Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI downloaded a required update Jan 3 and then created payroll. Social Security and Medicare deductions were double what they should have been on employee checks. How do I prevent this from happening again and correct this on checks that have already been cashed? QB shows employee and employer each at 6.2% for SS and Medicare at 1.45%.

Solved! Go to Solution.

Hi there, Melissa7,

I want to ensure your taxes are calculating correctly.

There are a few reasons why SS and Medicare taxes are calculating incorrectly. Consider the following:

To isolate the problem, let's make sure you're able to download the latest tax table update version 21902. You can check that by following these steps:

If you're using the correct version, let's check if there are any discrepancies or zero deductions for the SS and MD amounts on the employee's paycheck. We can use the Payroll Detail Review report to verify the taxes withheld and the difference. Here's how:

On the report, review if the checks have the correct deductions. You can get the correct calculation by multiplying the total wage base of each payroll items to its corresponding tax rate. If the figures are correct, then there is no action to be taken next.

However, if QuickBooks overwithheld the SS and MD taxes, there are 2 ways to remedy the situation. Here's how:

That should get you on the right track, Melissa7. Please feel free to let me know if there's anything you need help with. I'll be glad to work with you again. Have a good one!

That's correct. The company and employee items are both 6.2% and for medicare both rates are 1.45%.

See https://www.irs.gov/taxtopics/tc751

You should be familiar with these rates as well as the other information from the Circular E before attempting payroll on your own: https://www.irs.gov/publications/p15

I've been doing this for almost 20 years w/o issues but QB deducted the wrong amounts without me changing anything from one payroll to the next other than their required update.

Hi there, Melissa7,

I want to ensure your taxes are calculating correctly.

There are a few reasons why SS and Medicare taxes are calculating incorrectly. Consider the following:

To isolate the problem, let's make sure you're able to download the latest tax table update version 21902. You can check that by following these steps:

If you're using the correct version, let's check if there are any discrepancies or zero deductions for the SS and MD amounts on the employee's paycheck. We can use the Payroll Detail Review report to verify the taxes withheld and the difference. Here's how:

On the report, review if the checks have the correct deductions. You can get the correct calculation by multiplying the total wage base of each payroll items to its corresponding tax rate. If the figures are correct, then there is no action to be taken next.

However, if QuickBooks overwithheld the SS and MD taxes, there are 2 ways to remedy the situation. Here's how:

That should get you on the right track, Melissa7. Please feel free to let me know if there's anything you need help with. I'll be glad to work with you again. Have a good one!

RE: I've been doing this for almost 20 years w/o issues but QB deducted the wrong amounts.

Based on your description, the amounts are right. What's wrong with them?

We have also had problems. We just switched to another payroll provider and after we entered our YTD info their system doubled the amt of medicare/SS being taken out of each paycheck because they said it was compensating for "underwithholding" from our old provider...

I thought this was something QB handled automatically? Now our monthly payroll has increased significantly because of this, and our paychecks decreased by a couple hundred dollars. I see where we can edit state info, but under federal I see no where to look at medicare/SS rates being withheld... am I just missing something??

Thanks for reaching out to us here in the Intuit Community, @Melomara.

To clarify, did you switch to QuickBooks Desktop Payroll?

If so, you can see the Medicare or Social Security rates through your Payroll Item List page.

Let me guide you on how to see their rates:

To learn more about payroll calculations in QuickBooks Desktop, check this out: How QuickBooks calculates payroll taxes.

Please get back to me if you're referring to something else by clicking the Reply button in this thread. I'd be glad to help.

SAME PROBLEM HERE.

07/20/20 ALL UP TO DATE QB DESKTOP & PAYROLL SUBSCRIPTIONS, SENT TO CLIENT & MADE THE PAYMENTS THINKING QB COULD MAKE THIS SIMPLE CALCULATION & THEY CAN'T. WHAT A TOTAL DISASTER & SCREWUP.

Hi there, @ike4.

When your QuickBooks Desktop and payroll have the updated release version. Rest assured that you'll get the most current and accurate rates and calculations for state and federal tax tables.

Then, you'll need to check the employee's paycheck if there are discrepancies or zero deductions for the SS and Medicare. You can pull up the Payroll Detail Review report, please refer to the steps below:

Review if the checks have the correct deductions. If no, correct the calculation by multiplying the total wage base of each payroll item to its corresponding tax rate. If correct, no further action is needed.

Also, may I ask for further details about what's wrong with the numbers? Does it affect all of your employees? This way, I can make sure that we are on the same page so I can provide an appropriate solution.

You can also visit this article: How to calculate payroll. This article provides information on how to calculate payroll, including gross wages, payroll taxes, and benefits.

