Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowDo I have to have enhanced payroll to print out W-2/W-3? Can I do this in Basic payroll? If so how?

Solved! Go to Solution.

Yes, payroll forms require an Enhanced payroll subscription.

Basic is for people who have someone else, like their accountant, do payroll forms.

Yes, payroll forms require an Enhanced payroll subscription.

Basic is for people who have someone else, like their accountant, do payroll forms.

i have the enhanced version

Greetings, @201673729,

Thanks for adding to the conversation. Let's make sure you're able to print your W-2 forms.

Since you're using the Enhanced Payroll version, you can now print your reports anytime. Before doing so, please make sure your tax table is updated. Here's how:

To start printing your W-2s, please follow the steps below:

That should get you on the right track, @201673729. You may want to check this article to know more about printing your W-2s in QuickBooks Desktop: Print W-2 and W-3 forms

Do let me know if you have any more questions with the process. I'm here to assist you anytime. Have a good one!

I do have enhance payroll!!!!!! can you just tell me how to do it where to find it and how to print them off.

I appreciate you joining and voicing out in this thread, @joannlw.

We offer three different payroll subscription for our QuickBooks Desktop users: Basic, Standard, & Enhanced. Included in the Basic Payroll are the following:

To learn more about the features for each subscription, I recommend checking this link: Try Payroll for QuickBooks Desktop.

You'll have to upgrade your payroll so you can pull up and print the W-2 form. To do that, you can contact our phone team:

Additionally, I'm adding the Payroll Helplink for future help. The page has the articles related about employees, your subscription, payroll and paychecks, taxes, E-file, and E-pay, View My Paycheck and Payroll liabilities.

Let me know if there's anything else you need or if you have follow-up questions. I'm still here to help you more about payroll. Wishing you all the best!

I am using pre perforated paper. It aligns perfectly. The issue I have is I want two per page BUT the same employee. I cannot send an employee a W-2 with someone else info. I have enhanced payroll and I have done everything by instructions BUT when I go to print. It either prints one copy on a W-2 form (if I choose to just print one employee) OR I chose all employees and it prints TWO employees info on one form.

I'm glad that you reached out to us, @Lost In Indiana.

For now, there's no option in Quickbooks to print two W-2 copies of the same employee using a perforated paper. The program will only print a single copy if there's only one person selected.

Therefore, you need to print two W-2 forms for one employee.

You can also check the year-end checklist in QuickBooks Desktop Payroll to prepare your tax forms.

If you have other question in regards to printing tax forms in QuickBooks, you can comment below. I'll be there to help.

I do have enhanced

Good to have you here, Vicki65.

You can print W-2 and/W-3 forms using your Enhanced Payroll. You may refer to the steps provided above on how to print them or check out this article to learn additional information about printing W-2/W-3 forms.

I've also added this article you can check on how to E-File Federal W-2 forms for your reference: E-file Federal W-2 Forms

If you need more help, please don't hesitate to tag me in a comment below. Thanks!

I have done all these steps multiple times, and Adobe says the files aren't recognized. Adobe has never failed to print w-2's in all the years I have used it before, and still prints pay stubs perfectly now. If I save the files as .pdf to my computer and try to open them in Adobe I receive the same error message

Hey there, @MikeWenger.

Thanks for joining in on this thread. It's my priority that you're able to get this resolved.

Since you've already tried our steps to help remove this error, I recommend contacting our Customer Support Team. They have more tools to help walk you through some additional steps.

