Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowThanks for joining us here in the Community, @jason81.

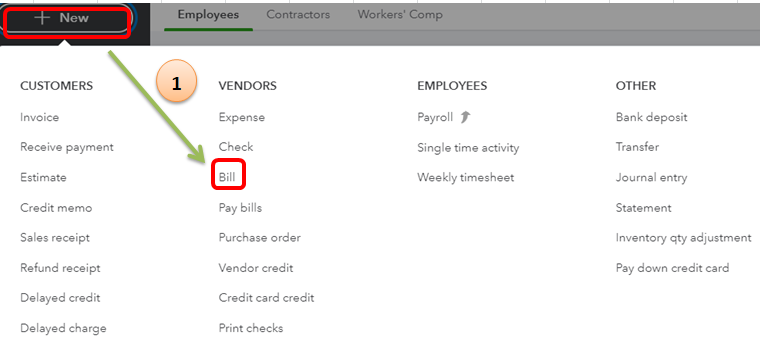

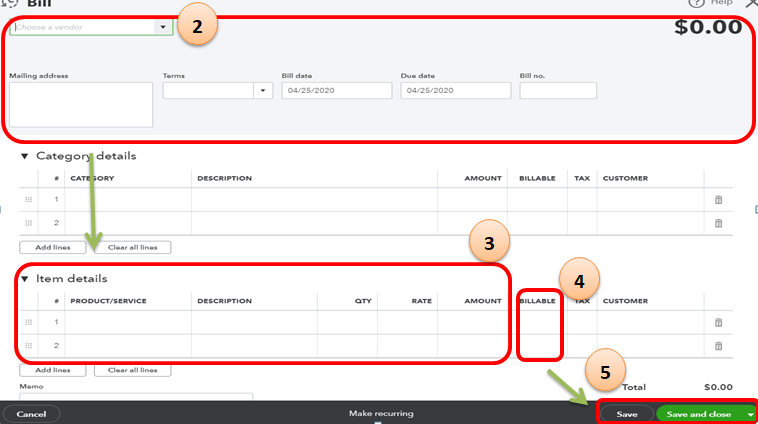

Yes, you can! You'll just have to enter the bill's number of hours and its rate in the Item details drop-down. I'll guide you on how to do it:

Also, I'll be including some articles to learn more about how the bill works in QuickBooks Online such as how to pay and make it recurring. This way, you'll be able to manage your bills wisely:

Get back here in the Community if you need more assistance. I'd be glad to help you. Take care and have a great day!

Hi ReyJon.

Yes, what you described is similar to my current workaround.

A bit more background, I'm running a maintenance company with a mix of employees and 1099 contractors. We keep track of all workers time in "Weekly Timesheets" and charge time to specific projects, make them as "Billable" and use specific services for each time section. Additionally, within the each 1099 contractor's vendor setup I have filled in their "Cost Rate" and "Billing Rate" with the appropriate values.

My question is, since QBO know how many hours each contractor has worked, which project they worked on, and how much they get paid per hour, why do I have to fill out a bill? Can/will QBO make it so that ours submitted to the timesheet can be linked into a bill? This would be similar to how "Billable Time" is added to customer invoices.

Thank you,

Hi ReyJohn,

I just subbmitted a reply but I'm not sure if the forum deleted it or not because I wasn't logged in, another awesome "feature" of Quick Books!

I think you missed the point of my question.

A bit more detail, our company has a mix of 1099 and W-2 workers. We track everyone time in "Weekly Timesheets." For the 1099 workers, I have setup the their vendor profile with both "Cost Rate" and "Billable Rate." When I make a line as "Billable" the amount in the vendor's "Billable Rate" is autofilled, unless a billable rate from a service overrides the amount. In grey the line item states the cost rate.

