Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI followed the directions I found to enter a vendor credit, I am not sure what account to put it under so I just used ask my accountant. I don't show any credits when I go to set credits to pay a bill. I am not sure what I have done wrong to not show any credits. I have tried different account to see if that would make it show up but it doesn't.

When a Vendor gives you a credit it is usually for something you had returned. If that is the case then you simply use the account such as materials or office supplies.

Now, to see if we can find that credit. "Vendors" "Vendor Center", Go to the Vendor. In the Box to the right under the "Transaction" Tab is "Show", schroll down and click on "All Transacations". Then search for the credit. Once you find it then double click on it. Click on the tab above in "Reports" then click on "Transaction History". This will show what happened to that credit.

If the credit had somehow been attached to another bill, then go to the credit, click from credit to bill, then back to credit. This is the only way I know to disconnect the credit from the bill.

I followed your instructions but I have a question: wouldn't you think that after 18 or 19 years of Quickbooks desktop, there would be a simple way to search for a payment, double click on it, see the invoices that were paid AND a line item that shows the credit amount that was used in this payment?

I followed your instructions but I have a question: wouldn't you think that after 18 or 19 years, the VIPS at Quickbooks Desktop would have developed a simple way for customers to find a vendor's payment, double click on it, see what invoices were paid AND also see what credit was applied in this payment?

Hi QuickDen7,

You'll want to create a bill to record a vendor's credit. Once it's paid, you'll see the available credits at the bottom of the screen. I'll walk you through how.

To create a vendor's credit:

To apply the credit to a bill:

Once done, you can pull up the Transaction List by Vendor report to see the vendor's payment, bill, and the credit's applied.

Here's how:

Additionally, you can find these transactions in the vendor's profile. The credit is posted in the Balance Total column.

I've added these articles for future reference:

The Community is always here if you have other questions. Please don't hesitate to reach out anytime.

I followed these instructions but when I go to vendor- pay bills - the credit doesn't show up. When I go to the vendor report, it shows the credit.

It's nice to see you here in the Community, CrossingsT.

I'm here to help you go over to your credit and have it applied to your vendor bill in QuickBooks Desktop. Let's get this sorted out.

The credit will still show on the report even if it's already tied to a bill or not. To better isolate the issue, you may want to check the Transactions History of the credit and see if it's applied to a bill.

Here's how:

If you want to un-apply the credit from the bill, you can follow the detailed steps in this article: Remove or un-apply a credit from an invoice or bill.

If you require more information about the vendor credits in QuickBooks, you’ll find detailed instructions by pulling up the article in your company file. Just press F1 on your keyboard.

For additional help, you can also reach out to our QuickBooks Desktop Support.

You can always get back to me if you need more help vendor credits in QuickBooks Desktop. I'd love to help.

Thank you for the quick response. When I look at the transaction history - it says there isn't any for this credit, and it doesn't show up when I click on pay bills. However, it does show up in bill tracker as a credit and when I look under the vendor it shows that there is a credit but not that it has been paid/deposited.

Thanks for the update on this goes, @CrossingsT1.

You should be able to set the vendor credit on the Pay Bills screen even if it's not yet deposited into your bank account.

Let's enter those transactions using a sample file to isolate the issue.

You can always use and play around with the sample file to test transactions that aren't working on the original file.

If that works, then transactions on the original company file may be damaged. You need to run the verify and rebuild utility to resolve data issues.

If the same issue persists, your QuickBooks company file is already affected. Thus, you need to clean install to replace the QuickBooks system files on your computer.

To do so, please follow the solutions outlined below:

Step 1: Make sure a clean install is right for you.

Step 2: Gather info and back up your data.

Step 3: Uninstall QuickBooks Desktop.

Step 4: Download and install the QuickBooks Tools Hub.

Step 5: Run the Clean Install Tool.

Step 6: Reinstall QuickBooks Desktop.

