Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowThe Q2 Form 941 2021 is putting my sick leave wages on the lines for wages paid before April 1 and populating Worksheet 1 instead of Worksheet 3.

The wages were paid in May for a late April pay period so I don't know how to fix it as most fields cannot be overwritten.

Is anyone else having this issue? And if so, is there a way you have found to fix it.

I have the file updated to the latest release. Customer service has not been able to solve the issue or explain it. I have the items set up correctly and it worked fine for Q1.

Yes. I am having the same problem. I submitted a bug report from the help menu.

Thanks for coming by, @Madeleine34608.

I'll share some information about correcting your Form 941. First, you'll want to make sure you've also updated the tax table version of your file. Keeping it updated fixes the forms info.

Here's how to do it.

After running the tax table update, try pulling up the form again. If you're still getting the same result, you can make a liability adjustment for your employees' wage base. Refer to this article for the step-by-step instructions: Adjust payroll liabilities in QuickBooks Desktop.

Additionally, here's a link that covers all the tasks you can do when using the payroll feature.

Don't hesitate to reach out to me anytime if you still have questions or concerns about payroll forms. I'll be here for you. Take care and have a great day ahead.

I've downloaded the updates (numerous times) and the form is not fixed. Amounts for sick leave wages are flowing to worksheet 1 instead of worksheet 3. Not sure why you sent me a link to adjust payroll liabilities as that is not the issue.

Wages paid in May 2021 for May 2021 period should not be showing up on the worksheet for "wages paid prior to April 1"

I did that too once I realized it wasn't something I had done.

Hi there, Madeleine34608.

I appreciate you for coming back to the thread to add additional details on what you've done to fix the issue. I'll ensure to provide another information so you're able to make sure that the amount for sick leave wages is flowing to the correct worksheet.

There are a couple of points you'll need to consider to track the Medicare credit properly or sick leave wages in QBDT. First, please ensure to use the correct expense accounts and payroll or tax items for accurate reporting of the said wages. For more insights, please refer to this article: How to track paid leave and sick time for the coronavirus.

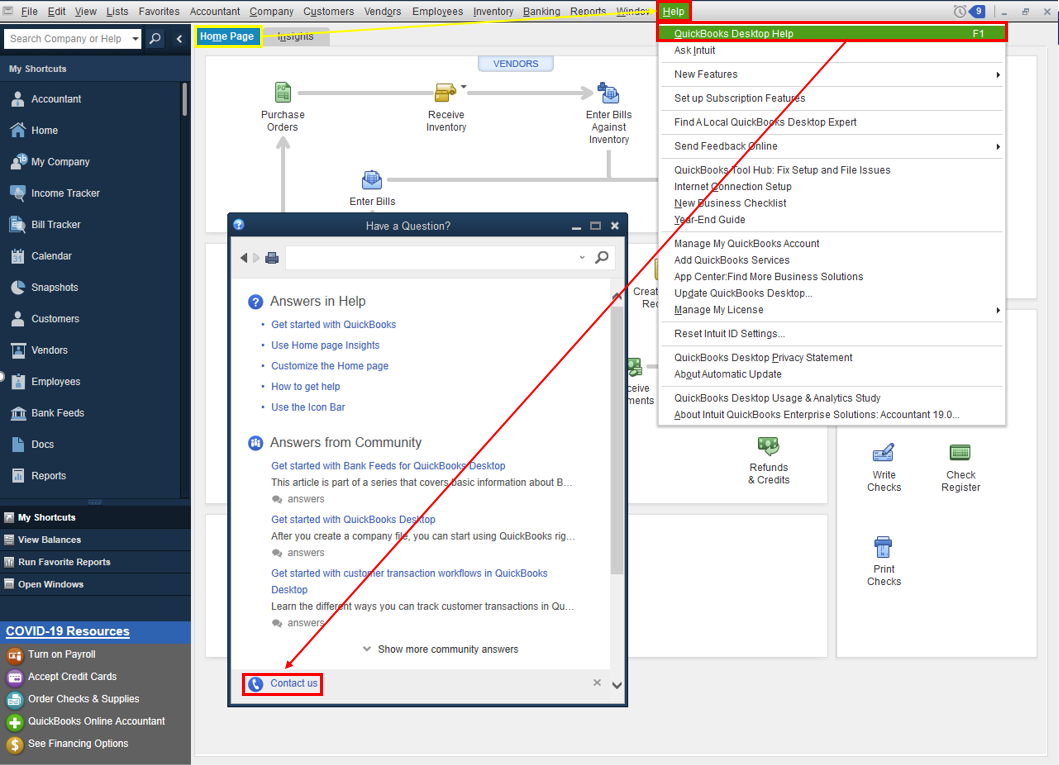

If the issue persists, I recommend contacting our QuickBooks Desktop Support Team. They have the tools to check your account to investigate the cause of the problem and have this fix.

Here's how:

Also, please check out the QuickBooks Desktop section of this article for our support hours. This is to ensure your issue gets addressed on time: Support Hours.

Then, you may want to print and save your form 941 so you have a copy on hand. You can explore the Print and save your forms section of this article for the steps: How to print form 941.

