Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWhat is a sub customer and do I have access with basic online subscription

Hello Tuhner22,

A sub-customer is similar to multiple franchises for a customer. This would allow you to do a detailed tracking of your transactions.

Before you can create one, make sure the parent customer is already set up. Now, here's how to create a sub-customer:

Meanwhile, Master Admin has access to every pages and functions in QuickBooks Online. You can check your access rights in the Manage Users page:

You can see here your user profile and your access rights. Otherwise, you don't have enough access rights to view the page. Thus, needing you to reach out to the Master or Company Admin of the account.

Feel free to browse this link to see the comparison of QuickBooks Online subscriptions: https://quickbooks.intuit.com/pricing/.

I'll get back to you if you have further questions, Tuhner22. Have a great day!

How can I unmark the sub customer? It keeps showing me an error message even though both accounts have no outstanding balance.

Error: You cannot change who this customer bills with because there are invoices for the parent that include charges for this customer, or there are payments from the parent that pay off invoices for this customer. Delete all payments or invoices to this customer's parent which link to this customer.

Thank you for joining the thread, @Ina Farmer.

Allow me to share some information about the error message you're getting.

The ability to move the customer to another sub-customer or unmark the sub-customer isn't available if the sub-customers transactions are associated with the parent customer through the Bill with parent option. You can only achieve your goal if the customer and sub-customer have individual entries in the system.

That said, you need to delete all the payments and invoices associated with the customer that you're trying to modify. This is to ensure that your records are accurate and to prevent issues in the future.

I'm adding a link that you can check out about managing your customer's information in QuickBooks Online from adding to restoring them, feel free to read the details from here during your free time: Manage your customer list.

Please know that I'm only a post away if you have any other issues or concerns. I'll be more than happy to help. Take care always!

I have a question if Sub Customers can be used for this example to simplify invoicing for our customer.

Our customer has 4 Regions - - - they are all same as as example region 1 below.

Region 1 - Lino & Cloud - everything bills to Lino but many jobs ship to Cloud. We need to bill Lino for all jobs shipping to Cloud but some jobs ship and bill to Lino as well.

Is this an option to use Sub Customers to ease in having to type in the ship-to address all of the time? I tried setting up Sub Customers. However, when I invoice something for Could it shows Cloud in the Bill To and needs to read Lino.

Make Sense? What am I doing wrong or is this not a good fit?

Hi there, Phusion.

Thanks for dropping by the Community, I'm happy to help. What you're going to want to do is change the profile for Lino so it has a different shipping address than billing address. Here's how:

When you uncheck that box and change the address, you'll enter Cloud's address. This way it sends to Cloud but is billed to Lino.

You can find further information on these steps and more in this link about entering shipping addresses on invoices.

If there's anything else I can help with, feel free to post here anytime. Thanks for dropping by and have a lovely day.

Hi - what if product is shipped to both the Lino & Cloud locations - and sales tax rates are not the same?

It's nice to have you in this thread, StudioMH.

In QuickBooks Online (QBO), you can have both customer and sub-customer charges to appear on the same invoice. We have two ways to get this done:

Creating a delayed charge:

Choose the charges you want to add to the invoice:

For more information about this process, see this article: What does the bill with parent feature let you do on invoices?.

Don't hesitate to post again if you have other concerns. I'm here to answer them.

I've never tried the "delayed charge". If one invoice is created, will the separate sales tax rates be applied based on final destination?

Hi @StudioMH,

Thank you for your prompt reply. I'll answer your query about sales tax calculation in QuickBooks Online (QBO) for you.

QBO automatically calculates the total tax rate for your transactions. It's based on these three things:

See this article for more details on this topic: Learn how QuickBooks Online calculates sales tax. It includes a sample calculation of sales tax along with screenshots for reference.

I'll also suggest this article for you: Add sales tax categories to your products and services. It has the steps on how to assign tax categories to your products and services, which allows you to track sales tax more accurately.

Feel free to leave a comment below if you have other questions about the sales tax calculation in QBO. I'll get back to you as soon as I can.

Hi there,

I am using QBE 21 version and I can't seem to see the "Is sub-customer box" option. Can you please advise if this feature is no more available?

Creating a sub-customer in QuickBooks is a breeze, @accountingsuppor.

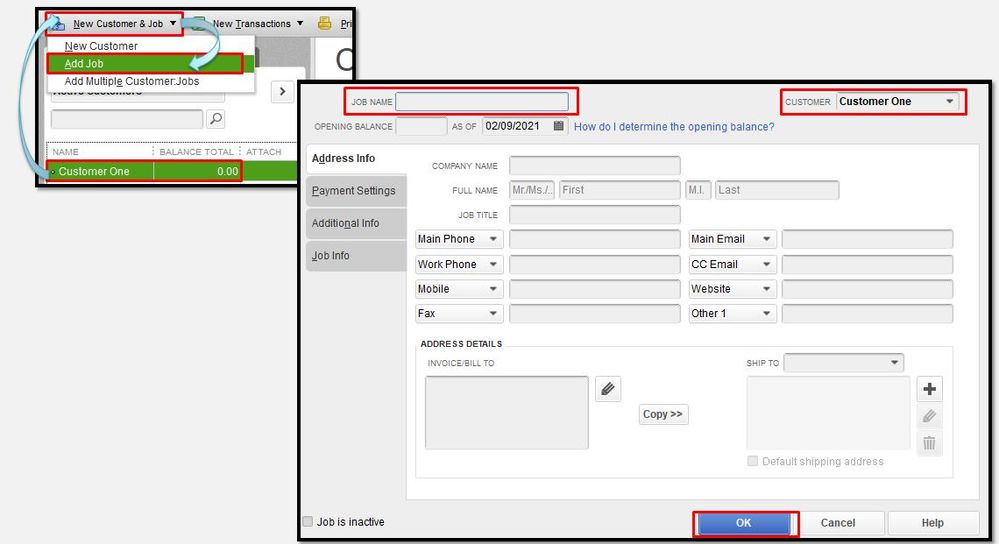

Yes, this feature is available in QuickBooks Desktop Enterprise 2021 version. To add a sub-customer you can use the Add job option. Follow along below to get started:

For your future reference, please see this article: Customize customer, job, and sales reports in QuickBooks Desktop.