Please follow this article on how perform each steps above: Clean install QuickBooks Desktop. This page provides a detailed solution and additional information to help you with the process.

Let me know how everything turns out. If you're getting the same result, leave a comment below so we can try other steps to resolve this.

Hmm....this doesn't make sense to me. The funds have already been deposited. We received an electronic credit from a vendor. So, I followed the steps in help file/instructions. I recorded the deposit, created a credit and then tried to do the last step. The credit shows up in the vendor's list, but not in the list to pay bills, so I can't associate the deposit with the credit for this vendor.

Hi there, @CrossingsT1!

You'll have to select your Accounts Payable account for your deposit so you can successfully record your vendor's credit. I'll be happy to help you accomplish this.

To start with, upon depositing your vendor's credit, you'll have to select your account's payable account. This way, it'll be recorded as an available credit to be applied as payments for your bills. To do that:

Onde completed, here's how you can link the deposit to your vendor's credit:

After following the steps above, you can now successfully pay your bills with your vendor's credit you just recorded.

To add, here's an article you can read to learn more about how to record a vendor's credit and link it to your bills: Record a Vendor Refund in QuickBooks Desktop.

Also, I've added one of our helpful article that'll help you handle your future tasks about recording your vendor's credit: Transfer and Apply Credit from one Vendor to Another in QuickBooks Desktop.

If there's anything else that I can help you with, please let me know in the comment section down below. I'll be always around ready to help.

I've been following this but have not found a solution. I have a credit from USPS. The bill was paid in 2019 but we received a refund on the box rent in February 2020. This is what I have done:

How do I apply the credit when there is no bill or invoice to apply it against?

Desktop Pro

Hello, tcba2016.

Thanks for dropping by the Community. What you can do is record a vendor refund. I'm including a link with multiple scenarios and how to apply them accordingly. Choose the one that best fits your personal situation: Record a vendor refund in QuickBooks Desktop.

Below, I'm including a sample of the first scenario, so you can see the process.

The Vendor sent you a refund check for a bill that is already paid.

Record a Deposit of the vendor check:

Record a Bill Credit for the refunded amount:

Link the deposit to the Bill Credit:

If you have any other questions, you can ask them down below. Thank you so much for taking the time to stop by the Community and have a lovely afternoon.

I have the same issue as the last commenter. I follow all the steps, and when I get to the last grouping, I open the "Pay Bills" window, and there's nothing there. No deposit, no credit. What am I doing wrong?

You may have turned on the option to automatically apply credits, Djwpe.

Let's verify this by going to the Account and settings page. Let me guide you with these steps:

Afterward, let's go back to your vendor's profile and then locate the deposit. Then, delete it. Afterward, you can now link it to the correct bill credit. You can follow the steps shared by my colleague above.

Let me know if there's anything that I can keep help. Keep safe!

None of what you have suggested makes any sense to me. I have no gear icon in Quickbooks Desktop.

If I open preferences, I do not have "automatically use credits" checked, and even if I did, I did not have an outstanding bill with the vendor in question.

Thanks for reaching out back to us again, @Djwpe,

The steps shared by my colleague works for QuickBooks Online, so the preference are different with your desktop software. Furthermore, the steps you've followed should create an outstanding credit when you pay a bill, given that the automated application of credits is turned off.

I'll be providing some screenshots to show you the entire process, so you can review the transactions you've created. First, when making the deposit of the vendor check, perform these steps:

Next, let's record a Bill Credit for the amount of the Vendor Check. See this:

Now, we will link the two entries using the Pay Bills option. Here's how:

Regardless, there are different scenarios that requires specific set of steps to account for a vendor refund. I would still recommend checking this article for other ways to record them in QuickBooks: Record a vendor refund in QuickBooks Desktop

Please tap me again for any updates or if you need further help. I'll be more than happy to share some more information to help you with vendor credits. Have a good one!

