Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am new to QBO - I have just downloaded all my transactions from year. I have aprx 75 contractors that perform services for a business that I work with each month. These are referees working for a sports league. I oversee the assignments and payments with my business.

I am trying to set up all the payments to these referees/contractors in QB online. Do I set them up as a Vendor or a Customer in the Payee Field? My category was going to be Contractors.

Solved! Go to Solution.

If they are working for you and you are paying them then they would be vendors. Customers are for people who you do work for and who pay you.

Thanks for choosing QuickBooks, SnoKingRef.

I agree with aj4fluentbiz. A Vendors are those people or companies that you pay money to, such as a store, utility, landlord, or subcontractors who do work for you. On the other hand, Customers are people who owe you money for products purchased or service rendered.

I'd be happy to walk you through on how to add Customer/Vendors by following the steps below:

To add Customers:

To add Vendors:

I've attached some screenshots below so you can have a better view.

Should you have additional questions about vendors and customers or anything else QuickBooks, don't hesitate to ask me here in the Community. I'll be around to help you out

If they are working for you and you are paying them then they would be vendors. Customers are for people who you do work for and who pay you.

Thanks for choosing QuickBooks, SnoKingRef.

I agree with aj4fluentbiz. A Vendors are those people or companies that you pay money to, such as a store, utility, landlord, or subcontractors who do work for you. On the other hand, Customers are people who owe you money for products purchased or service rendered.

I'd be happy to walk you through on how to add Customer/Vendors by following the steps below:

To add Customers:

To add Vendors:

I've attached some screenshots below so you can have a better view.

Should you have additional questions about vendors and customers or anything else QuickBooks, don't hesitate to ask me here in the Community. I'll be around to help you out

Very helpful thank you -

Are contractors entered under sub contracting ( cost of goods sold)

We hire out work to independent contractors to complete- they submit a bill for their time.

The goods are service related and not physical goods.

Is this the correct category for this transaction?

Hi there, @GTM Dawn.

Thank you for joining the Community. I'd be happy to help share some information about setting up a subcontractor in QuickBooks Online.

Generally, you pay a contractor using an expense account. This way, QuickBooks tracks these payments and adds it to the contractor’s when you create the 1099 form.

Expenses for products and services need to be clearly differentiated from the work they do as a subcontractor. You can create multiple expense accounts to map those transactions easily.

Here's how to set up a new Expense Account to track subcontractor expenses:

Moving forward, every time you enter an expense or a check to them, you can select the account you want based on the service they provide.

I've attached some articles below for additional details, as well as screenshots for additional reference:

That should point you in the right direction. Please know that I'm just a post away if you have any other questions about setting up contractors or while working with QuickBooks. I'll be happy to help you further. Have a great day ahead.

I new at this company and we use qbonline. There is a question. We have our clients who pay direct to insurance companies who in turn then send us a check for a certain dollar amount depending on how ever many clients paid that month. The person before me had these insurance companies set up as vendors but I believe if they are sending us a check they would be a customer , we supply them services of clients. Is this correct. I want the bookkeeping to be correct. If so where do I go change it.

You're correct, SStone4203.

We'll have to set them up as customers since they're sending you checks. For now, we need to make sure that the affected accounts are correct which is an Income account. That way, we don't need to modify all the transactions since it'll post to the appropriate accounts.

We can apply the changes moving forward to avoid this from happening again. Once you've set them up as customers, we can make their vendor profiles inactive to avoid confusion. Go to the Expenses tab and select Vendors. Check the box beside the vendor names. Under the Batch actions drop-down, select Make inactive.

Hope this helps. Let me know if you need more help.

The checks we get are for commissions. Would they still be customers?

The checks we get are for commissions. Would they still be customers?

The checks we get are for commissions. Would they still be customers? We are a yacht / boat brokerage company . They send us commission checks and once in a while we may send them a check but not often. How would I categorize them. Are they a customer, vendor, sales??

ALEXV The checks we get are for commissions. Would they still be customers? We are a yacht / boat brokerage company . They send us commission checks and once in a while we may send them a check but not often. How would I categorize them. Are they a customer, vendor, sales??

Good day, @SStone4203,

Commissions can either be revenue or an expense. If those checks are given to you for obtaining sales, it is an income on your books.

To account for this entry, create a service item called Commission Earned and select an income account for it. Use a generic client, or create the issuing company as a customer. Here's how:

Use it on a sales receipt once you get the commission. Follow the steps below:

If you have any follow-up questions or need further help, please let me know in the comment section below. I'll be glad to help. Have a nice day!

i work for a real estate firm and i pay my realtors commissions only (non payroll). they are independent contractors. i currently have them set up as "vendors" and write a check and then print. i'd like to set them up with direct deposit. i've got about 100 of them. i need the direct deposit to be timely, ie two days or less.

what is the difference between setting them up as a "vendor" vs "contractor" in QBO?

Hello, @HeidiMarcotte.

A vendor is a person or a business that sells a service or a product. While contractors are people assigned to a specific task that provides services to clients. You can pay both vendors and contractors using direct deposit.

