Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWhen does QB process W2's? This is our first year using QBO and we do not know how much time we have to make sure everything is reconciled before W2's are made available to employees. Do we control that timing or are they processed automatically?

Thank you

Solved! Go to Solution.

I see that it's your first time processing W-2 forms in QuickBooks Online. You have come to the right place. I've got the information you need about filing your W-2 forms.

The deadline to file your W-2s is January 30. Sending your W-2 and W-3 forms to the appropriate agencies on time is an essential payroll task at the end of the year. Depending on your payroll product, we may do this for you, or you can file electronically using QuickBooks.

Depending on your payroll tax setup, we will file your W-2s automatically, or you will have to e-file them through QuickBooks.

Here's how:

For detailed information, refer to this article: File your W-2 and W-3 forms.

I'm adding these articles you can use in the future:

Feel free to ping me if you have more questions about W2 forms, or you can post here again if you have further QuickBooks-related concerns. We are available 24/7 to lend a hand with each of your queries. Stay safe!

I see that it's your first time processing W-2 forms in QuickBooks Online. You have come to the right place. I've got the information you need about filing your W-2 forms.

The deadline to file your W-2s is January 30. Sending your W-2 and W-3 forms to the appropriate agencies on time is an essential payroll task at the end of the year. Depending on your payroll product, we may do this for you, or you can file electronically using QuickBooks.

Depending on your payroll tax setup, we will file your W-2s automatically, or you will have to e-file them through QuickBooks.

Here's how:

For detailed information, refer to this article: File your W-2 and W-3 forms.

I'm adding these articles you can use in the future:

Feel free to ping me if you have more questions about W2 forms, or you can post here again if you have further QuickBooks-related concerns. We are available 24/7 to lend a hand with each of your queries. Stay safe!

I checked the w-2 for 2023 and found the w-2 is wrong. QuickBooks takes care of filing 941s for our company. I checked the 941 Form which was filed for 3rd Quarter and the amounts are incorrect. How do I get the payroll account corrected?

Betty Diebold

QuickBooks does our payroll filings. Will QuickBooks make the needed corrections?

Hello, bdiebold67.

Thanks for joining this thread. I want to make sure the amounts are correct on your 941 form in QuickBooks Online.

In this instance I recommend reaching out to a member of the QuickBooks Online Payroll Support Team. An agent will be able to take a look at the amounts and point you in the right direction to have them corrected. Here's how to get in touch with the team:

1. Sign in to your QuickBooks Online company.

2. Go to Help (?).

3. Choose Contact Us.

4. Enter your concern, then select Let's talk.

5. Choose a way to connect with us:

- Start a chat with a support expert.

- Get a callback from the next available expert.

The following article provides these steps if you ever need them again in the future: Contact Payroll Support

I'm only a comment or post away if you have any additional questions or concerns. Take care!

I see that lines 12 a and 12b of my 2023 W2 are not the same. Why is there a discrepancy? How can I fix it?

Thanks

Thanks for checking in with us.

Box 12 code A is for uncollected social security or RRTA tax on tips reported to your employer while Box 12 code B is for uncollected Medicare tax on tips reported to your employer (but not Additional Medicare Tax). To correct the discrepancy, depending on your payroll service and if the W-2s and W-3s have already been filed, either you can fix it or we’ll fix it for you.

Additionally, you'll want to run the Payroll Details Report for the entire year and then make sure that the items used on the paychecks are set up correctly and the correct amounts were used. I'll show you how:

To learn more on what to do if you or your employee finds a mistake on their W-2 or your W-3, check out this article: Fix an incorrect W-2 and W-3. If you need further assistance with the correction, please contact our Payroll Support Team. They'll pull up your account in a secure environment and help you with this one. Here's how:

I want to include that reaching out to our Customer Care Support is best during business hours from 6 AM-6 PM PT Mondays-Fridays. Use this article to learn more: QuickBooks Online Payroll Support. You may also read this reference for another mode of payment and form filings to use: Pay and File Payroll Taxes and Forms in Online Payroll.

Feel free to visit our QuickBooks Online Payroll Hub page for more insights about setting up and processing payroll seamlessly in the future.

The Comments section below is the best place to ask questions or post any other payroll concerns if you have any. Don't hesitate to give me a shout and I'll be with you right away.

We switched in October so we wish to file our own W-2's versus entering all the data for Q1-Q3. How do I get rid of your message on the task list that says my W-2's are late.

Hello there, @joe123456. I'm here to help you archive your W-2 forms in QuickBooks Online (QBO) to remove the payroll notifications showing as overdue.

