Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowSolved! Go to Solution.

IMO, the "Detail Type" is a pointless field. It may be there just to assist users in naming the account. The field doesn't even exist in QB Desktop and that is a far superior product IMO.

You are exactly right that if your beginning inventory and ending inventory are the same, then your purchases account will equal your COGS for the period (month/year). And, any freight you have allocated to purchases will be fully expensed. However, a 'Purchases' account should always be a temporary asset account - not an expense or COGS account. You would create a journal entry to reduce (credit) purchases and increase (debit) COGS at period-end by the same amount if there is no change in inventory level. When using periodic inventory, you needn't take a physical inventory, you can estimate COGS via the gross profit method but that's a topic beyond the scope of this post probably.

Hi oceanbeachesglass!

Welcome and thank you for getting help with setting up your COGS account.

Adding an account Detail Type is currently not a feature in QuickBooks Online. We can only select from the available options. I suggest consulting your accountant to know which among the choices is best for the kind of purchases you have.

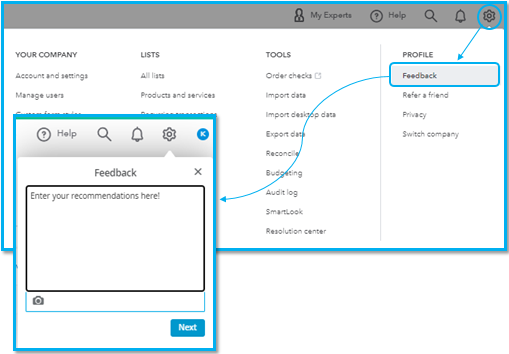

I also suggest sending feedback about this from your QBO company, so our engineers will be aware that you need a separate detail type for purchases. Just click on the Gear icon and choose Feedback.

Feel free to go back to this thread if you need anything else. Take care and have a good one!

Well, my accountant cannot help with this one. Based on what's on the Schedule C, the options simply don't reflect what's there.

On Schedule C, in the COGS section, line 36 is "Purchases", line 37 is "Labor", line 38 is "Materials and Supplies", and line 39 is "other".

What QBO offers for Account Detail types for COGS is, in order, "Cost of Labor", "Equipment Rental", "Other Costs", "Shipping", and "Supplies and Materials".

You can see there's a good match with Labor, Materials and Supplies, and Other (personally, I don't see why Equpment Rental and Shipping wouldn't be lumped in with Other, but that's beside the point).

My point is that there is no option for Purchases. Purchases, by definition, is what any raw materials go under, as well as any item purchased for sale (i.e., Inventory) goes under. For an inventory-based business - at least for a Sole Proprietorship - it's going to be the primary type of Cost of Goods Sold.

But then again, I think I remember the significance of the Account Detail Type from years ago when I used QB Desktop, and it was the criterion for which account would be linked in Turbotax during the QB-TT export. But I just discovered yesterday that there is no QBO-TT export, so I guess the whole issue becomes moot - it looks like Account Detail Type has no relevance, as far as I can tell.

I'd like to give an example of how I - and anyone else that uses a Schedule C for something other than a service-based business - is not able to use more than one, single Account Detail provided in QBO.

The "Detail Types" offered for the Account Type of "Cost of Goods Sold in QBO include:

- Cost of Labor - COS

- Equipment Rental - COS

- Other Costs of Services - COS

- Shipping, Freight & Delivery - COS

- Supplies & Materials - COG

I can't imagine that "COS" and "COG" would mean anything other than "Cost of Services" and "Cost of Goods", respectively. But this is in the Cost of Goods Sold Account Type, not Cost of Services Sold. COGS in Schedule C, anyway, is clearly for physical goods (inventory) that's bought and sold.

Now, these are the lines provided in the Schedule C, Part III, "Cost of Goods Sold", for 2021:

- Line 36: Purchases (less cost of items withdrawn...)

- Line 37: Cost of Labor (for Goods - not Services - sold)

- Line 38: Materials & Supplies (the one and only valid Account Detail for COGS!)

- Line 39: Other Costs (of Goods, not Services!)

Further, IRS instructions make it clear that raw materials and items purchased for sale are NOT included in Materials and Supplies, so there's very little I'm able to use that Account Detail for.

Also, there are lines in Expenses (Part II of Sched C) for Labor that's not associated with the Cost of Goods, and Equipment Rental that's not associated with Cost of Goods, so I don't know why they'd be in this Account Type at all.

However, I think all of this might be a moot point, since we can't export the data to Turbotax, and I can't find any reports that use it. It would be nice to have accurate information in there, though, for when we're manually entering our data into Turbotax!

One last thing - I do appreciate the QBO people replying to these kinds of concerns, but I think you all need to consider that many of us are beyond entry level, have used this software for some time, and may even do our own accounting. It's sufficient when one of you starts with the basic response to see if that helps, but when it doesn't, it would sure be helpful for further responses to go a little deeper.