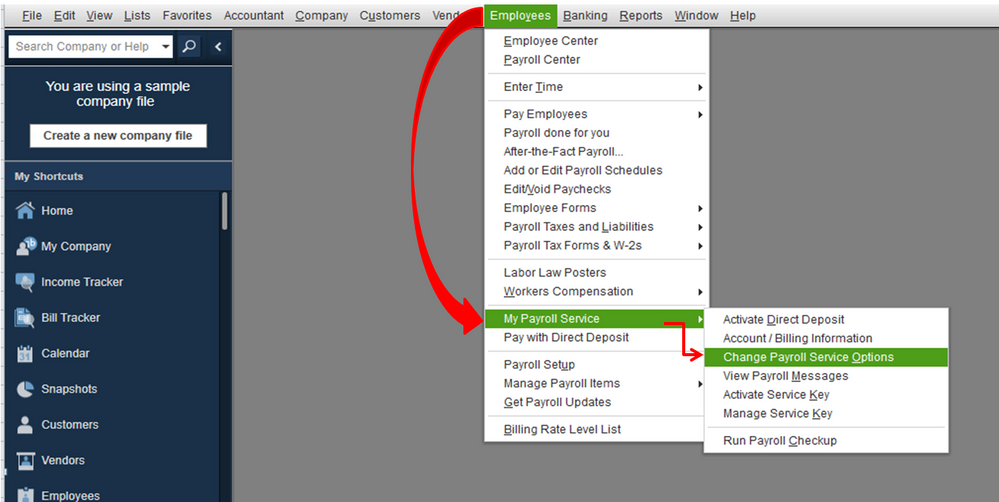

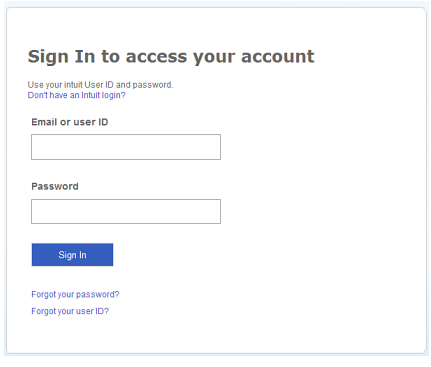

Here's how:

That's all there is to it. Here's an article that might become helpful for you and your business: Print your W-2 forms.

Let me know how it goes. I want to make sure that you're able to get back to running your business. I'm only a post away if you need me. Have a good one!

I need to upgarde to enchanced payroll to get w-2

By following these steps, you can generate and print the W2 form in QuickBooks, @perkinsgoodbye hugs.

Thanks for posting and joining this thread. I’m here to provide information, so you’ll be able to get W2 in QuickBooks Desktop.

Here are the steps to upgrade to Enhanced Payroll service:

You can also contact our Payroll Support team if you need further assistance with the upgrading process.

I’ve also attached several resources that can help manage your forms and other tasks before and after printing:

I’d be happy to help if you have additional questions about W2. Just drop a comment below. I’ll be here!

where do I find to print on online accountant?

Hello there, CraftsmenGroup.

In QuickBooks Online Accountant, you can print the W-2 forms by following these steps:

If you have auto pay and file turned off, you can check this article for more details: Print your W-2 forms. You may want to check the lists of payroll reports that you can run in the program: Run payroll reports.

Let me know if you have other questions. I'm right here to assist anytime. Take care always.

i need to speak with some one about a w-2's for one of my employees there social security number is wrong on there w-2's form

Good day, @464809382.

Thank you for joining the Community. Let me help you with correcting your employee's social security number.

Here's how:

In case you still want to speak to an agent, you can contact our customer support.

You can also check on this article if you want to print your W-2 forms.

Please let me know if I can be of any additional help. Have a good one and stay safe!

QuickBooks is saying that my enhanced payroll is in active, but it is not!

help me get my w2 please if there is no way you could help me change my old address send me the new address

Allow me to help you with your W-2 form concern, 5123.

If you need to correct any information on an employee's W2 form before filing, you can edit it on their profile. However, if it has already been filed, you'll need to manually create new W-2 and W-3 forms and file them with the Social Security Administration. Check out the steps below:

You can refer to the General Instructions for Forms W-2c and W-3c in the General Instructions for Forms W-2 and W-3.

For further information on correcting your forms, check out this link: Fix an incorrect W-2 and W-3.

Moreover, check out this article for detailed steps in printing your W-2 and W-3 forms: Print your W-2 and W-3 forms.

Comment below if you have additional questions about managing your W-2 forms. I'll be around to assist you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here