Feel free to post here if you have further questions. I'll be around to help. Take care always.

I am having a similar problem with an update downloaded today. After the update a payroll was created and the Social Security and Medicare deductions were correct on the employer side but off on the employee side. How can I fix the taxes?

Thanks for joining in on the thread, llcincar.

There's a possibility that these updates are incomplete. Hence, the calculations are off. It must have been blocked by your system firewall or security. I'd recommend changing these settings to suit QuickBooks. You can use this link for reference: Set up firewall and security settings for QuickBooks Desktop.

After that, we can update the following components again:

Then, we can delete and recreate the paycheck. This should recalculate the taxes correctly.

Let us know how this goes so we can further assist you. Have a great day!

Today is 09/10/2020.

When we did the taxes this morning, it took no FICA taxes out. We did an update then it took double the FICA taxes out.

I have verified everything is correct with the payroll. Did a payroll check and the only discrepancy is from today's check.

I am a QB Pro Advisor and been using QB Payroll for 15 years. This is the first year we have had to update the payroll each week to make sure everything is correct. First it took out no taxes and now double.

Please fix this issue ASAP!!

Sandy Joscelyn

Hi there, Pavati.

Generally, this situation happens when QuickBooks Desktop was unable to calculate your taxes on your previous payroll (first attempt). After the update has been applied, the program automatically corrects or calculates the taxes (including the taxes from your previous payroll) that's why the amount is doubled.

Since you've already made sure that everything is correct in your payroll and updated QuickBooks Desktop to the latest release, I encourage getting in touch with our technical supports. This way, we'll be able to pull up your account in a secure environment and then run a series of tests to rectify the underlying issue:

You may check our support hours first to ensure that we address your concerns on time.

Additionally, here's an article that you can read to help track where your business stands in terms of employee expenses: Customize payroll and employee reports.

If there's anything else that I can help you with, please don't hesitate to insert a comment below.

Why do my reports show I paid the correct Social Security and Medicare but when I print the quarterly report it shows should have paid more Social Security and Medicare?

I'm here to help you fix it, Quarterly differences.

First, let's ensure both reports have the same dates and accounting method. It helps us sort out your concern.

Then, if everything is the same but showing a different amount, I'll share an article to fix this unexpected behavior: Troubleshoot PDF and Print problems with QuickBooks Desktop.

You can get back to this thread after trying the steps. We're just around to help you. Take care!

I am working on reconciling my W3 year end filings and one client was off-after looking through several reports and paychecks I have 2 employees that each paycheck (started Dec 31 2021) Medicare is being doubled on the employee side. I have updated QB's I have updated payroll and it's still doing this. What's the deal-none of the other employees are doing this. Oh and I can not click on F1 for help-nothing come up. Really when I need a live person to help fix this no one is in site. What is Intuit doing? Oh and I also rebuilt the file-still doing this.

Any good help-please nothing but quality help is needed.

Thanks for joining this conversation, @kerryboersma.

I want to help you resolve this payroll concern you're having, before it gets reported to our Support Team. If you already followed the steps in the accepted solution post and still having the same problem, try this one last step. For this, we need to check if there is a duplicate Medicare Item in QuickBooks. Follow the steps below:

If there isn't nay duplicate item, we highly recommend contacting our Support Team to help check on this for you.

