Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWe have a client that was invoiced and the client paid the deposit amount. A few weeks later, the client decided to cancel the service and we issued a check in the amount of the refund.

We then did the following steps:

This did not work. Essentially, the initial deposit is still showing in the account. The Credit Memo shows as 'unapplied' and now the balance is in the negative. See screenshots.

Can someone please help me figure out what the issue is here or where we might have missed a step in the process?

If anyone on QB Online can help with this, I'd appreciate it. In the past, this was a simple thing to process. Thanks!

Screenshots:

Solved! Go to Solution.

Hi there, marketingmuses.

I'll help you in handling your customer balance.

The program prompts you that warning because you've entered the whole amount of the invoice in the credit memo. Please know that we only need to create a credit memo for the remaining balance of the invoice since you've already issued a refund for the initial deposit.

We can open the credit memo and edit the amount. This way, we'll be able to close the invoice and zero out the customer's balance. Here's how to do it:

Once done, you can now perform Receive payment using the credit memo that you've created.

In case you'll need to track all the invoices that are due on a particular day, we can customize your Transaction Detail By Account report.

Should you have any other concerns or follow-up questions, you can always find me here. Have a great rest of the weekend.

Hi there, marketingmuses.

Credit memo is usually created if you want to use a credit as a payment to a future invoice.

As you mentioned and shown in the screenshot, the initial deposit is still recorded in your account. This can be the reason why there's a negative balance in the customer's account.

If you want to keep the original payment in the record, you can directly create a refund receipt or check to refund the customer instead. Otherwise, applying the credit memo as a payment to the original invoice will still leave a negative balance.

I also checked the screenshots and it looks like the Credit Memo was not applied successfully as a payment to the original invoice. Let's open the invoice again and redo the process:

Let me share these articles for more details on how to record a refund or apply a credit memo:

I'll be around if you nee anything else.

Hi Jeno -

Thanks for the quick reply!

One of the issues is that the original invoice balance due was much higher than the deposit amount that was refunded. We did create a refund check, but the outstanding balance was still there from the original invoice balance due. So it wasn't the same amount refunded compared to the original invoice - hopefully this makes sense.

In the morning we will go through all of these steps that you are recommending and I will follow up if that solved the problem.

Thanks!

Hi Jeno -

Thanks for the quick reply!

One of the issues is that the original invoice balance due was much higher than the deposit amount that was refunded. We did create a refund check, but the outstanding balance was still there from the original invoice balance due. So it wasn't the same amount refunded compared to the original invoice - hopefully this makes sense.

In the morning we will go through all of these steps that you are recommending and I will follow up if that solved the problem.

Thanks!

Good day, marketingmuses.

Thanks for getting back to us.

In addition to what my colleague mentioned, you can also create a Credit Memo. Then, create a Check and select Account Receivable as the source account. Once done, we can link them together via Receive Payment.

We'll be right here if you need anything else. Have a great day!

Hello QB Team -

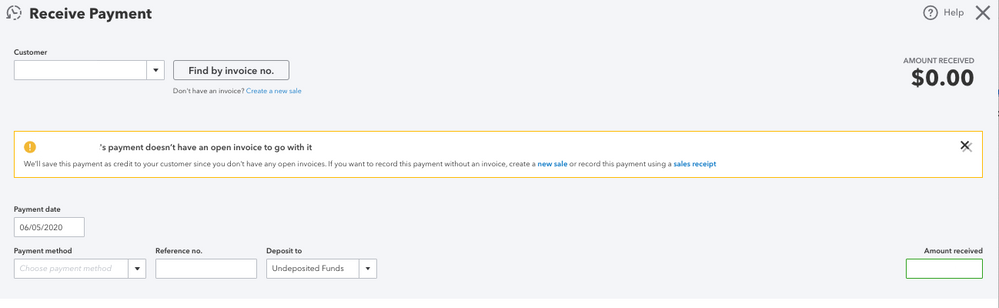

We followed these instructions step by step and when we arrived at the step:

Hi there, marketingmuses.

I'll help you in handling your customer balance.

The program prompts you that warning because you've entered the whole amount of the invoice in the credit memo. Please know that we only need to create a credit memo for the remaining balance of the invoice since you've already issued a refund for the initial deposit.

