Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

We switched payroll services and just missed canceling before the subscription renewal date. We have not used the payroll service in this renewal cycle. I would like to cancel the subscription and request a refund. Please advise on how to do this? Thank you!

Solved! Go to Solution.

I can help you with canceling your payroll subscription, @FAWE.

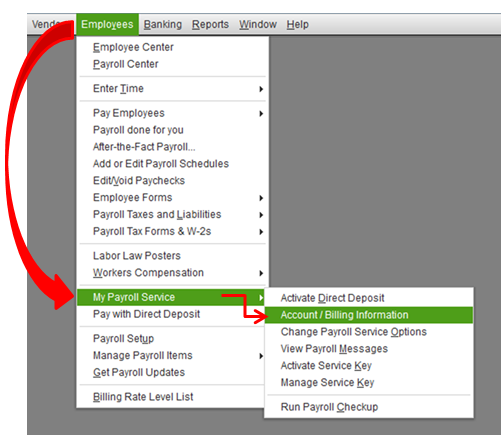

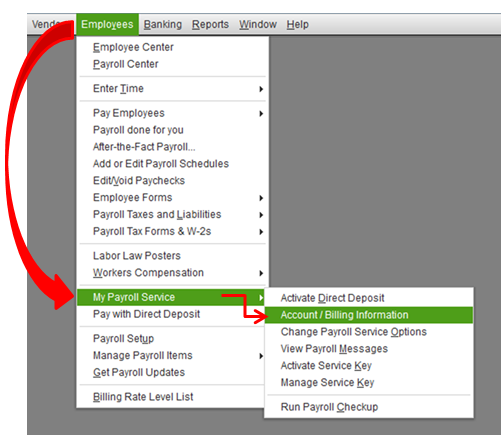

The best way to cancel your payroll service is directly in your QuickBooks Desktop company file, and there are only a few easy steps to do it.

Before that, you’ll want to make sure to print necessary payroll reports, complete and process any outstanding annual or quarterly forms and outstanding tax deposits. This way, everything is settled. Then follow these steps below:

Please know that once your service is canceled, you'll no longer be able to receive expert support for payroll-related issues, download payroll updates, process and print payroll tax forms including the direct deposit and QuickBooks Workforce.

Regarding refund, it depends on your plan. There are specific terms and conditions apply. These are the following:

For monthly plan

For the annual plan

You'll only receive a full refund if you cancel within 60 days from the signup. Refunds will be processed to the credit card that we have on file for you.

You’re unable to receive a prorated refund for the unused portion of your subscription.

You'll still have access to your service through the end of your current subscription period.

The service will be terminated at the next auto-renew date.

It would be best to contact our Customer Care team with this refund request. They can assist you further with this matter. They have tools that can process a return immediately once approved. Here’s how:

I’ve added these resources for more information on the cancelation process and its policies.

Get back to me here if you have follow-up questions about canceling payroll subscription. I’m always around to help.

I can help you with canceling your payroll subscription, @FAWE.

The best way to cancel your payroll service is directly in your QuickBooks Desktop company file, and there are only a few easy steps to do it.

Before that, you’ll want to make sure to print necessary payroll reports, complete and process any outstanding annual or quarterly forms and outstanding tax deposits. This way, everything is settled. Then follow these steps below:

Please know that once your service is canceled, you'll no longer be able to receive expert support for payroll-related issues, download payroll updates, process and print payroll tax forms including the direct deposit and QuickBooks Workforce.

Regarding refund, it depends on your plan. There are specific terms and conditions apply. These are the following:

For monthly plan

For the annual plan

You'll only receive a full refund if you cancel within 60 days from the signup. Refunds will be processed to the credit card that we have on file for you.

You’re unable to receive a prorated refund for the unused portion of your subscription.

You'll still have access to your service through the end of your current subscription period.

The service will be terminated at the next auto-renew date.

It would be best to contact our Customer Care team with this refund request. They can assist you further with this matter. They have tools that can process a return immediately once approved. Here’s how:

I’ve added these resources for more information on the cancelation process and its policies.

