Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Thanks for reaching out to the Community, @Vpg1.

On your QuickBooks Desktop (QBDT) account, you can access the PPP Forginess report by going to the Reports menu at the top. Then, at the bottom, select the PPP report you want to open.

To know more about the reports available, see the below links:

Additionally, here's an article that'll help you personalize the PPP reports you'd like to generate. Doing so helps you filter the important details you want to add: Customize reports in QuickBooks Desktop.

You can always get in touch with us anytime. This forum is always open and I'll be right here to help. Have a good one!

When trying to run a PPP report it says the end date cannot be beyond Dec 31, 2020. How do we run for PPP2 loans in 2021? Also, I cannot locate a report called PPP Forgiveness Payroll Cost on the QuickBooks Payroll Desktop 2019 version we are using.

Thanks for following up with the Community, Vpg1.

You can run Paycheck Protection Program (PPP) reports by accessing your Reports menu and selecting the appropriate one.

As for changing a report's end date, this can be controlled through the Dates section.

Since you're unable to locate your PPP Forgiveness Payroll Cost report, I'd recommend confirming QuickBooks is up-to-date with our latest payroll release (22110).

Here's how:

A notification window will be displayed once it's complete. When you're finished updating, you can return to your Report Center and check if the PPP Forgiveness Payroll Cost report's available.

In the event it's still not displaying, you'll also want to make sure you're using our latest release.

I've included a couple detailed resources about working with payroll and reports that may come in handy moving forward:

Please let me know if there's any questions. I'll be here to help. Have an awesome day!

As of 6-03-2021, I have downloaded all of the software updates and payroll updates for Quickbooks 2021 and I am still unable to run PPP reports with a date ending after 12-31-2020. The round 2 loans were given after December 31, 2020 so how are we to run the appropriate PPP reports for 2021?

Welcome to this thread, patrex.

The steps outlined by my colleagues above are the common ways to fix to the issue with running the PPP Forgiveness report.

Since you're still unable to run the report, it would be best t reach out to our QuickBooks Team for further investigation. They can review the status of your payroll and look for ways to come up with a complete resolution.

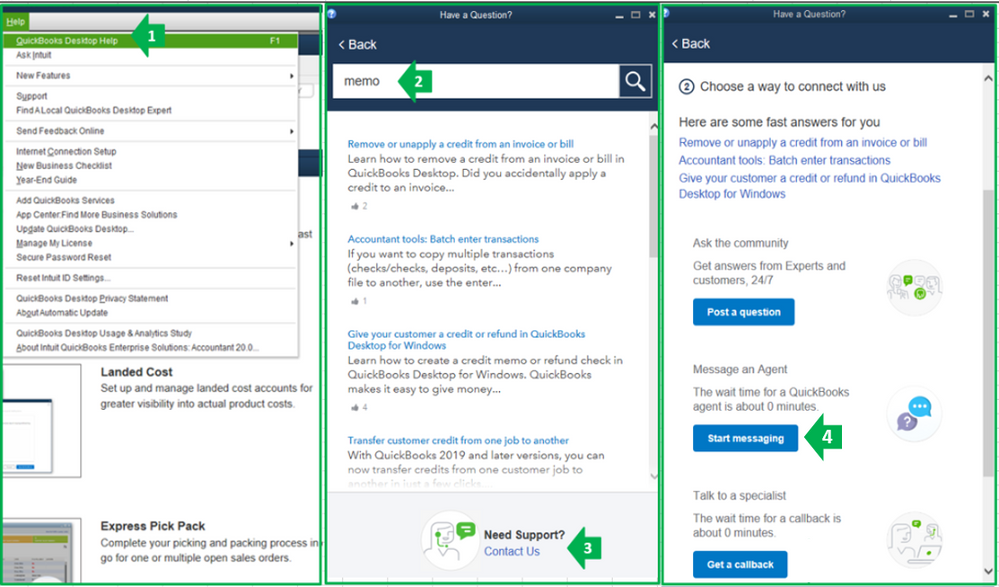

Here are the steps to contact support:

Please take note our operating hours for chat support depend on the version of QuickBooks that you're using. Please see this article for more details: Support hours and types.

If you need other helpful articles in the future, you can always visit our site: Help articles for QuickBooks Desktop.

Feel free to drop a comment below if you have any other questions when running PPP report. I'm always happy to help. Have a good day.

I am having the same issue. I was told by Intuit that technical knows of the issue and we will be receiving a software update when report is available.

I can't do it either. The report populates the dates from the first round of PPP Forgiveness and you can't change it.

Hi, sue-craven.

I do appreciate your time in letting us know the issue you're experiencing when pulling up PPP related reports.

I can direct you to our Phone Support Team to help you perform advanced troubleshooting steps. They'll be able to guide you and perform a remote session to walk you through running reports. For them to assist you immediately, you can contact them within their support hours.

You can check out this article that'll help you personalize the PPP reports you'd like to pull up. It will help you filter the important details you want to add or remove: Customize reports in QuickBooks Desktop.

Let me know if you have other questions, Just mention me in your reply and I'll be here to help. Take care and stay safe!

Hi Catherine,

It is my understanding that Quickbooks does not have the 2021 PPP reports operational at this time. I was told they are working on the reports and they will be available in a later update. This is unfortunate as we are almost half way through 2021 and we have clients needing the reports to support their PPP forgiveness application for loans made and used in 2021.

Thank you,

JB007

According the QB Payroll support Chat the 2021 PPP 2nd draw forgivenss reports are still not ready. This may save a few hours research. If yall find anything different, pls let us know.

