Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowInstead of creating a bill through "Enter Bills" for purchase orders, and matching it to the credit card charge, imported through the Downloaded card charges, does the following procedure have the same effect:

Enter a credit card Purchase/Charge, purchased from the vendor and select the Purchase Order to apply it to?????

Solved! Go to Solution.

Thee is no Enter Bill; if you already paid by credit card. The function of PO will be used for enter bill, write check or Enter Credit Card Charge, because you list the same Vendor name as "payee or purchased from" and Tab Out of Name, and the program reminds you there is an Open PO, and asks if this is fulfillment of that PO, or not.

Thee is no Enter Bill; if you already paid by credit card. The function of PO will be used for enter bill, write check or Enter Credit Card Charge, because you list the same Vendor name as "payee or purchased from" and Tab Out of Name, and the program reminds you there is an Open PO, and asks if this is fulfillment of that PO, or not.

Response doesn't address my question. A vendor invoiced me for $4400. I posted it through "Enter Bills". Later I paid that $4400 with a credit card. How do I post the second payment transaction?

Hello there, @tab.

Thank you for joining the thread. I'm here to help guide you record your transactions correctly in QuickBooks Desktop (QBDT).

To give you the right amount of information, may I know what are you referring to when you're asking about how to post the second payment?

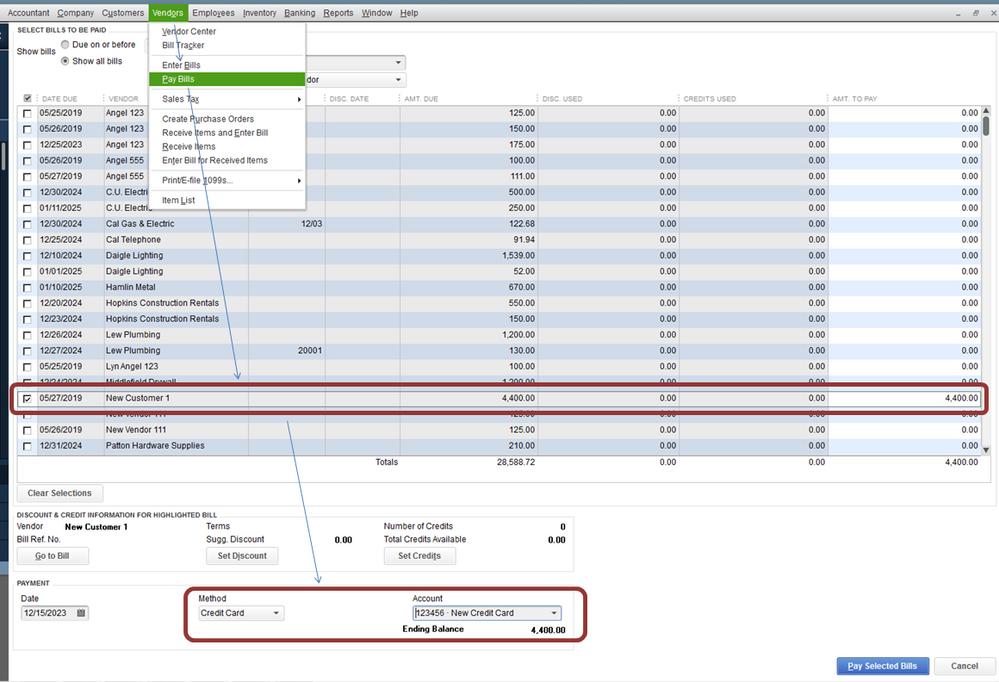

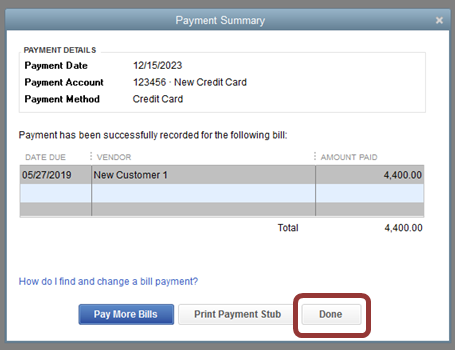

If you're referring to applying/linking the credit card payment to the bill you've created. Then you can pay the bill following these steps:

For additional reference about accounts payable workflows in QBDT, you may check this article: Accounts Payable workflows in QuickBooks Desktop.

You may also check our help articles for you future reference: Help articles for QuickBooks Desktop.

Stay posted if you have any other questions about handling/recording transactions in QuickBooks, I'll be always here to help you. Wishing you the best!

Maybe this is a similar situation.

I enter a purchase order and rather than pay by check, a credit card payment may be made to pay the invoice. In the past I have entered the amount on the PO, then backed it out as a - amount. That at least lets me track activity with the vendor. Then when the credit card comes in the amount will be entered along with the expense category.

Looking for a better (correct) way to do this.