We can open the credit memo and edit the amount. This way, we'll be able to close the invoice and zero out the customer's balance. Here's how to do it:

Once done, you can now perform Receive payment using the credit memo that you've created.

In case you'll need to track all the invoices that are due on a particular day, we can customize your Transaction Detail By Account report.

Should you have any other concerns or follow-up questions, you can always find me here. Have a great rest of the weekend.

Hello KlentB.

I have a similar situation and am using QuickBooks 2019 for Mac.

I created an invoice for a client for a booking fee. The client paid the invoice but then, a couple weeks later, they needed to cancel and we agreed to issue a refund.

I created a Credit Memo for the full amount of the paid invoice, but now I have a an accounts receiveable outstanding amount showing for the original invoiced amount; which shows as paid within invoices.

Wondering if I should not have utilized the credit memo here and instead processed this differently?

The client is not moving forward so need to clear out the account receive amount so it is not showing in my chart of accounts or as an outstanding amount owed by the client

Thank you for bringing this to our attention so that we can deal with this quickly, @MandRGamez.

I appreciate you for providing the detailed concern and the effort you've done in applying for the refund. Let me share with you the correct way of recording a refund on QuickBooks Desktop.

Creating a Credit Memo for the refund is the most reliable path. After creating that, you'll need to create a refund check to complete the process. Let me guide you how:

Let's now link the credit memo to the check to avoid getting open credit memos and unapplied refund checks.

Here's how:

I've got this article for your QuickBooks Desktop version: Record a credit memo or refund in QuickBooks Desktop for Mac.

Also, you can run the Transaction List by Customer Report to track all the transactions you've entered into the system. Then customize it to show precise data. See the sample screenshot below.

Feel free to visit our QuickBooks for Mac 2020 USer's Guide for your later reference.

Please mentioned my name in the comment section if you have follow-up questions about refunds. I'm glad to help you anytime. Keep safe.

Hi there!

I credited a customer that went out of business using Accounting Tools-Write off Invoices. The customer still shows balances, and the credits show. I can't apply anything. I get a message saying the customer has no open balances. How do I get to a zero balance?

Welcome to the Community, tk93706.

Thank you for reaching out to us with your concern on how to write off a balance.

I'll be happy to share some insights with you about it.

If you want to write off a balance, it would be best if you consult an accountant to guide you through how to do it. Since you already have tried, I'd recommend you to redo it. But before that, consult an accountant before you redo it. That way, you will be guided on how to properly do it.

You may also check on these accountant tools to write off invoices.

Feel free to reach back out to me if I can be of more help to write off invoices. I'll make sure to get back to you as soon as I can.

I used the accounting tools-write off invoices. Credits show. Customer still has a balance. I will just delete the transactions and do a journal entry. Seems like the write off toll doesn't work correctly.

I have issued a credit memo refund for a client, which in this case includes sales tax collected and refunded. I do not see where the tax is credited back in my monthly reports for sales tax liability. DO I need to process the refund differently? In running my monthly sales tax reports I need to account for this refund given to a client and therefore tax refund to the State, if that makes sense.

Thank you for reaching out to us with your concern, @CherSto.

Rest assured, we take compliance and accurate financial reporting seriously, and I'm here to assist you in resolving this matter.

It's essential to ensure that the tax is correctly credited back in your monthly sales tax liability reports.

Typically, the amount should get back in the report. Since you didn't see the tax credited back, we can open and click review your tax return and verify the credit memo details. To proceed, double-check the credit memo you issued to the client and confirm that the sales tax amount is reflected accurately in the credit memo transaction.

Then click the View Sales Tax liability report, and select on the amount under the Tax amount section. This action will lead you to a transaction report, where you can find the credit memo and its associated information.

If the transaction is missing, we can open the credit memo to review and adjust the tax rate. It is also essential to use the same tax code as in the original sales transaction to ensure reporting accuracy.

Moreover, there is no need to process the refund differently.

Finally, I'd like to share this link that guides how to refund a customer in QuickBooks Online: Record a customer refund.

Please feel free to share any additional details or questions you may have. I'll be around to lend a helping hand. Stay safe!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here