I'm around in the Community if you need more help with payroll forms or anything else related to QuickBooks. Take care and stay safe always.

I'll double check everything.

excert

Hi Jeff,

In previous quarters i was able to override fields on the worksheet to get the correct numbers to flow for the qualified sick and family leave wages. Why is this not working now?

After the fact i need to re- enter enter payroll for second quarter in order to flow the numbers correctly why not be able to override on the worksheet in the past?

Can overrides be reactivated?

Greetings to you, @djm20300.

The posting of the amounts on the IRS Form 941 in QuickBooks is determined by the tax tracking type used on the paycheck. Please note that overriding the amount directly on the form will not change the calculated amount on payroll reports.

This also means, that previous overrides won't carry over when you create a new tax form.

If you need someone to assist you with your forms and make corrections, I recommend reaching out to our Support Team. They can initiate a viewing session with you and can help further with your 941 reporting.

To get our Support, follow the steps below:

Refer to this article to learn more about our contact options and support availability: Contact QuickBooks Desktop support

Post here again if you have other payroll forms concerns, I want to make sure you're taken care of. I'm also here to provide further assistance any time.

I had the same issue for qt2 and also for this quarter.

Updating is not working.

I have quickbooks desktop pay annually. I update very frequently. Quickbooks forces us. If we don update the payroll choices are not there.

quickbooks needs to include worksheet 2 and worksheet 3. Only worksheet 1 are there.

NO amount of "updating" is fixing this problem.

Let me make it up to you, Mgmt1.

The Employee Retention Credit amounts are added to the corresponding lines of Form 941, and their worksheet is based on the items being used on paychecks dated within each quarter.

It may be you're still using the old setup. We have new instructions updated last May 2021 to help you track paid leave. Then, you'll have to go back to each employee with paid leave and change the account to match the new setup. After updating everything, it will be processed to the right worksheets.

Once done, you may prepare the Form 941.

If you have further questions, please feel free to let us know. We're around to help you with your payroll concern. Take care!

Hi All,

I received a letter from IRS about my 941 form Q3 saying I owe payroll taxes for the Qualified sick leave wages(5a(i) which should give me full credit against my payroll taxes for Sick leave wages paid after March 31, 2021. My non refundable portion of credit for qualified sick and family leave wages for leave taken after MArch 31 ( 11d ) doesn't match my line 59a( i). If someone has any idea what the problem could be, please let me know.

Thanks for joining this conversation, @brunello. I'm here to share with you some information about line 11d and line 5a(i) in your 941 form.

In 941 form, line 11d shows how much money was paid to employees who used Payroll Items with tax tracking types, namely: National Leave ARPA - Emp, National Leave ARPA - Family, and National Leave ARPA - FMLA. It also includes amounts recorded on paychecks using Payroll Items with the tax tracking type of National Paid Leave - Health during the quarter. Unless the credit is extended to subsequent dates, this line should be utilized for leave taken between April 1 to September 30, 2021. You'll know more about this by going to the 11d. Nonrefundable Portion of Credit for Qualified Sick and Family Leave Wages for Leave Taken After March 31, 2021 section of this link: Instructions for Form 941.

On the other hand, line 5a(i) will display only earnings paid throughout the quarter using Payroll Items with tax tracking types National Paid Leave-Emp and National Paid Leave-Family. These should only be used to pay for leave taken on or March 31, 2021. Those taken on or after April 1, 2021, should use new payroll items tax tracking types with ARPA in their descriptions, and will not appear on Line 5a(i). To get additional information about this, proceed to the 5a(i). Qualified sick leave wages section of this article: Instructions for Form 941.

For more details about this, please see this article: How QuickBooks populates Form 941.

It's easy to view your employee data and monitor your business finances in QuickBooks Desktop. To do so, you can open any payroll reports that suit your needs. To give you a list of those reports and an overview of what data they show, please head to the Excel-based payroll reports page.

I'm always around if you have any other concerns about your 941 form. Feel free to post your reply below. Have a good one.

Thank you DivinaMercy,

My problem is that I paid some employees in the third quarter for Covid-19 leaving sick with old payroll item and these amounts were added up on line 5a(i) so when I used the worksheet 3 to compute the total credit , worksheet 3 is not using the amount of Covid-19 leave sick gross wages as credit and Intuit submitted the 941 form to the IRS, afterwards IRS sent to me a notice that I was short in my payroll tax deposits for the quarter. I reviewed and I need to correct my payroll and amend 941 form for the 3er quarter. I don't know how to correct the previous payrolls using the appropriate payroll item and thereafter re-run 941 form.

Thank you for following up, brunello.

I'd like to share an idea on how you can start correcting your quarter-to-date payroll taxes in QuickBooks Desktop.

We can run a payroll summary report and customize it so that it only shows the 941 taxes. This way, you'll find out where the discrepancies are coming from.

Like this:

You can click the total amount for each items to see the payroll details. Take note of the amounts for each payroll items.

After that, you can check out the steps in this article on how to adjust your payroll liabilities under Step 2.

I'd also recommend consulting an accountant before making any payroll adjustments.

Tag my name and let me know how it goes by click the Reply button below. I'll be around if you still have questions about payroll taxes. Have a great week!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here