Thanks for your help.

Glad to have you back, @sprints.

You've got me here to provide the information that you need in handling your payments in QuickBooks Desktop.

If you're referring to recording the PO transaction that will indicate that the payment was processed through a credit card instead of a check, then you may follow the steps presented by my peer above.

However, if you wanted to link the credit card payment and its charges to the bill, this can be done by performing these steps below.

Let's start by recording the credit card payment.

Once done, you can now link it to the bill:

Additionally, I've included here a couple of links that you can check out about handing the payables in QuickBooks Desktop:

If you need further assistance with the process, you can always reach out to our Customer Care Team. They have advanced tools that can help walk you through this procedure.

Please let me know how this works for you, sprints or if you're referring to something else. I want to ensure you're all set. Have a nice day ahead!

Thank you for the information. I will give it a try and to if it does the trick.

I see payment can be made by credit card. When the credit card for payment is selected, I do not see how that can be brought up with the credit card statement comes in so it can match to the statement. I am thinking when credit card payment is selected

Generally I make a PO, enter the item and amount, then back it would with a minus - amount. The actual amount and category is entered when the credit card statement comes in. Your way places the payment immediately in the check register as being paid. When the credit card statement comes in and paid there wouldn't be a way to enter the category line item and amount because it would take it out twice from the bank account.

Am I not understanding what you have in mind?

You're on the right track, @sprints!

You can also pay your bills directly with the credit card payment you received. I'm here to share a few insights and help you from there.

Firstly, you'll have to convert your purchase order to a bill so you pay it with the credit card you received. To convert a purchase order:

Once completed, you can now pay your bill with the credit card payment you received. Let me show you how:

As always, you can visit our Help Articles page for QuickBooks Desktop in case you need some related articles for your future tasks.

If there's anything else that I can help you with, please let me know in the comment section down below. I'll be always around ready to help.

Hello,

What can I do if only the bank account is on botoom of pay bill screen?

Not cc

Thanks

I'm glad to see you here in the Community, @admin1218.

The Credit card will show as part of the payment method for paying bills.

If you have Credit Card set up, you’ll want to ensure the method is set to the credit card, so it will show in the accounts dropdown. You can use the sample file to verify.

Once the sample company file has a CC option, you can contact our Technical Support team to check this further. They can check your account securely and can offer a screen share session if needed.

Here’s how:

Otherwise, you’ll want to set up credit card accounts first so you can have this payment method. You can refer to this article for step-by-step instruction: Set up, use, and pay credit card accounts. Once done, you can now pay bills in QuickBooks Desktop.

We’re always here if you need additional assistance. Take care.

None of the suggestions provided makes sense to me. I entered a bill, then paid the bill with the credit card and now the vendor shows a credit. Why? Why doesn't it zero out when it's paid by a credit card?

There are several reasons why QuickBooks doesn’t recognize paid transactions, @syringaboutiquei.

It might be you entered record the payment, but not applied to a bill, or it could be a duplicate transaction.

You can double-check your vendor events. This way, we can ensure everything is settled. You’ll want to check both the bill and payment sections. Then delete if there's a duplicate.

Here’s how:

If there’s none, verify the payment if it’s applied to the bill correctly.

Vendor Credits usually appear if there are available credits that haven’t been applied previously. You can check this guide on resolving open transactions.

In case you want to keep track of your finances and help them more organized, you can visit this article on how to get this done: Merge Accounts, Customers, and Vendors.

Don’t hesitate to get back if there’s anything you need to know about QuickBooks. Take care.

One you receive the credit card bill how do you then account for/enter that purchase you have already entered in vendor bills along with other purchases not enter as vendor bills?

My current process:

Enter vendor /purchases bill into vender enter bills indicating that the bill was paid via credit card

Then once I receive the credit card bill I also add it in Vendors enter bills- (entering items and the vendor purchases as expenses again in some cases because I have make sure the that the balance matches the bill amount)

Doing it this way is allowing me to be able still see all vendor activity clearly and it is still searchable purchases/prices/individual items purchased) but it is causing the credit card account in my chart of accounts to show as a growing balance even though the card card itself had no open balance and is paid each month.

Hey there, @GSDA. I'm happy to help you with your growing credit card account.

Once you received the credit card bill statement, you don't have to enter it again in QuickBooks. This might be the reason why your credit card balance shows a growing balance in the Chart of Accounts.

To fix this, you'll have to delete the created bills or bill payments. Then, you only need to create a check when the bank will pay the balance so it will not grow and will offset the amount.

Here's how to delete the bill:

For details on how to delete a check and record credit card charges see these articles:

Also, you can run and customize any vendor reports in the software. This way, you can efficiently manage your expenses and accounts payable. These help you get the specific information you need for your business. To learn more about this process, visit this article: Customizing Vendor Reports.