The tax notification will appear if you have tasks that require your attention, such as tax forms filing, payroll tax liabilities, etc. If your auto-filing is disabled, you can archive your W-2 Copies B, C, & 2 to clear their payroll alerts. Here's how:

To remove the reminder for W-2 Copies A & D (employer), I recommend reaching out to our Payroll support team. They have the necessary tools to check your account and remove the payroll task forms on your behalf.

Additionally, you can access your previous forms and payments to print them for record-keeping.

Feel free to visit us anytime you have questions about filing your W-2 forms in QBO. Our team is available 24/7 to assist you. Stay safe, and have a good one.

Hi,

This is my first time also with QB online and I talked to several support persons, and they say we were all setup for W2 filings and mailings, but some employees haven't gotten their W2's yet. How do I check to see if they were mailed out? I don't seem to have chat support for the weekends.

thanks.

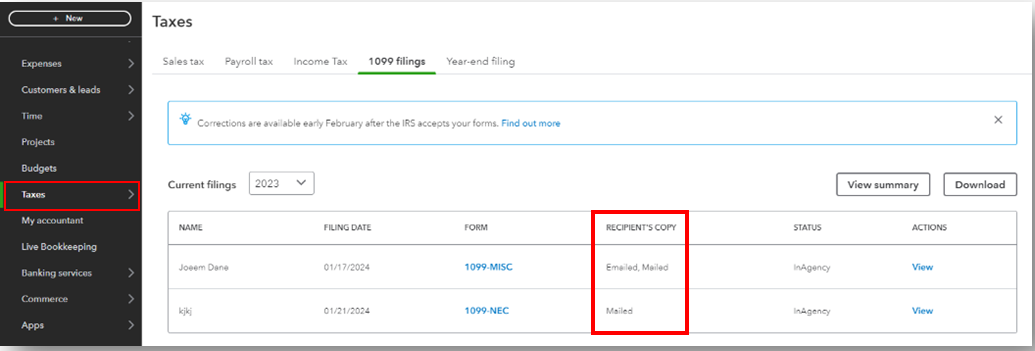

I'd love to see new users here, santacruz. Let me elaborate on some details of when contractors received their 1099s.

If you e-filed 1099 forms on or before January 28, they can be processed and mailed to contractors by January 31. Therefore, they should receive it within 7-10 business days from the postmarked date. Please also consider that this timeframe depends on factors like USPS service and weather conditions.

To view the status of the forms, refer to the steps below:

Furthermore, our support hours are available from Monday to Friday, 6 AM to 6 PM PT. Here's an article for the best way to contact us: Contact Payroll Support.

In case you need to make modifications, check out this guide: Correct or change 1099s in QuickBooks.

Save this reference to get a copy of these forms: Print your 1099 and 1096 forms.

Please let me know if you have any other concerns about 1099. Remember, I'm here to ensure that we've got you covered. Have a great day ahead!

so I have problem filing W-2 copy A. I guess I have sent the wrong paperwork to SSA.

I read the article and found that 'You cannot print the employer copies from QuickBooks.'

I don't know how to file electronically. Does it have anything to do with me 'pay & file' with agencies outside QB?

Let's go through some troubleshooting steps to correct the filed W-2 copy A to the Social Security Administration, Aom2.

If you've sent incorrect paperwork to the SSA, we'll need to correct it regardless of how you file (electronically or by paper). We can manually create and file a W-2c and W-3 form with the SSA. To do this, see the General Instructions for Forms W-2c and W-3c section in the General Instructions for Forms W-2 and W-3. You can also reach out to the SSA for guidance tailored to your situation.

Once done, fix the issue in your QuickBooks Online (QBO) account and use any payroll reports you need to fill out the W-2C form. You can check out this article on what to do if you or your employee finds a mistake on their W-2 or your W-3: Fix an incorrect W-2 and W-3.

To file the forms electronically, you can access your QBO account (with an active payroll subscription). Then, follow the steps and details in this article: File your W-2 and W-3 forms.

If you prefer filing the form directly with the SSA, use their Business Services Online (BSO) portal. Log in to the SSA website and upload the forms to submit your W-2s electronically.

On the other hand, the "Pay & File" with agencies outside QuickBooks refers to outsourcing your payroll tax filing to a third-party agency or service provider outside the program.

You can refer to this article to guide you in printing W-2s if you send paper copies to your employees, for your records, and a W-3 to send to your accountant: Print your W-2 and W-3 forms.

We are always available to assist you if you need help with payroll tax forms or QuickBooks-related concerns. Have a great day ahead.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here