Get back to me here if you have follow-up questions about canceling payroll subscription. I’m always around to help.

My subscription auto renwed on sept. 1, the payroll files are corrupt, and your company wants to charge extortion rates to fix errors created by your product. therefor your services no longer work, and will will be switching to a different payroll company and on the first of the year switching to a different account software.

how do I request a refund for the remaining 10 months that was prepaid?

This is not the kind of experience we want you to have, @elsie4.

Customer Support is free of charge for 12 months after product registration. To know more about the issues that are free of charge and those who need personalized assistance from an Intuit Support Professional, you can check this article: Intuit QuickBooks Desktop & Point-of-Sale software support policies.

You'll need to reach our Customer Support to check your account and process a refund request in a safe and secure environment.

You can follow the steps below on how to reach them:

Here's the contact the QuickBooks Desktop Customer Support Team article for more information about this.

I'm always here if you have questions about the account and or anything else. Take care and have a great rest of the day!

That would be helpful if anything actually happened when clicking on that help topic. Which is why i am here. There is no number to contact, and getting actual useful helpful information is nearly impossible.

I'm glad to see you here in the Community, @elsie4.

You can actually post the specific issue you've encountered so that we can provide you a more specific solution.

You can also get in touch with our Quickbooks Support Team through the application itself. Let me show you how:

Make sure to check our support hours and contact us at your most convenient time.

The comment section is always open if you have additional questions. It's my pleasure to help you further. Have a great day.

I just cancelled my enhanced payroll subscription today. The annual plan was auto renewed on 10/17/20. When I called Intuit on 9/28/20 to put on a monthly plan because we were closing the business on 12/31/20, the agent told me that the refund would be prorated, so just let the auto renew go through. Now after calling every phone number I could find, and having no luck because the machine tells you to chat online and then disconnects, I chatted with 8 different agents. They kept sending me to another agent. Finally, the last one just ended our conversation after not answering for 20+ minutes. This is now way to run a company!!! Never again will I subscribe or purchase your products!

I paid for an annual subscription, but now Quickbooks is forcing me to either switch my program to annual subscription as well or lose access to the Payroll module. I have the 2019 version. For one part time employee, it doesn't make sense to spend all that extra money annually, so I'm not changing to the 2022 version. Thus, the Payroll won't work after May 31. How do I get refunded for the balance of my forced cancellation??

Hello there, Frame Lady.

Glad you've mentioned that you're using the 2019 version. Since you're using an old version, you're affected with the service discontinuation. It appears that your access to QuickBooks Desktop Payroll Services, Live Support, Online Backup, Online Banking, and other services through QuickBooks Desktop 2019 software will be discontinued after May 31, 2022. Please refer to this guide for more information: QuickBooks Desktop service discontinuation policy.

Still, you can contact our Support Team using the Help menu within your company file to talk about the refund (if necessary). After May 31, you can contact us anytime using this link: QuickBooks Desktop Contact Support.

For additional reference, you can check out these help articles if you have any questions related to QuickBooks.

Visit again if you have more concerns with QuickBooks. I'd be glad to help and provide the details you need. Stay safe.

I absolutely can feel your pain as I have just went through this with QB. If anyone knows of any other software that I can use I'm all ears! This company is horrible!

Please refund the $650.00 charge that was charged to renew our subscription. We didn't cancel because we were told our credit card expired. Then the charge was put thru some how - Reference #P1-79297904

I wish I could make it better, mtmissionchurch.

We have a designated team that'll help with your refund concern. They have full access to your account and can review the logs made in reference to these charges. They can also determine its main cause to ensure it won't happen again

Here's how to contact our QuickBooks Online support:

If you're using the desktop version, I'd recommend checking out this article to reach out to them: Contact QuickBooks Support.

Additionally, I've added these articles that'll help you manage your QuickBooks subscription to ensure you'll be billed correctly:

I appreciate your understanding on this matter. Please know that I'm determined to get this resolved.

if this isn't credited this week I am turning it over to the bank and reporting it as a wrongful charge. I have asked three times for a refund. This was charged without our permission and supposedly on a card you reported as expired.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here