My question is, since QBO knows how many hours, on which project, and how much per hour each workers is paid, why do I need to manually re-enter all of the info to make a bill? I would like to know how to have column on the right pop up to add known hours so that I can link them between the bill and the timesheet. QBO already does this with invoices and "Billable Time" with the "Add to Invoice" column on the right when creating an invoice.

Does, QBO have the functionality I described?

Hi @jason81,

Thank you for your prompt reply, as well as providing additional details on your query. As for your previous reply, it's located on this same thread.

Going back to your query, the weekly timesheets you record on a project can be found on the Projects tab. That's where you can create an invoice and link all those billable time, so you won't need to manually enter them. Given that you've already entered a weekly timesheet, follow the steps below:

In case you have other questions about the Projects feature, see this article: Projects FAQ. It's a list of common questions regarding the feature in question, along with their answers and related links.

I'll be around in case you need further assistance. Leave a comment below, and I'll be sure to get back to you.

I’m not sure you’re answering the question posted. The response indicates how to generate an invoice to the client based on the vendor's hours input, but I think the questions was "how do I create a bill", that is a charge from the vendor.

or maybe I have it wrong. Here’s what I’m contemplating. For ease of tracking I wanted to have a supplier input their hours into QuickBooks for tracking, however, how do I pay this vendor? Or if a vendor then invoices me and I put it against the project, I’m now double counting that vendor's hours.

There are a couple of scenarios I can think of to ensure you can track billable time entries in QuickBooks Online, @neirbos.

Yes, you're right. If your vendor sent you a bill, then there's no need to track the hours. This is because it can cause duplicates or to double counting of the hours. You can just wait for the bill, and then make it billable to a project. To achieve this, you can follow the steps given by my peer Ryan_M. This time, please ensure to associate the correct bill.

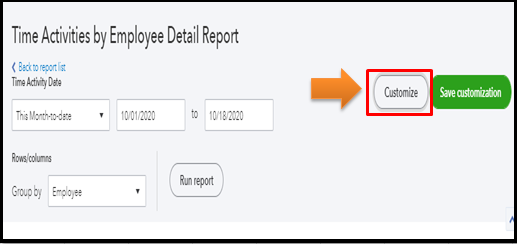

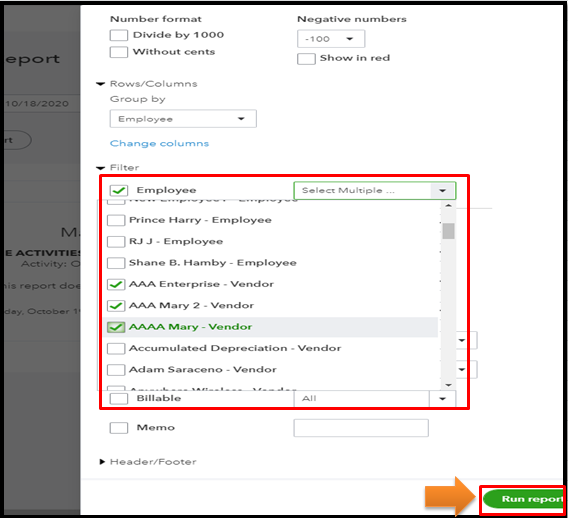

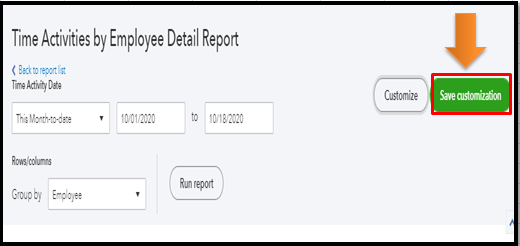

If your vendor hasn't sent you a bill yet, you can pull up and then customize the Time Activities by Employee Detail report. This way, you'll easily know the total numbers worked. Here's how:

Once done, you can now create a bill or write a check for that vendor like you normally would. For more insights, please review this article: How to pay a vendor from timesheet entries.