Also, if in case you'll want to manage your customers and create a group for them, you can visit this page for the detailed instructions: Create a customer group in QuickBooks Desktop.

If you need further assistance in creating sub-customers in QuickBooks, please let me know in the comment section down below. I'll be always around and ready to help. Have a good one.

I do not have a "is the sub customer" option

Hi Gina Suscon!

The Is sub-customer is available in all plans of QuickBooks Online. Let me help you in setting it up.

Please make sure that the page isn't zoomed in. That way, you'll be able to see the entire QuickBooks Online page.

I also suggest using an incognito window when adding a sub-customer. Here are some of the shortcut keys:

If the same thing happens, please clear the cache and make sure your browser is up-to-date to fix issues in QuickBooks Online.

This is how it looks like:

You can find the detailed steps in adding a customer here: Add and manage customers in QuickBooks Online. For assistance about your company's income and sales, visit this page: Sales and customers.

Leave a reply again here if you need anything else. Have a great day!

It appears that when I create a sub customer, the box for "Bill to parent" is already checked. Can that be changed? I don't want my sub customers to be billed to the parent company.

I appreciate you for joining the thread, @JMG6.

I'll step forward to give some workaround for billing a sub-customer in QuickBooks Online.

With the help of this option, you can enter charges for a parent customer and a sub-customer to have both appear on the same invoice. Since you've mentioned that you don't want to bill your sub-customer, we can uncheck the Sub-customer checkbox.

I'm also adding this article for additional insight into creating invoices.

In addition, if the customer pays the invoice, you'll have to record the payment. It is the best way to help your books balance. Check out this page as your reference: Record invoice payments in QuickBooks Online.

Don't hesitate to mention me if you need help with how to run your sales report in QuickBooks. I'd be happy to share some ideas with you.

I didn't ask that question. Please read carefully and respond. It appears that when I create a new sub-customer, the Bill to Parent box is already marked. My question is this: how can I change it so the box is not automatically marked? I know that I can unmark it. This is what I am trying to avoid doing. I am training people and I don't want to rely on them doing it right. I want the box to be unmarked, without anyone having to do it. Can I change the settings?

I appreciate your response and clarifying your concern, JMG6.

When adding a new sub-customer, and right after choosing a parent customer, the Bill to Parent box or Bill parent customer box will automatically be marked. The system automatically recognizes the box. As you mentioned in your previous reply, we have to manually uncheck it if necessary.

Let's send your valuable feedback to our Product Development team. Sign in to your QuickBooks Online account and share your insights about the Bill to Parent box. I'll show you how:

We can visit these articles to learn more about handling sales, income, and customers in the program:

Let me know if you have other concerns about adding sub-customer and managing customer information. I'll help you in any way that I can.

I have a customer called LSI Flooring that I currently bill for Rug pad they sell and we distribute for them and they pay through the QB Link on the invoice.

They have created I guess you could say a different entity "Rugs by LSI" under the Mother company that they now sell these Rugs through with a different name and want me to bill it in the name of the new entity because the payment will come from a different checking account they set up for selling the rugs but there is no separate tax ID for the rug selling just a different checking account. Is this possible to do in quickbooks? They say they can't pay my invoices for the Rugs when I send the invocie to the main company LSI Flooring because of the differnt checking accounts.I am so confused I don't know what to tell them or do.

I might add also that they want the "Rug side of thigs sent to a different email address as well for billing.

Hello there, Kathy.

I'd like to share some insights with you on the process of sending online invoices to your sub-company known as Rugs by SLI.

To begin, we can add Rugs by LSI as a sub-customer to LSI Flooring. Make sure to enter their new banking info and email address so they'll be able to receive and pay the invoices online. This way you can track individual customers.

Let me show you how:

Once you've finished the setup, you can easily send the invoices by selecting the sub-customer and initiating the process.

Moreover, I've collected some relevant articles you can use to help manage your invoices and other sales transactions in QBO:

If you have any additional questions or concerns regarding the process of sending invoices to a sub-company, please keep me updated. I'm here to assist you. Take care and stay safe!

HOw do I just get invoices for a sub customer without having to delete everything? I used to beable to go it, now I get this messgare

You cannot change who this customer bills with because there are invoices for the parent that include charges for this customer, or there are payments from the parent that pay off invoices for this customer. Delete all payments or invoices to this customer's parent which link to this customer.

@ChristineJoieR Thank you for your answers. l need help with this situation and l want to know if l can use the sub-accounts to solve it.

l have customers who are students, and now there applied for a student loan. They got it, though this student had paid something before. so the loan is for the balance they owed. But the loan company does not pay the students directly, but rather pays us directly. and they want us to invoice them not the student. How do l go about this using the sub accounts, so that we don't double record these transactions. Thank you

I am grateful for your participation in this discussion, majestyloe. Allow me to offer further support in handling this matter within QuickBooks.

You can create a sub-customer and choose to check the Bill parent checkbox if you prefer a combined total, or leave it unchecked if you want the totals to be itemized separately. Subsequently, create an account to monitor the loan and create a recurring invoice for your customer's monthly payments.

Before doing the process, I would recommend to consult with an accountant. They can provide a specific guide required for your business needs.

Tag me if you have any more questions regarding customer loan tracking. I’m eager to help you once more.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here