Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowGood Afternoon, @theresawojahn.

Congrats on making your first post in the Community. Let's get this sorted out.

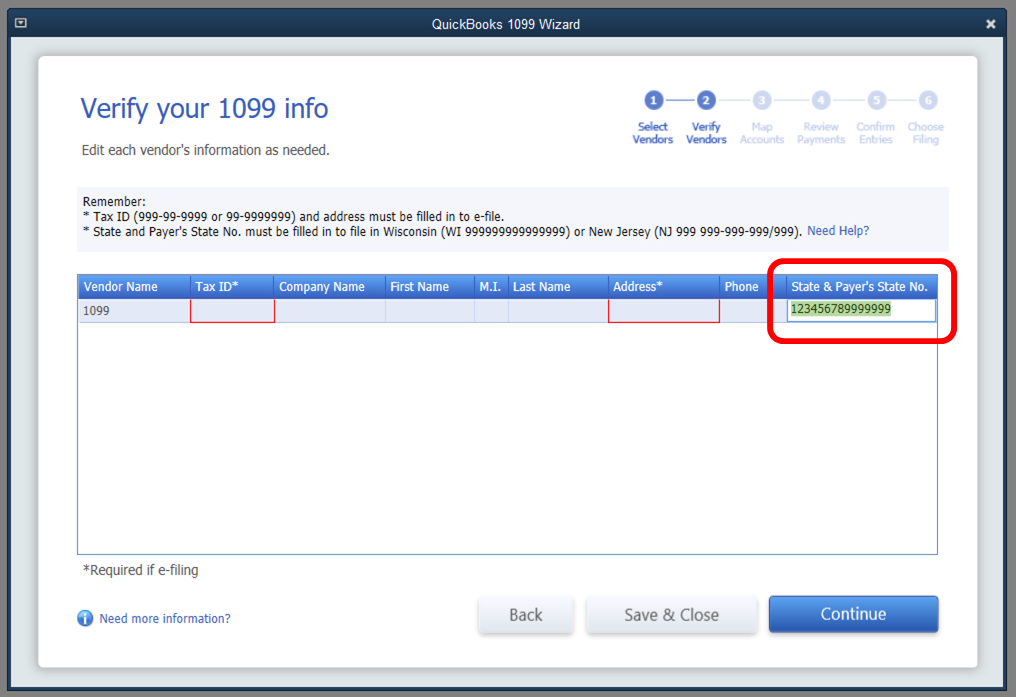

You'll need to enter your State & Payer's State No. in box number 17.

Since you're not able to edit or enter any information in box 16 or 17, then the best option for you is to use the 1099 Wizard to populate and edit the information. I'll show you how:

1. Go to Vendors.

2. Pick Print/E-file 1099s.

3. Select the 1099 Wizard.

4. Press Get started.

5. Choose the vendors.

6. Click Continue.

7. Double-click on the boxes you need to enter or edit information.

8. Continue the set up until you're on Choose filing window.

Learn more on how to prepare and file your 1099s in QuickBooks Desktop with this link.

Let me know how this goes. If you have other questions, feel free to ask. Have a great day!

Does box 17 (1099 MISC) and box 7 (1099NEC) need to be filled in with the dollar amount?

Form 1099-MISC

Does box 17 need to be filled in with the dollar amount as I already filled in box 16 with our State and number?

Same question for box 7 (1099-NEC form)?

You can enter the state income with a dollar amount, @DM-62.

Thanks for joining and sharing your concern with us. Let me provide information about these forms.

If your state tax department requires you to file paper copies with this information, then you may enter the amount on box 17 in the 1099 MISC and box 7 on the form 1099 NEC.

QuickBooks Desktop now supports 1099 boxes 16 & 17 for filing state taxes. So once you generate the form, it’ll automatically be populated.

You can visit these resources for detailed instructions on each form:

If you have further questions about the forms, please reach out to me again. We’re always here to help you out. Have a good rest.

I'm using QB Desktop Pro 2019 and I don't see the option to do 1099 Wizard. Then, when I fill in the State Payers No, it doesn't print on the form. Is there an update I need to perform to get this function to work?