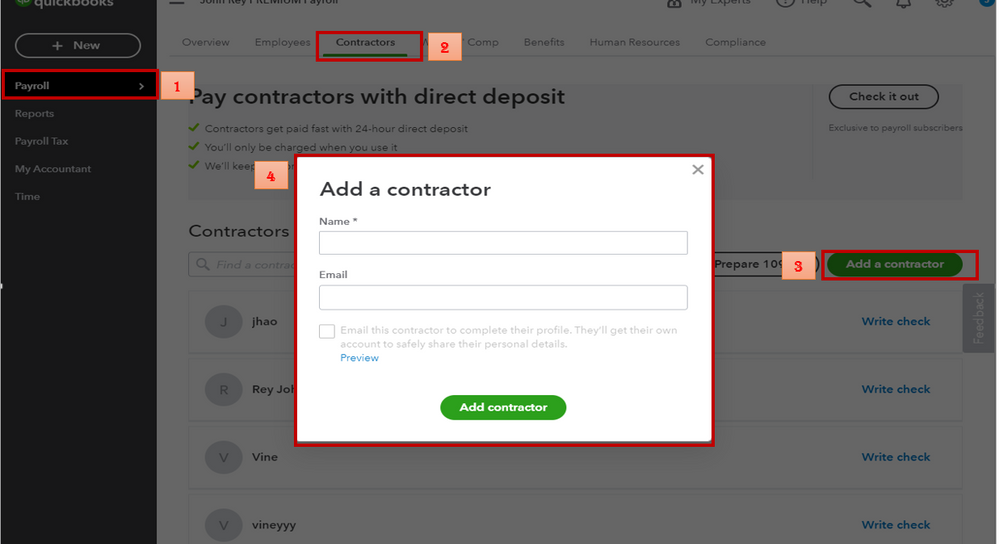

Here's how to set up direct deposit for your contractors:

You can browse this article for more detailed steps: Contractor direct deposit.

Also, you can read through these articles to learn more about the direct deposit processing timelines and schedules:

We got your back if you have other questions about managing your vendors and contractors. Have a great day!

Thank you so much. So why cant i just choose "write check" and instead of choosing print check you choose pay by direct deposit?

I'd like to send out an email to all 100 of my realtors (independent contractors) asking them to add their bank routing and account numbers so i can pay them direct deposit. I already have all of their W-9's in a print format and recorded in QB's under vendors. Is there a way to gather this bank info electronically?

Hi again, @HeidiMarcotte. Let me clarify things out.

In QuickBooks Online, the requirement to pay your contractors for Direct Deposit is to have an active payroll.

To learn more about this, here's a great resource that you can read: Contractor direct deposit.

However, if you're under a non-payroll subscription, you can continue to write a check, expense and create a bill for your contractors.

If you have any other questions, let me know by commenting below. I'm here for you. Have a great day!

New to QBO this year. So in Jan. I paid my contractors by manual checks. Thru the bank download, I had to code them vendors. I would like to pay them by direct deposit in Feb. and I set them up as contractors under the Payroll tab (I am not using the Payroll module by the $4/mo/contractor option). I am having difficulty getting them paid. I am not sure if it's because they are vendors and contractors. When I tried to pay them using direct depo pay, I could not get pass "Corresponding Account in QuickBooks" . Someone please help.

Thanks for following this thread, @tastehgrc. I'm here to help ensure you're able to pay your vendors/contractors using direct deposit.

To pay contractors by direct deposit, you'll need to have an active QuickBooks payroll subscription even you don’t run payroll for employees.

First off, you'll need to set up your vendor/contractor's profile. Here's how:

Once done, you're ready to set up for their direct deposit. Follow Step 2: Set up direct deposit outlined in this help article: Pay a contractor with direct deposit.

For future reference, read through this article: How to set up contractors and track them for 1099s in QuickBooks. It helps you learn about adding and tracking contractor's payments in QuickBooks Online.

Feel free to post more questions in the Community. I look forward to answering your next posts.

Thanks for posting again, tastehgrc,

Allow me to join the discussion and share some insights about this problem. If you're using the mobile app and can't see the bank account(s) from the Corresponding Account in QuickBooks field, this is currently tagged as an ongoing issue for QuickBooks Online.

Our engineers are working on the fix internally so we can't provide the exact turnaround time on when this will be resolved. They instead send live updates about the status of the investigation through email. To add your account to the notification list, please contact our Support Team and provide the investigation number INV-40422 to them.

Our Live Support are available from 6:00 AM until 6:00 PM on weekdays, and 6:00 AM til 3:00 PM on Saturday. If you can't reach us during this time, you can request a callback so you won't have to wait on the line.

Here's how to contact us if you're using QuickBooks Online:

Also, here's a workaround recommended by our engineers. Change the detail type of bank account from "Cash on Hand" to "Checking". Then, log out and log back in, it should show up from the drop down menu.

We ask for your patience while this is still being worked on. If you have other questions or concerns that needs immediate attention, please let me know in the comment below. I'll be more than happy to help.