Thank you!! I was using the wrong account on the deposit. That cleared it up. Thank you for the step-by-step with Screenshots.

I've finally fixed the four years worth of credits that left my workers comp account out of balance.

I am having the same issue. I'm trying to match an expense to invoices already entered and when I go to pull out a credit and apply it there are none that appear. I have about 50 credits for this specific account and none of them are appearing at all. I've never had an issue like this before, so I'm confused as to what the issue is now.

Hi there, @Cinthia1. Thanks for reaching out.

To isolate why the credits are not showing, let's run the Transactions History of the credit to see if it's applied to a bill.

Here's how:

From there, check the bill associated with the credit. If it's still not showing, a data integrity issue could be the reason why this is happening. In this case, let's run the Verify Rebuild Data tool that helps identify and repairs data issues within your company file. Here's what you'll need to do:

For more details about the Verify/Rebuild process, check this article: Verify and Rebuild Data in QuickBooks Desktop.

Once done, check to see if everything is working now.

You'll also want to visit this link for more troubleshooting steps: Fix data damage on your QuickBooks Desktop company file.

Please let me know how things go on your end. I want to ensure this gets resolve for you. Take care.

I have this same issue, only I was issued the credit to my Credit Card instead of receiving a check to deposit into the bank.

If I use the Credit Card Refund method, the transaction does not show up when running a Vendor Balance Detail report.

I've got you covered, @Tuli O.

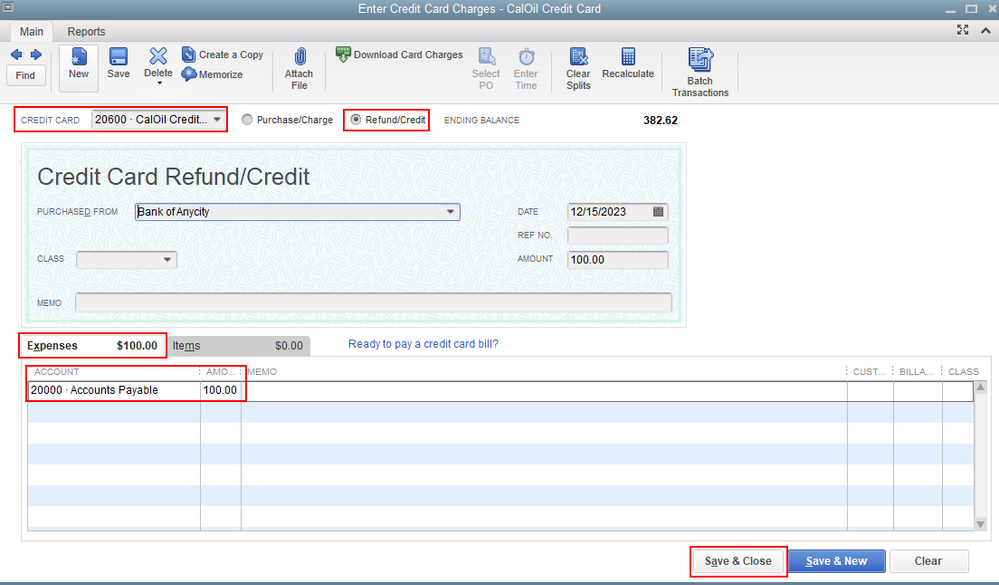

When your vendor sends you the refund as a credit card credit, you'll have to record it as Credit Card Charges. Then, associate it with an Accounts Payable account to show on your Vendor Balance Details report. Here's how:

After the steps, you'll be able to see your credit card refund on your Vendor Balance Detail report.

You can read this article and go to Scenario 5 to learn more about recording refund as a credit card credit: Record a vendor refund in QuickBooks Desktop.

Just in case you need to run specific reports for your vendor, feel free to check out this article to learn how to run and customize the report: Customize vendor reports.

Please let me know if you need clarification about this, or there's anything else I can do for you. I'll be standing by for your response. Have a great day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here