Please let me know if you have additional questions or concerns. I'll be here every step of the way. You can reach out to the Community at any time. Take care and enjoy the day, @GSDA.

I am using the procedure described above and it works well...if you have one person performing all of these functions. It is getting a bit trickier as our department has grown. The problem for us is that there's one person who handles the bank feeds that bring in the credit card payments. There's another person who handles the purchase orders and item receipts, and a third person (me) that processes vendor payments for the weekly check run. The issue is that there are three people managing their responsibilities on different time lines and balancing different work loads. So, as the person paying vendors, I do not always know that credit card payments still need to be applied to open payables and I have processed checks for open payables that still needed to be matched up to credit card payments.

It would be a great improvement if we could designate vendors that are paid by credit card and I could filter them in the payables screen in the same manner that I am able to filter out vendors paid by direct deposit.

I appreciate you for sharing your concern with us, @susiejo3. I understand that you want to make some changes and improvements to QuickBooks Desktop (QBDT) to meet your business needs.

It would be nice to have this as an option as it will help you run your business seamlessly. I recommend sending your thoughts about designating vendors paid by credit card straight to our developers. Ideas like this help identify the features our customers want the most for consideration in future enhancements.

You can send feedback by following these steps:

I'm also attaching this screenshot for visual reference:

All feedback goes to them, and everything we update in QuickBooks is based on the information provided by our customers.

In addition, feel free to check out this article to help you with modifying or adding transactions with renaming rules.

Also, you might be interested in learning more about the Accounts Payable workflows used in QBDT: Accounts Payable workflows in QuickBooks Desktop.

In case you have other questions in mind, post them in the comments below. I'll get back to you as soon as I can. Have a good one!

This is very helpful however when I tried to set this up I received an error stating credit card being the incorrect account type (only bank account types accepted). Please advise. I am using QB Desktop Enterprise

Thanks for updating us on this, lcdexcavation. It can be rough when you encounter an error message when following the steps above. I'm here to help you with that.

Are you referring to applying or linking the credit card payment to the bill you've created? If so, you can pay the bill by following steps:

If you still get the same error message, I'd suggest attaching a screenshot on this thread. This way, we'll be able to investigate the main cause of this.

In case you're pertaining to something else, please let us know. This way, we'll be able to provide accurate steps to resolve this.

For more guidance in tracking vendor transactions, you can check out this article: Accounts Payable Workflows.

Additionally, I've added these resources that'll provide different perspectives of how your business is doing. This helps you keep your books accurate:

Please let us know if you need additional help in managing your vendor transactions. It's always my pleasure to help you out again.

Hello Charlene,

I'm running QBDT pro not premier

I have tried to pay bills with a cc in "pay bills" but it doesn't literally pay the bill listed in QB. I was thinking as long as I selected the bills to pay in the pay bills window and then selecting credit card and then the credit card to use this would work. But it doesn't. The bill still sits there as unpaid. What I want to do is enter bills as they come in and be reminded of them in reminders. Then pay them as needed in pay bills with the cc. I can't seem to get it to work properly. I know if I were to track the cc and reconcile it I could pay it then but that is not what I want to do. Is there a difference in DT and Premier with this process?

Thanks for joining this thread, @PaulMin. Allow me to provide some information about paying bills.

Once you fully pay your bills, QuickBooks will automatically mark them as "Paid," regardless of the payment method. This works the same for all QuickBooks Desktop versions.

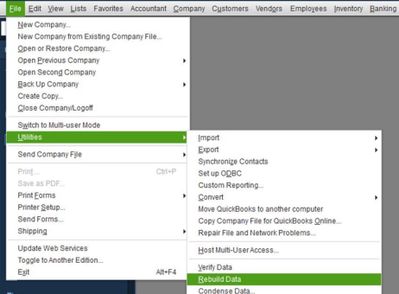

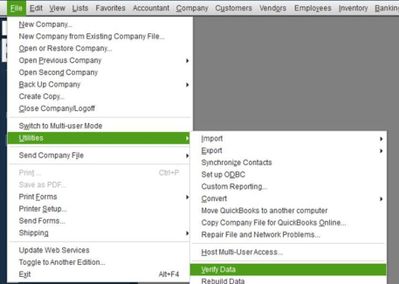

There might be an issue with your company file that's causing them to remain unpaid. I recommend running the Verify/Rebuild tool. Verifying it will detect any damaged data and fix it by rebuilding it. It also allows your QuickBooks software to refresh the data inside the company file. Make sure to create a backup copy of your company file before doing the process. If there are changes that occur, having a backup copy allows you to restore it to undo the changes.

First, rebuild your data by following these steps:

Then, run Verify Data again to make sure there's no error.

Additionally, make sure your QuickBooks Desktop is up-to-date. This way, you always have the latest features and fixes.

I'm always around if you need further assistance and let me know how these steps turn out. I'm determined to ensure everything is working as it should be. Wishing you continued success!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here