My question will be what is the Difference on setting up a Vendor and a contractor? Since QB has a difference in between the two. If I need to pay them? Do I set then up as vendor? Or contractor? Also if I need certain documentation in order to pay them is there a way that QB can validate that documentation? In order for me to be able to pay them

I can share some ideas about the difference between vendor and contractors in QuickBooks, @Gabby1582.

If the person works for you as an independent contractor, you should set up that person as a vendor. The general IRS rule is that an individual is an independent contractor if you have the right to control or direct the result of the work but not the means and methods of accomplishing the result.

An independent contractor is a person, business, or corporation that provides goods or services under a written contract or a verbal agreement. Unlike employees, independent contractors do not work regularly for an employer but work as required.

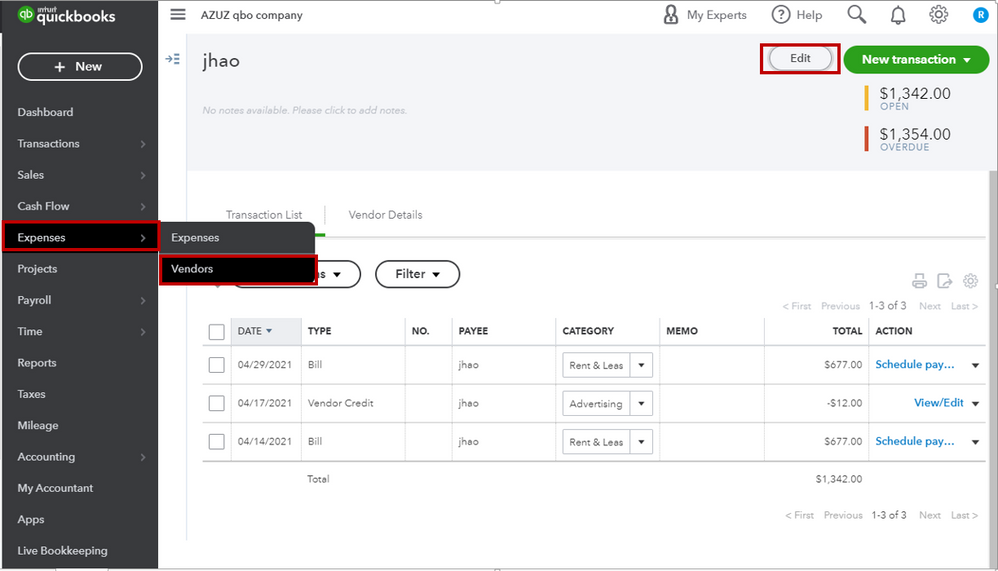

You can either set them up as vendors or contractors. To add a contractor as a vendor, here's how:

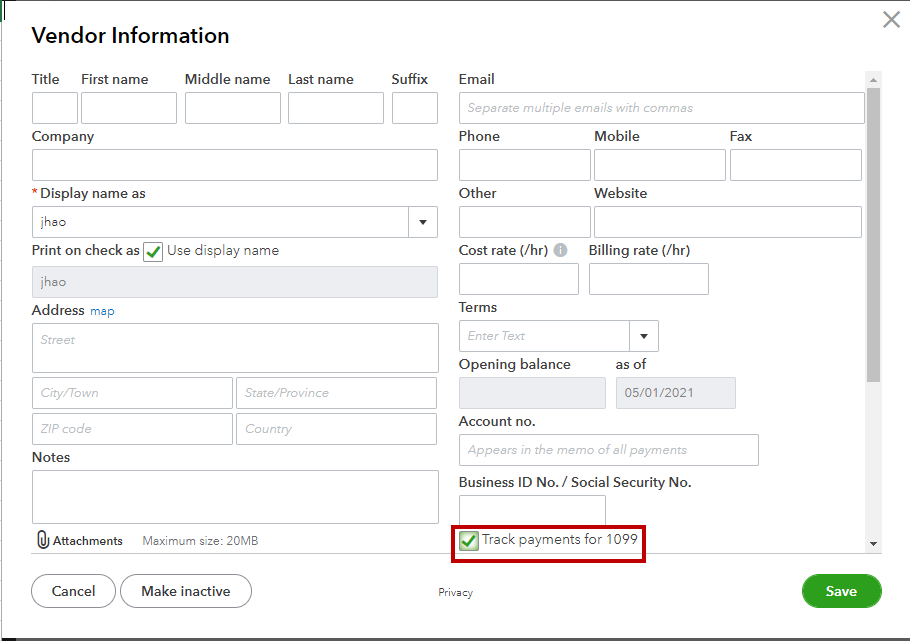

Now that you entered the contractor as a vendor, you need to start tracking their payments. Let me show you how:

QuickBooks will start tracking all of its payments. When you're ready to file your 1099s, you can easily add the tracked payments to the form.

I'm also adding this link on how to prepare and file your 1099s during tax season.

Feel free to drop a line below if you have any other questions about setting up vendors or contractors in QuickBooks. Have a wonderful day.

Basically, You`re saying that if I create them as "contractors" they would also appear in the "vendors" section? Am I understanding you correctly?. What If I`ve created them as vendors and not contractors, Can I still see them on the "contractor`s" menu?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here