Aside from the above report, you can also access the following reports on the Reports menu for time tracking purposes:

>Highlights the products or services (time activities) you haven't invoiced yet.

>Shows the products and services (time activities) your employees provided to each customer.

>Outlines the time activities your employees recently entered or edited.

You can count on me if you have more questions about managing your time sheets or vendors in QBO. Just add a reply in the comment section so I can assist you right away. Take care and have a good one.

Basically, the answer appears to be "No." QBO will not create a vendor bill based on time entries. They are only available to be invoiced to customers.

You can, however, generate time reports to assist in manually creating vendor bills.

So, if I want the individual time entries on both the customer invoice and the vendor bill, I need to enter the detail in 2 places.

Is this a correct summary?

Yes, you'll have to enter your customer and vendor detail separately, Teerose67.

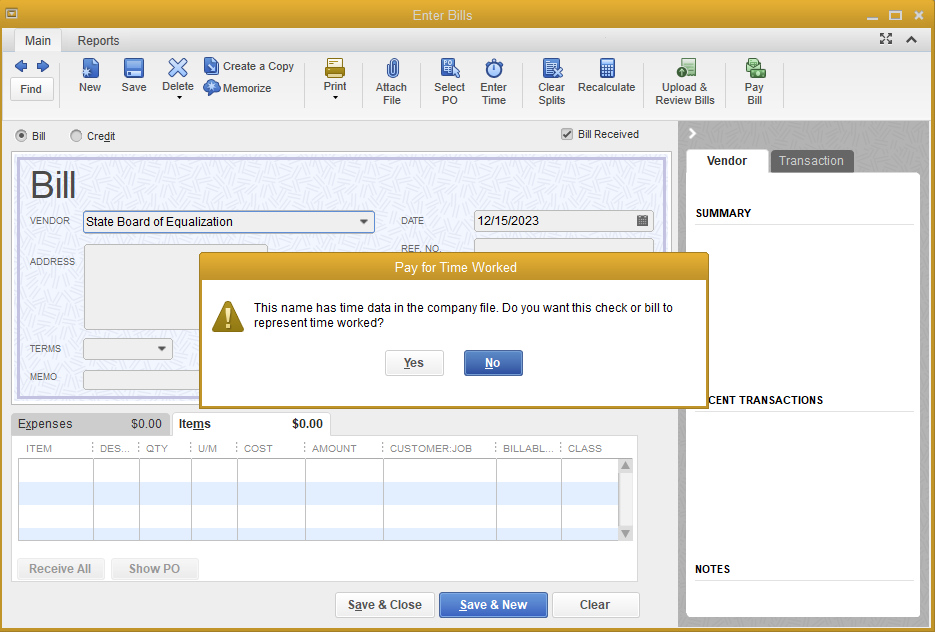

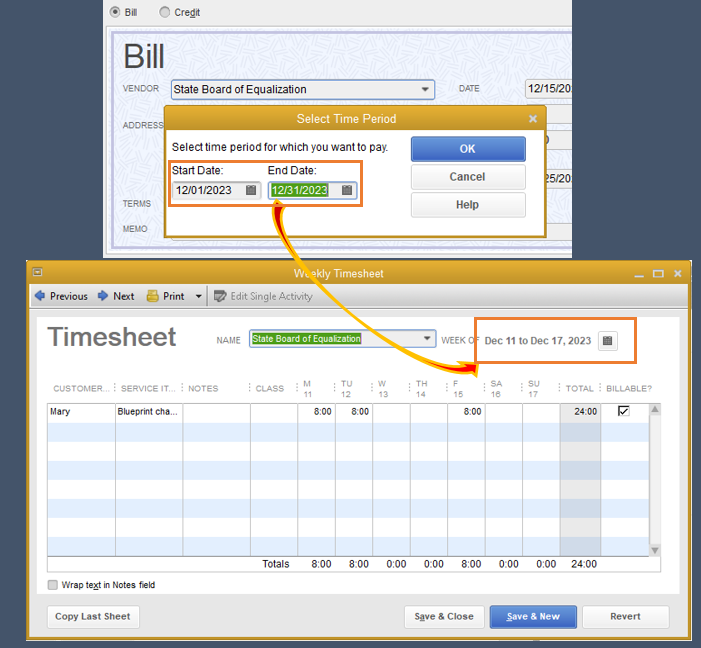

But if your using Timesheet as your time entry, you can just actually create a Bill and make it billable to the customer. However, this is only applicable if you're paying a vendor and not the employee. Please see the attached screenshot below:

You may also want to check out the QuickBook Blog and stay current for the latest updates.

If you want to check out our help articles, you can browse them for your reference.

Stay in touch if you have any other questions about time entries. You can always touch base with us anytime if you need further assistance.

Agreed that QBO should try to more "automate" the ability of companies to pay their "contractors" and/or "vendors" that also enter their hourly time into the the QBO system (via either QBO time or TSheets). Currently an "employee" that enters their time on a timesheet, once approve or accepted in the QBO system, once can simply then "run employee payroll" and and the employees time is automatically brought into the payroll side and pay and taxes are auto computed and the user can simply approve and the pay is scheduled (via DD or can print check if use checks). This what is being discussed in needed above also for "contractors" that also enter time on their QBO timesheets. Currently, when a "contractor" or "vendor" enters their time on a QBO timesheet, to pay this "contractor" you have to set up a QBO "report" to see hw many hours the "contractor" worked, Then manually outside of QBO calculate the number of hours by the rate of pay. Once that amount is manually calculated outside QBO, you then have to go the the payroll > contractor to pay the contractor and manually enter the amount the contractor should be paid for the period. This makes no sense as, as stated above QBO already has the time in the system that the contractor worked, just