Hello @DCLLC,

Let's make sure you've used the latest release for QuickBooks and your payroll tax table so you can prepare your 1099 form and print it with the state payer's number. Let me show you how.

In addition, here's an article you can read to learn more about how you can update and install the latest release: Update QuickBooks Desktop to the latest release.

Once done, here's how you can update your payroll tax table so your taxes are calculated accurately.

To add, I've got you this helpful article for ideas about updating your payroll tax table: Get the latest payroll tax table update.

Lastly, I've got you this helpful article so you can keep up with the latest payroll compliance mandated by your local and national agency: Payroll Tax Compliance Links.

Keep me posted in the comments if you have any other questions. I'll be here to lend a hand. Stay safe!

I did confirm that I am working with the latest updates ~ and there was nothing new to download.

I still was not able to have QB input the information on my forms - so I did it manually. All my forms are complete, so hopefully next year QB will find a resolution to make this functional! Or better yet, fix it this year so others trying to accomplish this years forms can do so without frustration!

Yeah, so I was told that I need to upgrade to QB ProPlus2022 to get the state number to prefill. So I did that. It took about 4 hours just to get the update and a few hundred dollars. It still doesn't print on the 1099 Misc. I am so pissed.

.Hi there, Harbor300,

I would feel the same way if this happens to me. Let me help you with the number so you can print your forms.

You'll want to be sure you enter your state number, like how QuickBooks formatted it in the samples. If that doesn't work, let's reset your QuickBooks update to load up the critical fixes to the software. I know it's a new one, but there may be some program files that may haven't been installed properly during setup.

If the issue is still not resolved, please contact our Support team again, so they can take further actions to resolve this.

You can also check the E-filing information and FAQs in this article for your additional reference: Create and file 1099s with QuickBooks Desktop.

I'm just right here if you need more help with printing your 1099 forms. Have a good one!

I figured it out on my own. The instructions are to enter it like this: WI 123456789012345

You have to enter the state, space, and then the 15 digit tax number. My error.

I put in the information but it won't print on n the 1099 misc.

I appreciate you for joining the thread, @Rhgh5661. I'm here to help you with printing your 1099 Misc in QuickBooks Desktop (QBDT).

You may want to consider updating your QuickBooks Desktop to the latest release to isolate the issue of why the information won't print on your 1099.

Here's how:

Once done, prepare your form again.

Just in case you're getting the same result, you can run the verify and rebuild tool to narrow down the result. The process self-identifies and resolves most data integrity issues that cause odd behavior while working with QuickBooks. You can check out this article for the detailed steps: Verify and Rebuild Data in QuickBooks Desktop.

For additional help about 1099s in the future, see this link: Tax1099 support page.

If you have any other follow-up questions about your form, let me know by adding a comment below. I'm more than happy to help. Have a good one!

I did the upgrade, even reset and upgraded again. I did not have this problem last year.

I have done all that reset, updates and stuff. I even restarted my computer. I can put it in but it won't print on 1099misc.

Thank you for getting back, @Rhgh5661.

I appreciate you for performing the updates to isolate the issue with your 1099-Misc. For the time being, let's try re-running the updates for the last time and make sure to download the Critical Fixes. Then, tick the Reset Update box to get the updates.

Once done, ensure to hit Yes when receiving a prompt to install the latest updates. You can also remap your 1099s, then print it again.

If you're getting the same result, I'd suggest reaching out to our Support Team. This way, a live representative can look into your account securely and investigate the issue of why the information is not printing on your form.

Please, let me know how else I can help you with your 1099s. I'm just a post away to provide additional assistance. Keep safe!

How do I get the $ amount to show up in Box 17?

I'm here to take care of your 1099 concern, ATCWI.

You can manually enter the amount in Box 17 when you prepare and file your 1099 Misc form.

Here's how:

Once done, you can now prepare and file your 1099 Misc form including your state ID number.

For your reference, I've included a screenshot below and a guide in preparing and filing your 1099 Misc form.

For more information, here's a great article you can refer to: Set Up A 1099 Vendor and Print Forms.

You know where to go if you have any other concerns with 1099's. I’m always here to help. Have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here