Thanks - I've spent so much time over the past month trying to figure out how to get QB's to generate this 2nd round of PPP Forgiveness data. Why couldn't technical support simply state - it's not working at this time.

I do not look forward to telling my boss that we will have to make a payment on our PPP loan because I can't run a report. I'm sure there are companies out there like ours that are getting close to first payments being due on this. Come on QB!! Get it done!!

Get the report fixed!!

Hopeless, Seems like the PPP2 forgiveness report option is still not there as of 7/16/21.

One suggestion is just run regular payroll reports for the period and try to submit those.

QB-- please get the PPP2 report options available.

I'm a Desktop QB user. Small business.

We are closely looking into a fix to the PPP report issue, Mark12345.

You can reach out to us so we can add your account to the investigation. Any updates and a permanent fix about the issue will be sent via email. Here's how to contact us:

Alternatively, you can use this link to get a direct chat link and more details of our available hours and support types: Contact QuickBooks Desktop support.

Thanks for your patience and you can run other related payroll reports for now. I'm just around if you have other questions. Take care!

This response is typical of QuickBooks. Instead of posting a video or actually telling the user how to fix it you refer the user to the call center. Doing that jams the call center lines and provides little help. To make life more difficult, you hide your call center phone number instead of making it prominent on the web site.

I have been trying to print some of the reports and the names in the first column do not print completely. Why can I not open that section in order to read the names? The SSN's are visible on the report. Why not allow the columns to be expanded and contracted as needed? What about a "preview" for these reports so that everything prints, not every printer is the same.

Hi there, chairman25.

Thank you for visiting the QuickBooks Community. This isn't the kind of feeling that I'd wish you to have, and we know how much time it can take when something isn’t working the way you need it. With this, I'll make sure to provide details or troubleshooting steps so you'll be back on track.

You should totally print some of the reports and the names in the first column and you can constantly open the section in order to read the names. Then, the columns on any reports must be expanded and contracted as needed by dragging the lines. I've attached a screenshot below for visual reference.

Since you've encountered unusual behavior, I suggest running the Verify and Rebuild Data Utilities to get this sorted out. The Verify Data utility identifies any potential data damage issues that might've caused some reports that didn't work properly. While the Rebuild Data utility repairs damaged data in your company file. Before this, you'll have to secure a backup copy of your company file.

To Verify data:

To Rebuild Data:

For further details, you can refer to this article: Verify and Rebuild Data in QuickBooks Desktop.

If the issue continues to occur, I reccomend contacting our QuickBooks Support Team. They have the tools to pull your account to deep investigate the cause of the problem.

Please click this article to see steps on how you can save QuickBooks reports so you can use them in Microsoft Excel: Export reports as Excel workbooks in QuickBooks Desktop.

Let me know if you have other questions about QuickBooks. I'm always free to help you whenever you need my assistance. Take care and stay safe always!

As of July 25, the issue is still a no go. Can someone tell me what specific reports can replace the PPP reports and exactly what information I can use from those reports that will support my forgiveness? Please speak simple for my non-analytical brain.

Thank you,

Wwidu

I understand how important it is to get the PPP Forgiveness report, Wwidu.

Let me provide the report you need to support your forgiveness. Before applying for PPP loan forgiveness, it's important to know which payroll costs are eligible for forgiveness.

There are two reports that you can use for PPP loan forgiveness. The first one is the Cash compensation report. It reflects certain cash compensation identified in your QuickBooks account based on the time period you select.

The second one is the Tax Cost report to show certain employer state and local taxes. These two reports are based on the time period you've selected.

Please browse these links for additional information and how to pull them up in QuickBooks:

If you need further assistance with these reports, I suggest contacting our QuickBooks Desktop Payroll Live Support Team. They can do screen-sharing with you and walk you through the process of running the reports.

To do so, please refer to this link to know when to get in touch with them: Contact Payroll Support.

Let me know if you need anything else you need about running PPP Forgiveness reports. I'll be around to provide additional information about it.

FIX THIS !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

NOT HELPFUL AT ALL

FIX THIS

Hi Quickbooks,

Any updates on PPP2 loan forgiveness reports after Dec 31, 2020?

The Cash compensation and Tax reports do not allow for entries after 12/31/2020.

I hope you can adjust the reports so we change the date range limit.

There are a lot of users ready to file for PPP2 forgiveness waiting.

Just ran updates and the reports for PPP still don't work past 12/31/20.

Shouldn't be too hard to fix. It was working for PPP1.

Small business user. Desktop version.

Thank you,

Mark12345

Hello Mark12345!

Allow me to share and assist you regarding the PPP reports.

We already reported this to our engineers and they are working diligently to get this resolved. I suggest you contact our Support Team so that your company info will be included in the investigation.

In the meantime, you'll want to run any payroll report available in QuickBooks Desktop that you can use. You can generate Excel-based payroll reports from the system.

I've added some links you can check. These will show more details and understand more about the PPP reports in QuickBooks Desktop:

Leave a comment again here and we'll answer as soon as we can. Thanks!

This is EXTREMELY frustrating. For round 1 forgiveness QuickBooks couldn't get their act together and get the reports needed out on time. There were so many issues with getting the reports that I had to wait a month for them to fix it to generate the correct reports needed. I spent hours on the phone with QuickBooks and them remoting into my computer to try and get them. I find this to be so unacceptable that AGAIN for round 2 PPP forgiveness they do not have the reports ready. It's not like round 2 forgiveness is a surprise. LET'S GET IT TOGETHER QUICKBOOKS!

Same problem here, still cannot run the needed report as of August 10th.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here