like an employee, and the pay system for contractors and vendors should automated be the same are currently for employees. Actually, it should be easier to pay a contractor or vendor in a automated way in QBO as you don't have to calculate tax withholdings or unemployment taxes as its simply a straight multiplication of hours worked on timesheet by the rate or pay for the contractor, so it should be a easy process for QBO to create a way in the contractor payroll module to allow for a user to set up a rate of pay for a contractor and to pull in the hours worked for a contractor based on pay period selection (weekly, biweekly, monthly..ect) so that when you go to pay a contractor it works similar to how it works similar to hoe it works for when you go to pay an employee without have to compute anything outside QBO. Its also understood there are multiple ways currently to pay a contractor, either via the contractor module, create a bill, or connection of add-ons like bill quick. The missing ingredient of all of these current methods is no currently automates the use of a contract already enter work time on a QBO system times sheet. Hope this helps clarify the need on the "contractor" and "vendor" pay side for within QBO.

I was also just trying to find a way for the vendor's time sheet to transfer over to an expense instead of having to enter the information twice. Quickbooks makes it so easy to create bills for time, it would be amazing for this information to also transfer as expenses on what was paid out on the same time... you're always asking for ideas on improvements- this is a big one that I think all of your customers would love to see happen.

Hello there, Bethany62179. I appreciate you for joining here.

I agree with you. This would be a great feature to be added in QuickBooks. I can help you send your valuable feedback to our Product Development team. Please follow the steps below and share with us your insights about the feature you want to include in the program.

You can input the details in the Feedback field. Here's how:

Also, you can visit our blog site. This is where we share recent happenings and future developments, such as updates to newly added features.

We always want to hear your suggestions as we continue developing the product as best for your business. Feel free to comment below if you have other concerns with QuickBooks. Take care always.

QBO is a disgrace. This can be done in QB Desktop in 2 minutes but it can't be done in QBO. I "upgraded" to QBO thinking I would get more automation, not less. So, it seems that I paid thousands of dollars for new subscriptions and bookeeping support just to have "downgraded". The worst part of transitioning is that all of my inactive customers, vendors, and employees are now active -- and I that can't be inactived because the transition created millions of dollars in unbillable charges that prevent the inactivation. What a major disappointment!