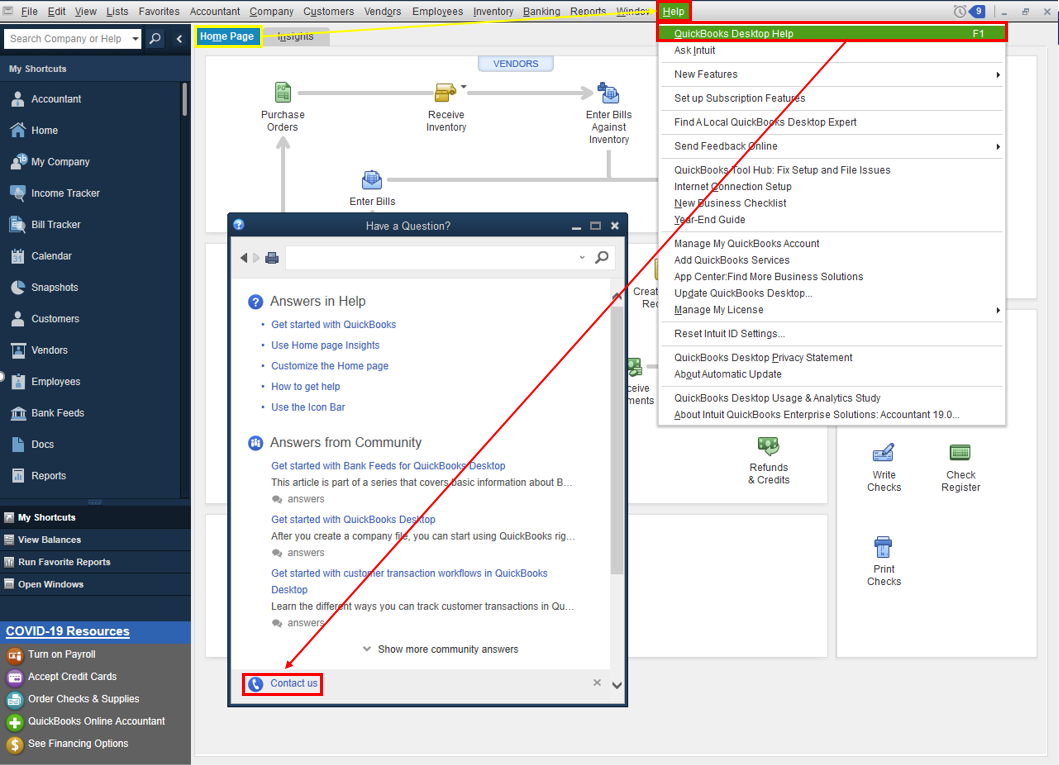

To get our support, follow these steps:

I'm also adding this article about our contact options and support availability for your reference: Contact QuickBooks Desktop support

I want to make sure this is taken care of and I'll be right here if you need any help with QuickBooks Desktop payroll.

Yep, I had Social Security Employee in the employees Payroll Info tab under Taxes... and it was calculating Social Security Employee TWICE on paychecks for an entire quarter for one employee. Thanks for the help, Jen_D!

I'm doing a bonus only payroll. I have one person who now that I'm trying to run her, medicare and SS are zeroed out for both employee and employer.

I changed absolutely NOTHING on the employee's withholdings and all of that, it just disappeared.

I appreciate you for joining the thread and sharing your concerns, @keithCDC.

The first thing we can do is to ensure that QuickBooks Desktop is up-to-date to enable payroll to run the Medicare and SS of your employee. With this, you'll always have the latest features and fixes.

Then, update your tax table to have the current and accurate rates and calculations. I'll show you how:

From there, revert your paycheck if an error needs to be fixed. You can refer to this article for detailed steps: Save or revert pending payroll checks.

For future reference, you can pull up payroll reports to get helpful information about your employees. To view this, feel free to visit this article for guide: Create a payroll summary report in QuickBooks.

Keep me posted if you need further assistance with payroll. I'll ensure that you get back to business in no time. Have a great day!

I use QBO and the instructions you've provided me do not work for this. I had two people that were going through a different issue and this only happened to one of them so I don't believe your fix is helpful.

Let me guide you on how to fix your employee's deduction and contribution, keithCDC.

In QuickBooks Online Payroll (QBO), setting up deduction items can be pre-tax or after-tax. You'll want to make sure that the setup for each item is correct so it would show the information. After you've checked the setup, you'll want to change the employee deduction to the correct one if the information entered was incorrect. I've provided the steps below:

Moreover, there are several reports that you use so you'll be able to view your employees' information. Learn from this article on how to access and customize the reports: Run Payroll Reports In QuickBooks Online Payroll.

Feel free to let us know if you have any other concerns with your employee

This does not help AT ALL. this is for if I need to add a deduction/withholding. The ones that vanished are the Social Security and Medicare taxes for BOTH EMPLOYEE AND EMPLOYER. These ones are ones that should be AND REMAIN programmed in. That means your system is messed up and you need to fix it immediately. There are 29 employees and this only happened to ONE. I need a fix in the next few hours. Meet with a manager, developer, something and get back with me. No more searching your own forums to tell me tired answers that do not correlate to a helpful answer.

Hi @keithCDC.

I recognize your concern about the vanished SSN and Medicare taxes in QuickBooks Online. I'm here to share details to connect with our phone support to resolve this matter.

I'd suggest reaching out to our Payroll Support Team so they can look into your setup. They also have resources that can easily walk you through recording prior payroll.

Here's how to contact us:

You can check our support hours and types for more information about our availability.

Once everything is good, you can start with payroll by paying and filing taxes and adding a payment history to QuickBooks Online Payroll.

If there's anything else I can do for you, I'm just around the corner. Take good care!

I have a payroll coming up and want to double social security and medicare deduction for an employee that did not have withholding from a previous paycheck. How do I do a one time change in medicare and social security for this employee?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here