One more last thing - I know it would be tedious for one of your software guys to correct something like this, but please try to imagine the level of frustration that we end users have to get to before we spend the time to fully and accurately submit something like this. It's only that it matters tremendously to us that this sort of seemingly trivial stuff is cleaned up.

As it appears you discovered, don't get too hung up on the Detail Type for accounts in QBO. This is not equivalent to tax-line mapping in QB Desktop. Agreed that they could be better in QBO. The name of the account is what drives the accounting and you can name COGS accounts whatever works best for you.

You mentioned "Purchases" in a previous post. Purchases are not a type of COGS account - purchases are an 'Other Current Asset' account used as a temporary account when you track inventory under the periodic method, before expensing those purchases to COGS. The reason 'Shipping' is a separate detail type is that small businesses (as defined by the IRS) can expense inbound freight directly to COGS and not capitalize it into inventory.

The only thing that keeps me hung up on the Account Details is the question of why they're even included when they have no (apparent) use? If that field is going to even be there, I think there ought to be some function. For instance, when I look at my Accounts, I'd like to see something useful, like even "Account Description", which I can't see unless I edit an account.

As far as Purchases, I've read any support article I can find, and it does seem that it's preferably an Asset account for the periodic inventory method. However, data seems to be moved (via something like a journal entry) into a COGS account only once an inventory is done - so if I do an annual inventory, it would seem that any COGS data would remain blank through that interval on my P&Ls. Or am I missing something?

As far as I can see, if my inventory stays the same every year (which doesn't quite happen, of course), my COGS would be accurate simply by entering Purchases into COGS accounts - which would give me up-to-date (though, admittedly, not exact) information on my P&L through the entire year. Simultaneously, I could have my total inventory value in an Asset account, and create annual journal entries at time of inventory to adjust both the Inventory Asset account and the COGS accounts. Again, I may well be missing something.

You're certainly correct as far as freight costs. I suppose I've taken another step away from what's probably accepted accounting practice and just lump the freight in with item cost, so have no use for it. As an example, one box supplier I've used sells boxes at amazingly low prices, but charges FAR MORE than the box cost for the freight - while another charges more for each box, but provides free shipping. There's no way I can determine a "best price" without considering both - or calculate a retail price (and I have yet to find a POS system that factors freight as well as pure cost of a good into retail price calculation).

IMO, the "Detail Type" is a pointless field. It may be there just to assist users in naming the account. The field doesn't even exist in QB Desktop and that is a far superior product IMO.

You are exactly right that if your beginning inventory and ending inventory are the same, then your purchases account will equal your COGS for the period (month/year). And, any freight you have allocated to purchases will be fully expensed. However, a 'Purchases' account should always be a temporary asset account - not an expense or COGS account. You would create a journal entry to reduce (credit) purchases and increase (debit) COGS at period-end by the same amount if there is no change in inventory level. When using periodic inventory, you needn't take a physical inventory, you can estimate COGS via the gross profit method but that's a topic beyond the scope of this post probably.

Hi @oceanbeachesglass. I have to share some insights about the Account Detail Type.

Though the specific item will only show under the COGS account, the amounts will be placed in a given category when pulling a report. That is the main use of the account Detail Type.

As Rainflurry said, you're correct, and you aren't missing something. The items you purchased are placed temporarily in an other asset account. And by the time you want to use the purchases, you can account for them as an expense or assign them to a different category. You may want to discuss it with your accountant about handling journal entries in times if it needs to affect both the inventory asset account and the COGS account. This way, you're certain that the amounts recorded are accurate.

I'm adding this article to learn more about the importance of account types and detail types.

Many accounts have an account register where you can review the transaction history and current balance. For accounts that don’t have a register, you can run a report to see transactions on that account. To view the register or reports from your chart of accounts list, select either View register or Run report from the Action column.

Please let me know if you have additional questions about the chart of accounts. I'll answer them here. Stay safe and well!

Thanks for taking the time to explain more. Between that and doing a little more reading, I understand what you're getting at. I guess the term "cost of goods sold" should be self-explanatory, shouldn't it?

Thanks for the information and links - they help.

I do still think it would be helpful, though, for the Account Detail options to be able to reflect what I'm actually dealing with. When there's only one of the Details that can apply, there's no value at all to that field.

Thanks!

Thanks for getting back to us, @oceanbeachesglass. I'm here to share some insight about the

Yes, you're correct that the term Cost of Goods Sold (COGS) can be self-explanatory.

Also, I recognize how beneficial it is to your business to show what you're dealing with using the Account Detail option. I recommend sending a feature request directly to our Product Development team. They are always open to any suggestions as this can help us make QuickBooks better.

Here's how:

Moreover, you can track feature requests through the Customer Feedback for QuickBooks Online website.

Additionally, you can also seek self-help video tutorials on our video tutorials for QuickBooks Online to help you get your QuickBooks tasks done in no time.

You're welcome to reply to this thread if you have more questions or need help with other tasks in your account. We're always available to help you out. Take care!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here