Hi JSammarco,

I'm contemplating making the move from QB Desktop to QBO for the automation benefits. However this could be a show stopper. Can you let me know how you handle above in QB Desktop?

Thanks!

Thank you for joining this thread, Jmiller.

I'm glad to show you how to pull up the data from the weekly timesheet when creating a bill. Let's proceed by following the steps I've outlined below.

I'm adding these links for a video tutorial and performing other tasks after creating a timesheet.

Let me know if there's anything else I can help you with creating a bill from the weekly timesheet data. I'm always around whenever you have additional questions about the process, Jmiller.

Hi JMiller

Yes, QBO can create an invoice for hours worked and recorded in a weekly timesheet.

Transitioning from QB Desktop to QBO was a huge effort. I spent at least 40 hours cleaning-up the data (unbilled charges) and about 10 hours on the support line and eventually had to figure it out in my own. In a nutshell, I had to: 1) activate all of the inactive accounts in the chart of accounts; 2) create invoices for all of the unbilled charges (which were previously billed), 3) void the new invoices; 4) re-inactivate the accounts in the chart of accounts; 5) re-inactivate customers, vendors, and employees. After you get on the backside of that; there will be many more quirks and gotchas.

I have regretted the transition to QBO but can't turn back now. The next move will be to a different system. Having used QB Desktop for 20 years, I never had one issue or one complaint. Since the transition, I have had one hurdle after another. Although support tries to be helpful, many are not sufficiently trained to solve problems so it turns into a group research project.

Two areas to watch out for -- 1) Syncing bank account transactions in unreliable, at least with TD Bank; 2) Using service items in QB Time and syncing data back to QBO.

Desktop just keeps dumbing down! I USED TO be able to enter time in timesheets to appear on customer invoices.

NOW ONLY FOR EMPLOYEES

I entered employee time in time sheet. And what service was done. Then I don't Rember what I did but made invoices for the billable hours, ON the invoice it only shows "Total Reimbursable Expenses". and then a total but it doesn't show what the employee did.

Well, we didn't notice it and I have been getting calls from customers saying what was this for. BUT when I pull up the invoice it shows all the work done. But when I print the invoice it only shows Total Reimbursable Expenses and the amount.

ngHello there, Lakefront3.

I'm here to resolve the issue when printing the invoice.

Let's modify the template you use before printing the transaction. I'll walk you through the steps.

Here's how:

Afterward, you can send and print the invoices again. Then, moving forward, ensure to select the same form style to include the description of what work was done.

Feel free to pin this link as a reference in customizing forms: Customize invoices, estimates, and sales receipts in QuickBooks Online.

I'll be around if you have other concerns with printing invoices.

SHOOT SORRY I need that in Desktop please

Hi John, if we have already entered hours in weekly timesheet, this is duplicating the effort to enter hours again. In QB desktop while enter Bills, system would automatically pickup time entered in weekly timesheet. Is that feature not available in QBO?

I'll provide details concerning the weekly timesheet in QuickBooks Online (QBO), Gauravl.

I understand that you intended to include timesheets in your bills within QuickBooks Online (QBO), however, this feature is not available at the moment. In QBO, you're unable to directly associate or link the timesheet you created to the bill. Instead, you must manually input the hours into the bill. Currently, it can only be included in your employee's payroll check and customer's invoice.

I recommend providing feedback to our software engineers. They may take it into account for future product updates. Here’s the process:

You may refer to this article to see information on how you can track bills and record payments in QBO: Enter and manage bills and bill payments in QuickBooks Online.

If you have any further questions regarding timesheets or any other QuickBooks matters, simply click the reply button below. I'm here to help and will get back to you quickly.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here