to the "updates" in QBDT. I have sense gone back and made changes to accounts - however, we have not deducted anything yet from our 941 deposits. So, I have several questions and I'm hoping you can help.

1) Do I need to do a journal entry crediting the COVID-19 Expense account (making it .00), and debiting the COVID-19 Liability?

2) I also do not see that the Employer FICA Credit has not been recorded. Is this a manual entry also. Credit FICA Expense for the Employer FICA tax on the Sick wages, and also crediting COVID-19 Liability?

3) I still have an amount showing on the 941 worksheet, line 11b "Nonrefundable portion of credit for qualified sick and family leave wages from Worksheet 1. I believe this should be .00 and still do not see where this amount is coming from.

On the 941 I thought I could take the full credit for Sick Wages, plus FICA on those wages - and since I haven't deducted from deposits yet show an overpayment to apply to next return. Am I missing something?

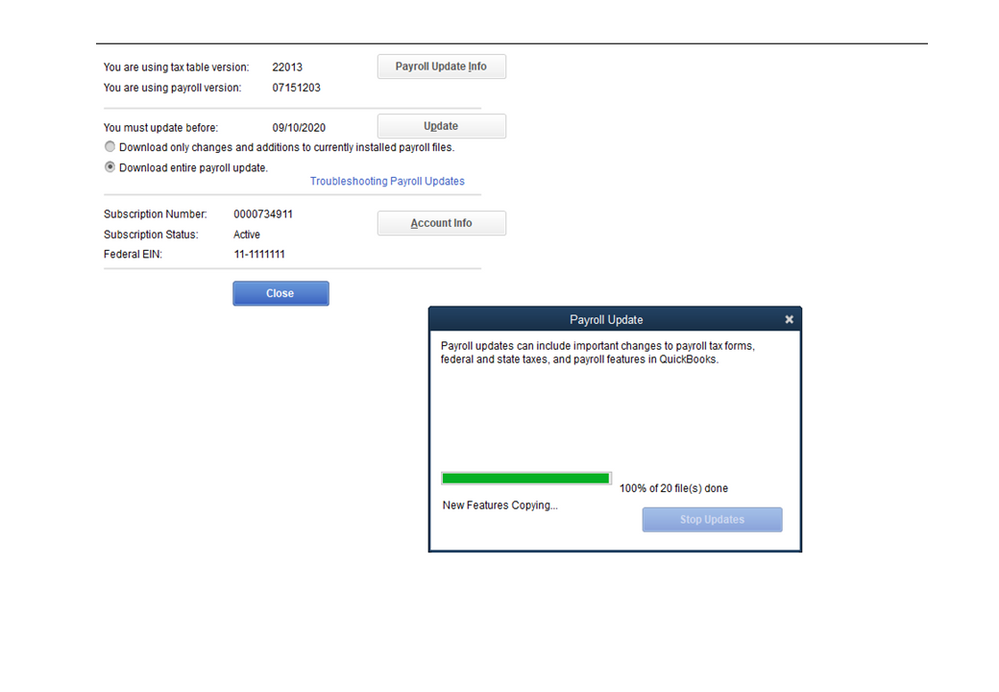

I am on the final step of your instructions above #2 Tick the box for Download entire payroll....

It has been on this screen for about 25 minutes - is it still working or has it stalled? Photo attached. When I position my cursor over the "Payroll Update" box, it shows a spinning circle.

I think I set up something wrong for the FFCRA pay. I have uncleared checks in my bank register for the gross amount of the paycheck for each employee for each week that pay item was used as well as a net amount paycheck that actually cleared my bank account. What am I missing or how do I fix this?

Hello, CherriezMe.

For us to check on your account and ensure you have the correct setup for Family First Coronavirus Response Act (FFCRA), I'd recommend reaching out to our Customer Care Team to pull up your account and assist you with this.

Here's how:

Please let me know if there's anything else I can help you with, I'd be more than happy to assist you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here